Offered books video rental coupons its patrons per book

|

||||||||

|---|---|---|---|---|---|---|---|---|

|

||||||||

| 1. |  |

|

|

|||||

| 3. |  |

|

|---|---|---|

|

|

|

|

||

|

||

| 2.00 points |

The SEC requires corporate officers to sign the Form 10-K, which is filed annually with the SEC. Which of the following officers is not among those required to sign?

CEO (Chief Executive Officer).

An accounting principle must receive substantial authoritative support to qualify as generally accepted. Among the organizations and agencies that have been influential in the development of generally accepted accounting principles, which of the following has provided the most influential leadership?

| 5. |  |

|

|---|---|---|

|

||

|

||

|

||

|

||

| 2.00 points |

In the phrase "generally accepted accounting principles," the words accounting principles refers to:

| 7. |  |

|

|---|---|---|

|

||

|

||

|

||

|

||

|

||

| 2.00 points |

| 8. |

|---|

Which of the following is correct if at the end of Crystal Imports' first year of operations, Assets are $800,000 and Owners' Equity is $720,000?

$800,000(Assets) - $720,000(Owners' Equity) = $80,000 (Liabilities)

| 9. |

|---|

| 11. |  |

|

|---|---|---|

|

|

|

|

||

|

||

|

On June 18, Baltic Arena paid $6,600 to Marvin Maintenance, Inc. for cleaning the arena following a monster truck show. Which of the following most likely occurred as a result of this transaction?

| 12. |

|---|

$28,000 + $13,000 = $41,000

| 13. |

|

|---|

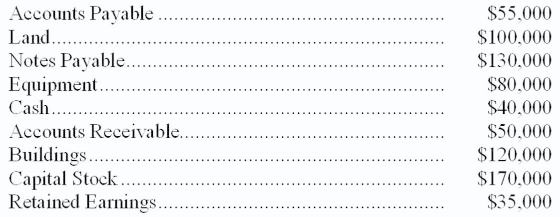

| 14. |

|---|

On January 2, 2015, Indirect Oil collected $25,000 of its accounts receivable and paid $20,000 of its accounts payable. On January 3, 2015, total liabilities are:

$35,000 + $130,000 = $165,000

| 15. |

|---|

|

|

|---|

$800 × 4/5 × 7 = $4,480

| 18. |  |

|

|---|---|---|

|

||

|

|

|

|

|

|

Which of the following statements regarding depreciation is correct?

| 20. |

|

|---|

Gourmet Shop purchased cash registers on April 1 for $12,000. If this asset has an estimated useful life of four years, what is the book value of the cash registers on May 31?

| 21. |

|---|

The December 31, 2014 worksheet for Fran's Fine Dining showed the following amounts related to the Supplies Expense account:

(a). In the Trial Balance debit column: $745

(b). In the Adjustments debit column: $125

(c). In the Adjusted Trial Balance debit column: $870

| 22. |

|---|

If current assets are $90,000 and current liabilities are $70,000, the current ratio will be:

|

|---|

|

|

|---|

| 26. |

|

|

|

|---|---|---|---|

|

||

|---|---|---|

|

$ 15,650 | |

| 12,825 | ||

| 22,800 | ||

| $ 6,150 | ||

| 7,825 | ||

|

22,650 | |

|

0 | |

| 7,650 | ||

| 46,250 | ||

| 16,300 | ||

| 3,325 | ||

|

4,325 | |

| $ 82,875 | $ 82,875 | |

|

|

|---|

|

|---|

$90,500/$69,400 = 1.30

| $ 20,000 | |

|

$ 40,000 |

|

|

| $ 6,000 |

$20,000/$130,000 = 15%

| 30. |

|

|---|