Global remittances

Executive summary

Table of Contents

Introduction

There has been an increase in migration, especially in Stable countries. the main purpose of this report is to provide a better approach towards global remittance as well as to provide an in-depth analysis of how before the exchange market operated. the report has been established by analyzing the various journals, online resources, and authentic articles. the report is divided into small sections so that it could provide proper detail. in the first part, the theories have been discussed that are associated with the subject as well as a proper experiment is also proposed where on Nepali migrant will become a virtual investor. the experiment will focus on the choice of forex, the reasons will be discussed and it will also provide an overview of previous market observation. the second part of the report will focus on migrant's investment performance through the IG platform and how does the global event affect its. in the latter section it will focus on the option through which the migraine could send money from Australia to Nepal, this section will also include a comparison between the two. Lastly, the end section will focus on the financial crisis and how it will impact the forex as well as the global remittance. the report will also include a detailed conclusion and recommendation.

Global remittances

Evaluating NPR Against the AUD (Australia, Australian dollar), CHF (France, Swiss franc), GBP (Pound sterling, UK), USD (US, United States Dollar), and JPY (Japanese Yen). In 10 years, analysis can be seen that GBP has been one of the currencies which have been appreciated, and after that it was EUR. According to the average, it indicates that 1 unit of GBP can buy 151.70 whereas EUR can buy 137.77. Currently, it can be said that both of them appreciated well than the NPR. On 3rd Feb 2018, 1 unit of GBP was able to buy 143.32, while for the EUR, 1-unit could buy 127.15.

In case of evaluating AUD against the same currencies that are mentioned above (CHF, JPY, EUR, USD, and GBP), then in that case it would be to right to say that GBP and EUR are one of the stronger currencies. The average indicates that 1 Unit of AUD can only buy 0.5672 GBP and for EUR it can only buy 0.61371 EUR. However, from past history, it can be said that there has been little appreciation. On March 21, 2020, it was seen that 1 Unit of AUD can only buy 0.5685 GBP and forEUR it can only buy 0. 641371. Several other currencies have been also considered and observed so that it reduces the risk of investing when it comes to the forex market. It has been found that owning a diversified currency is much better than just owning one single currency as it reduces the risk. The currencies that have been selected are the major currency that are CHF, JPY, EUR, USD, and GBP. Moreover, the global trade Was also forecasted, which highlighted that JPY is one of the safest currencies, and in terms of the highest return CHF and euro currencies are promising. Whereas according to the forex market which forecasted that NZ dollar, the Canadian dollar, the Australian dollar as well as US dollar will be at higher risk

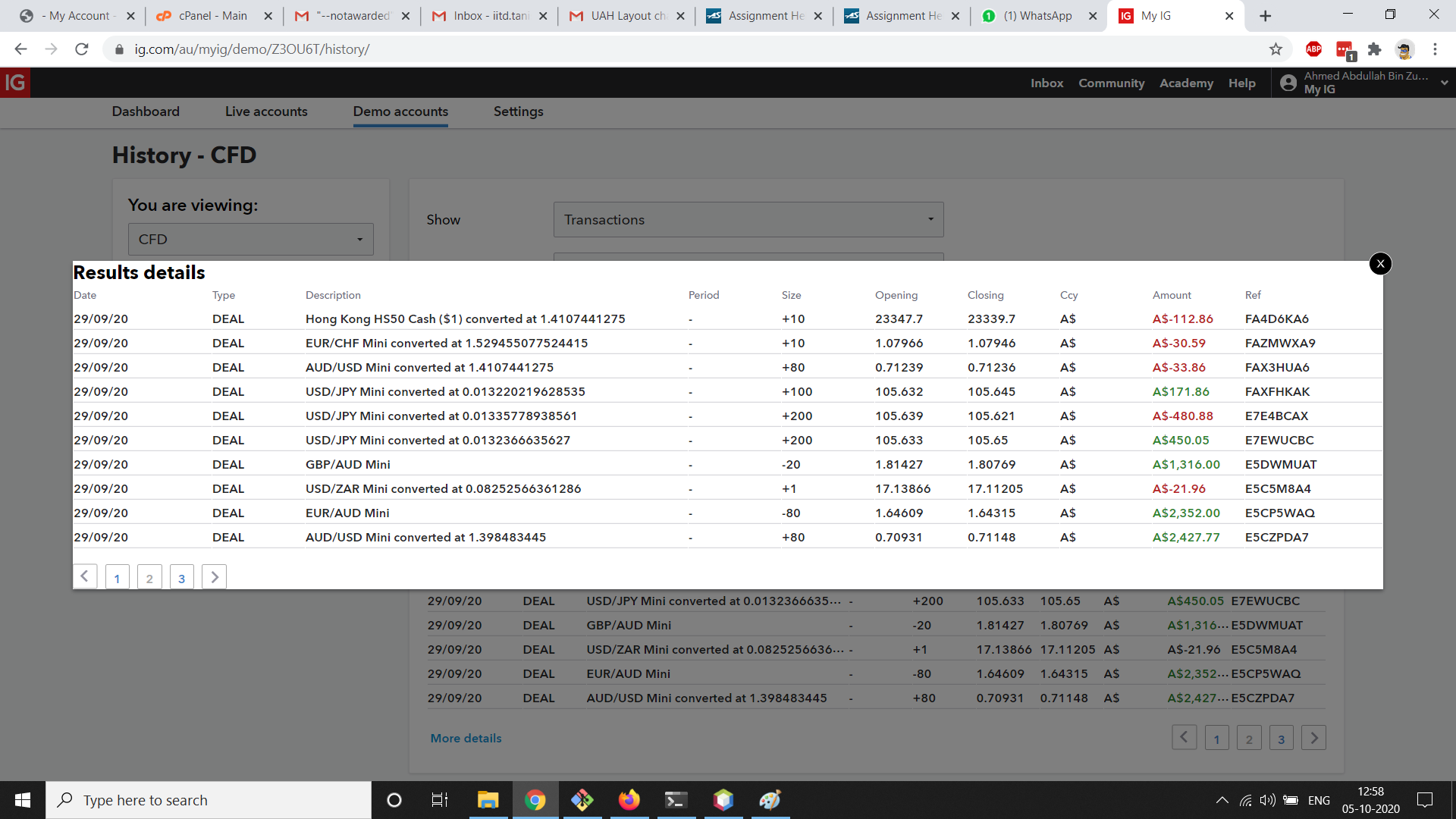

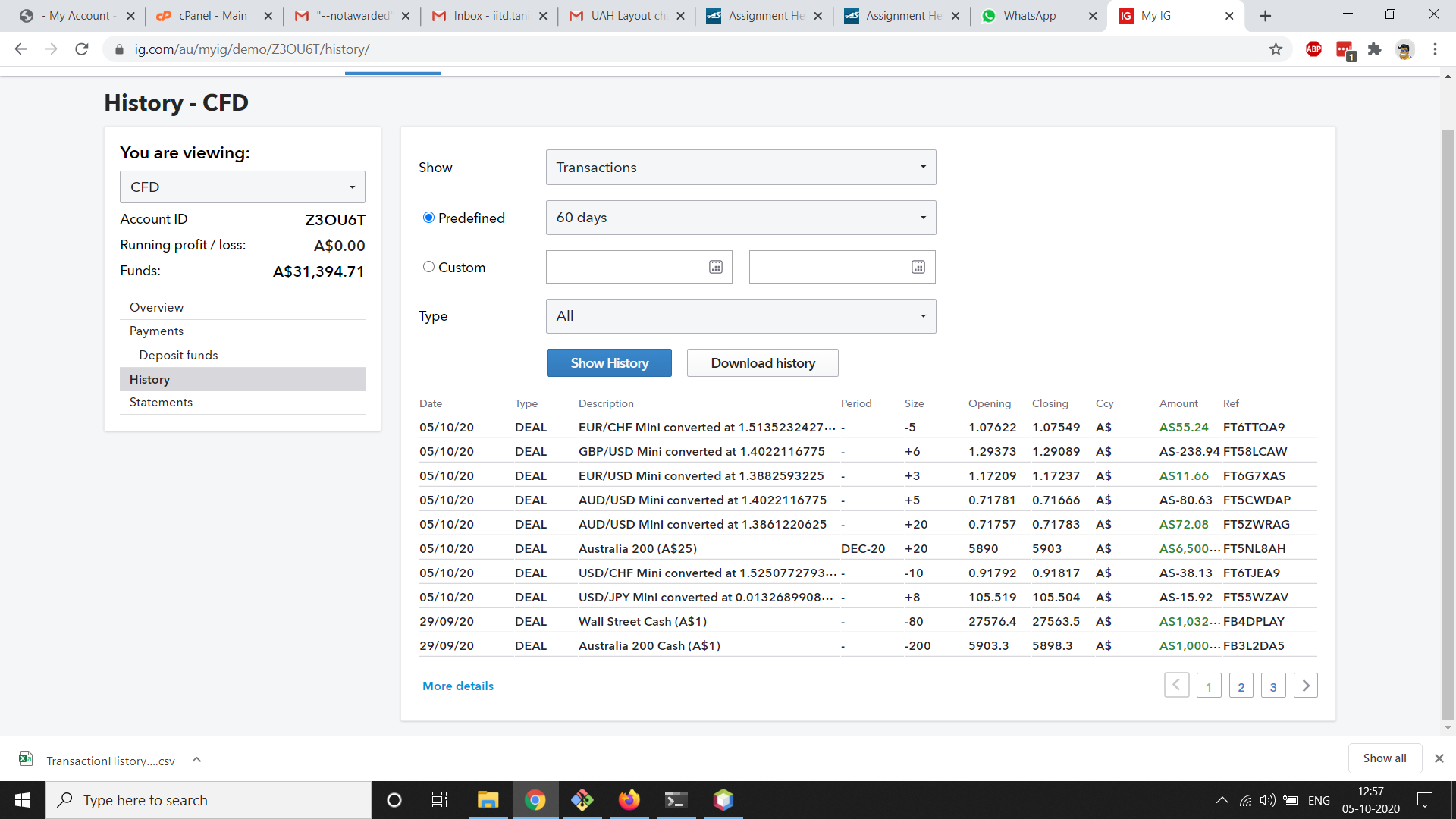

IG Platform Investment

Home country transfer

Bank-to-Bank Transfer: in this case, potential of transferring or sending money is possible if both the concerning parties have bank accounts. This process of bank-to-bank transfer requires to have bank accounts linked for sending or receiving the money (Fowler, 2020; Pritchard and Cheng, 2020).

Advantages:

Payment is difficult to recover in case of fraud

Fees are present for the sender when transferring between back accounts

Reduced transaction cost as there no typical additional charges or fees when transferring money

Disadvantages

Convenient to use as it reduces the amount of cash carried and track of the money

Easy to use as it only requires the payee’s name

Requirement of minimal bank balance to issue a check for transfer (Checks Advantages and Disadvantages, n.d.)

Cash Deposit: this mode of sending money simple required withdrawing the cash required and deposit the cash at the back of the recipient’s checking account. This can be considered when transfer time is not of the essence (Fowler, 2020).

Risker to transfer as their potential to be stolen

Fraud potential as it can be stolen before the transfer (Hawkins, 2019)

Convenient to transfer a large sum of money as there is no need to withdraw cash or a limit

There is a potential to trace the money from the bank draft or money order

Financial Crisis

Just keeping the accumulated money from September to October transferring AUD to NPR would have Being loss to the migraine as Even though EUD has appreciated however the profit that migrant has made by investing into different currency would have not been possible.

Nepal has been severely impacted due to the coronavirus and still, the path of recovery is far away. the rate of poverty, unemployment, wealth distribution, high inflation rate, and fiscal imbalances have severely impacted Nepal. besides this, the country is unstable in terms of politics and economics and there is also a high rate of corruption scandals. This is one of the reasons that NPR is under pressure as well as depreciating at a rapid pace. however, the migrant has benefited by investing in two different currencies which have helped the migrant in making the profit

Conclusion and recommendations

References

Anon, n.d. Checks Advantages and Disadvantages. [online] Google Docs. Available at: <https://docs.google.com/document/preview?hgd=1&id=1a85piUflN4XeIu1EGbu_-LzjrAp3LqB_R4pxx0BprO4> [Accessed 5 Oct. 2020].

Consumer Tips, 2018. The Pros and Cons of International Wire Transfers. [online] FinSMEs. Available at: <https://www.finsmes.com/2018/10/the-pros-and-cons-of-international-wire-transfers.html> [Accessed 5 Oct. 2020].

Appendix