Calculate the gross savings percentage finance question answer img

N = 4

I/Y = (1+.075)/(1+.0625) -1 = 1.1765%

PV = ? = $1,007.417.06 = $1,007,417

N = 22

3. What is the total financing activities during the year?

($19,425)

Total Cash Flow – Targeted for retirement = Net Cash Flow

Total Cash Flow = Cash Flow from Operating Activities – Capital Expenditure -+ Financing Activities

| Business Income | 115,000 | ||

|---|---|---|---|

| Interest Income | 1,500 | ||

| Dividend Income | 2,200 | ||

| Total Income | 118,700 | ||

| Hobbies | 550 | ||

| Recreational Expenses | 5,500 | ||

| Vacation Expenses | 2,500 | ||

| Total Discretionary | 8,550 | ||

5. What is the total cash flow from operations during the year?

$87,495

| Business Income | 115,000 | ||

|---|---|---|---|

| Interest Income | 1,500 | ||

| Dividend Income | 2,200 | ||

| Total Income | 118,700 | ||

| Hobbies | 550 | ||

| Recreational Expenses | 5,500 | ||

| Vacation Expenses | 2,500 | ||

| Total Discretionary | 8,550 | ||

7. Maria wants to accumulate $45,000 in today's dollar terms in the next 6 years. She expects to earn a return of 6.25% per year and inflation is expected to be 1.75%. How much should be the serial payment in the 5th yearso that Maria can achieve the target? END MODE

PV = 0

PMT = ? = $6,712.58

Serial Payment 5 = $7,194.94*1.0175 = $7,320.85 = $7,321

Serial Payment 6 = $7,320.85*1.0175 = $7,448.96

I/Y = (1.0625)/(1.0175) – 1= 4.4226%

PV = 0

Serial Payment 4 = $7,071.19*1.0175 = $7,194.94

Serial Payment 5 = $7,194.94*1.0175 = $7,320.85

N = 6

I/Y = (1.0625)/(1.0175) – 1= 4.4226%

Serial Payment 3 = $6,949.58*1.0175 = $7,071.19

Serial Payment 4 = $7,071.19*1.0175 = $7,194.94

END:

PV = 0

BGN:

PV = 0

$43,954.32 - $41,564.37 = $2,389.95 = $2,390

Dorothy has $750 in cash, $2000 in savings account, $34,300 in stocks, $5,500 in bonds, and owns a car worth $15,500. She had $1,500 in credit card payments and an education loan of $24,000 of which $2,700 is due during the current year. She has a mortgage loan of $300,000 of which $7,000 due this year. She has an auto loan of $9,500 of which $3,700 is due in the next 12 months. She owns a home worth $350,000, furniture and fixtures of $1,500, appliances with a value of $1,000, a Condo worth $120,000 and stamp collection of $1,000. She also has mortgage on condo for $97,500 of which $3,200 is payable during the current year.

12. What is Dorothy total current liabilities?

$18,100

14. What is Dorothy net worth?

$99,050

$162,183

PV = $25,000

A household has the following statistics related to Balance Sheet and annual Cash Flow:

| Balance Sheet Items: | in Dollars |

|---|---|

| Cash | 2,500 |

| CD | 12,000 |

| Savings Account Balance | 3,500 |

| Credit Card Debt | 9,500 |

| Current Year Portion of mortgage | 7,800 |

| Cash Flow Items: | |

| Salary | 115,000 |

| Dividend Income | 1,500 |

| Discretionary Expenses | 8,000 |

| Nondiscretionary Expenses | 28,975 |

| Debt Repayment | 8,700 |

| Retirement Investments | 15,500 |

| Capital Expenditure | - |

16. Compute the Nondiscretionary Cost percentage

$5.84

Liquid Assets/Monthly Household Expenses = Emergency Fund Ratio

$18,000/$3,081.25 = 5.84%

18. Compute the Current Ratio.

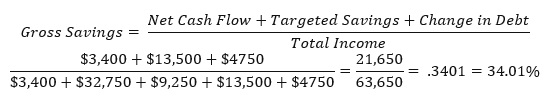

19. Compute the Gross Savings percentage.

$68.26%

$8,000 / ($115,000 + $1,500) = .0687 = 6.87%