And the price level michael parkin modular level

Questions 1 through 18 relate to Ethical and Professional Standards.

Answer = A

“Guidance for Standards I–VII,” CFA Institute

2013 Modular Level I, Vol. 1, Reading 2, Standard III (B) Fair Dealing

Study Session 1–2–c

Recommend practices and procedures designed to prevent violations of the Code of Ethics and Standards of Professional Conduct.“Guidance for Standards I–VII,” CFA Institute

2013 Modular Level I, Vol. 1, Reading 2, Standard I (B) Independence and Objectivity

Study Session 1–2–c

Recommend practices and procedures designed to prevent violations of the Code of Ethics and Standards of Professional Conduct.C is correct because Standard I (B) Independence and Objectivity requires members and candidates to use reasonable care and judgment to maintain their independence and objectivity in their professional activities. Best practice dictates that Kumar only accept transportation to the remote mining sites in that it is unlikely he would be able to source commercial flights to the locations and ground transport may not be viable. Because Kumar would normally visit mining sites around the world as part of his job and because he is combining this trip with trip to other mine sites in different countries, it would be inappropriate for Cerberus to pay for the analyst’s travel expenses from London. Although Kumar could go on safari with the group of analysts, he should pay his own way so as to restrict any influence such a gift could possibly have when making his investment recommendations on Cerberus.

B is correct because Naib knowingly misrepresented his qualifications by stating he had obtained an MBA degree at the time of his hire when in fact he had not. This reflects adversely on his professional integrity, violating Standard I (D) Misconduct. Stating he passed his CFA exams in three consecutive years is not a violation of Standard VII (B) Reference to CFA Institute,

the CFA Designation, and the CFA Program if it is factual. There is no evidence given to indicate he did not pass as claimed.

C is correct because Standard III (A) Loyalty, Prudence and Care stipulates that the client owns the brokerage. Therefore members and candidates are required to only use client brokerage to the benefit of the clients (soft commissions policy). Because the firm specializes in domestic equity, an offshore investment database service would not benefit clients.

5.Elbie Botha, CFA, an equity research analyst at an investment bank, disagrees with her research team’s buy recommendation for a particular company’s rights issue. She acknowledges the recommendation is based on a well-developed process and extensive research but feels the valuation is overpriced based on her assumptions. Despite her contrarian view, her name is included on the research report to be distributed to all of the investment bank’s clients. To avoid violating any CFA Institute standards, it would be least appropriate for Botha to undertake which of the following?

C is correct because Standard IV (A) calls for employees to be loyal to their employer by not causing harm. If Botha released a contradictory research recommendation report to clients, it could possibly cause confusion amongst clients and embarrassment to the firm.

6.Colleen O’Neil, CFA, manages a private investment fund with a balanced global investment mandate. Her clients insist that her personal investment portfolio replicate the investments within their portfolio to assure them she is willing to put her money at risk. By undertaking which of the following simultaneous investment actions for her own portfolio would O’Neil most likely be in violation of Standard VI (B) Priority of Transactions?

7.Christina Ng, a Level I CFA candidate, defaulted on a bank loan she obtained to pay for her Master’s degree tuition when her wedding cost more than expected. A micro finance loan company lent her money to pay off the tuition loan in full, including penalties and interest. The micro finance loan company even extended further credit to pay for her parents’ outstanding medical bills. Unfortunately, her parents’ health problems escalated to the point where Ng had to take extensive time away from work to deal with the issues. She was subsequently fired and consequently defaulted on the second loan. Because she was no longer employed, Ng decided to file for personal bankruptcy. Do the loan defaults leading up to Ng’s bankruptcy most likely violate Standard I (D) Misconduct?

A. No

B. Yes, with regard to the first loan default8.Charles Mbuwanga, a Level III CFA Candidate, is the business development manager for Sokoza Investment Group, an investment management firm with high-net-worth retail clients

throughout Africa. Sokoza introduced listed Kenyan Real Estate Investment Trusts (REITs) to its line of investment products based on new regulations introduced in Kenya so as to diversify its product offering to clients. The product introduction comes after months of researching Kenyan property correlations with other property markets and asset classes in Africa. Sokoza assigns Mbuwanga as part of the sales team in introducing this product to its clients across Africa.Mbuwanga subsequently determines most of Sokoza’s clients’ portfolios would benefit from having a small Kenyan property exposure to help diversify their investment portfolios. By promoting the Kenyan REITs for Sokoza’s client portfolios as planned, Mbuwanga would least likely violate which of the following standards?

done. He may also be in violation of Standard I (A) Knowledge of the Law in that he would need to determine if the Kenyan REIT product is allowable in each of the countries where his clients reside.

9.Victoria Christchurch, CFA, is a management consultant currently working with a financial services firm interested in curtailing its high staff turnover, particularly amongst CFA

charterholders. In recent months, the company lost 5 of its 10 most senior managers, all of whom have cited systemic unethical business practices as the reason for their leaving. To curtail staff turnover by encouraging ethical behavior, it would be least appropriate for Christchurch to recommend the company do which of the following?Under Standard I (A) Knowledge of the Law, CFA charterholders and candidates must

disassociate themselves from unethical behavior. Because the unethical business practices are seen as systemic, it would likely require them to leave the firm. Implementing a whistleblowing policy and adopting a corporate code of ethics would likely help to build a foundation of strong ethical behavior.10.Henrietta Huerta, CFA, writes a weekly investment newsletter to market her services and obtain new asset management clients. A third party distributes the free newsletter on her behalf to those individuals on its mailing list. As a result, it is widely read by thousands of individual investors. The newsletter recommendations reflect most of Huerta’s investment actions. After completing further research on East-West Coffee Roasters, Huerta decides to change her initial buy recommendation to a sell. To avoid violating the CFA Institute Standards of Professional Conduct it would be most appropriate for Huerta to distribute the new investment

recommendation to:“Guidance for Standards I–VII,” CFA Institute

2013 Modular Level I, Vol. 1, Reading 2, Section Standard III (A) Loyalty, Prudence, and Care Study Session 1–2–c

Recommend practices and procedures designed to prevent violations of the Code of Ethics and Standards of Professional Conduct.B is correct because according to Standard III (A) Loyalty, Prudence and Care members and candidates must place their clients’ interests first before their own interests. The temptation may be to release the changed recommendation to newsletter recipients simultaneously with or even before the asset management clients to try to obtain new clients. However, to avoid violating Standard III (A) Loyalty, Prudence and Care, Huerta must ensure any change in an investment recommendation is first distributed to her asset management clients before any newsletter recipients, who are not necessarily clients (that is, they receive the newsletter for free from a third party distribution list).

C is correct because Deschutes most likely violated Standard III (E) Preservation of

Confidentiality by failing to preserve the confidentiality of client records when she disclosed specific details about clients in the equity portfolio.12.When Abdullah Younis, CFA, was hired as a portfolio manager at an asset management firm two years ago, he was told he could allocate his work hours as he saw fit. At that time, Younis served on the board of three non-public golf equipment companies and managed a pooled investment fund for several members of his immediate family. Younis was not compensated for his board

“Guidance for Standards I–VII,” CFA Institute

2013 Modular Level I, Vol. 1, Reading 2, Standard IV (B) Additional Compensation Arrangements, Standard VI (A) Disclosure of Conflicts

Study Session 1–2–c

Recommend practices and procedures designed to prevent violations of the Code of Ethics and Standards of Professional Conduct.A is correct because golf equipment is a business independent of the financial services industry such that any board obligations would not likely be considered a conflict of interest requiring disclosure according to Standard IV (B) Additional Compensation Arrangements. Standard IV (B) requires members and candidates to obtain permission from their employer before accepting compensation or other benefits from third parties for the services that might create a conflict with their employer’s interests. Managing investments for family and non-family members could likely create a conflict of interest for Younis’ employer and should be disclosed to his employer.

“Guidance for Standards I–VII”, CFA Institute

2013 Modular Level I, Vol. 1, Reading 2, Standard IV (C) Responsibilities of SupervisorsStudy Session 1–2–b

Distinguish between conduct that conforms to the Code and Standards and conduct that violates the Code and Standards.“Guidance for Standards I–VII,” CFA Institute

2013 Modular Level I, Vol. 1, Reading 2, Standard III (B) Fair Dealing, Standard V (A) Diligence and Reasonable Basis, Standard VI (B) Priority of Transactions

Study Session 1–2–b

Distinguish between conduct that conforms to the Code and Standards and conduct that violates the Code and Standards.A is correct because the analyst violated Standard III (B) Fair Dealing by selectively distributing the recommendation only to investment banking clients despite being responsible for making investment recommendations to all group clients. Schleif should distribute the change in recommendation to all clients who received the initial recommendation, not just those within the investment banking division of the group.

Answer = A

“Guidance for Standards I–VII,” CFA Institute

2013 Modular Level I, Vol. 1, Reading 2, Standard V (A) Selecting External Advisers and Subadvisers

Study Session 1–2–b

Distinguish between conduct that conforms to the Code and Standards and conduct that violates the Code and Standards.“Guidance for Standards I–VII,” CFA Institute

2013 Modular Level I, Vol. 1, Reading 2, Standard VI (C) Referral Fees

Study Session 1–2–c

Recommend practices and procedures designed to prevent violations of the Code of Ethics and Standards of Professional Conduct.C is correct because the referral arrangements should be disclosed to potential clients “before entry into any formal agreement for services” and not after the fact. This allows potential clients to consider whether the arrangement causes them any potential harm as a result of the arrangement (e.g., higher fees and potential conflicts of interests).

Answer = C

“Guidance for Standards I–VII,” CFA Institute

2013 Modular Level I, Vol. 1, Reading 2, Standard VII (A) Confidential Program Information Study Session 1–2–b

Distinguish between conduct that conforms to the Code and Standards and conduct that violates the Code and Standards.A. Statement 1

B. Statement 2

C. Statement 3Answer = C

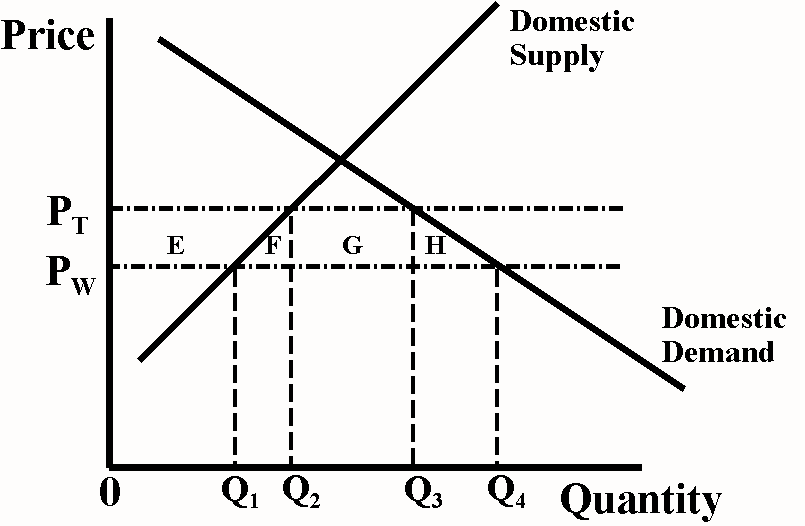

19.The nominal (quoted) annual interest rate on an automobile loan is 10%. The effective annual rate of the loan is 10.47%. The frequency of compounding periods per year for the loan is closest to:

A.weekly.

B is correct. Use the formula for effective annual rate: EAR = (1 + Periodic interest rate)m – 1.

Iteratively substitute the possible frequency of compounding until the EAR is 10.47%.

C.mesokurtotic (identical to the normal distribution in peakedness).

Answer = B

| Observation | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| Value | –3 | –11 | 3 | –18 | 18 | 20 | –6 | 9 | 2 | –16 |

The sample standard deviation is closest to:

A. 11.92.

B.12.50.

C.13.18.The sample standard deviation is the (positive) square root of the sample variance.

A.0.1.

B.0.3.

C.0.7.Answer = A

|

|

|

|---|---|---|

| Sud,du = 79.2 | ||

|

The initial value of the stock is $80. The probability of an up move in any given period is 75% and the probability of a down move in any given period is 25%. Using the binomial model, the probability that the stock’s price will be $79.20 at the end of two periods is closest to:

Construct a binomial tree to describe stock price movement.

B is correct. Across two periods, there are four possibilities: • an up move followed by an up move ($96.8 end value), • an up move followed by a down move ($79.2 end value),

24.Which of the following statements of null and alternative hypotheses requires a two-tailed test?

A.H0: θ = θ0 versus Ha: θ ≠θ0

B.H0: θ ≤ θ0 versus Ha: θ >θ0

C.H0: θ ≥ θ0 versus Ha: θ <θ0A.support level.

B.resistance level.

26.You are given the following discrete uniform probability distribution of gross profits from purchase of an option:

“Common Probability Distributions,” Richard A. DeFusco, CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFA

2013 Modular Level I, Vol. 1, Reading 9, Section 2.1

Study Session 3– 9– d

Calculate and interpret probabilities for a random variable, given its cumulative distribution function.C is correct. There are two ways to find P(1 ≤ X ≤ 4):

1)Find the sum of four probabilities: P(1), P(2), P(3), and P(4), 0.2 + 0.2 + 0.2 + 0.2 = 0.8.A. 0.00096.

B. 0.00710.

C. 0.01485.Answer = C

|

||

|---|---|---|

| Here, |

|

|

If he assumes that the S&P return this year will be the same as it was last year, which of the following is the best estimate of the 95% confidence interval for this year’s S&P return?

A. –0.11600 to +0.34400

B. +0.05024 to +0.17775

C. +0.06110 to +0.16690With sample variance of 0.0529, .The estimated interval is

(√ ) ) = +0.05024 to +0.17775.

“The Time Value of Money,” Richard A. DeFusco, CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFA

2013 Modular Level I, Vol. 1, Reading 5, Section 2

Study Session 2–5–b

Explain an interest rate as the sum of a real risk-free rate and premiums that compensate investors for bearing distinct types of risk.A is correct. “The liquidity premium compensates investors for the risk of loss relative to an investment’s fair value if the investment needs to be converted to cash quickly.”

| 9.81 |

|

13.99 | ||

|

10.12 | 14.47 | ||

| 10.84 | 14.85 | |||

| 11.33 |

|

15.00 | ||

|

12.25 | 17.36 | ||

| 13.39 | 17.98 | |||

| 13.42 |

The value of the first quintile is closest to:

A. 10.70%.

B. 10.84%.

C. 11.09%Therefore, the location of the first quintile is between the volatility of Fund 2 and Fund 3 (because they are ranked in ascending order).

Then, use linear interpolation to find the approximate value of the first quintile: P20 ≈ X2 + (2.80 – 2) × (X3– X2),

where

X2 is the volatility of Fund 2

X3 is the volatility of Fund 3

P20 is the approximate value of the first quintile

P20 ≈ 10.12% + (2.80 – 2) × (10.84% –10.12%) = 10.70%

“Statistical Concepts and Market Returns,” Richard A. DeFusco, CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFA

2013 Modular Level I, Vol. 1, Reading 7, Section 7.2 (Example 10)

Study Session 2–7–g

Calculate and interpret (1) a range and a mean absolute deviation and (2) the variance and standard deviation of a population and of a sample.A is correct. The mean absolute deviation (MAD) for a sample is calculated as follow:

| ∑ |

|---|

32.Consider the following information in relation to a portfolio composed of Fund A and Fund B:

| Fund A | ||

|---|---|---|

| 70 | 30 | |

| 10 | 16 | |

| 7 | 13 | |

|

0.80 | |

The portfolio standard deviation of returns is closest to:

B is correct. First, calculate the covariance between Fund A and Fund B given the standard deviation of returns and the correlation between the two funds:

Cov(RA, RB) = ρ(RA, RB)σ(RA)σ(RB),

where

σ(RA) = 7%. This is the standard deviation of returns of fund A

σ(RB) = 13%. This is the standard deviation of returns of fund B

ρ(RA, RB) = 0.80. This is the correlation between the returns of Fund A and Fund B. Cov(RA, RB) = 0.80 × 7% × 13%= 0.00728.Then calculate the portfolio standard deviation of returns as follow:

| . |

|---|

Alternatively, use correlation directly in the formula for portfolio standard deviation: σRPortfolio=[ 2σ2 RA+ 𝐵2σ2 RB+2𝐵𝜌RA, RB σRA σRB]0.5

σRPortfolio= [(0.70)2×0.072+0.302×0.132+2∗0.70×0.30×0.80×0.07×0.13]0.5=8.35%.

Questions 33 through 44 relate to Economics

The student’s current monthly food budget is $500, the price of a pizza is $5 and the price of cola is $1.25/bottle. If the student’s monthly food budget were to increase to $700, the slope of her demand curve for pizza would be closest to:

B is correct.

|

|---|

|

|

C. greater than 60.

Answer = C

|

|---|

60.

A.$6.00, all firms should exit the market in the long run.

B.$3.50, firm X should continue to operate in the short run, but firms Y and Z should shut down production.

B is correct.

|

||

|---|---|---|

|

||

|

||

|

||

|

||

A.106.2.

B.106.8.

C.113.4.Answer = C

| Nominal GDP | Real GDP | |

|---|---|---|

|

||

|

||

“Understanding Business Cycles,” Michele Gambera, CFA, Milton Ezrati, and Bolong Cao, CFA 2013 Modular Level I, Vol. 2, Reading 18, Section 5.1, Exhibit 7

Study Session 5-18-i, j

Describe economic indicators, including their uses and limitations.Identify the past, current, or expected future business cycle phase of an economy based on economic indicators.

|

|

|---|

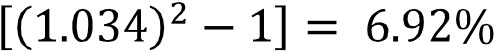

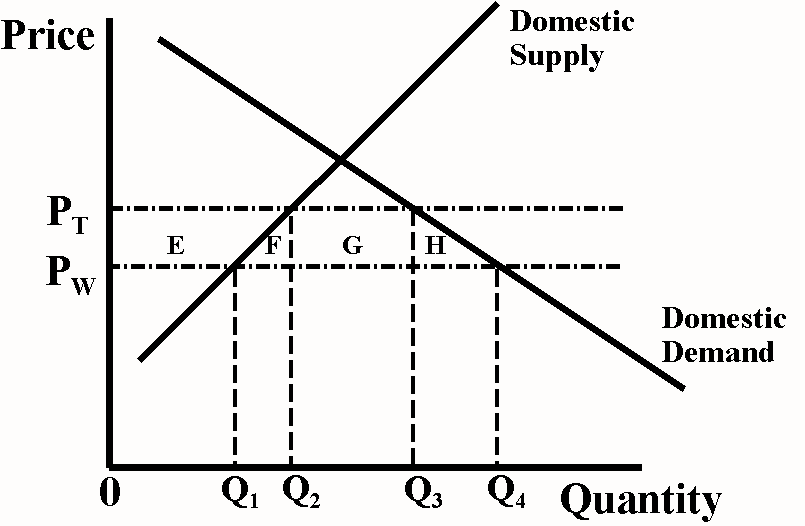

C is correct. The loss in consumer surplus because of higher prices is represented by area E+F+G+H. This exceeds the gains from producer surplus (E) and government revenues on imports (G). Hence, the net welfare effect to the country is a deadweight loss of [E + F + G + H] – [E] – [G] = F+H.

39.The International Bank for Reconstruction and Development most likely:

A is correct. Closely affiliated with The World Bank Group, the International Bank for Reconstruction and Development (IBRD) provides low or no-interest loans and grants to developing countries that have unfavorable or no access to international credit markets.

40.An investor examines the following rate quotes for the Brazilian real and the Australian dollar:

Answer = B

“Currency Exchange Rates,” William A. Barker, CFA, Paul D. McNelis, and Jerry Nickelsburg 2013 Modular Level I, Vol. 2, Reading 21, Section 3.3

Study Session 6–21–f, g

Explain the arbitrage relationship between spot rates, forward rates and interest rates. Calculate and interpret a forward rate consistent with a spot rate and the interest rate in each currency.

| ) | ⁄( ) ( |

|---|

Arbitrage profit = BRL521,844 (right side above) – BRL520,500 (left side above) = 1,344.

41.The demand and supply functions for a leading smartphone are furnished below:

| Qd sp = 1,000 – 20Psp+ 2I; |

|---|

A. $250.

B. $300.

C. $425.Answer = B

A. shut down in the short run and exit in the long run. B. increase its level of production to enter profit territory. C. decrease its level of production to enter profit territory.

Answer = C

Answer = A

“Understanding Business Cycles,” Michele Gambera, CFA, Milton Ezrati, and Bolong Cao, CFA 2013 Modular Level I, Vol. 2, Reading 18, Section 4.2.2

Study Session 5-18-f, g

Explain the construction of indices used to measure inflation.

Compare inflation measures, including their uses and limitations.Answer = B

“Understanding Business Cycles,” Michele Gambera, CFA, Milton Ezrati, and Bolong Cao, CFA 2013 Modular Level I, Vol. 2, Reading 18, Section 3.3.1

Study Session 5–18–c

Describe theories of the business cycle.

| £ ‘000s | |

|---|---|

|

200 |

|

350 |

| 1,250 | |

| 300 | |

| 200 | |

| 600 |

Using the current ratio, when compared with the industry, the firm is best described as being:

A. as liquid.

Study Session 8-26-i, 11-40-b

Calculate and interpret liquidity and solvency ratios.Compare a company’s liquidity measures with those of peer companies.

The higher the current ratio the more liquid the company. Thus, with a current ratio of 2.6 (1,800 ÷ 700), the company is less liquid than the industry, with a current ratio of 3.2.

Answer = A

“Understanding Income Statements,” Elaine Henry, CFA and Thomas R. Robinson, CFA

2013 Modular Level I, Vol. 3, Reading 25, Section 5.3

“Financial Analysis Techniques,” Elaine Henry, CFA, Thomas R. Robinson, CFA, and Jan Hendrik van Greuning, CFA

2013 Modular Level I, Vol.4, Reading 28, Section 4.6.2

“Introduction to Industry and Company Analysis,” Patrick W. Dorsey, CFA, Anthony M. Fiore, CFA and Ian Rossa O’Reilly, CFA

2013 Modular Level I, Vol.5, Reading 50, Section 5.1.2

Study Sessions: 8-25-e, 8-28-d, 14-50-g

Describe the financial reporting treatment and analysis of non-recurring items (including discontinued operations, extraordinary items, and unusual or infrequent items) and changes in accounting standards.47.In 2011, a software company recorded unearned revenue related to a software license that it will recognize as revenue during 2012. Ignoring income taxes, this recognition of the software revenue will most likely have which of the following effects on cash from operations in 2012?

A. No effect

B. A decrease

C. An increaseA is correct. The company received the cash in 2011 when it recorded the unearned revenue and it was a part of the cash from operations in that year. In 2012, the revenue is earned but there is no cash exchanged and hence no effect of the cash from operations, ignoring taxes.

48.The following information for the current year is available for a company that prepares its financial statements in accordance with U.S. GAAP.

| 7,000 | |

| 4,200 | |

| 500 | |

|

250 |

|

200 |

49.Which of the following activities would an analyst least likely complete as part of the processing data phase of a financial analysis?

A. Analyzing the prospects of the industry

B. Preparing common-sized financial statement data C. Making adjustments for different accounting policiesA. Form 10-K

B. Annual report

C. Proxy statementAnswer = B

• Company 2 has been offering the same products throughout the period, and the demand and cost structures for its products have not experienced any significant changes.

• Company 3 has recently restructured its product offerings focusing on high margin products only.

“Financial Statement Analysis: Applications,” Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, Elaine Henry, CFA, and Michael A. Broihahn, CFA

2013 Modular Level I, Vol. 3, Reading 35, Section 3.1 Example 3

Study Session 10–35–b

Prepare a basic projection of a company’s future net income and cash flow.B is correct. Company 2 because it has been offering the same products and its demand and cost structures have been stable too. Therefore, the relationship between sales and gross profit (i.e., gross margin) should be stable and most reliable.

| Component | Cost | Useful Life |

|---|---|---|

| A | $500,000 | 10 years |

| B | $500,000 | 5 years |

Answer = C

“Long-Lived Assets” Elaine Henry, CFA and Elizabeth A Gordon 2013 Modular Level I, Vol. 3, Reading 30, Section 3.1, Example 5 Study Session 9–30–d

Calculate depreciation expense.

A. Investing

B. Financing

C. OperatingAnswer = C

| $ millions | |

|---|---|

| 90.0 | |

|

15.2 |

|

28.0 |

| 34.3 | |

| 13.0 |

Answer = B

“Understanding Cash Flow Statements,”Elaine Henry, CFA, Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, and Michael A Broihahn, CFA

2013 Modular Level I, Vol. 3, Section 4.3

Study Session: 8–27-i

Calculate and interpret free cash flow to the firm, free cash flow to equity, and performance and coverage cash flow ratios.

| 74.7 |

|---|

“Financial Analysis Techniques,”Elaine Henry, CFA, Thomas R. Robinson, CFA, and Jan Hendrik van Greuning, CFA

2013 Modular Level I, Vol. 3, Section 5.1.1, Exhibit 18

Study Session: 8-28-e

Calculate and interpret ratios used in equity analysis, credit analysis, and segment analysis.B is correct.

|

|

|

“Inventories,”Michael A Broihahn, CFA

2013 Modular Level I, Vol. 3, Section 6, Example 5

Study Session: 9-29-h

Calculate and interpret ratios used to evaluate inventory management.B is correct. All else held constant, in a period of rising costs the ending inventory would be lower under weighted average and cost of goods sold (CGS) will be higher (compared to FIFO) resulting in lower net income and retained earnings. There will be no impact on the debt level, current or long-term. Therefore the debt-to-equity ratio (Total debt ÷ Total shareholder’s equity) will increase due to the decrease in retained earnings (and lower shareholders’ equity).

“Financial Statement Analysis: An Introduction,” Elaine Henry, CFA and Thomas R. Robinson, CFA 2013 Modular Level 1, Vol.3, Reading 22, Section 3.1.6

Study Session: 7-22-e

Identify and explain information sources that analysts use in financial statement analysis besides annual financial statements and supplementary information.C is correct. Forward-looking information such as those about planned capital expenditures is typically provided in the management discussion and analysis (MD&A).

Answer = B

“Financial Reporting Mechanics,” Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, Karen O’Connor Rubsam, CFA, Elaine Henry, CFA, and Michael A. Broihahn, CFA

2013 Modular Level 1, Vol.3, Reading 23, Sections 3.2, 4.2

Study Session: 7-23-b, e

|

||

|---|---|---|

| $ 50,000 | ||

| 225,000 | ||

| 450,000 | ||

| 5,000 | ||

|

(402,000) | |

|

53,000 | |

| (10,000) | ||

| 43,000 | 43,000 | |

| $318,000 | ||

A. timeliness and accrual accounting.

B. understandability and verifiability.

C. relevance and faithful representation.A. U.S. GAAP, intangibles must be valued at historical cost.

B. IFRS, a commercial real estate company should use a liquidity based presentation. C. IFRS, a classified balance sheet must present current assets before non-current assets.

61. A company recorded the following events in 2012:

A is correct.

“Understanding Cash Flow Statements,” Elaine Henry, CFA, Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, and Michael A. Broihahn, CFA

2013 Modular Level I, Vol. 3, Reading 27, Section 2.1

Study Session 8-27-a

Compare cash flows from operating, investing, and financing activities and classify cash flow items as relating to one of those three categories given a description of the items.

| $ millions | |

|---|---|

| 4,800 | |

| 2,880 |

B. 120.

C. 138.Answer = B

| Accounts receivable | Inventory |

|

|

|---|---|---|---|

| Days in Sales (DSO) | Days on hand (DHO) |

|

|

| Sales | Purchases | ||

| A/R | Inventory | Payables | |

| 4,800 ÷ 625 | 2,880 ÷ 710 | 2,940 ÷ 145 | |

| = 7.68 times | |||

| = 4.06 times | = 20.3 times | ||

| 365 ÷ 7.68 | |||

| 365 ÷ 4.06 | 365 ÷ 20.3 | ||

| = 48 days | = 90 days | = 18 days |

| 300 | 7.70 | ||

|---|---|---|---|

| 600 | 12.00 | ||

|

400 |

If the company used a perpetual system versus a periodic inventory system, the gross margin would most likely be:

“Inventories,” Michael A. Broihahn, CFA

2013 Modular Level 1, Vol.3, Reading 29, Section 3.6

Study Session: 9-29-d, e

Calculate and compare cost of sales, gross profit, and ending inventory using perpetual and periodic inventory systems.Compare and contrast cost of sales, ending inventory and gross profit using different inventory valuation methods.

"Long-Lived Assets,” Elaine Henry, CFA and Elizabeth A. Gordon 2013 Modular Level 1, Vol.3, Reading 30, Section 8

Study Session: 9-30-g, kDescribe the revaluation model.

B. U.S. GAAP if there is doubt about recovering a deferred tax asset.

C. both IFRS and U.S. GAAP on tax differences arising from the translation of foreign operations.

A. increase in gross margin.

B. decrease in the LIFO reserve.

67. Selected information about a company is as follows:

|

2011 December 31 |

|

|---|---|---|

| 2,200 | 2,500 | |

| 28% | 30% | |

| 1,400 | 1,400 | |

|

25% | 25% |

|

55 | 60 |

| 500 | 500 |

“Financial Statement Analysis: Applications,” Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, Elaine Henry, CFA and Michael A. Broihahn, CFA

2013 Modular Level 1, Vol. 3, Reading 35, Section 3.2, Example 5

Study Session: 10-35-b

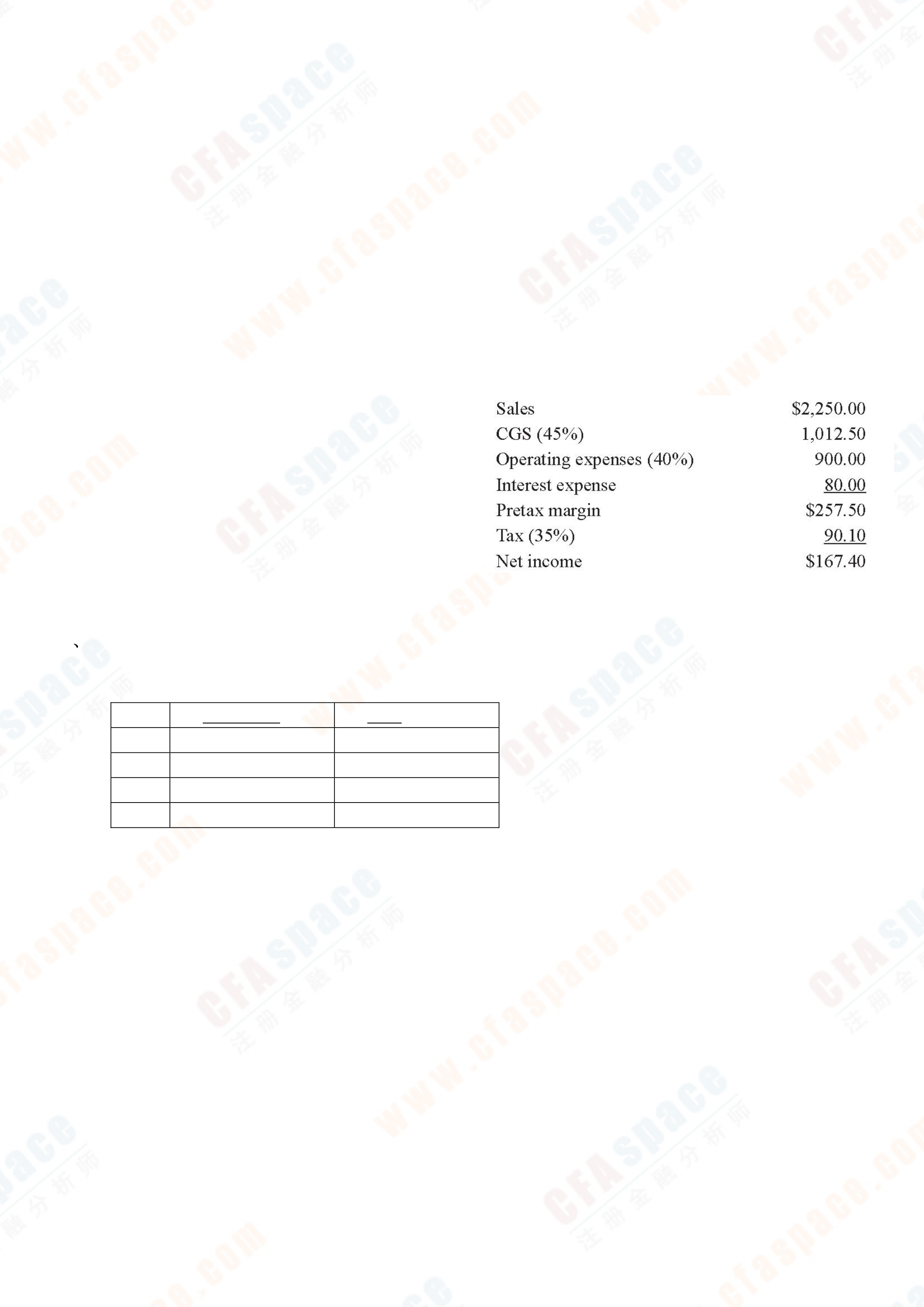

Prepare a basic projection of a company’s future net income and cash flow.C is correct. Forecasted net income is calculated as follows: Sales $2,500 Given

Variable costs (750) 30% of sales Fixed costs (1,400) Given

“Understanding Cash Flow Statements,” Elaine Henry, CFA, Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, and Michael A. Broihahn, CFA

2013 Modular Level I, Vol. 3, Reading 27, Section 4.3

"Long-Lived Assets,” Elaine Henry, CFA and Elizabeth A. Gordon

2013 Modular Level 1, Vol.3, Reading 30, Section 2.1, Example 1,

Study Session 8-27-i, 9-30-a,

Calculate and interpret free cash flow to the firm, free cash flow to equity, and performance and coverage cash flow ratios.Distinguish between costs that are capitalised and costs that are expensed in the period in which they are incurred.

| Example | ||

|---|---|---|

|

||

|

||

Questions 69 through 78 relate to Corporate Finance

69. Two mutually exclusive projects have the following cash flows (€) and internal rates of return (IRR):

Study Session 11-36-c, d, e

Explain how the evaluation and selection of capital projects is affected by mutually exclusive projects, project sequencing, and capital rationing.

| ) | ) | ) | ) |

|---|

B is correct because Project A has a higher NPV and the projects are mutually exclusive, only Project A should be accepted.

70. A company’s asset beta is 1.2 based on a debt-to-equity ratio of 50%. If the company’s tax rate increases, the associated equity beta will most likely:

“Cost of Capital,” Yves Courtois, CFA, Gene C. Lai, and Pamela Peterson Drake, CFA 2013 Modular Level I, Vol.4, Reading 37, Section 4.1.

Study Session 11-37-h

Calculate and interpret the cost of equity capital using the capital asset pricing model approach, the dividend discount model approach, and the bond-yield-plus risk-premium approach.

| [ ( ) |

|---|

A.declaration date.

B.ex-dividend date.

B is correct. The ex-dividend date is normally determined by the Securities Exchange on which the shares are listed. The corporation determines the holder-of-record date and declaration date.

72. A firm’s price-to-earnings ratio (P/E) is 12.5. The firm has decided to repurchase shares using external funds that have an after-tax cost of 9%. After the repurchase, the earnings per share (EPS) will most likely:

“Dividends and Share Repurchases: Basics,” George H. Troughton, CFA and Gregory Noronha, CFA

2013 Modular Level I, Vol.4, Reading 39, Section 4.2.1.Study Session 11-39-d

Calculate and compare the effects of a share repurchase on earnings per share when 1) the repurchase is financed with the company’s excess cash and 2) the company uses funded debt to finance the repurchase.“Working Capital Management,” Edgar A. Norton, Jr., CFA, Kenneth L. Parkinson, and Pamela Peterson Drake, CFA

2013 Modular Level I, Vol.4, Reading 40, Section 2.1.3.Study Session 11-40-a

Describe primary and secondary sources of liquidity and factors that influence a company’s liquidity position.Answer = B

“The Corporate Governance of Listed Companies: A Manual for Investors,” Kurt Schacht, CFA, James C. Allen, CFA, and Matthew Orsagh, CFA, CIPM

2013 Modular Level I, Vol.4, Reading 41, Section: Board Independence.B.1,000.

C.1,250.Answer = B

Answer = A

“Working Capital Management,” Edgar A. Norton, Jr., CFA, Kenneth L. Parkinson, and Pamela Peterson Drake, CFA

2013 Modular Level I, Vol. 4, Reading 40, Section 8.4., Example 7

Study Session 11-40-g

Evaluate the choices of short-term funding available to a company and recommend a financing method.

B.All committees within the firm should benefit from the direct guidance of management. C.Appropriate controls and procedures exist that cover management’s activities in running the daily operations of the firm.

Answer = C

78. Which of the following is the least appropriate method for an external analyst to estimate a company’s target capital structure for determining WACC? Using the:

A.averages of comparable companies’ capital structure.

B is correct. An external analyst does not know a company’s actual target capital structure. Consequently, the analyst should rely on market value (not book value) weights for the components of the company’s current capital structure.

Questions 79 through 90 relate to Equity Investments

Answer = C

“Market Organization and Structure,” Larry Harris

2013 Modular Level I, Vol. 5, Reading 46, Section 10

Study Session 13-46-l

Describe the objectives of market regulation.“Financial Analysis Techniques,” Elaine Henry, CFA, Thomas R. Robinson, CFA, and Jan Hendrik van Greuning, CFA

2013 Modular Level I, Vol. 3, Reading 28, Sections 4.5.2, 4.6.2.“Introduction to Industry and Company Analysis,” Patrick W. Dorsey, CFA, Anthony M. Fiore, CFA and Ian Rossa O’Reilly, CFA

2013 Modular Level I, Vol. 5, Reading 50, Section 6.1

Study Session 8-28-c, d, e; 14-50-k

Describe the relationships among ratios and evaluate a company using ratio analysis.A. FCFE is a measure of the firm’s dividend paying capacity.

B. FCFE models provide more accurate valuations than the dividend discount models. C. A firm’s borrowing activities could influence dividend decisions but they would not impact FCFE.

The current value per share of the company’s common stock according to the two-stage dividend discount model is closest to:

A is correct.

Net profit margin = Net earnings ÷ Sales

Net earnings = Net profit margin × Sales;

Dividends per share (“Dn”) = (Net earnings × Payout ratio) ÷ # of outstanding shares; Therefore, D1 = ($180 million × 0.15 × 0.60) ÷ 8 million = $2.00

D2 = $2.00 ×(1+ 0.25) = $2.50

D3 = $2.00 × (1+ 0.25)2 = $3.13

D4 = $2.00 × (1+ 0.25)2 × (1+0.05) = $3.28

| V3 = | ) = $46.86 | ) + | ||

|---|---|---|---|---|

| V0 = | ) + | ) + | ||

“Market Organization and Structure,” Larry Harris

2013 Modular Level I, Vol. 5, Reading 46, Section 5.2, Example 20

Study Session 13-46-f

Calculate and interpret the leverage ratio, the rate of return on a margin transaction, and the security price at which the investor would receive a margin call.A is correct.

“Market Organization and Structure,” Larry Harris

2013 Modular Level I, Vol. 5, Reading 46, Sections 4.1, 4.2

Study Session 13-46-d

Describe types of financial intermediaries and services they provide.A is correct. The service that dealers provide is liquidity. Liquidity is the ability to buy or sell with low transaction costs when you want to trade. By allowing their clients to trade when they want to trade, dealers provide liquidity to them.

Compare market orders with limit orders.

B is correct. An order is filled at the best available price as long as this price is lower than the limit price. In this case, the best available price is the market ask price = $49.49 x (1+ 0.7%) = $49.84. Since this price is lower than the limit price of $49.94, the order will be filled at this price

Answer = C

“Market Organization and Structure,” Larry Harris

2013 Modular Level I, Vol. 5, Reading 46, Section 9

Study Session 13-46-k

Describe characteristics of a well-functioning financial system.

The value of the index as of January 1, 2012 is closest to:

A. 1,047.

B. 1,070.

C. 1,094.TRI = (VPRI1 − VPRI0 + IncI) ÷ VPRI0

where

TRI = the total return of the index portfolio (as a decimal number)

VPRI1= the value of the price return index at the end of the period

VPRI0 = the value of the price return index at the beginning of the period

IncI = the total income (dividends and/or interest) from all securities in the index held over the period

-4.5% = (1000 - VPRI0 + 23.5 + 21.5) ÷ VPRI0;

VPRI0 = 1000 + 23.5 + 21.5 ÷ (1 - 4.5%) = 1,094.88. After the public announcement of the merger of two firms an investor makes abnormal returns by going long on the target firm and short on the acquiring firm. This most likely violates which form of market efficiency?

B is correct. In a semi-strong efficient market, prices adjust quickly and accurately to new information. In this case, prices would quickly adjust to the merger announcement and if the market is semi-strong efficient market, investors acting after the merger announcement would not be able to earn abnormal returns. Therefore, it is a violation of the semi-strong form of market efficiency. Note that the semi-strong form of market efficiency encompasses the weak form. Therefore, both weak and semi-strong forms of market efficiency are violated.

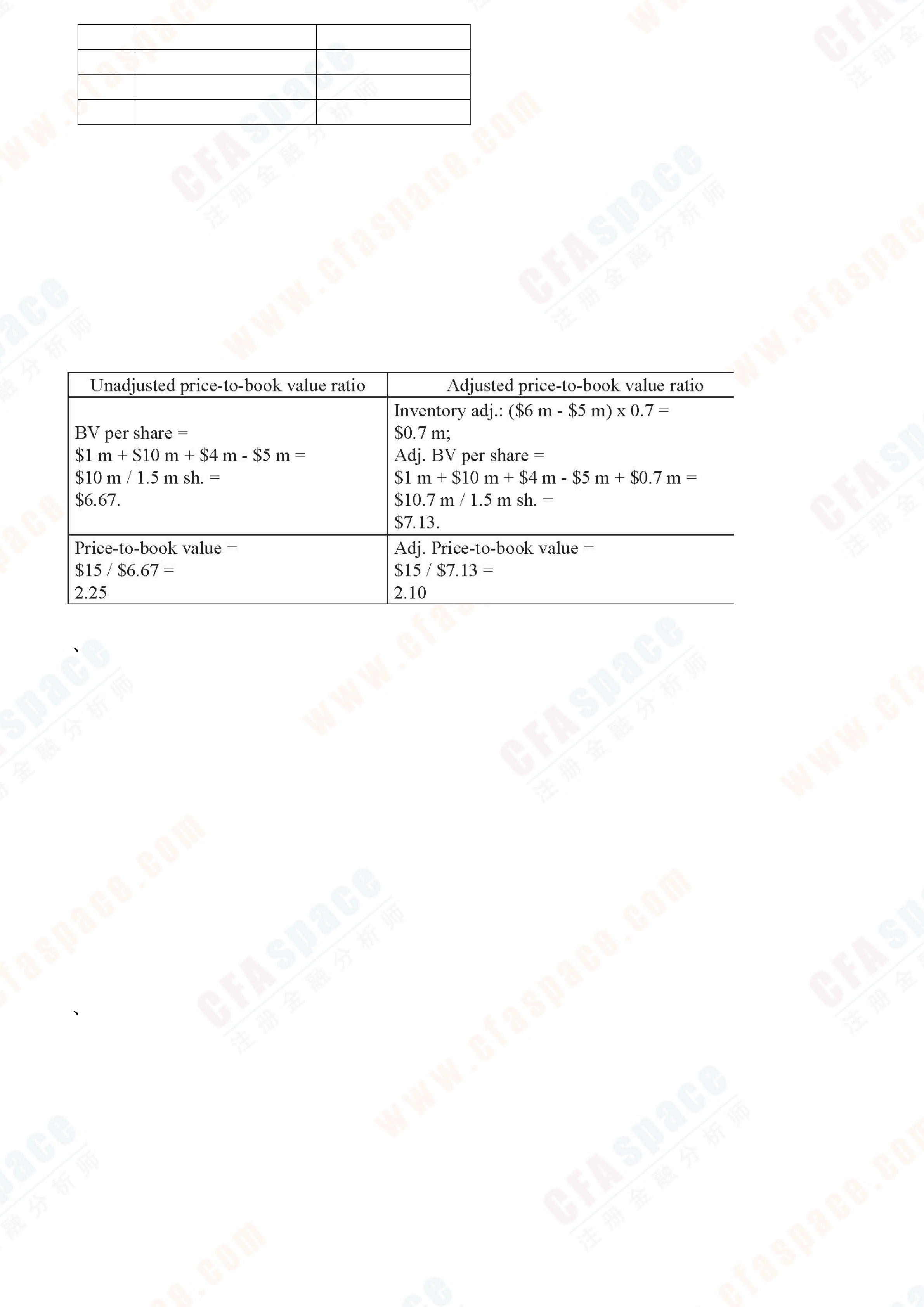

89. An analyst gathers the following information about two companies in the same industry:

| Company A | Company B | |

|---|---|---|

| $20 | $10 | |

| $22 | $13 | |

| 16% | 13% | |

| 40% | 60% |

What is the most appropriate conclusion regarding investors’ expectations? Compared to Company B, Company A has:

A. higher intrinsic value as reflected by its higher market price.

C is correct. The price-to-book ratio, which is also referred to as the market-to-book ratio, provides an indication of investors’ expectations about a company’s future investment and cash flow-generating opportunities. The larger the price-to-book ratio (i.e., the greater the

divergence between market value per share and book value per share), the more favorably investors will view the company’s future investment opportunities. In this case, as shown below, Company A has lower price-to-book ratio than Company B and therefore an expectation of lower future investment opportunities.

| $1.47 | |

|---|---|

|

$4.00 |

| Estimate of long-run return on equity (ROE) | 15% |

|

40% |

| 12% |

“Equity Valuation: Concepts and Basic Tools,” John J. Nagorniak, CFA, and Stephen E. Wilcox, CFA

2013 Modular Level I, Vol. 5, Reading 51, Section 5.1, Example 11

Study Session 14-51-hCalculate and interpret the following multiples: price to earnings, price to an estimate of operating cash flow, price to sales, and price to book value.

91. A corporation issues 5-year fixed-rate bonds. Its treasurer expects interest rates to decline for all maturities for at least the next year. She enters into a 1-year agreement with a bank to receive quarterly fixed-rate payments and to make payments based on floating rates benchmarked on 3-month LIBOR. This agreement is best described as a:

A.swap.

92. A portfolio manager is required to sell 31,250 shares of XYZ Inc. in two months. She is concerned the price of XYZ shares will decline during the 2-month period, so she enters into a

deliverable equity forward contract to sell 31,250 shares of XYZ in two months for EUR 160 per share. When the contract expires, XYZ is trading at EUR 138 per share. The portfolio manager will most likely:

C is correct because the portfolio manager entered into a contract to sell the stock to the dealer at $160 per share in 2 months time. 31,250 shares x EUR 160 = EUR 5,000,000.

93. A trader takes a long position in 40 futures contracts on Day 1. The futures have a daily price limit of $5 and closes with a settlement price of $106. On Day 2, the futures trade at $111 and the bid and offer move to $113 and $115, respectively. The futures price remains at these price levels until the market closes. The marked-to-market amount the trader receives in his account at the end of Day 2 is closest to:

94. An investor is long an in-the-money American call option on a dividend paying stock. Would this option most likely ever be exercised early?

A.No.

C is correct because a cash flow such as a dividend payment is required for an early exercise. A dividend payment doesn’t guarantee early exercise, as the dividend also needs to be large enough to justify the early exercise.

95. A European company issues a 5-year euro-denominated bond with a face value of EUR 50,000,000. The company then enters into a 5-year currency swap with a bank to convert the EUR exposure into USD exposure. The notional principals of the swap are EUR 50,000,000 and USD 70,000,000. The European company pays a fixed rate of 5% and the bank pays a fixed rate of 4.5%. Payments are made semiannually on a basis of 30 days per month and 360 days per year. What is the payment from the bank to the company at the end of year 4?

96. An investor with $5000 to invest believes that the price of ABC Corp. stock will appreciate by $7 to $95 in two months. The two-month at-the-money put on one share of ABC stock costs $1.76, while the two-month at-the-money call costs $1.56. In order to profit from his view on ABC stock, he will most likely:

A.sell calls on shares of ABC.

B.sell puts on shares of ABC.

C.buy calls on shares of ABC.

97. If a bond’s issuer is required to retire a specified portion of the issue each year, the bond most likely:

A.is callable.

C is correct because a sinking fund provision requires retirement of a portion of the bond issue each year, rather than retirement of the entire issue at maturity.

98. One reason why the duration of a portfolio of bonds does not properly reflect that portfolio’s yield curve risk is the duration measure:

Describe yield-curve risk and explain why duration does not account for yield-curve risk.

A is correct because duration assumes all interest rates across the yield curve change by the same amount and therefore each bond’s yield changes by the same amount.

Answer = B

“Understanding Yield Spreads”, Frank J. Fabozzi, CFA

2013 Modular Level I, Vol. 5, Reading 55, Section 4.6.1

Study Session 15-55-i

Calculate the after-tax yield of a taxable security and the tax-equivalent yield of a tax-exempt security.Answer = A

“Understanding Yield Spreads”, Frank J. Fabozzi, CFA 2013 Modular Level I, Vol. 5, Reading 55, Section 3.3 Study Session 15-55-d

Define a spot rate.C.stay the same.

Answer = A

Answer = A

“Introduction to the Valuation of Debt Securities”, Frank J. Fabozzi, CFA 2013 Modular Level I, Vol. 5, Reading 56, Section 2.6

Study Session 16-56-c

Calculate the value of a bond (coupon and zero-coupon).

103. All else equal, the difference between the nominal spread and the Z-spread for a non-Treasury security will most likely be larger when the:

A.yield curve is flat.

B is correct because the main factor causing any difference between the nominal spread and the Z-spread is the shape of the Treasury spot rate curve. The steeper the spot rate curve, the greater the difference.

104. Assume the following six-month forward rates (presented on an annualized, bond-equivalent basis) were calculated from the yield curve.

| Notation | Forward Rate |

|---|---|

| 1f0 | 0.50% |

| 1f1 | 0.70% |

| 1f2 | 1.00% |

| 1f3 | 1.50% |

| 1f4 | 2.20% |

| 1f5 | 3.00% |

| 1f6 | 4.00% |

A.increases measurement accuracy.

B.is easier to model than scenario analysis.

106. An analyst uses a valuation model to estimate the value of an option-free bond at 92.733 to yield 11%. If the value is 94.474 for a 60 basis point decrease in yield and 91.041 for a 60 basis point increase in yield, the effective duration of the bond is closest to:

A.1.85.

B.3.09.

C.6.17.

| D | = | 2 | V | − | − | , | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

× | V 0 | × | ∆y | ||||||||||

|

||||||||||||||

| D | = | 2 | 94 . 474 | − | = | |||||||||

| × | 92 . 733 | × | .0 0060 | |||||||||||

A.put the issue.

B.call the issue.

108. The bonds issued by ALS Corp. are currently priced at 108.00 and are option free. Based on a portfolio manager’s valuation model, a 10 basis points rise in interest rates will result in the bond price falling to 106.50 while a 10 basis points fall in interest rates will result in the bond price rising to 110.00. The market value of the portfolio manager’s holdings of ALS bonds is $2 million. The expected change in the market value of this holding for a 100 basis point change in interest rates will be closest to:

A.$124,000.

B.$322,600.

C.$645,200.The approximate percent change in the value of the holdings (the dollar duration) is: 0.1613 × 2,000,000 = $322,600.

Questions 109 through 114 relate to Alternative Investments.

“Introduction to Alternative Investments,” Terri Duhon, George Spentzos, CFA, and Scott D.

Stewart, CFA

2013 Modular Level I, Vol. 6, Reading 66, Sections 2.1 Study Session 18-66-b

Describe categories of alternative investments.C. convenience yield.

Answer = B

C. reduce exposure to inflation.

Answer = C

A. assets are not marked to market.

B. data are subject to survivorship bias.

C is correct. Since commodity indices are constructed using commodity futures and not the underlying commodities there can be differences between commodity index returns and the returns of the underlying commodities.

113. Which of the following investments most likely provides an investor with indirect, equity exposure to real estate?

“Introduction to Alternative Investments,” Terri Duhon, George Spentzos, CFA, and Scott D.

Stewart, CFA

2013 Modular Level I, Vol. 6, Reading 66, Sections 5.1, 5.2 Study Session 18-66-dexposure. Real estate investment partnerships are a form of direct real estate equity investment.

Commercial mortgage backed securities (CMBS) provides investors with indirect, debt investment

Answer = A

“Introduction to Alternative Investments,” Terri Duhon, George Spentzos, CFA, and Scott D.

The incentive fee = ($541,500,000 - $475,000,000) × 0.10 = $6,650,000

Total fees = $14,772,500

Answer = A

"Portfolio Management: An Overview” by Robert M. Conroy, CFA and Alistair Byrne, CFA Modular Level I, Vol. 4, Reading 42, Section 3 (Exhibit 14)

The 2012 return needed to achieve a trailing five year geometric mean annualized return of 5.0% when calculated at the end of 2012 is closest to:

Holding period total return (cumulative) factor calculation through 2011:

(1-0.348)×(1+0.322)×(1+0.111)×(1-0.014) = 0.652 × 1.322 × 1.111 × 0.986 = 0.9442 Compound total return (cumulative) factor at 5% per year of five percent for five years: 1.055 = 1.2763

Return needed in 2012 to achieve a compound annualized return of 5%

1.2763/.9442 = 1.3517 = 35.2 percent

Check: 0.944 × 1.352 = 1.276(1/5) = 1.050 = 5 percent annualized117. Consider a portfolio with two assets. Asset A comprises 25% of the portfolio and has a standard deviation of 17.9%. Asset B comprises 75% of the portfolio and has a standard deviation of 6.2%. If the correlation of these two investments is 0.5, the portfolio standard deviation is closest to:

|

2 + w2 2σ2 |

|

|---|

A. 1.02.

B. 1.05.

C. 1.16Answer = B

A. M-squared

B. Sharpe ratio

C. Treynor ratioAnswer = C

A. low ability to take risk, but a high willingness to take risk B. high ability to take risk, but a low willingness to take risk C. high ability to take risk and a high willingness to take risk

Answer = C

2013 Level I Mock Exam: Morning Session

The morning session of the 2013 Level I Chartered Financial Analyst

(CFA®) Mock Examination has 120 questions. To best simulate the exam day

experience, candidates are advised to allocate an average of 1.5 minutes

per question for a total of 180 minutes (3 hours) for this session of

the exam.

A. reducing each pension fund’s allocation proportionately.

B. distributing them equally amongst all the pension fund portfolios.

2.Dilshan Kumar, CFA, is a world-renowned mining analyst based in London. Recently, he received an invitation from Cerberus Mining, a London Stock Exchange listed company with headquarters in Johannesburg, South Africa. Cerberus asked Kumar to join a group of prominent analysts from around the world on a tour of its mines in South Africa, some of which are in remote locations, not easily accessible. The invitation also includes an arranged wildlife safari to Krueger National Park for the analysts. Kumar accepts the invitation, planning to visit other mining companies he covers in Namibia and Botswana after the safari. To prevent violating any CFA Institute Standards of Professional Conduct, it is most appropriate for Kumar to only accept which type of paid travel arrangements from Cerberus?

A. Ground transportation to Krueger National Park

B. Economy class round trip ticket from London to Johannesburg

C. Flights on a private airplane to the remote mining sites in South AfricaA. No

B. Yes, with regard to Misconduct

C. Yes, with regard to Reference to the CFA DesignationAnswer = B

A. Equity research reports

B. Investment conference attendance

C. Database services for offshore investmentsAnswer = C

Answer = C

“Guidance for Standards I–VII”, CFA Institute

2013 Modular Level I, Vol. 1, Reading 2, Standard IV (A) Loyalty, Standard V (A) Diligence and Reasonable Basis

Study Session 1–2–bAnswer = B

“Guidance for Standards I–VII,” CFA Institute

2013 Modular Level I, Vol. 1, Reading 2, Standard VI (B) Priority of Transactions

Study Session 1–2–b

Distinguish between conduct that conforms to the Code and Standards and conduct that violates the Code and Standards.Answer = A

“Guidance for Standards I–VII,” CFA Institute

2013 Modular Level I, Vol. 1, Reading 2, Standard I (D) Misconduct

Study Session 1–2–a

Demonstrate the application of the Code of Ethics and Standards of Professional Conduct to situations involving issues of professional integrity.Answer = C

“Guidance for Standards I–VII,” CFA Institute

2013 Modular Level I, Vol. 1, Reading 2, Standard I (A) Knowledge of the Law, Standard I (B) Independence and Objectivity, Standard III (C) Suitability

Study Session 1–2–c

Recommend practices and procedures designed to prevent violations of the Code of Ethics and Standards of Professional Conduct.Answer = B

“Guidance for Standards I–VII,” CFA Institute

2013 Modular Level I, Vol. 1, Reading 2, Standard I (A) Knowledge of the Law

Study Session 1–2–c

Recommend practices and procedures designed to prevent violations of the Code of Ethics and Standards of Professional Conduct.B. asset management clients first.

C. newsletter recipients and asset management clients simultaneously.

A. the stock portfolio’s performance history.

B. her contribution to the portfolio’s returns.

C. providing details of the institutional clients.Answer = C

Younis has never told his employer about any of these activities. To comply with the CFA Institute Standards of Professional Conduct with regards to his business activities over the past two years, Younis would least likely be required to disclose which of the following to his employer?

A. Board activities

B. Family investment pool management

C. Non-family member management feesA.firm policies.

B.legal restrictions.

C.industry standards.14.Sheila Schleif, CFA, is an equity analyst at an investment banking division of Mokara Financial Group, a full service financial group. Schleif uses a multi-factor computer model to make stock recommendations for all clients of Mokara. Schleif discovers the model contains an error. If the error were corrected, her most recent buy recommendation communicated to all clients would change to a sell. Schleif corrects the error, changing the buy to a sell recommendation, and then simultaneously distributes via e-mail the revision to all investment banking clients who received the initial recommendation. A week later, Schleif sells the same shares she held in her personal portfolio. Concerning her actions, Schleif most likely violated which of the following CFA Institute Standards of Professional Conduct?

A. Fair Dealing

B. Priority of Transactions

C. Diligence and Reasonable BasisA. adherence to strategy.

B. performance measures.

16.Jackson Barnes, CFA, works for an insurance company providing financial planning services to clients for a fee. Barnes has developed a network of specialists, including accountants, lawyers, and brokers who contribute their expertise to the financial planning process. Each of the specialists is an independent contractor. Each contractor bills Barnes separately for the work he or she performs, providing a discount based upon the number of clients Barnes has referred. What steps should Barnes take to be consistent with the CFA Institute Standards of Professional Conduct?

A. Have his independent contractors approved by the insurance company

B. List the consideration he receives from the specialists on monthly client invoices

C. Inform potential clients about his arrangement with the contractors before they agree to hire himmuch harder than they had expected and they were not able to complete all questions as a result. The candidates go on to tell Plain about broad topic areas that were tested and complain about specific formulas they had memorized what did not appear on the exam. The Level III candidates least likely violated the CFA Institute Standards of Professional Conduct by

discussing:

A. specific formulas.B. broad topic areas.

18.On a flight to Europe, Romy Haas, CFA, strikes up a conversation with a fellow passenger, Vincent Trujillo. When Trujillo learns Haas is in the investment profession, he asks about the CFA designation. Haas tells him the following about the CFA designation:

Statement 1: Individuals who have completed the CFA Program have the right to use the CFA designation.Statement 2: The CFA designation is globally recognized which is why I use it as part of my firm’s name

Statement 3: CFA charterholders must satisfy membership requirements to continue using the designation.Study Session 1–2–b

Distinguish between conduct that conforms to the Code and Standards and conduct that violates the Code and Standards.C is correct because according to Standard VII (B) Reference to CFA Institute, the CFA

Designation, and the CFA Program this is an accurate statement concerning the CFA designation.

Answer = B

“The Time Value of Money,” Richard A. DeFusco, CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFA

2013 Modular Level I, Vol. 1, Reading 5, Section 3.3

Study Session 2–5–c, d20.Equity return series are best described as, for the most part:

A.platykurtotic (less peaked than a normal distribution).

Study Session 2–7–l

Explain measures of sample skewness and kurtosis.B is correct. Most equity return series have been found to be leptokurtotic.

| Observation | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| Value | –3 | –11 | 3 | –18 | 18 | 20 | –6 | 9 | 2 | –16 |

“Statistical Concepts and Market Returns,” Richard A. DeFusco, CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFA

2013 Modular Level I, Vol. 1, Reading 7, Section 7.3.2, Example 12

Study Session 2–7–g

Calculate and interpret 1) a range and a mean absolute deviation and 2) the variance and standard deviation of a population and of a sample.C is correct. The sample mean is:

̅ ∑ / n = (– 3 – 11 + 3 – 18 + 18 + 20 – 6 + 9 + 2 –16) / 10 = –2.00 / 10 = –0.20.

Sum of squared

differences 1563.6

Divided by n –1 173.7333333

Square root 13.18079411A is correct. Given that X and Y are independent, their joint probability is equal to the product of their individual probabilities. In this problem, we calculate 0.2 × 0.5 = 0.1.

23.Assume that a stock’s price over the next two periods is as shown below.

|

|

|

| Sud,du = 79.2 | ||

B. 37.50%.

C. 56.25%.Answer = B

The probability of an up move followed by a down move is 0.75 × 0.25 = 0.1875.

The probability of a down move followed by an up move is 0.25 × 0.75 also = 0.1875. Both of these sequences result in an end value of $79.2.

“Hypothesis Testing,” Richard A. DeFusco, CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFA

2013 Modular Level I, Vol. 1, Reading 11, Section 2

Study Session 3– 11– a

Define a hypothesis, describe the steps of hypothesis testing, describe and interpret the choice of the null and alternative hypotheses, and distinguish between one-tailed and two-tailed tests of hypotheses.A is correct. When the null and alternative hypotheses are of the form: H0: θ = θ0 versus Ha: θ ≠θ0, the correct approach is to use a two-tailed test.

Answer = A

“Technical Analysis,” Barry M. Sine, CFA and Robert A. Strong, CFA

2013 Modular Level I, Vol. 1, Reading 12, Section 3.2

Study Session 3– 12– c

Explain the uses of trend, support, resistance lines, and change in polarity.

The probability of a profit greater than or equal to $1 and less than or equal to $4 is closest to:

A. 0.4.

B. 0.6.

C. 0.8.In this case, F(4) = P( X ≤ 4) = 1.0 and F(1) = P(X ≤ 1) = 0.2.

Therefore, P(1 ≤ X ≤ 4) = 1.0 – 0.2 = 0.8.

Study Session 3– 10– f

Calculate and interpret the standard error of the sample mean.C is correct.

| Here, | ||

|---|---|---|

“Sampling and Estimation,” Richard A. DeFusco, CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFA

2013 Modular Level I, Vol. 1, Reading 10, Section 4.2

Study Session 3–10–j

Calculate and interpret a confidence interval for a population mean, given a normal distribution with (1) a known population variance, (2) an unknown population variance, or (3) an unknown variance and a large sample size.B is correct. The reliability factor for a 95% confidence interval with unknown population variance and sample size greater than 30 is .

B. increased sensitivity of the market value of debt to a change in market interest rates as maturity is extended.

C. possibility that the borrower will fail to make a promised payment at the contracted time and in the contracted amount.

|

|

|||

|---|---|---|---|---|

| 9.81 | 13.99 | |||

| 10.12 | 14.47 | |||

|

10.84 |

|

14.85 | |

| 11.33 | 15.00 | |||

| 12.25 | 17.36 | |||

|

13.39 |

|

17.98 | |

| 13.42 |

“Statistical Concepts and Market Returns,” Richard A. DeFusco, CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFA

2013 Modular Level I, Vol. 1, Reading 7, Section 6.1

Study Session 2–7–f

Calculate and interpret quartiles, quintiles, deciles, and percentiles.A is correct. First, find the position of the first quintile with the following formula:

Ly = (n + 1) × (y / 100),

where

y is the percentage point at which we are dividing the distribution. In our case we have y = 20, which corresponds to the 20th percentile (first quintile);

n is the number of observations (funds) in the peer group. In our case we have n = 13;

The mean absolute deviation of returns for the fund is closest to:

A. 9.53%.

B. 11.91%.

C. 13.69%.

| ∑ |

|---|

where

Xiis the return of the fund during year i

̅ is the mean of the returns of the sample

n is the number of returns in the sample

i is the index for the year

In this problem:

Mean: ̅ (–20.60% + 15.00% + 0.50% + 9.80% + 4.60%)/5 = 1.86%

MAD = (|–20.60% – 1.86%| + |15.00% – 1.86%| + |0.50% – 1.86%| + |9.80% – 1.86%| + |4.60% – 1.86%|)/5 = 47.64% / 5=9.53%

| Fund A | ||

|---|---|---|

|

70 | 30 |

|

10 | 16 |

| 7 | 13 | |

| 0.80 | ||

Answer = B

“Probability Concepts,” Richard A. DeFusco, CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFA

2013 Modular Level I, Vol. 1, Reading 8, Section 3

Study Session 2–8–k, l

Calculate and interpret covariance and correlation.

where

WA = 70%. This is the weight of Fund A in the portfolio WB = 30%. This is the weight of Fund B in the portfolio.

| . |

|---|

Answer = B

“Demand and Supply Analysis: Introduction,” Richard V. Eastin and Gary L. Arbogast, CFA 2013 Modular Level I, Vol. 2, Reading 13, Section 3.2, Example 2.

|

|

A consumer’s indifference curves are strictly convex and he claims that he is indifferent between Baskets 2 and 3. If he is also indifferent between Baskets 1 and 3, the number of units of A in basket 1 is most likely:

A. equal to 60.

Describe the use of indifference curves, opportunity sets, and budget constraints in decision making.

C is correct. Because the consumer is indifferent between all three baskets, they must all fall on the same indifference curve. The MRSBA at Basket 2 is 4, meaning that the slope of the

Answer = B

“Demand and Supply Analysis: The Firm,” Gary L. Arbogast, CFA and Richard V. Eastin

|

||

|---|---|---|

|

||

|

||

|

||

|

||

36.The following data pertain to the total output in units and average selling prices in an economy that produces only two products, X and Y:

C is correct.

| Nominal GDP | Real GDP | |

|---|---|---|

|

||

|

||

|

||

37.Which of the following would be most useful as a leading indicator to signal the start of an economic recovery?

A.An increase in aggregate real personal income (less transfer payments)

B.A decrease in average weekly initial claims for unemployment insurance

C.The narrowing of the spread between the 10-year Treasury yield and the federal funds rate38.

|

|

|---|

Answer = C

“Demand and Supply Analysis: Introduction,” Richard V. Eastin and Gary L. Arbogast, CFA 2013 Modular Level I, Vol. 2, Reading 13, Sections 3.9, 3.10

“International Trade and Capital Flows,” Usha Nair-Reichert, PhD and Daniel Robert Witschi, PhD, CFA

2013 Modular Level I, Vol. 2, Reading 20, Sections 3.1, Exhibit 12

Study Session 4–13–i, j, 6–20–e

Calculate and interpret consumer surplus, producer surplus, and total surplus.

Analyze the effects of government regulation and intervention on demand and supply.B. lends foreign currencies on a temporary basis to address balance of payment issues. C. stands ready to lend foreign currencies to member countries during periods of significant external deficits.

Answer = A

If the investor shorts BRL500,000 he will achieve a risk-free arbitrage profit (in BRL) closest to:

| ) | ⁄( ) ( |

|

|---|

Sf/d = Spot rate: number of units of foreign currency (price currency) per one unit of domestic currency

Ff/d = Forward rate: number of units of foreign currency (price currency) per one unit of domestic currency

id = Domestic interest rate

if = Foreign interest rate

The arbitrage profit is the right side of the equation minus the left side.

| Qd sp = 1,000 – 20Psp+ 2I; |

|

|---|

Qd sp = Quantity demanded in number of units

Qs sp = Quantity supplied in number of units

Psp = Price per smart phone in $

I = Household income in $ per year

W = Wage rate in $ per hourB is correct. Market equilibrium occurs when quantity demanded is equal to quantity supplied, so set

Qd sp = Qs sp after inserting the given values for I and W. Next, solve for Psp:1,000 – 20Psp+ 2(9,500) = –200 + 50Psp– 80(10)

– 20Psp – 50Psp = – 200 – 800 – 1,000 – 19,000

–70Psp = – 21,000; Psp = – 21,000/–70 = $300.Determine and describe breakeven and shutdown points of production.

C is correct. A firm in a perfectly competitive environment with total costs equal to total revenue and marginal costs greater than marginal revenue is operating at the upper breakeven point. Therefore, it should decrease the level of production to enter profit territory.

Using the consumption basket for August 2011, the Paasche index is closest to:

44.Which of the following is most consistent with real business cycle (RBC) models? The arguments and recommendations of RBC models suggest that:

A. monetary variables have a major impact on GDP growth.

Questions 45 through 68 relate to Financial Statement Analysis

45.The current ratio for an industry is 3.2. Data for a firm in the industry is presented below:

| £ ‘000s | |

|---|---|

| 200 | |

| 350 | |

| 1,250 | |

|

300 |

|

200 |

| 600 |

C. more liquid.

Answer = B

A. increased the prices of its product significantly.

B.decided to make greater use of long-term borrowing capacity.

Explain the effects of barriers to entry, industry concentration, industry capacity, and market share stability on pricing power and return on capital.

A is correct.

“Financial Reporting Mechanics,” Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, Karen O’Connor Rubsam, CFA, Elaine Henry, CFA, and Michael A. Broihahn, CFA

2013 Modular Level I, Vol.3, Reading 23, Section 5.1“Understanding Cash Flow Statements,” Elaine Henry, CFA, Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, and Michael A. Broihahn, CFA

2013 Modular Level I, Vol.3, Reading 27, Section 3.1, 3.2.5

Study Session 7–23–-e, 8–27–e

Explain the relationships among the income statement, balance sheet, statement of cash flows, and statement of owners’ equity.

|

7,000 |

|

4,200 |

| 500 | |

| 250 | |

| 200 |

A.1,850.

B.2,050.

C.2,300.Answer = B

“Financial Statement Analysis: An Introduction,” Elaine Henry, CFA, and Thomas R. Robinson, CFA

2013 Modular Level I, Vol. 3, Reading 22, Section 4.2, 4.3

Study Session 7–22–f

Describe the steps in the financial statement analysis framework.A is correct. Analyzing the prospects of the industry would be done in the collect data phase of a financial analysis.

B is correct. The annual report is not a requirement of the SEC.

51.An analyst is forecasting gross profit of the three following companies. He uses the five-year average gross margins and forecasts sales using an internal model.

A. 1.

B. 2.C. 3.

| Component | Cost | Useful Life |

|---|---|---|

| A | $500,000 | 10 years |

| B | $500,000 | 5 years |

The depreciation expense for the first year computed under IFRS compared with under U.S. GAAP will most likely be:

A. the same.

C is correct. Dividends received can be classified as either an operating or investing activity under IFRS, but can only be classified as an operating activity under U.S. GAAP.

54.The following selected data are available for a firm:

| $ millions | |

|---|---|

| 90.0 | |

| 15.2 | |

| 28.0 | |

| 34.3 | |

|

13.0 |

If the firm’s tax rate is 40%, the free cash flow to the firm (FCFF) is closest to:

Calculate FCFF:

|

74.7 |

|---|

55.The following financial data is available for a company:

The company’s sustainable growth rate is closest to:

A. 4.00%.

B. 4.40%.

C. 4.78%.

|

|

|---|---|

56.During a period of rising inventory costs, a company decides to change its inventory method from FIFO to the weighted average cost method. Which of the following financial ratios will most likely increase as a result of this change?

A. Current

B. Debt-to-equity

C. Number of days in inventoryA. proxy statement.

B. notes to the financial statements.

C. management discussion and analysis.

Total liabilities at the end of the year are closest to:

Explain the relationships among the income statement, balance sheet, statement of cash flows, and statement of owners’ equity.

B is correct.

| $ 50,000 | ||

|

225,000 | |

|

450,000 | |

| 5,000 | ||

| (402,000) | ||

| 53,000 | ||

| (10,000) | ||

|

43,000 | 43,000 |

|

$318,000 | |

“Financial Reporting Standards,” Elaine Henry, CFA, Jan Hendrik van Greuning, CFA, and Thomas R. Robinson, CFA

2013 Modular Level I, Vol. 3, Reading 24, Section 5.2

Study Session 7-24-d

Describe the International Accounting Standards Board’s conceptual framework, including the objective and qualitative characteristics of financial statements, required reporting elements, and constraints and assumptions in preparing financial statements.C is correct. Relevance and faithful representation are the two fundamental qualitative characteristics that make financial information useful according to the IASB Conceptual Framework.

“Understanding Balance Sheets," Elaine Henry, CFA and Thomas R. Robinson, CFA 2013 Modular Level 1, Vol.3, Reading 26, Section 2.2, 2.3, 4.3,

Study Session: 8-26- c, e

Describe alternative formats of balance sheet presentation.Describe different types of assets and liabilities and the measurement bases of each.

On the 2012 statement of cash flows, the company’s net cash flow from investing activities (in $‘000s) is closest to:

62. Selected information for a company is provided below.

| $ millions | |

|---|---|

|

4,800 |

| 2,880 |

The company’s cash conversion cycle (in days) is closest to:

B is correct.

Cash conversion cycle = Days sales outstanding + Days of inventory on hand – Days of payables

| Accounts receivable | Inventory | ||

|---|---|---|---|

| Days in Sales (DSO) | Days on hand (DHO) | ||

| Sales | Purchases | ||

| A/R | Inventory | Payables | |

|

4,800 ÷ 625 | 2,880 ÷ 710 | 2,940 ÷ 145 |

| = 7.68 times | |||

| = 4.06 times | = 20.3 times | ||

| 365 ÷ 7.68 | |||

| 365 ÷ 4.06 | 365 ÷ 20.3 | ||

| = 48 days | = 90 days | = 18 days |

Cash conversion cycle = DSO + DOH – Days in Payables = 48 + 90 – 18 = 120 days

| 300 | 7.70 |

|

|

|---|---|---|---|

|

600 | 12.00 | |

| 400 |

B. higher.

C. the same.

64. A company, which prepares its financial statements according to IFRS, owns several investment properties on which it earns rental income. It values the properties using the fair value model based on prevailing rental markets. After two years of increases the market softened in 2012 and values decreased. A summary of the properties’ valuations is as follows:

Which of the following best describes the impact of the revaluation on the 2012 financial statements?

A.€6.5 million charge to net income

B.€6.5 million charge to revaluation surplus

C.€4.5 million charge to revaluation surplus and €2.0 million charge to net incomeA is correct. For investment properties, when using the fair value model of revaluing assets, all increases and decreases affect net income.

65. Which of the following statements most accurately describes a valuation allowance for deferred taxes? A valuation allowance is required under:

“Income Taxes,” Elbie Antonites, CFA and Michael A. Broihahn, CFA

2013 Modular Level 1, Vol. 3, Reading 31, Section 6.1

Study Session, 9-31-g

Describe the valuation allowance for deferred tax assets—when it is required and what impact it has on financial statements.B is correct. A valuation allowance is required under U.S. GAAP if there is doubt about whether a deferred tax asset will be recovered. Under IFRS the deferred tax asset is written down directly.

Answer = B

“Financial Reporting Quality: Red Flags and Accounting Warning Signs,”Thomas R. Robinson, CFA and Paul Munter

2013 Modular Level 1, Vol. 3, Reading 33, Section 3

Study Session: 10-33-d

Describe common accounting warning signs and methods for detecting each.

| 2011 December 31 |

||

|---|---|---|

|

2,200 | 2,500 |

|

28% | 30% |

| 1,400 | 1,400 | |

| 25% | 25% | |

| 55 | 60 | |

| 500 | 500 |

The forecasted net income (in ‘000s) for 2012 is closest to:

A. $169.

B. $202.

C. $244.

(25) 0.05 x 500 average debt

A. a lower cash flow per share in that period.

B. a higher earnings per share in future periods. C. the same free cash flow to the firm in that period.

| Example |

|

|

|---|---|---|

|

||

|

|

|

A.both projects.

B.Project A only.

C.Project B only.Answer = B

Explain the NPV profile, compare NPV and IRR methods when evaluating independent and mutually-exclusive projects, and describe the problems associated with each of the evaluation methods.

The NPV of project A is €1,780.59

| ) | ) | ) | ) |

|---|

B.decrease.

C.remain unchanged.

| [ ( ) |

|

|---|

If the tax rate increases, then the bracketed term (1 – tax rate) decreases making the equity beta decrease because the asset beta is unchanged.

Answer = B

“Dividends and Share Repurchases: Basics,” George H. Troughton, CFA and Gregory Noronha, CFA

2013 Modular Level I, Vol.4, Reading 39, Section 3.1, 3.2, 3.3.B.decrease.

C.remain unchanged.

73. Which is most likely considered a “pull” on liquidity?

A.Obsolete inventory

B.Reduction in a line of credit

C.Increased difficulty in collecting receivables74. Based on best practices in corporate governance procedures, independent board members most likely:

A.meet only in the presence of management.

B is correct. Under best practices in corporate governance procedures, independent board members should have a “lead” director when the board chair is not independent.

75. The unit contribution margin for a product is $12. Assuming fixed costs of $12,000, interest costs of $3,000, and a tax rate of 40%, the operating breakeven point (in units) is closest to:

B is correct. The operating breakeven point is:

76. The effective annualized cost (%) of a banker’s acceptance that has an all-inclusive annual rate of 5.25% for a one-month loan of $2,000,000 is closest to:

)

77. Which of the following is most consistent with the best practices of corporate governance?

Study Session 11-41-a, b

Define corporate governance.Describe practices related to board and committee independence, experience, compensation, external consultants, and frequency of elections, and determine whether they are supportive of shareowner protection.

C.statements made by the company’s management regarding capital structure policy.

Answer = B

A. act to level the playing field for market participants.

B. help define minimum standards of practice for agents.

80. A company has initiated the process of selling unproductive land representing 5% of its total assets and using the proceeds to buy back its common shares. Holding other factors constant, these actions by the company will most likely result in a:

A. higher return on equity.

B. higher operating margin.

C. lower sustainable growth.Calculate and interpret ratios used in equity analysis, credit analysis, and segment analysis. Describe the elements that should be covered in a thorough company analysis.