And zip codeprima donna partnership flamingo drive haines city

paraphrased I also certify that this paper was prepared by me specifically for this course.

Signature Member 1 : _________N.B._________

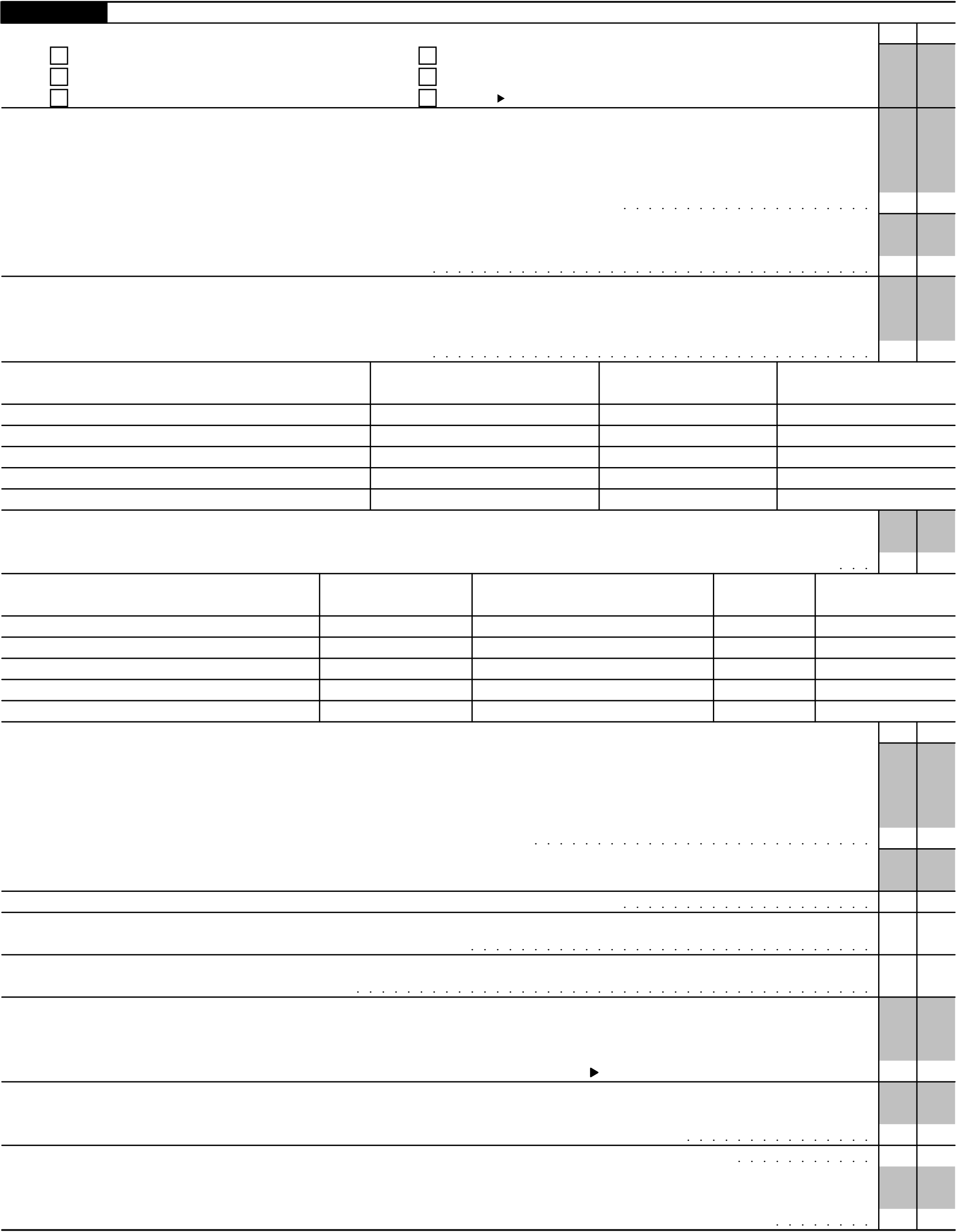

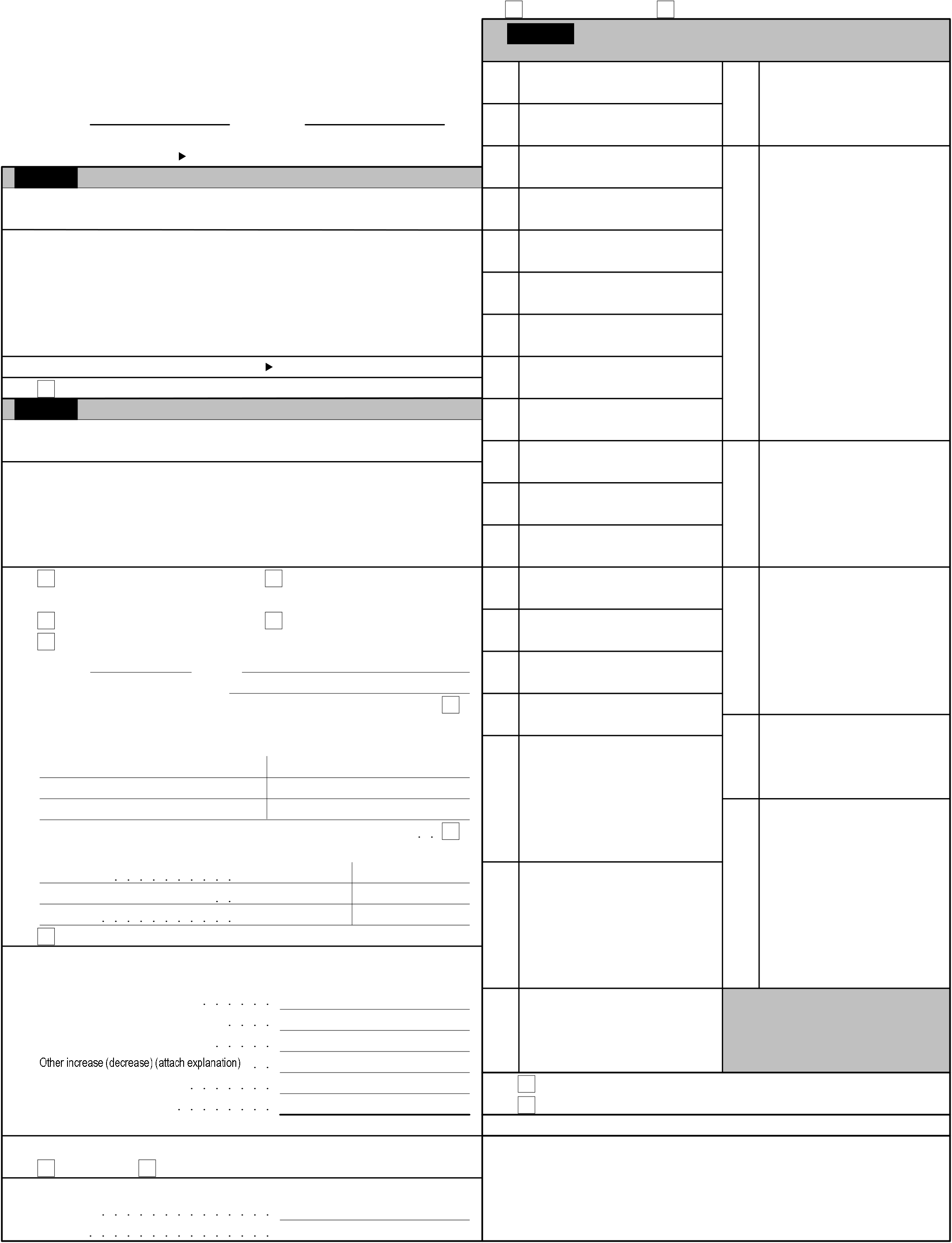

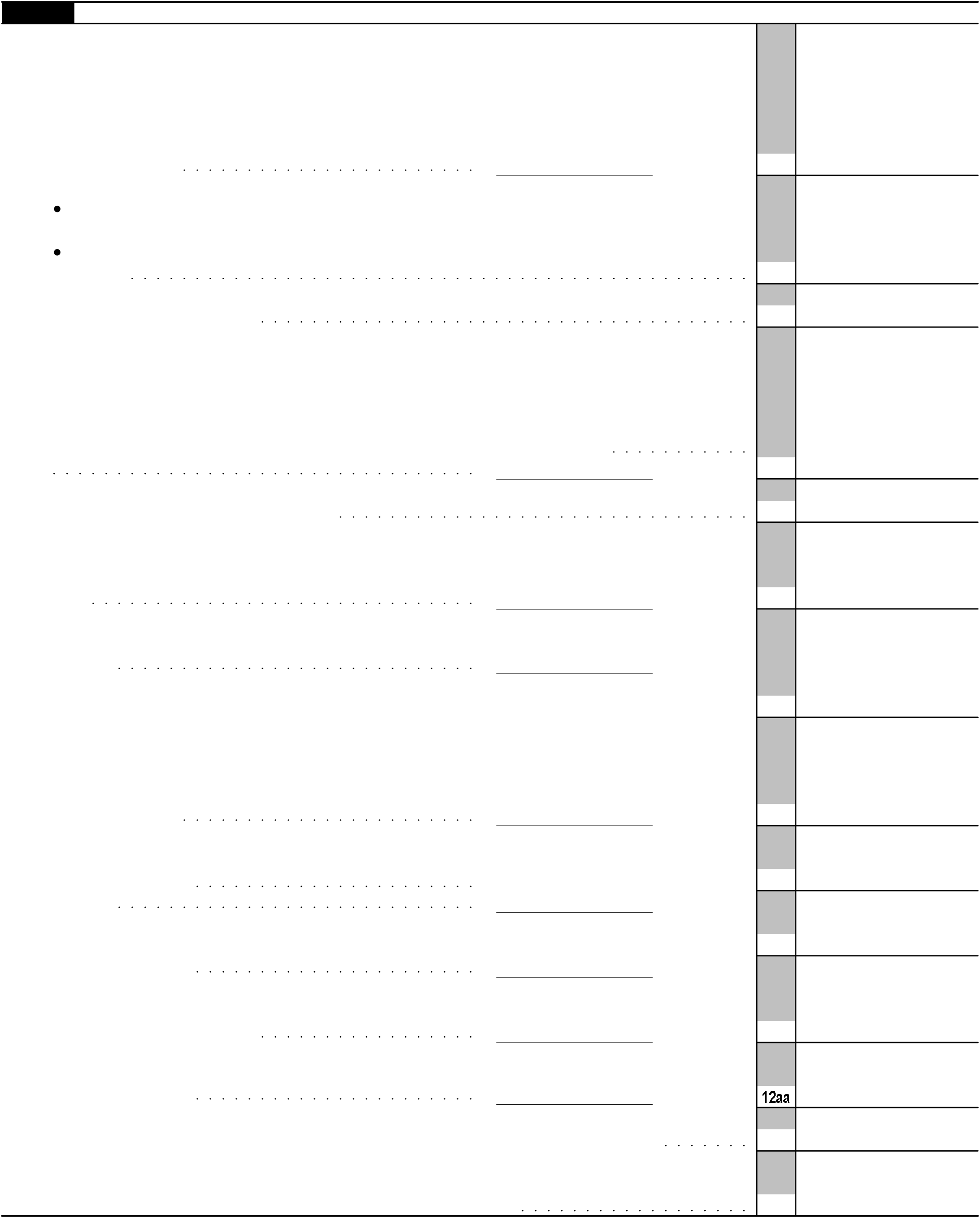

Internal Revenue Service

1065 For calendar year 2019, or tax year beginningGo to

U.S. Return of Partnership Income

Manufacturing Prima Donna Partnership 92-4765432

B Principal product or service Type Number, street, and room or suite no. If a P.O. box, see instructions. E Date business started

G Check applicable boxes: (1) Initial return (2) Final return (3) Name change (4) Address change (5) Amended return

H Check accounting method: (1) Cash (2) X Accrual (3) Other (specify)

1 Gross receipts or sales 1a 2,850,000.

b Returns and allowances 1b 27,000.

5 Net farm profit (loss) (attach Schedule F (Form 1040 or 1040-SR)) 5

6 Net gain (loss) from Form 4797, Part II, line 17 (attach Form 4797) 6

11 Repairs and maintenance 11 63,800.

12 Bad debts 12 24,000.

b 16b 16c 92,270.

17 Depletion (Do not deduct oil and gas depletion.) 17

22 Ordinary business income (loss). Subtract line 21 from line 8 22 788,630.

23 23

28 Payment (see instructions) 28

29 Amount owed. If line 28 is smaller than line 27, enter amount owed 29

May the IRS discuss this return

Here with the preparer shown below?

Preparer

Use Only Firm's name Firm's EIN

Form 1065 (2019) Prima Donna Partnership

92-4765432 Page 2 Schedule B

Other Information

1 What type of entity is filing this return? Check the

applicable box: Yes No

04/01/2020 07:19:19PM

If “Yes” to any, complete and attach Form 8990.

25 Is the partnership electing out of the centralized partnership audit regime under section 6221(b)? See instructions. X If “Yes,” the partnership must complete Schedule B-2 (Form 1065). Enter the total from Schedule B-2, Part III,

line 3.If the PR is an entity, name of the designated individual for the PR

U.S. address of U.S. phone number of

designated individual designated individual

26 Is the partnership attaching Form 8996 to certify as a Qualified Opportunity Fund? X $ If “Yes,” enter the amount from Form 8996, line 14.

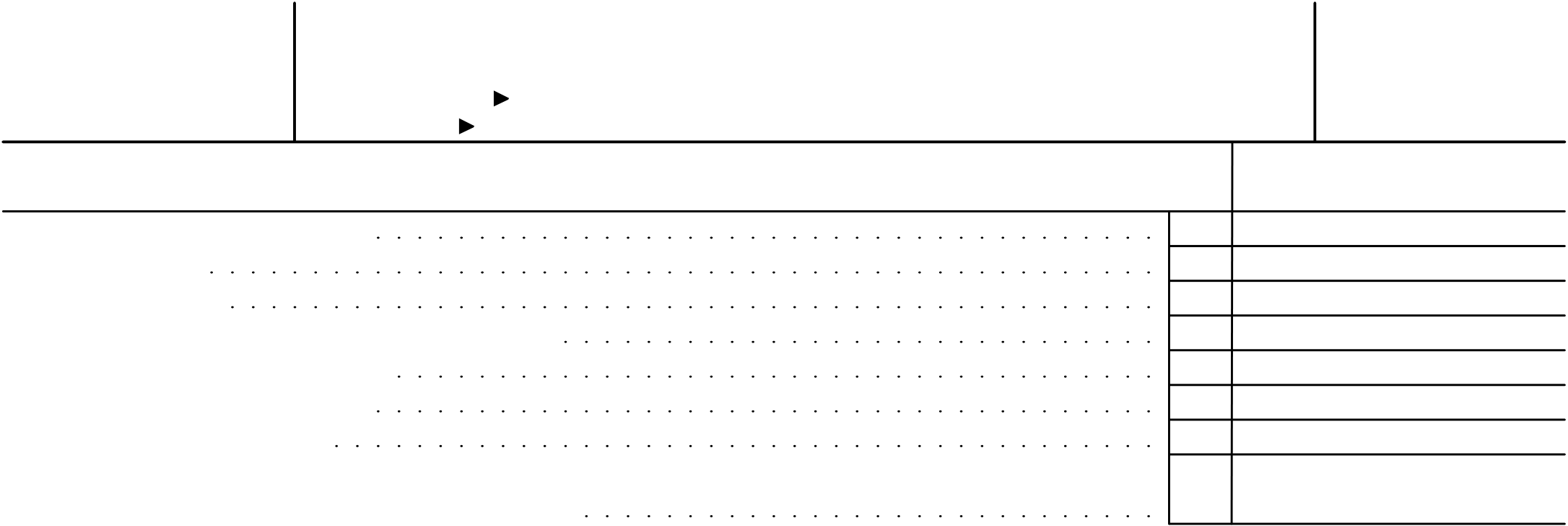

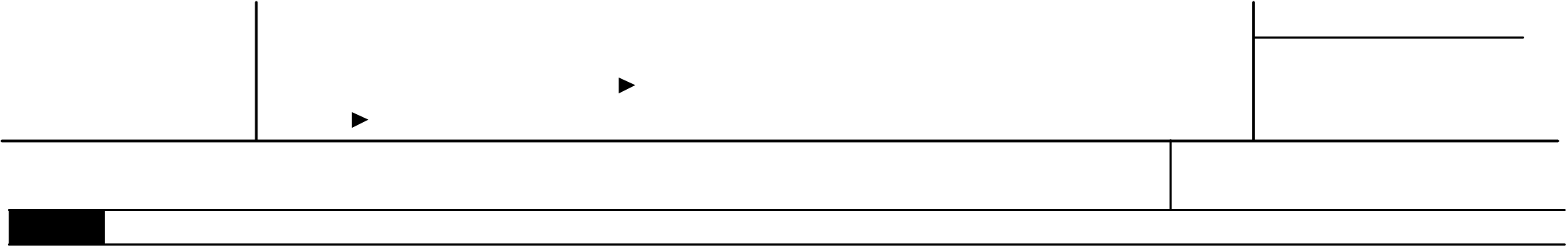

| Form 1065 (2019) Schedule K | Prima Donna

Partnership Partners' Distributive Share Items |

92-4765432 | Page 4 | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Total amount | ||||||||||||||||||||||||||

| 1 | 1 | 788,630. | ||||||||||||||||||||||||

| 2 |

|

|

||||||||||||||||||||||||

| 3a | 3a | |||||||||||||||||||||||||

| b | 3b | |||||||||||||||||||||||||

| c | ||||||||||||||||||||||||||

|

4 | Guaranteed payments: |

|

80,000. | b | Capital | ||||||||||||||||||||

| 5 |

|

|

||||||||||||||||||||||||

| 6 | Dividends and dividend equivalents: | |||||||||||||||||||||||||

| b Qualified dividends | c Dividend equivalents | |||||||||||||||||||||||||

| 7 |

|

|

||||||||||||||||||||||||

| 8 | 8 | -9,000. | ||||||||||||||||||||||||

| 9a | ||||||||||||||||||||||||||

| b | 9b | 10 | 25,000. | |||||||||||||||||||||||

| c |

|

9c | ||||||||||||||||||||||||

| 10 |

|

|||||||||||||||||||||||||

| 11 | Other income (loss) (see instructions) | |||||||||||||||||||||||||

| Deductions | 12 | (2) Amount | ||||||||||||||||||||||||

| 13a | 13a | 15,800. | ||||||||||||||||||||||||

| b |

|

|

||||||||||||||||||||||||

| c | 13c | |||||||||||||||||||||||||

| d | Other deductions (see instructions) | |||||||||||||||||||||||||

| Self- Employ- ment |

14a |

|

|

|||||||||||||||||||||||

| b | ||||||||||||||||||||||||||

| 14c | 1,413,000. | |||||||||||||||||||||||||

| 15a |

|

|

||||||||||||||||||||||||

| Credits | ||||||||||||||||||||||||||

| c | 1,000. | |||||||||||||||||||||||||

| d |

|

|

||||||||||||||||||||||||

| e |

|

|

||||||||||||||||||||||||

| f | Type | |||||||||||||||||||||||||

| 16a | ||||||||||||||||||||||||||

| c | ||||||||||||||||||||||||||

| Foreign Transactions | d |

|

||||||||||||||||||||||||

|

e | |||||||||||||||||||||||||

| f | g | h | Other (attach statement) | |||||||||||||||||||||||

| i | ||||||||||||||||||||||||||

|

j |

|

||||||||||||||||||||||||

| k | ||||||||||||||||||||||||||

| l | ||||||||||||||||||||||||||

| m | n |

|

o | Other (attach statement) | ||||||||||||||||||||||

| p |

|

|||||||||||||||||||||||||

| q | ||||||||||||||||||||||||||

| r |

|

9,000. | ||||||||||||||||||||||||

| 17a |

|

|||||||||||||||||||||||||

| Alternative Minimum Tax (AMT) Items |

b | |||||||||||||||||||||||||

| c | ||||||||||||||||||||||||||

| d | Oil, gas, and geothermal properties | |||||||||||||||||||||||||

| e | Oil, gas, and geothermal properties | — |

|

|||||||||||||||||||||||

| f |

|

|||||||||||||||||||||||||

| Other Information | 18a | |||||||||||||||||||||||||

| b | ||||||||||||||||||||||||||

| c | 4,000. 600,000. |

|||||||||||||||||||||||||

| 19a | ||||||||||||||||||||||||||

| b | ||||||||||||||||||||||||||

| 20a | 20a | 27,500. | ||||||||||||||||||||||||

| b |

|

|

||||||||||||||||||||||||

| c | Other items and amounts (attach statement) | |||||||||||||||||||||||||

|

1 | OMB No. 1545-0123 | ||

|---|---|---|---|---|

|

|

|||

| 1 | ||||

| 2 | 2 | |||

| 3 |

|

3 | ||

| 4 |

|

4 | ||

| 5 | 5 | |||

| 6 | 6 | |||

| 7 |

|

7 | ||

| 8 |

|

|||

unde |

Other (Specify method used and attach explanation.) |

||||||||

|---|---|---|---|---|---|---|---|---|---|

04/01/2020 07:19:20PM

Amount 71,000. |

||

|---|---|---|

| 1. | ||

| 2. | ||

4.

5.

10.

UYA

04/01/2020 07:19:20PM

More of the Partnership OMB No. 1545-0123

Department of the Treasury Attach to Form 1065.

2009 through 2017))

Complete columns (i) through (v) below for any foreign or domestic corporation, partnership (including any entity treated as a

| Part II | (iii) Type of Entity |

|

|

||

|---|---|---|---|---|---|

|

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||

| Go to | www.irs.gov/Form1065 |

|

||||||||||

| X |

|

|||||||||||

|

Yes | |||||||||||

to gain or loss from Adjustments

|

||||||||||||

| 1a | ||||||||||||

| 111,000. | -9,000. | |||||||||||

| 1b | ||||||||||||

| 2 |

|

|||||||||||

| 3 |

|

|||||||||||

| 4 | 4 | |||||||||||

| 5 | 5 | |||||||||||

| 6 | ||||||||||||

| 6 | ||||||||||||

| 7 |

|

|

||||||||||

| (d) | (e) | (g) Adjustments to gain or loss from Form(s) 8949, Part II, line 2, column (g) |

|

|||||||||

| Subtract column (e) from column (d) and combine the result with column (g) | ||||||||||||

| Proceeds (sales price) |

Cost (or other basis) |

|||||||||||

|

||||||||||||

| 8a | ||||||||||||

| 8b | ||||||||||||

| 9 | ||||||||||||

| 10 |

|

|||||||||||

| 11 |

|

11 | ||||||||||

| 12 | 12 | |||||||||||

| 13 | ||||||||||||

| 13 | ||||||||||||

| 14 | 14 | |||||||||||

| 15 |

|

|||||||||||

|

15 | |||||||||||

| Schedule D (Form 1065) 2019 | ||||||||||||

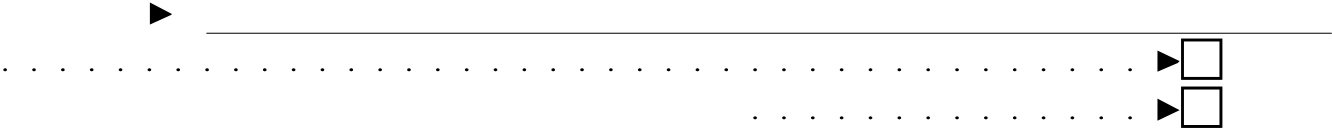

Final K-1 Amended K-1 OMB No. 1545-0123 Schedule K-1 (Form 1065) 2019

$ $ 321,552. 376,065.

) beginning ending

|

|

|---|---|

| For Paperwork Reduction Act Notice, see Instructions for Form 1065. UYA 04/01/2020 07:19:20PM www.irs.gov/Form1065 | Schedule K-1 (Form 1065) 2019 |

|

||

|---|---|---|

| Code |

|

|

| A | ||

| EIN: |

|

||

|---|---|---|---|

|

|

||

|

|||

|

|||

| 11,250. |

|---|

Section 179 deduction

Charitable contributions

Other deductions

Cooperative

EIN:PTP Aggregated Partner's share of: SSTB

|

EIN: 92-4765432 |

|

|

|---|---|---|---|

| Partner: | |||

$ $

393,009.

|

|

|---|---|

| For Paperwork Reduction Act Notice, see Instructions for Form 1065. UYA 04/01/2020 07:19:20PM www.irs.gov/Form1065 | Schedule K-1 (Form 1065) 2019 |

| Code |

|

|

|---|---|---|

| A |

|

|

| EIN: | |||

|---|---|---|---|

|

|

||

|

|

||

|

|||

| 13,750. |

|---|

Section 199A dividends

PTP Aggregated Partner's share of: SSTB

QBI items allocable to qualified payments subject to partner-specific determinations:

Partnership: Prima Donna Partnership EIN: 92-4765432

Partner: Donna Hart ID Number: 567-54-4221

|

Investment Credit | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Attach to your tax return. | |||||||||

| Identifying number | |||||||||

|

|||||||||

| 1 | |||||||||

| 2 | |||||||||

|

|||||||||

| 5 | |||||||||

|

|

x 20% (0.20) | |||||||

| b | |||||||||

| c |

|

||||||||

|

|||||||||

| 5d | |||||||||

| 6 | |||||||||

|

|

||||||||

| b | |||||||||

| 6c | |||||||||

| 7 | |||||||||

|

|||||||||

|

$ | x 30% (0.30) | |||||||

| 8 | 8 | ||||||||

| 9 | Form 3468 (2019) | ||||||||

| 10 | |||||||||

|

|||||||||

04/01/2020 07:19:20PM

04/01/2020 07:19:20PM

| Page 3 | |||||

|---|---|---|---|---|---|

|

|

||||

| p | |||||

| q |

|

x 10% (0.10) | |||

| If the electrical capacity of the property is measured in: | |||||

|

|||||

| r |

|

|

|||

04/01/2020 07:19:20PM

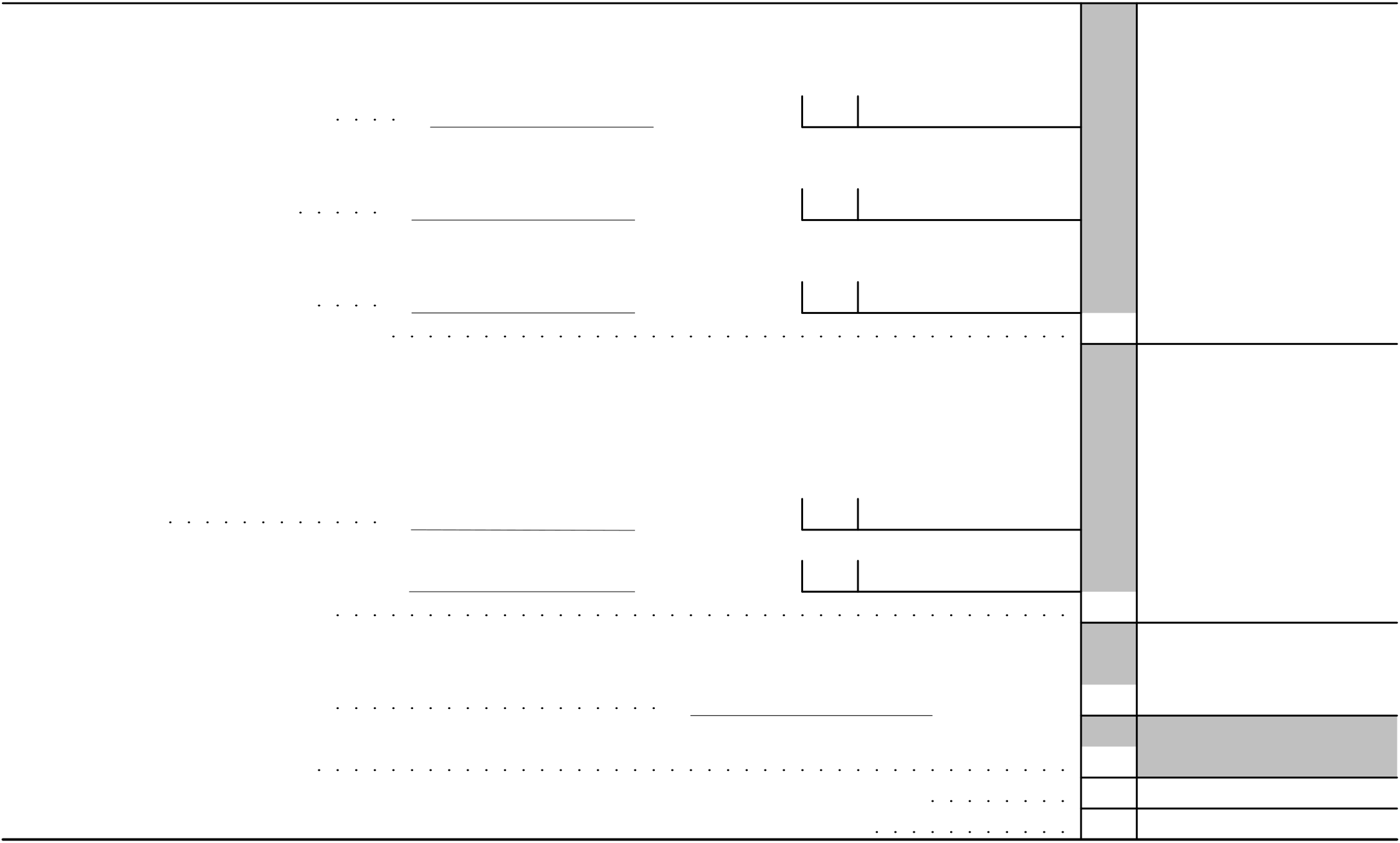

Attachment 2019

Internal Revenue Service Attach to your tax return. Sequence No. 27

substitute statement) that you are including on line 2, 10, or 20. See instructions 1

Part I Sales or Exchanges of Property Used in a Trade or Business and Involuntary Conversions From

acquisition

improvements andexpense of sale sum of (d) and (e)

6 Gain, if any, from line 32, from other than casualty or theft 6

7 Combine lines 2 through 6. Enter the gain or (loss) here and on the appropriate line as follows 7 25,000.

1231 losses, or they were recaptured in an earlier year, enter the gain from line 7 as a long-term capital gain on

the Schedule D filed with your return and skip lines 8, 9, 11, and 12 below.

| 8 | 8 | 0. | ||

|---|---|---|---|---|

| 9 | 9 | |||

|

||||

| 10 |

|

11 | ) | |

| 11 | ||||

| 12 | 12 | |||

| 13 | 13 | |||

| 14 | 14 | |||

| 15 |

|

15 | ||

| 16 |

|

16 | ||

| 17 | 17 | |||

| 18 | ||||

loss from income-producing property on Schedule A (Form 1040 or Form 1040-SR), line 16. (Do not include any

|

18a | Form 4797 (2019) | |

|---|---|---|---|

| b | 18b | ||

04/01/2020 07:19:20PM

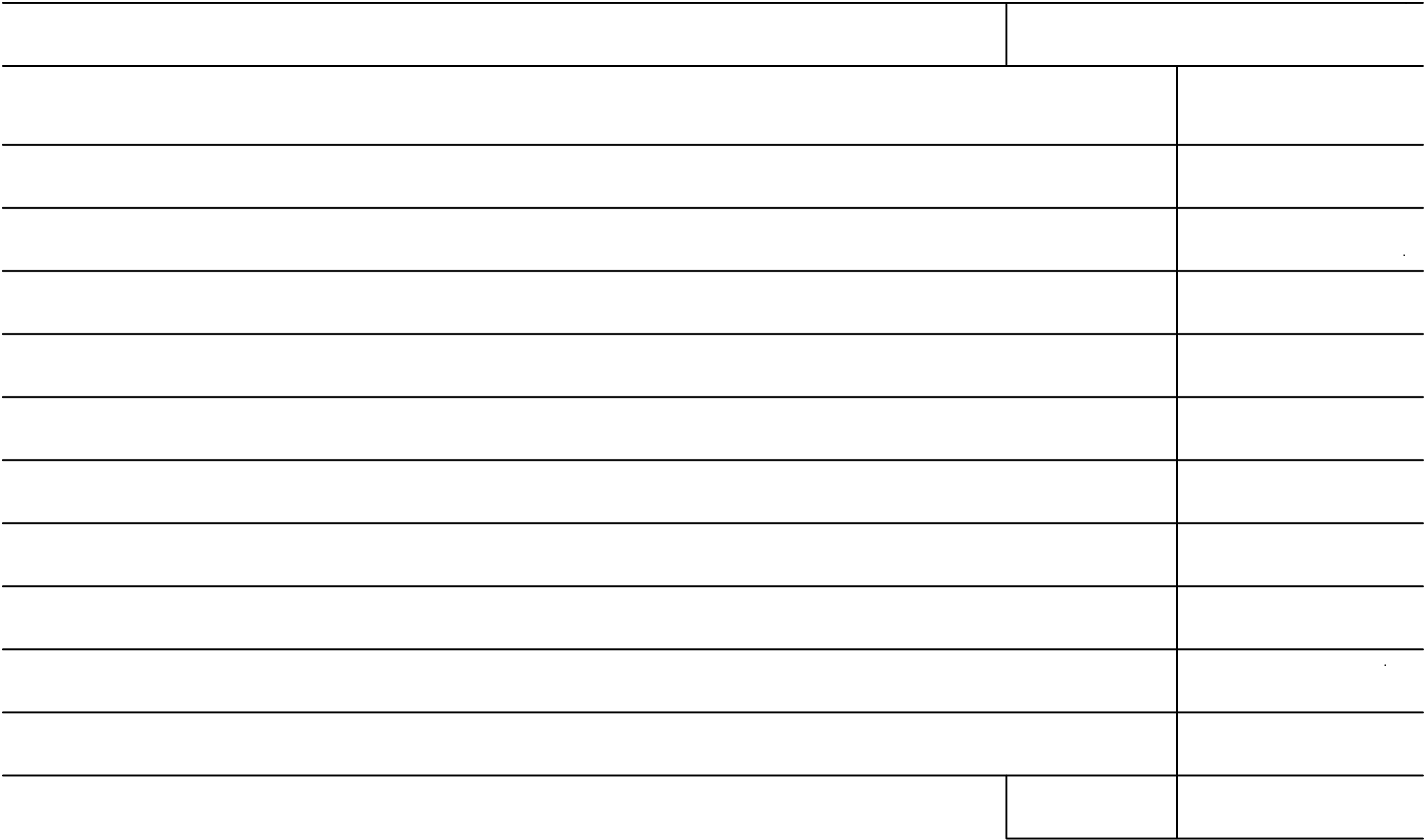

| Partnership's name Prima Donna Partnership |

Employer identifying number 92-4765432 |

|---|

Detail Statements

| Code | Description | Amount | |

|---|---|---|---|

| A | 15,800. |

|

|

|---|

Statement A - QBI Pass-through Entity Reporting

|

|||

|---|---|---|---|

| Partner's name: | Partner's identifying number: | ||

| Ordinary business income (loss) |  |

|

|

|

|

|

|

|

|

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

|

|

|

|

|

|

|

|

||||||||

| Rental income (loss) |  |

|

|

||||||||||||||

Section 179 deduction

Charitable contributions

Other deductions

| 132,000. |

|---|

Partner's name: Partner's identifying number:

Cooperative

EIN:

| Beginning of tax year | End of tax year |

|---|

2.

3.

8.

9.

STATEMENT 1

FORM 1065, LINE 20 (OTHER DEDUCTIONS)

| $ | 168,900.00 |

|---|

|

|

STATEMENT 5

FORM 1065, SCHEDULE L , LINE 6 - OTHER CURRENT ASSETS

|

ENDING BALANCE | |

|---|---|---|

STATEMENT 7

FORM 1125-A, LINE 5 Other Cost

|

|

|

|

|

|

|---|---|

|

|

|

|

SCHEDULE K-1, PART III interest income

|

|

|

|

SCHEDULE K-1, PART III 8 Net Short term capital gain (LOSS)

|

|

|

|

|

|

SCHEDULE K-1, PART III, 10, NET SECTION 1231 Gain/loss

|

|

|

|

SCHEDULE K-1, PART III, 18, Tax exmenpt income & Nondedectuble expenses

|

|

|

|

|

|

|---|---|

|

|

|

|

SCHEDULE K-1, PART III, 14A, self employment earning

|

|

|

|

RECONCILATION OF PARTNERS CAPITAL ACCOUNT

| PARTNERS | BEG. CAPITAL | DISTRIBUTION | END. CAPITAL | |

|---|---|---|---|---|

| Marianna Prima 45% |

|

|

||

| Donna Hart 55% |