Gower and davies principles modern company law

= 0.023794 i.e., 2%

Price chart for five years from 18th March 2016 to 12th March 2021.

= 0.0408456 i.e., 4%

Price Chart for 5 years

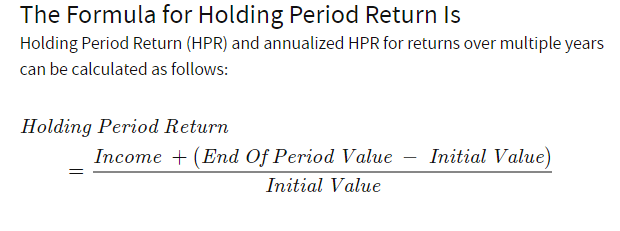

Holding Period return = D1+(p1-p0)/p0

= 80.19 %

So, if the investor holds its investment in Coca Cola HBC for 5 years from March 2016 to March 2021, he will get return of 80.19%.

Answer: 2

Methods of risk measurement in investment.

Sharpe Ratio

This ratio was developed by William Sharpe to help the investors in understanding the return on the investment made by them compared to its volatility. It is the average return gained in addition to the risk-free rate per unit of the total risk.

(Anon., n.d.) Another popular measurement of risk is beta. It measures the amount of undiversifiable risk an individual security has compared to the whole stock market. If the market has a beta of 1, and it can be used to determine the risk of a security. If a security's beta is also 1, the security's price moves with the market. A security which has a beta greater than 1 signifies that it is more unstable than the market.

On the Contrary, if a security's beta is fewer than 1, it implies that the security is less unstable than the market. For instance, suppose a security's beta is 1.5. In notion, the security is 50 percent fickle more than the market.

Types of risks

Systematic Risk

(MANGEMENT), n.d.) He risks that arises out of micro economic factors or the internal factor of the company is known as unsystematic risk. This type of risk is only associated with the one particular security or the company. This risk is avoidable by diversifying the portfolio and is totally manageable by the management of the company. The unsystematic risk affects the security of the company and not whole market.

The main types of unsystematic risk are insolvency, financial and business risk.

Calculating CAPM from the above example of question 1.

Simple return of coca cola HBC = ( current price – purchase price / purchase price)

= 11.11%

As the Coca Cola HBC company is based in Switzerland, the average risk-free rate in Switzerland was 0.9 percent as of 2020. So, risk free rate is taken as 0.9% in this example

CAPM

Expected return = risk free rate + (beta * market risk premium)

According to the CAPM it is observed that the risky investments should be mixed with other investment in the form of portfolio so, that the risk can be diversified. To minimize risk investors, hold diversified portfolio so that the unsystematic risk can be eliminated.

For example, there are two companies in the country with textile as the chief industry. One company produces cotton fabrics which performs well during unclouded years while other produces cotton yarn which performs well pouring years. Both companies stock performs equally poor in unclouded and pouring years and each company has average return of 18%.

Capital structure is the combination of equity and debt used by the corporations to finance their overall operations and growth. Equity is the common stock listed and traded on stock exchanges and debt is in the form of long-term borrowings.

The Coca Cola HBC:

Key advantages:

Strong brand portfolio and market leadership as a major brand bottler.

Funding Types:

A company need money to grow their firm into a new area, undertake research, or fight against competitors. Funding can be categorized based on the duration of a company's need.

Long-term financing:

Share Capital: As of December 31, 2020, the Company has a share capital of €2,014.4 million, consisting of 369,930,157 shares, and a share premium balance of €3,321.4 million.

Short Term financing:

Commercial papers: The company has financed €100 million using commercial paper, which is issued for terms ranging from 7 to 364 days. They can be issued as either non-interest-bearing notes sold at a discount or interest-bearing notes with a fixed or fluctuating interest rate.

Preference Shares: Preference shares are those that offer the bearer a predetermined dividend rate and whose payment takes precedence over regular share pay-outs. Companies typically prefer this choice when they do not want a stakeholder to engage in voting for an extended length of time. This approach becomes somewhat costly because the firm does not benefit from any tax savings on dividends given to preference shareholders.

Loan From associated parties: A Company can borrow cash from a Group Company at an arm's length rate with no difficulty. In certain circumstances, the loan is granted with no interest.

Equity capital increases the company's creditworthiness and gives prospective loan providers confidence.

Equity shares are preferred by investors who are ready to take on more risk in exchange for better profits.

It is not required to deliver dividends to shareholders, therefore if the firm is losing money, it can avoid spending such expenditures.

Disadvantages:

Due to the high risk, investors may suffer significant losses in a short period of time.

From the perspective of the firm, the initial cost of issuing shares may be higher than obtaining them directly from a bank, but it is less expensive over time because there is no interest payment requirement.

Preference shares provide a stable income in the form of a predetermined rate of return, as well as investment safety.

It is appropriate for investors seeking a set rate of return with a low degree of risk.

The dividend on these shares is to be paid only when the company earns a profit; there is no guaranteed return for investors in non-cumulative preference shares, whereas in the case of cumulative preference shares, the dividend becomes an obligation to pay, i.e., if the company incurs losses, the dividend for that year will be paid in the following year on a cumulative basis.

Preference shares are disliked by investors who are ready to accept a risk in exchange for better profits.

They are preferred by investors seeking stable income with lower risk. (ORHEIAN, 2012)

Because debentures do not have voting rights, they do not dilute equity shareholders' power over management.

Each firm has a specific amount of borrowing capacity. Issuing an increasing number of debentures will limit a company's earning capability. (Davies, 2012)

With a redeemable debenture, the business is required to make preparations for repayment on the stated date, even if the company is experiencing financial difficulties.

Aside from finance, they also offer consultation and technical guidance.

Financial institutions are ideal for long-term company funding needs since they provide long-term finance, whereas commercial banks do not.

WACC for Coca Cola HBC:

The weighted average cost of capital (WACC) is a statistic that displays the firm's cost of capital in relation to each capital type. WACC takes into account all sources of capital, including common stock, preferred stock, bonds, and any other long-term debt. It is a critical metric in the financial business. It is useful for determining business valuation, capital budgeting analysis, and a variety of other tasks.

We = Weightage of Equity in Total Capital

Ke = Cost of Equity

= 6.42%

Source:

Total debt as at 31st December 2020 = € 2,925.5 millions

(Source for market capital - https://www.coca-colahellenic.com/content/dam/cch/us/documents/oar2020/2020-Integrated-Annual-Report-18Mar2021.pdf.downloadasset.pdf)

= 2.04%

Weightage of Debt in total Capital (Wd)= 33%

As equity is 67 percent, there is a risk of dilution of voting power, and earnings per share decrease for all owners. In addition, the cost of issuing capital is substantially high. If the Company intends to raise funds through debentures/bonds, there may be no dilution of voting rights and the Company will receive a tax benefit on the amount owed; however, the Company will always be compelled to pay interest regardless of profits, and this will be a permanent problem for the Company. In addition, regardless of financial constraints, the Company will be required to make money accessible during redemption.

If the Company intends to obtain term loans from a bank or financial institution, it will receive a tax benefit on the interest payable, but they will place limits on dividend payments, which Coca Cola HBC does not favour because it pays dividends on a regular basis. Additionally, limits are put on the Company's spending, or authorization from banks or financial institutions are required for different expenditures. There is also a duty for the Company to maintain debt covenants, which it must do or face fines. Also, if the loan has a variable interest rate, the interest will rise in tandem with inflation, resulting in larger expenditures than anticipated.

References

Anon., n.d. Investopedia. [Online]

Available at:

https://www.investopedia.com/terms/h/holdingperiodreturn-yield.asp

Anon., n.d. Investopedia. [Online]

Available at: http://www.investopedia.com

ORHEIAN, 2012. he advantages of using factoring, as financing technique on international transactions market.. Issue 2012.

Prakash, A., february 2013. Regulation of Bond/Debt/Debenture Market in Malaysia. Issue 201.