And reputational assets brand names

THIS CHAPTER WILL HELP YOU UNDERSTAND:

1. How to take stock of how well a company’s strategy is working 2. Why a company’s resources and capabilities are centrally important in giving the company a competitive edge over rivals

3. How to assess the company’s strengths and weaknesses in light of market opportunities and external threats

4. How a company’s value chain activities can affect the company’s cost structure and customer value proposition

5. How a comprehensive evaluation of a company’s competitive situation can assist managers in making critical decisions about their next strategic moves© McGraw-Hill Education.

5. Is the firm competitively stronger or weaker than key rivals?

6. What strategic issues and problems merit front-burner managerial attention?

© McGraw-Hill Education.

| Single-Business Company’s Strategy |

|---|

| STRATEGIC SUCCESS |

|---|

• Trends in the firm’s sales and earnings growth• Trends in the firm’s stock price

• The firm’s overall financial strength

• The firm’s customer retention rate

• The rate at which new customers are acquired• Evidence of improvement in internal processes such as defect rate, order fulfillment, delivery times, days of inventory, and employee

productivity© McGraw-Hill Education.

|

How Calculated | ||

|

Jump to Appendix 2 long image description |

|

|---|---|---|

| and What They Mean (2 of 8) | |||||||||

|---|---|---|---|---|---|---|---|---|---|

|

|||||||||

| Net return on total assets | Profits after taxes |

|

|||||||

| Total assets | |||||||||

| the firm’s total assets. | |||||||||

| Profits after taxes | |||||||||

|

|

||||||||

|

|||||||||

|

Long-term debt + | ||||||||

|

in the enterprise. A higher | ||||||||

|

return reflects greater bottom- | ||||||||

|

|||

|---|---|---|---|

|

How Calculated | What It Shows | |

|

Current assets | ||

| Current liabilities | |||

|

|

||

|

|||

|---|---|---|---|

|

|

What It Shows | |

| Measures the extent to which borrowed | |||

| Total assets | |||

|

|||

| Long-term debt |

|

||

| balance-sheet strength. It indicates the | |||

| equity | |||

|

|||

|

|||

Ratios |

|

What It Shows | |

| Total debt | Shows the balance between debt (funds | ||

| borrowed, both short term and long term) | |||

| equity |

|

||

|

|||

| equity |

|

||

|

|||

|

|||

|

|||

|

What It Shows | ||

Days of inventory Average collection |

Inventory | ||

| 365 |

|

||

|

|||

| Inventory | |||

|

|

||

| or | receive cash payment. A shorter collection | ||

|

|||

|

How Calculated | What It Shows | |

| Annual dividends |

|

||

| per share |

|

||

| Current market price | |||

| per share | |||

| Current market price | |||

| per share | confidence in a firm’s outlook and earnings | ||

| Earnings per share |

|

||

|

|||

| Annual dividends | Indicates the percentage of after-tax profits | ||

| per share | |||

|

|---|

| COMPANIES? |

|---|

● Are the determinants of its competitiveness and

ability to succeed in the marketplace

A capability or competence is the capacity of a firm to perform an internal activity competently through deployment of a firm’s resources.

A firm’s resources and capabilities represent its competitive assets and are determinants of its competitiveness and ability to succeed in the marketplace.

| RESOURCES AND CAPABILITIES |

|---|

A capability:

● The capacity of a firm to perform some activity proficiently (e.g., superior skills in marketing)

| • |

|

|---|

| • |

|

|

|---|---|

| • | ||

|---|---|---|

|

||

| • |

|

|

| • | ||

| • | ||

|

||

A resource bundle is a linked and closely

integrated set of competitive assets centered around one or more cross-functional capabilities.The VRIN Test for sustainable competitive

advantageasks if a resource is Valuable, Rare, Inimitable, and Non-substitutable.

| CAPABILITIES |

|---|

● Is the resource invulnerable to the threat of substitution of different types of resources and capabilities (non-substitutable)?

© McGraw-Hill Education.

| COMPETITIVE POWER | |

|---|---|

| Support for sustained | |

| Nonsubstitutable |

|---|

Social complexity (company culture, interpersonal relationships among managers or R&D teams, trust-based relations with customers or suppliers) and causal ambiguity are two factors that inhibit the ability of rivals to imitate a firm’s most valuable resources and capabilities.

Causal ambiguity makes it very hard to figure out how a complex resource contributes to competitive advantage and therefore exactly what to imitate.

© McGraw-Hill Education.

| CAPABILITIES DYNAMICALLY |

|---|

| AND EXTERNAL THREATS? |

|---|

SWOT Analysis

Basing a company’s strategy on its most competitively valuable strengths gives the company its best chance for market success.

© McGraw-Hill Education.

| STRENGTHS |

|---|

A core competence is an activity that a firm performs proficiently and that is also central to its strategy and competitive success.

A distinctive competence is a competitively important activity that a firm performs better than its rivals—it thus represents a competitively

superior internal strength.

© McGraw-Hill Education.

A firm’s strengths represent its competitive assets. A firm’s weaknesses are shortcomings that

constitute competitive liabilities.

A company is well advised to pass on a particular market opportunity unless it has or can acquire the competencies needed to capture it.

© McGraw-Hill Education.

| Weaknesses, Opportunities, and Threats (1 of 4) | |||

|---|---|---|---|

|

|||

| • | • | ||

|

|||

| • |

|

• | |

| • | • | No distinctive competencies or competitively | |

|

|

||

| • | • | ||

| • | • |

|

|

| attributes that are inferior to those of rivals | |||

| • |

|

• | Weak balance sheet, few financial resources |

| to grow the firm, too much debt | |||

| • | • | ||

| technological skills, important patents | |||

| • | • | ||

|---|---|---|---|

|

|||

| • |

|

• | |

|

|||

| • | Wide geographic coverage or strong | • | A plague of internal operating problems |

| • |

|

• | |

| Weaknesses, Opportunities, and Threats (3 of 4) | |||

|---|---|---|---|

|

|

||

| • | • | ||

|

• |

|---|

| Weaknesses, Opportunities, and Threats (4 of 4) |

|---|

| • | • | ||

|---|---|---|---|

| • |

|

• |

|

| • | |||

| Entering into alliances or joint ventures | • | ||

|

|||

|

SWOT analysis involves:

● Drawing conclusions from the SWOT listings about the firm’s overall situation

● Translating these conclusions into strategic actions by the firm that:

Match its strategy to its internal strengths and to market opportunities

Correct important weaknesses and defend it against external threats© McGraw-Hill Education.

Jump to Appendix 8 long image description

© McGraw-Hill Education.

• Do the firm’s strengths outweigh its weaknesses by an attractive margin?

• Does the firm have attractive market opportunities that are well suited to its internal strengths?

| CUSTOMER VALUE PROPOSITION? |

|---|

Signs of a firm’s competitive strength:

● Its prices and costs are in line with rivals

● Its customer-value proposition is competitive and cost effective

● Its bundled capabilities are yielding a sustainable competitive advantage

| VALUE CHAIN |

|---|

The value chain:

A company’s value chain identifies the primary activities and related support activities that create customer value.

© McGraw-Hill Education.

| Value Chain |

|---|

© McGraw-Hill Education.

| CHAINS OF RIVAL FIRMS |

|---|

● Uses activity-based costing to evaluate the activities

● Does the same for significant competitors

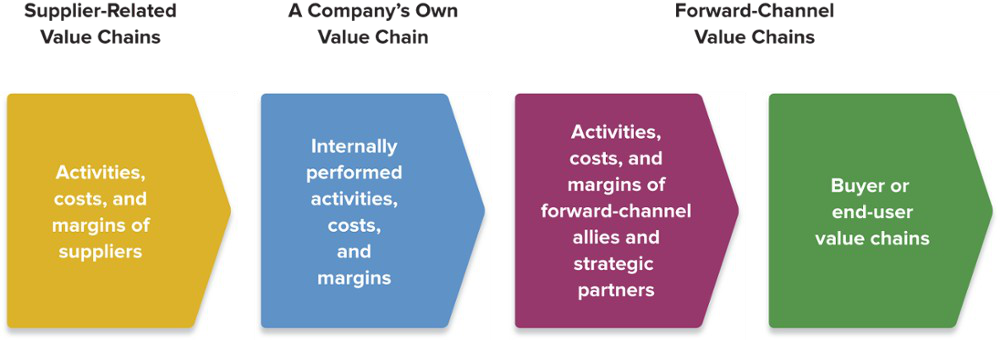

| AN ENTIRE INDUSTRY |

|---|

| Value Chain System |

|---|

| $ 28.16 | $68.46 | |

|---|---|---|

|

12.00 | |

| Cutting/Sewing/Finishing | 9.50 | |

|

3.00 | |

| 15.80 | ||

| Cost of Goods | ||

| 5.48 | $154.38 | |

| Ocean Freight/Insurance | 4.55 | |

| 8.22 | ||

| 8.50 | ||

|

15.15 | |

|

14.00 | |

| 30.00 | ||

| Total Cost | ||

| About 60% | $250.00 | |

| Boll & Brand Retail Price | ||

| Gross Margin | $ 95.62 | |

♦ Which activities in the value chain are primary activities? Which are secondary activities?

♦ Which activities are linked to the value chain for the entire industry?

Benchmarking is a potent tool for improving a company’s own internal activities that is based on learning how other companies perform them and borrowing their “best practices.”

© McGraw-Hill Education.

● Assesses whether the cost competitiveness and effectiveness of a firm’s value chain activities are in line with its competitors’ activities

Sources of benchmarking information

| STRATEGIC MANAGEMENT PRINCIPLE (9 of 14 |

|---|

Benchmarking the costs of a firm's activities

against those of rivals provides hard evidence of

| DELIVERED-COST |

|---|

| INDUSTRY |

|---|

Why is the collection of competitive intelligence to accurately benchmark delivered costs of such importance in the cement industry?

How could key data about competitors published by the PCA create an temptation for unethical price fixing, market or customer allocation schemes, dealing

arrangements, bid rigging, or bribery in the industry?

© McGraw-Hill Education.

|

|---|

Invest in productivity-enhancing, cost-saving technological improvements.

Find ways to detour around activities or items where costs are high.

|

|---|

Implement best practices for quality of high-value activities.

Adopt best practices for marketing, brand management, and enhancing customer perceptions.

© McGraw-Hill Education.

Work with suppliers to enhance the firm’s differentiation.

Select and retain suppliers who meet higher-quality standards. Coordinate with suppliers to enhance design or other features desired by customers.

| PARTNERS |

|---|

Achieving cost-based competitiveness

● Pressure forward channel allies to reduce their costs and markups.● Collaborate with forward channel allies to identify win- win opportunities to reduce costs.

| SYSTEM |

|---|

Engage in cooperative advertising and promotions with forward channel allies.

© McGraw-Hill Education.

|

|---|

| INTO COMPETITIVE ADVANTAGE |

|---|

|

|---|

Assessing the firm’s overall competitive strength

© McGraw-Hill Education.

|

|---|

5. Use overall strength ratings to draw conclusions about the company’s net competitive advantage or disadvantage and to take specific note of areas of strength and weakness.

© McGraw-Hill Education.

| ABC Co. | Rival 1 | Rival 2 | |||||

|---|---|---|---|---|---|---|---|

|

Strength |

|

Strength | Weighted | Strength | Weighted | |

| Weight | Rating | Score | Rating | Score | |||

| 0.10 | 8 | 0.80 | 5 | 0.50 | 1 | 0.10 | |

|

0.10 | 8 | 0.80 | 7 | 0.70 | 1 | 0.10 |

|

0.10 | 2 | 0.20 | 10 | 1.00 | 5 | 0.50 |

| 0.05 | 10 | 0.50 | 1 | 0.05 | 3 | 0.15 | |

| 0.05 | 9 | 0.45 | 4 | 0.20 | 5 | 0.25 | |

| 4 | 0.20 | 5 | 0.25 | ||||

| 0.05 | 9 | 0.45 | |||||

|

|||||||

|

0.10 | 5 | 0.50 | 10 | 1.00 | 3 | 0.30 |

| 0.30 | 5 | 1.50 | 10 | 3.00 | 1 | 0.30 | |

| 0.15 | 5 | 0.75 | 7 | 1.05 | 1 | 0.15 | |

|

5.95 | 7.70 | 2.10 | ||||

|

Jump to Appendix 14 long image description | ||||||

| COMPETITIVE STRENGTH ASSESSMENT |

|---|

The rating score indicates the total net competitive advantage for a firm relative to other firms.

Firms with high competitive strength scores are targets for benchmarking.

|

|---|

| ATTENTION? |

|---|

|

|---|

| ATTENTION? |

|---|

© McGraw-Hill Education.

A good strategy must contain ways to deal with all the strategic issues and obstacles that stand in the way of the company’s financial and competitive success in the years ahead.