Face add bond premium bonds payable

Reporting and Analyzing Liabilities

|

2 |

|---|

Assets = Liabilities + Equity

|

|---|

Liabilities as a Source of Financing

|

|---|

they relate

|

|---|

| Learning Objective | 1 |

|---|

Current Liabilities

Short-term in nature

Due within one year

Categories of current obligations

Current operating liabilities

Accounts payable

Accrued liabilities

Deferred performance liabilities

Current nonoperating liabilities

Short-term interest-bearing debt

Current maturities of long-term debt

Most create a corresponding impact on selling, general and administrative expenses on the income statement

| $ | 3,453 | $ | 2,645 | |

|---|---|---|---|---|

| $ | 21,232 | $ | 19,593 | |

|

$ | 8,352 | $ | 8,102 |

|

$ | 33,037 | $ | 30,340 |

| 7 |

|---|

account.

| (1) | 800 | |

|---|---|---|

|

800 | |

|

Selling Inventory on Account

| 2) |

|

|---|

| (2a) |

|

9 | ||

|---|---|---|---|---|

|

1,500 | |||

| 600 | ||||

|

||||

|

1,500 | |||

| (2b) | ||||

| 600 | ||||

| ©2020 Cambridge Business Publishers |

Recording Payments Received on Account

| (3) |

|

1,100 |

|---|---|---|

| Accounts receivable (–A) | 1,100 | |

Recording a Payment to a Creditor

| 4) |

|---|

| Balance Sheet | Income Statement | |||||

|---|---|---|---|---|---|---|

|

||||||

| (4) | 800 | 11 |

|---|

Cash Discounts

Incentives granted to buyers to encourage payment within a specified period of time

Part of credit terms

Stated as a percentage of the purchase priceA buyer purchases $1,000 of merchandise on June 1

with terms of 2/10, n/30. Payment is made on June 9.

|

$20 extra to pay 20 days later | 13 | |

| $20 ÷ 20 days = $1 per day | |||

| or $365 for one year | |||

| $365 ÷ $980 = 37.2% per year! | |||

| ©2020 Cambridge Business Publishers | |||

n/30.

| (1) | (1) | 156.80 |

|

14 | |

|---|---|---|---|---|---|

| Accounts payable (+L) | 156.80 | ||||

| Inventory (A) | Accounts Payable (L) | ||||

|

156.80 | ||||

| ©2020 Cambridge Business Publishers | |||||

| Balance Sheet | Income Statement | |||||

|---|---|---|---|---|---|---|

|

||||||

| (2a) |

|

156.80 |

|

15 |

|---|---|---|---|---|

| 156.80 | ||||

| ©2020 Cambridge Business Publishers |

period ends.

| (2b) | |||

|---|---|---|---|

|

3.20 | ||

|

160.00 | ||

| 160.00 |

|

|---|

|

||

|---|---|---|

|

|

©2020 Cambridge Business Publishers 17

Accrued Liabilities

|

18 | |

|---|---|---|

|

||

|

||

| ©2020 Cambridge Business Publishers |

Accounting for Accruals

| 1) |

|---|

| (1) |

|

300 |

|---|

| 2) |

|

|---|

period.

| Balance Sheet | Income Statement | |||||

|---|---|---|---|---|---|---|

|

||||||

|

| (2) | 300 | 300 | 21 | |||

|---|---|---|---|---|---|---|

| ©2020 Cambridge Business Publishers | 300 |

Contingent Liabilities

Not all liabilities are certain

Criteria to be met before recognizing:

©2020 Cambridge Business Publishers 22

| 23 |

|---|

What are warranties?

Commitments made by manufacturers to their customers to repair or replace defective products within a specified time period

Estimating Warranty Accruals

| 1) |

|

|---|

| (1) |

|

2,000 |

|---|

Warranty Repairs / Replacement

| 2) |

|

|---|

| Balance Sheet | Income Statement | |||||

|---|---|---|---|---|---|---|

|

||||||

Disclosure for Warranties

Excerpt from Apple’s financial statement notespresented in its 2018 10-K annual report:

©2020 Cambridge Business Publishers

Current Financial Liabilities

| 29 |

|---|

Financing is often permanent and seasonal for seasonal operations

Example of a company with higher seasonal sales in summer

Bank provides a commitment to lend up to a given level with the understanding that the amounts borrowed are repaid in full sometime during the year

Evidenced by an interest-bearing note

|

31 |

|---|

Calculating Interest

Principal x Annual Rate x Portion of Year

Outstanding

| 32 |

|---|

each quarter (April 1, July 1, October 1, and January 1).

| (1) | (1) | 33 | |||

|---|---|---|---|---|---|

| 3,000 | |||||

| Cash (A) |

|

||||

|

3,000 | ||||

| ©2020 Cambridge Business Publishers | |||||

| Balance Sheet | Income Statement | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||

|

| 3) |

|---|

| Balance Sheet | Income Statement | |||||

|---|---|---|---|---|---|---|

|

||||||

|

|

|---|

©2020 Cambridge Business Publishers 37

Debt Securities

| When a company issues bonds, it is borrowing money. |

|---|

Explain and illustrate the pricing of long-term nonoperating

liabilities.

|

||

|---|---|---|

Also known as the contract |

|

|

41 |

|---|

Valuing Bonds Issued at Par

$400,000 × 8% × 6/12 = $16,000

Interest rate per period:

8% annual rate ÷ 2 payments per year = 4% per period

|

= $270,226 |

|---|

Valuing Bonds Issued at a Discount

$400,000 × 8% × 6/12 = $16,000

|

|---|

Market interest rate per period:

10% annual rate / 2 payments per year = 5% per period

|

= $369,112 |

|---|

Investors wish to value a bond with a face amount of $400,000, an 8% annual coupon rate, 6% market rate, interest payable semiannually, and a maturity of 5 years.

Step 1: Calculate the interest payment.

Step 2: Calculate the present value (PV) of the cash

flows.

PV of interest payments $ $16,000 x 8.53020 = $136,483

PV of annuity for 10 periods @ 3% per period (Table A.3)

| = $434,119 |

|---|

Investors wish to value a bond with a face amount of $400,000, an 8% annual coupon rate, 6% market rate, interest payable semiannually, and a maturity of

PV = unknown, the amount to solve for

PMT = the periodic interest payment: $400,000 × 8% × 6/12 = $16,000

Investors wish to value a bond with a face amount of $400,000, an 8% annual coupon rate, 10% market rate, interest payable semiannually, and a maturity

PMT = the periodic interest payment: $400,000 × 8% × 6/12 = $16,000

FV = the principal amount of the debt: $400,000 given

|

|

Coupon | Equal to | 50 | |

|---|---|---|---|---|---|

| Rate | Rate | ||||

|

|

||||

| $400,000 bonds | Less than | ||||

| sold at a discount | |||||

| $400,000 bonds |

|

Greater | |||

| than face | |||||

| sold at a premium | |||||

| value | |||||

|

|||||

|

Interest payments | ||

|---|---|---|---|

|

= | ||

$160,000 $160,000 |

|||

|

= $190,887 | ||

|---|---|---|---|

|

|||

Offers debt

investment to the

public Referred to as a

tombstone

| 52 |

|---|

©2020 Cambridge Business Publishers

Issuing Bonds at Par

$400,000 bonds with 8% coupon rate, issued at par:

|

400,000 |

|---|

Bonds Payable (L) |

|---|

Issuing Bonds at a Premium

$400,000 bonds with 8% coupon rate, issued at a premium, 6%market rate:

|

|

|---|

Reporting Bonds

on the Balance Sheet

|

|

|

|---|---|---|

Bonds payable, face $400,000

|

A benefit |

|---|

|

|

|---|

The $16,000 interest payment was made on the $400,000, 8%

bonds, issued at $369,113 (10% market rate).

|

|||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

| 60 |

|---|

| 0 | $13,024 | $16,000 | $2,976 |

|

|

61 |

|---|---|---|---|---|---|---|

| 1 | 31,145 | 431,145 | ||||

| 2 | 12,934 | 16,000 | 3,066 | 28,079 | 428,079 | |

| 3 | 12,842 | 16,000 | 3,158 | 24,921 | 424,921 | |

| 4 | 12,748 | 16,000 | 3,252 | 21,669 | 421,669 | |

| 5 | 12,650 | 16,000 | 3,350 | 18,319 | 418,319 | |

| 6 | 12,550 | 16,000 | 3,450 | 14,869 | 414,869 | |

| 7 | 12,446 | 16,000 | 3,554 | 11,315 | 411,315 | |

| 8 | 12,339 | 16,000 | 3,661 | 7,654 | 407,654 | |

| 9 | 12,230 | 16,000 | 3,770 | 3,884 | 403,884 | |

| 10 | 12,117 | 16,000 | 3,883 | 0 | 400,000 | |

| 3% |

|

|||||

| $16,000 - |

|

|||||

| $13,024 | ||||||

| ©2020 Cambridge Business Publishers | ||||||

Cash (A) |

|---|

Financial Statement Effects of Bond Repurchase

Bonds trade in secondary markets between

(indenture)

Call provision gives the company the right to repurchase its bonds

| 63 |

|---|

Financial Statement Footnotes

Verizon presented a schedule in its note disclosure of Interest must be excluded from operating activities section of cash flows statement and from net

operating profit when performing a financial

analysis. Interest income

Interest-bearing bonds and notes

|

66 |

|---|

A measure of solvency

Measures the corporation’s financial leverage

| Applying the Debt-to-Equity ratio to Verizon: | |

©2020 Cambridge Business Publishers 68

©2020 Cambridge Business Publishers 69

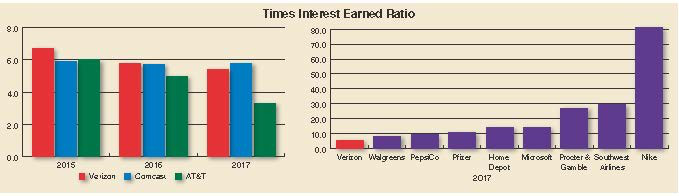

Verizon in Context

Debt-to-Equity Ratio

©2020 Cambridge Business Publishers 70

Times Interest Earned (TIE)

Measures how many times interest expense is

| TIE = | ||

|---|---|---|

| Interest expense | ||

| Applying Times Interest Earned ratio to Verizon: | ||

|

|---|

|

73 |

|---|

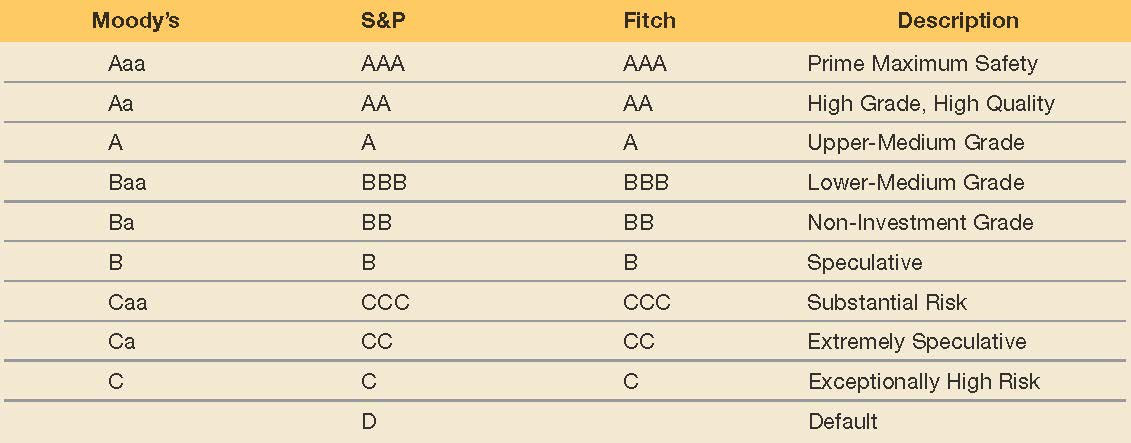

Debt Ratings

Agencies include

Moody’s Investors Service

major bond rating services:

Collateral

Security in the form of assets provided for debt

Debt holder is in a preferred position with secured debtCovenants

Restrictions specified in the debt agreement

Provide debt holder a means of control over the issuer’s operations

Financial Accounting Sixth Edition

Cambridge Business