And describes the cash flows into and out the organization

Statement of Cash Flow

he statement of cash flows is a magnification of the cash account on the balance sheet and accounts for the entire period reconciling the beginning of period to end of period cash balance. It typically begins with net income and is then adjusted for various non-cash expenses and non-cash income to arrive at cash from

operating. Cash from investing and financing are then added to cash flow from operations to arrive at net change in cash for the year.”2. What is the purpose of balance sheet?

4. Explain the principle of cash accounting?

Cash accounting is simple and straightforward. Transactions are recorded only when money goes in or out of an account.

Cash accounting doesn't work as well for larger companies or companies with a large inventory because it can obscure the true financial position.

transactions that are related to cash. Other transactions won’t be taken into consideration.

Maintenance is easy: Maintaining an accrual system of accounting is tough.

Not very accurate: Since it is only recorded cash transactions, It doesn’t include all the transactions. As a result, we can’t say that cash accounting is very accurate. Plus under this accounting revenue or expenses is recorded when the company receives or pays cash, even in the different accounting period.

Not recognized by Companies Act: Few businesses follow this accounting, but it is not a recognized method under the Companies Act. As a result, This isn’t practiced by big companies.

which the related to them occur. The accrual principle is a

fundamental requirement of all , such as

Record an when you incur it, rather than when you pay for it.

Record the estimated amount of when you invoice a customer,

than the period in which he or she is paid it.

| |

|

|

|---|---|---|

is often looked at as more permanent and established than businesses that use cash-basis accounting methods.

3. It's the preferred method for GAAP. The Generally Accepted Accounting Principles set forth by the Financial Accounting Standards Board prefers accrual accounting over cash-basis accounting because the financial statements for a business that uses accrual accounting are deemed more accurate since the transactions reflect when they actually took place instead of when money is exchanged.

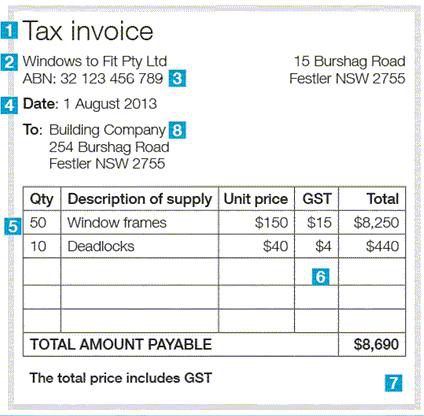

The goods and services tax (GST) in is a of 10% on most goods and services sales, with some exemptions (such as for certain food,

health care and housing items) and concessions (including qualifying long term accommodation which is taxed at an effective rate of 5.5%). GST is levied on most transactions in the production process, but is in many cases refunded to all parties in the chain of production other than the final consumer.

Court

Courts will not charge GST to pass judgement.

| II. | ||

|---|---|---|

| | ||

GST reporting method:

The GST reporting method you use is based on your business's GST turnover and

if your aggregated turnover is greater than $10 million, or you make input taxed supplies as your main business or enterprise activity, you have the option to use either Simpler BAS or the GST full reporting method

if you pay GST instalments quarterly and report annually, you may use the GST instalment method.

11.What is the penalty rate to be applied if a supplier does not provide an ABN?

If a business or organization supplies you with goods or services, it should quote its Australian business number (ABN) to you. Most quote their ABN on their invoice, and you need to keep this invoice in your business records. They can also quote their ABN to you on another document as long as it relates to the supply they are making.

The supply is wholly input taxed under GST – this includes most financial supplies, supplies of residential rent, residential premises and some precious metals, and food supplies by school tuck shops and canteens that have chosen to be input taxed – contact us if you are not sure whether a supply is input taxed.

12.A non-profit organization needs to register for GST after it has a turnover of more than how much?

Generally, an organization that registers for gst must stay registered for at least 12 months, even if its gst turnover is less than $150,000.

| 13. |

|

|---|

|

|

|---|---|

| 14. | |

Long to keep your records

Generally, you must keep your written evidence for five years from the date you

However a proprietary company may be exempt from having its financial report audited (see and Audit Relief for Proprietary Companies) or may otherwise be eligible for audit relief.

A disclosing entity must have its interim financial report reviewed and obtain a registered company auditor's review report.

The goal of an auditor's report is to document reasonable assurance that a company’s financial statements are free from error.

Along with balance sheets, profit & loss statements, and , auditor's reports make up part of a company's .

The statement of cash flows is one of the issued by a business, and describes the cash flows into and out of the organization. Its particular focus is on the types of activities that create and use cash, which are operations, investments, and financing. Though the statement of cash flows is generally considered less critical than the and , it can be used to discern trends in business performance that are not readily apparent in the rest of the financial statements. It is especially useful when there is a divergence between the amount of reported and the amount of generated by operations.

The statement of retained earnings reconciles changes in the account during a . The statement begins with the beginning balance in the retained earnings account, and then adds or subtracts such items as profits and dividend payments to arrive at the ending retained earnings balance. The general calculation structure of the statement is:

The profit and loss (P&L) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a fiscal quarter or year. The P&L statement is synonymous with the .

These records provide information about a company's ability or inability to generate profit by increasing revenue, reducing costs, or both. Some refer to the P&L statement as a statement of profit and loss, income statement, statement of operations, statement of financial results or income, earnings statement or expense statement.

| 19. |

|---|

Types of Profit and Loss

Gross profit/ Gross loss

Offer Discounts on Loans

Everyone loves an incentive, and if you offer customers a discount if they pay their bills ahead of time, you’re creating a win/win situation for both of you. Getting the cash in early helps your cash flow, of course.Conduct Customer Credit Checks

If a customer doesn't want to pay you in cash, then be sure to conduct a credit check—especially before you sign them up. If the client has poor credit, you can safely assume that you won’t be receiving payments on time.Based on amount allocated to each marketing activity.Complete the budget template provided given below?

|

Jul-16 |

|

|

|

Total | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Redesign Website |

|

5,000 | |||||||||||

| 200 | 200 |

|

200 | 200 | 200 |

|

2400 | ||||||

| 83 |

|

|

|

|

1000 | ||||||||

| 33 00 |

3300 | ||||||||||||

|

1000 |

|

1500 | ||||||||||

| Sponsor Local | 200 | 500 | 100 | 200 | 2000 | ||||||||

|

|||||||||||||

|

Television commercials are seen and heard by anyone tuned into the television channel at the time of airing. While many call this a shotgun approach, there is a strong branding message that happens when you have a good commercial seen by tens of thousands of people. You don't need to advertise on the national platform, but instead keep to local markets where your products and services will benefit from strong brand recognition.

Cable Targeting for Specific Demographics

Because everyone is advertising online, media outlets are desperate to sell more commercial packages. If you pay attention to TV commercials, you will see the same companies in the advertising rotation constantly. There are two reasons for this: The first is to enhance branding by constant advertising. The second is because packages are purchased to help sell more airtime for commercial buyers.

A smart business owner can research the stations and times he wants to advertise and then contact advertising distributors to see what packages are available. This means a business owner can gain a captive audience compared to competing against the noise in digital formats.

marketing plan typically includes

Set your annual goals

Your positioning strategy defines how you’ll differentiate your offering from those of your competitors.

Your brand strategy defines what you stand for and how you’ll communicate with the market.

Whether you’ll need to develop new compensation plans, or hire and train new personnel

Top priority markets, industries or customer segments; if you have a list of key prospects, include them

You also use ROI to determine the appropriate total budget for your marketing efforts.

Revisit your marketing plan regularly

The planning process itself is immensely valuable, but if you don’t

review the plan regularly, it’s easy to lose focus. Periodically revisit

the plan, and measure your progress.

|

|

||

|---|---|---|---|

| 25,000(Favourable) | |||

|

|

||

|

|||

|

|||

|

|

||

|

|||

|

|||

|

|

||

|

|||

|

|||

|

|

||

| 23600(Favourable) |

| Electricity and gas | |||

|---|---|---|---|

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

Assessment Task 5

Make sure you complete thorough credit history and business reference checks before you offer credit to new customers. Clearly articulate to your customers up front, in writing, your terms and the credit limits (so they know you are serious about your collection program) and ensure that they sign acceptance of your terms. It’s important that all your staff understand and follow this credit policy.

2. Provide the right information on quotes, invoices and statements

3. Make sure your systems are up to date and monitored

The secret to good debtor management is well-maintained information. There are many software solutions available to help you with your credit management, and increasingly more of them are cloud-based. Good software solutions can relieve you

Check your delivery systems and keep signed delivery dockets so that you can prove delivery.

Invoice as early and as often as possible, as receiving invoices late encourages customers to delay payment.

credit facilities. Long-standing customers can be the greatest credit risk, because no one thinks to check on them.

High customer concentration (i.e. doing a large proportion of your business with any one customer) carries substantial risks, which can far outweigh any benefits in the long term. Be careful when handling any requests for extended credit, and keep an eye on customers who appear to be expanding quickly. A growing customer may help your sales, but rapid growth also puts pressure on their ability to pay. Make commercial decisions based on their behaviour and any available information –industry gossip about a company’s financial position is often surprisingly accurate.