Gem strategy november theme investing lower return

| STRATEGY |

|---|

Global

Highlights of this Issue

| • | ||

|---|---|---|

| • | ||

|

||

|

• | |

| • | ||

| • |

|

|

|

• | |

| • |

John Morris>>

S.A. Strategist, Merrill Lynch (South

Africa)

(27) 11 305 5151

|

|---|

>>Employed by a non-US affiliate of MLPF&S and is not registered/qualified as a research analyst under NYSE/NASD rules.

Merrill Lynch does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.

| Table 1: Total Return (%) YTD as of |

1. |

|

|||

| 2004 | 4-Nov-05 | ||||

| MSCI (US$) | |||||

| World | 15.2 | 5.3 |

|

||

| EMF | 26.0 | 21.1 | |||

| Russia | 5.7 | 59.3 | |||

| Brazil | 36.5 | 49.0 | |||

| South Korea | 22.9 | 35.7 | |||

| Mexico | 48.3 | 33.6 | |||

| Turkey | 42.0 | 32.6 | |||

| India | 19.1 | 29.0 | |||

| Chile | 29.0 | 19.4 | |||

| Israel | 20.3 | 16.7 | |||

| Poland | 61.5 | 16.0 | |||

| Thailand | -0.9 | 4.6 | |||

| Taiwan | 9.8 | -5.4 | |||

| Sectors (US dollar terms) | |||||

| Energy | 25.4 | 51.5 | |||

| Utilities | 21.5 | 27.2 | |||

| Staples | 28.2 | 26.5 | |||

| Health Care | 7.7 | 21.3 | |||

| Telecom | 34.6 | 17.9 | |||

| Financials | 39.5 | 16.9 | |||

| Cons. Disc | 28.3 | 15.7 | |||

| Inf. Technology | 10.0 | 13.8 | |||

| Industrials | 33.3 | 12.2 | |||

| Bond Indices (US dollar terms) | |||||

| EM Debt | 11.8 | 7.7 |

|

||

| EM Corp. Debt | 13.7 | 5.6 | |||

| US High Yield | 10.8 | 1.5 | |||

| UST 10 Year | 4.8 | -0.5 | |||

| Commodities | |||||

| Oil (WTI) | 33.6 | 39.4 |

|

||

| CRB Index | 11.2 | 12.3 | |||

| Gold | 5.2 | 5.3 | |||

| Foreign Exchange* | |||||

| USD (trd-wgt) | -7 | 12.9 | |||

| Brazilian Real | 8.9 | 20.1 | |||

| Korean Won | 1.5 | 15.6 | |||

| Mexican Peso | 0.7 | 3.7 | |||

| Chilean Peso | 6.7 | 2.9 | |||

| Thai Baht | 1.7 | 1.7 | |||

| Turkish Lira | 4.7 | -0.4 | |||

| Russian Ruble | 5.5 | -3.0 | |||

| Indian Rupee | 5 | -4.6 | |||

| Taiwan Dollar | 7 | -5.7 | |||

| Israeli Shekel | 1.6 | -7.3 | |||

| Czech Koruna | 14.7 | -9.4 | |||

| Polish Zloty | 24 | -11.2 | |||

| Hungary Forint | 15.3 | -14.3 | |||

| SA Rand | 18 | -15.4 | |||

Source: Bloomberg. * (-) depreciation, (+) appreciation

vs. the US dollar. Total Return assumes dividends were

reinvested where applicable.

| Sector |

|

Stance |

|

||

|---|---|---|---|---|---|

| Materials | Overweight | ||||

| Staples |

|

Overweight |

|

||

| Technology | Overweight | ||||

| Energy |

|

Neutral |

|

||

| Utilities | Neutral | ||||

| Telecom |

|

Neutral |

|

||

| Financials | Neutral | ||||

| Consumer Disc. | Underweight |

|

|

||

| Health Care | Underweight | ||||

| Industrials | Underweight |

|

|

||

| Refer to important disclosures on page 35. | 3 | ||||

� The Late Cycle Show

Inflation Rises

| We are currently “late-cycle”, a | Growth Recovers |

|

Stocks | ||

|---|---|---|---|---|---|

| Bonds | Cash |

|

|||

| shines |

Inflation Falls

GEM Strategy – 8 November 2005

| • | A slump in growth and trade: A sharp slowdown in global growth would hit |

|---|

|

|

|

|---|---|---|

| Energy + Materials | ||

Table 4: GEM Bull & Bear Markets and Drivers

|

Bull 1988-94 | Bull 2003- | ||

|---|---|---|---|---|

| GEM CAC Balance | Surplus | Deficit | Surplus | |

| Relative Valuation | Overvalued | Undervalued | ||

| currently visible | US Real Short Rates | Falling/Low | Rising | Falling/Low |

| Equity Volatility | Decreasing | Increasing | Decreasing | |

| EM Debt Spreads | Falling | Rising | Falling | |

| US$ (trade-weighted) | Falling | Rising | Falling |

Refer to important disclosures on page 35. 6

1.Capital inflows are abating. This is the message from the recent weak Indian rupee (worst performer within EM Asia this past month). Note that capital inflows have been a key driver of the +20% year-to-date total return from India (local currency terms).

2.An inflection point in inflation is imminent. Indian Economist Rajeev Varma predicts a rise in wholesale price inflation from 3% to 6% in the next 6 months. Indian short-rates will rise by at least 75bps over this period. Our mid-year bullishness on India was predicated on lower inflation keeping rates low and liquidity high. As inflation trends higher instead of lower in coming months, the liquidity story reverses.

Chart 8: Chronology of the 2002 Brazil Crisis

| 27 | Selic Interest Rate (%) |

|

Easing | 8000 |

|---|

22 5000

21

| 20 | Tightening | 36% | 4000 | |

|---|---|---|---|---|

| 19 | begins |

GEM Strategy – 8 November 2005

�Theme Investing in 2006

1.GEM Consumer Theme

2.Urbanization Theme

| Themes |

|

|

|---|---|---|

| The GEM Consumer | Consumption % GDP in EM = 56%. In the USA = 70%.GEM consumption |

| Urbanization in Emerging | ||

|---|---|---|

| The UN forecasts that the urban population in the developing world will grow | ||

|

at close to one million persons per week in the next 25 years. Cities such as |

|

|

|

|---|

GEM Strategy – 8 November 2005

| View | • |

|

|

|

↑ | ||

| • | |||

| ↑ | |||

| ↓ | • | G7 interest rates remain low in nominal and real terms. A spike in U.S. | |

| ↓ | |||

|

|||

|

↑ | ||

| • | |||

|

|---|

GEM underperforms only once Fed has done enough to halt

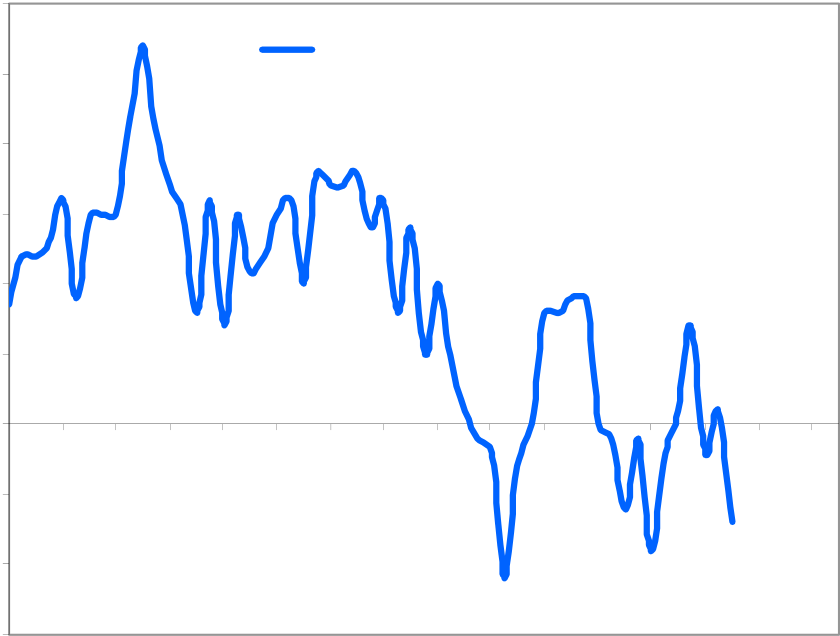

Chart 10: EMF & U.S. 10-Year Bond Yield

Chart 11: Global Liquidity*

We forecast ample growth (+10%) in our global liquidity

measure.

Refer to important disclosures on page 35. 10

3

|

|---|

GEM Strategy – 8 November 2005

| Table 6: GEM Investment Drivers | • | ||

|---|---|---|---|

| Driver | |||

| Liquidity |

|

• |

|

| Growth | • | ||

| Sentiment | |||

| Valuation |

|

||

| Risk Appetite |

|

• | |

| ↑ = Positive, ↓ = Negative, ⎯ = Neutral |

Fund managers on balance want to remain overweight GEM…

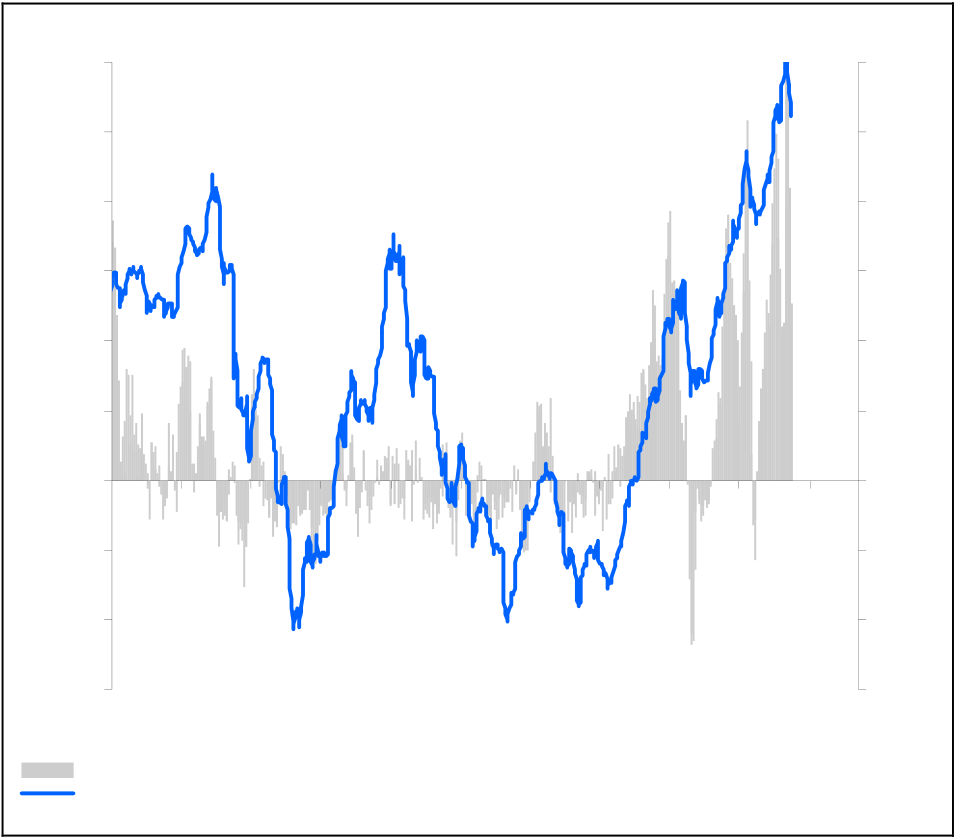

Chart 19: Weekly Emerging Market Equity Inflows, US$ bn

Net % Saying Increasing Position in GEM Equities

|

|---|

Chart 20: Cash Levels in GEM Equity Portfolios

5.0

3.5

| 12 | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

|||||||||||||||||

|

||||||||||||||||||

|

||||||||||||||||||

| 96 | 97 | 98 | 99 | 00 | 01 | 02 | 03 | 04 | 05 | |||||||||

| 00 | 01 | 02 | 03 | 04 | 05 | |||||||||||||

|

|

|||||||||||||||||

| Source: AMG, Merrill Lynch. Weekly reporters only, five-week moving average. | ||||||||||||||||||

GEM Strategy – 8 November 2005

| Valuation: A Modest Negative | |||||

|---|---|---|---|---|---|

| • | |||||

|

|

• | |||

| • | |||||

|

|

||||

| • | |||||

|

• | ||||

| And GEM earnings yield in line with EM corporate bond yield (7-8%). | |||||

| ↑ = Positive, ↓ = Negative, ⎯ = Neutral | |||||

|

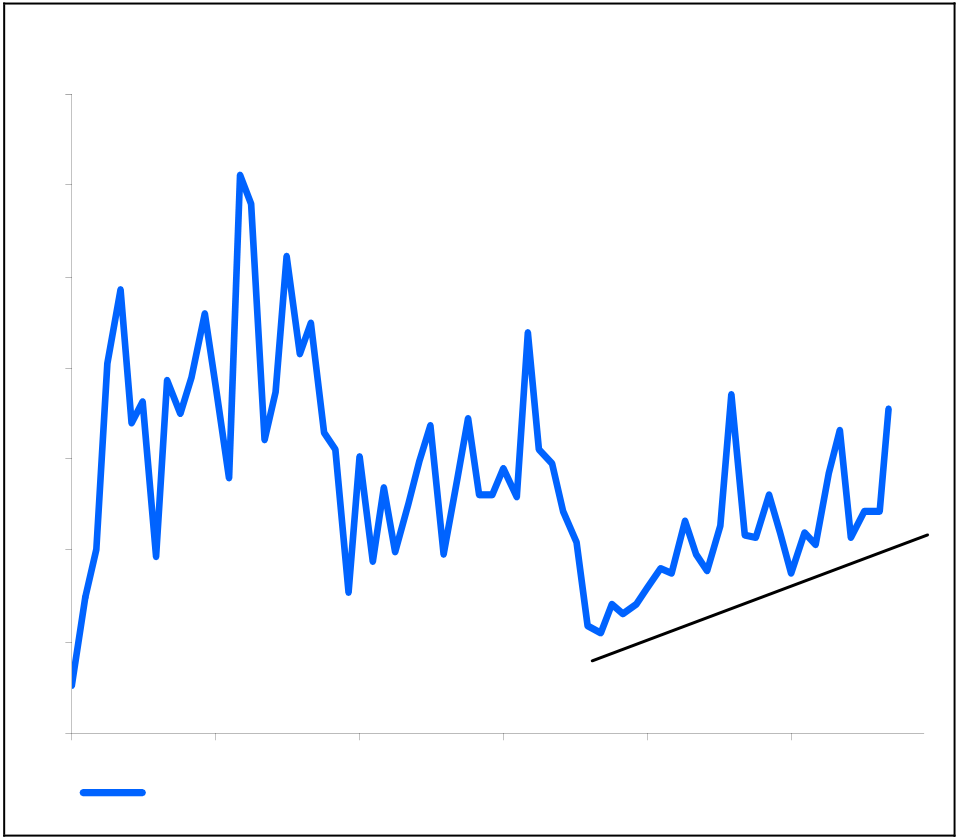

Chart 22: EMF Forward PE Relative to World | ||||

|

|||||

Risk Appetite: Positive

Chart 25: EMF Relative & VIX Index

| Table 9: GEM Investment Drivers | • | |||

|---|---|---|---|---|

| Driver | View | |||

| Liquidity | ↑ | • | ||

| Growth | ↑ | • |

|

|

| Sentiment | ↓ | |||

| Valuation | ↓ | • |

|

|

| Risk Appetite | ↑ | • | ||

| ↑ = Positive, ↓ = Negative, ⎯ = Neutral | ||||

| Chart 30: U.S. High Yield Spreads | ||||

5. Country Views Underweight/Overweight

GEM Strategy – 8 November 2005

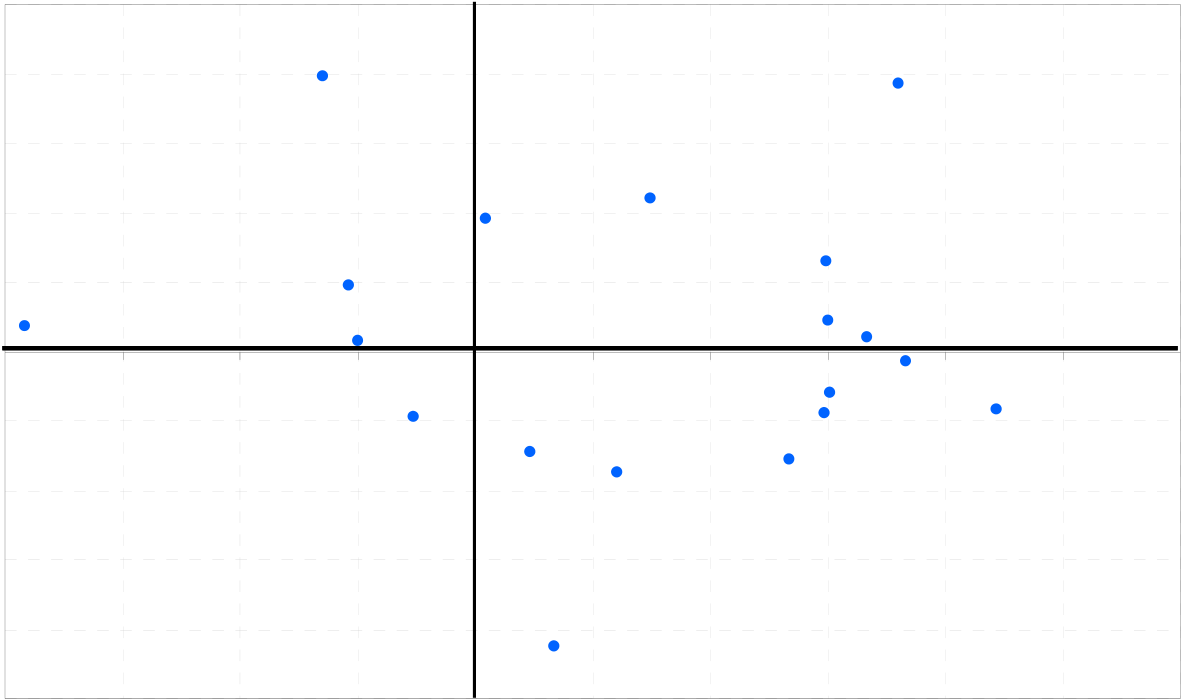

Chart 37: Price Relative & GEM Fund Allocation

|

|---|

GEM Strategy – 8 November 2005

| Underweight/Overweight | |||

|---|---|---|---|

| • | |||

| Country | |||

| Russia | Overweight | • | |

| Brazil | Overweight | ||

| • |

|

||

| Korea | Overweight | ||

| Indonesia |

|

• | Inflation and interest rates rising but FX stability implies crisis over. |

| Turkey | Overweight | ||

| Taiwan | Overweight | ||

| Mexico | Neutral | ||

| South Africa | Neutral | ||

| Israel | Neutral | ||

| Thailand | Neutral | ||

| India | |||

| Central Europe | |||

| China | |||

| Chile | |||

Chart 45: Price Relative & GEM Fund Allocation

Lowest exposure to Indonesia since end of 2001.

Chart 47: Indonesia Current Account Balance (US$ mn)

Chart 48: Indonesia Target Rate and FX Rate

|

|

• | |

| Overweight | |||

| Overweight | • | Liquidity-story a positive. Debt spreads tight. Rates to be cut 50bps. | |

| Overweight | |||

| • |

|

||

|

Overweight | ||

| • | |||

| Overweight | |||

|

Neutral |

|

|

| Neutral | • | ||

| Neutral | |||

| Neutral | |||

|

|

||

|

|

||