Income tax equals taxable income rate tax offsets

Tutor’s name: Kayleen Wood

Assignment No.: 2

Section 18 – Academic Misconduct Including Plagiarism) as

Declaration: contained in the SCU Policy Library. I understand the penalties that

| Assessable | 156,000.00 |

|---|

[6.20] explains "Receipts earned from personal services and employment (also

known as "personal exertion", which encompasses both income from employment

and services) may be assessable as either ordinary or statutory income.

| Not Assessable | 1,128.00 | - | The term "fringe benefit" is defined in s136(1) of FBTAA as a benefit which is |

|---|

|

Assessable/Not Assessable |

|

|---|

| Dividend CBA Dividend COH Dividend FLT Dividend TLS |

Assessable | 680.00 | 291.43 | 971.43 | |

|---|---|---|---|---|---|

| Assessable | 900.00 | 385.71 | 1,285.71 | ||

| Assessable | 450.00 | 192.86 | 642.86 | ||

| Assessable | 210.00 | 90.00 | 300.00 |

|

|

|

58,240.00 | 24,960.00 | |||

Compensation payout for medical expenses The client has recevied a payout of $50,000 during this financial year for compensation of medical expenses because of injuries from an accident.This payment is not assessable under the replacement principal in s6-5. It states that a receipt of compensation or a reward for damages takes on the character of the item it is to replace. Therefore does not have to disclose this as income in tax return.

|

|||||||||

|---|---|---|---|---|---|---|---|---|---|

|

Assessable | 26.54 | 120.00 | 60,922.00 | 11,500.00 | Under s 110-35 of ITAA 1997 brokerage fees are a incidental cost | |||

|

||

|---|---|---|

|

| Deductable/Non deductable/Assessable/Not assessable |

Calculation Income | Calculation Expenses | Legislation/Case Law/Income Tax Rulings |

|---|

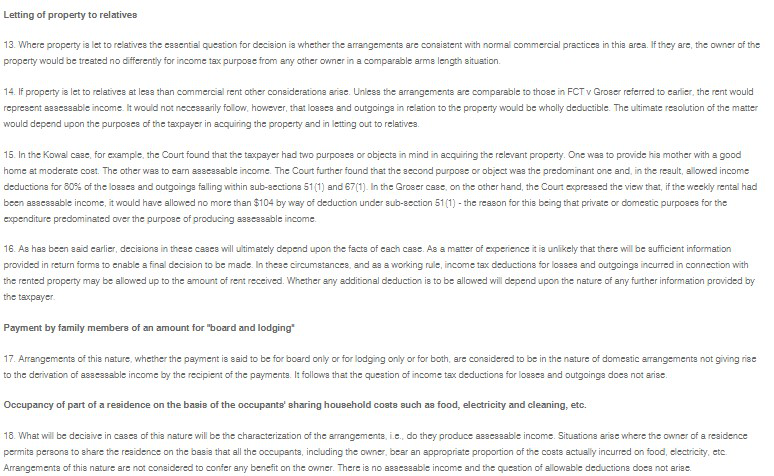

an agreed amount of time. The receipt of rent by the lessor clearly

constitutes ordinary income as it is income from property. The rental

income received from the daughter is within normal rental rates in the

Bilinga area, so therefore it is within an arms length transaction and isn't a

problem renting to a relative as stated in, FCT v Groser, 82 ATC 4478: 13

ATR 445 (see Appendix 2).

|

|---|

| deductable |

|

|---|

1(1), the loss or outgoing must be: incurred in gaining and producing

assessable income. This expense incurred towards the rental property

passes the 1st limb of the positive limbs of s 8-1 ITAA97, as it has incurred

while gaining and producing assessable income using a rental property.

| deductable | As above |

|---|

370.00

| As above |

|---|

| deductable | As above |

|---|

| Rental Assets | Opening Balances | Depreciable Years | Depreciable Rate- Diminishing Balance |

Depreciation | Closing Balance |

|---|

1574.66 Calculation for Capital Works Deduction

|

Deductable/Non deductable | Amounts | Amount claimed |

|---|

|

Deductable | 1,200.00 | 1,200.00 |

|

|---|

|

|

1,200.00 |

|---|

ITAA 1997-an expense incurred in gaining or

producing assessable income. Therefore, can be

claimed.

| Non deductable | 200.00 |

|---|

| Deductable | 860.00 | 57.02 |

|---|

|

Non deductable | 630.00 | Rebate 73.00 |

|

|---|---|---|---|---|

| Non deductable | 5,200.00 | - |

TAX PAYABLE/HANDITAX RECONCILIATION

|

Amounts |

|---|

|

22,381.02 |

|---|---|

|

246,730.98 |

|

48,337.00 |

|

|---|

|

4,934.62 |

|

|---|

|

|

|---|

As your BHP shares inherited by you from your father are a pre-CGT asset-04/01/1985, it is shown at its market value at the date of your fathers’ death on the 15/07/2018. This BHP shares value at the date shown above was $21.30 per share. These shares were sold on 5/01/2019 at $26.54 per share totalling $61 042. From the disposal of BHP shares there was a profit of $49 422. You also sold MYR shares which is a post CGT asset as it was acquired at cost and your father paid $4.10 per share. You sold the shares on 05/01/2019 for $1.31 resulting in a loss of -$26 550. It should have been recommended that you had kept these shares and waited to sell them at a higher price in the future. Your loss from the disposal of MYR shares will offset your gain from the BHP shares sold, giving you a total capital gain of $22 872 .

Your rental property, 4/285 Pacific Parade, Bilinga, 4225 your expenses associated with it are deductable as they have been necessary to produce an assessable income. You are also allowed a capital works deduction on the building of $1 577. Your assets purchased for the rental are also depreciable and have been added into a depreciation schedule giving you a deduction of $173. Lastly the interest paid on the loan is a deductable expense as it was obtained with the purpose of producing income. Regarding you renting out your property to your daughter it can sometimes cause problems and the main concern are if the arrangements made will be stable with the normal practices of rental properties in the area. Your arrangements however are within normal rates and won’t be treated any differently.

You have also got additional superannuation amount of $5 200 under a salary sacrifice agreement with your employer and is reportable by your employer. This is also considered a personal contribution and is reportable as 10% of your income is from activities that results in you being treated as an employee under the superannuation guarantee law. This means it is not deductible and can not be claimed as an expense.

Concerning your supporting documentation for your 2019 tax return, it is required that you keep these for a period of 5 years. I suggest keeping them in a safe place such as filing system or scan to your computer. This is a precaution in case the ATO office have any queries or want proof to support your deduction claims.

Fringe Benefits Tax Assessment Act 1986

Taxation Ruling TR 2004/16

Appendix 1 Appendix 2

|

|---|