Pierre-cyrille hautcoeur and angelo riva paris

Still, for other, more pragmatic reasons, a return to the past is inevitable, because “rare events” thrust comparative economic history to the fore. If regular business cycles are roughly once-per-decade events, then we already have very few observa-tions in the postwar data for any given country. More disruptive events like depres-sions and financial crises are rarer still, at least in developed economies. When sample sizes are this small, providing a detailed quantitative rendition, or even just a sketch of the basic stylized facts, requires that we work on a larger canvas, expand-ing our dataset across both time and space. Hence, scholars have reached back to make careful comparisons not just with past decades, but past centuries, using for-mal statistical analysis to examine the nature of financial crises and other rare events with new panel datasets, as in recent work by Reinhart and Rogoff (2009), Barro (2009), and Almunia et al. (2010). In the same spirit, the purpose of this paper is to step back and ask such questions about money, credit, and the macroeconomy in the

* Schularick: Department of Economics, John F. Kennedy Institute, Free University of Berlin, Lansstraße 7–9, 14195 Berlin, Germany (e-mail: moritz.schularick@fu-berlin.de); Taylor: Department of Economics, University of Virginia, Charlottesville, VA 22903 (e-mail: alan.m.taylor@virginia.edu). Some research was undertaken while Taylor was a visitor at the London School of Economics and a Houblon-Norman/George Fellow at the Bank of England. The generous support of both institutions is gratefully acknowledged. We thank Roland Beck, Warren Coats, Steven Davis, Charles Goodhart, Pierre-Cyrille Hautcoeur, Carl-Ludwig Holtfrerich, Gerhard Illing, Christopher Meissner, Kris Mitchener, Eric Monnet, Andreas Pick, Hyun Shin, Solomos Solomou, Richard Sylla, and two anonymous referees for helpful comments. We also benefitted from helpful comments by confer-ence and workshop participants at the Bank of England, the Federal Reserve Bank of San Francisco, the 2010 EHA meetings, the ECB, the NBER DAE Program Meeting, the 16th Dubrovnik Economic Conference, New York University, Fordham University, Columbia University, the Free University of Berlin, and the Universities of Munich, Mannheim, Muenster, and Kiel. Farina Casselmann, Stephanie Feser, and Felix Mihram provided valuable research assistance. All remaining errors are our own.

Economic thinking about the role of money and credit in the macroeconomy has changed substantially over time (Freixas and Rochet 1997, chapter 6). The experi-ence of the late nineteenth and early twentieth centuries, including the disruptions of the 1930s, formed the foundation of the “money view,” which is indelibly associated with the seminal contributions of Friedman and Schwartz (1963).1 In the late twen-tieth century the “irrelevance view” gained influence, associated with the ideas of Modigliani and Miller (1958) among others, where real economic decisions became independent of financial structure altogether. Starting in the 1980s, the “credit view” gradually attracted attention and adherents. In this view, starting with the works of Mishkin (1978), Bernanke (1983), and Gertler (1988), and drawing on ideas dating back to Fisher (1933) and Gurley and Shaw (1955), the mechanisms and quantities of bank credit matter, above and beyond the level of bank money.2 Still, one strand of criticism notes that in most financial-accelerator models, credit is largely passive—a propagator of shocks, not an independent source of shocks (Borio 2008; Hume and Sentance 2009).3 By contrast, in other classes of models, multiple equilibria or feed-back effects are possible (Bernanke and Gertler 1995; Kiyotaki and Moore 1997); work by Geanakoplos (2009) on leverage cycles meshes with this view.4 Given these disparate views, we ask: what are the facts? To our knowledge, the dynamics of money, credit, and output have not been studied across a broad sample of countries over the long run. There are, however, a few recent studies that are comparable to ours in spirit, in that they lift the veil of finance to reexamine the link between financial structure and real activity in the past or present. Adrian and Shin (2008, 2009), Mendoza and Terrones (2008), as well as Hume and Sentance (2009), have analyzed the structural changes in the financial system in recent years and the consequences for financial stability and monetary policy. Previously, Rousseau and Wachtel (1998) investigated the link between economic performance and finan-cial intermediation between 1870 and 1929 for five industrial countries, while

1 In this account, the central bank can and must exert proper indirect control of aggregate bank liabilities, but beyond that, the actual functions of the banks, and their role in credit creation via bank loans, are of no great importance.

Eichengreen and Mitchener (2003), among others, have studied the credit boom preceding the Great Depression.5

I. Money, Credit, and Crises in the Long Run

| 1032 |

|

ApRIl 2012 |

|---|

or “now” versus “then.” In postwar crises, central banks have strongly supported money base growth, and crises have not been accompanied by a collapse of broad money, although credit does still contract. On the real side, a striking result is that the economic impact of financial crises is no more muted in the postwar era than in the prewar era. Given the much larger financial systems we have today (the first stylized fact above),however, the real effects of the postwar regime could take the form of preventing potentially even larger real output losses that could be realized in today’s more heavily financialized economies without such policies. With regard to prices, inflation has tended to rise after crises in the post-WW2 era, with econo-mies avoiding the strong Fisherian debt-deflation mechanism that tended to operate in pre-WW2 crises, and this could be another factor preventing larger output losses. The bottom line is that the lessons of the Great Depression, once learned, were put into practice. After 1945, financial crises were fought with more aggressive mon-etary policy responses, banking systems imploded neither so frequently nor as dra-matically, and deflation was avoided—although crises still had real costs. In tandem with our previous findings, however, it is natural to ask to what extent the implicit and explicit insurance of financial systems by governments encouraged the massive expansion of leverage that emerged after the war.

VOl. 102 NO. 2 sCHulARICk ANd TAylOR: CREdIT BOOMs gONE BusT 1033

total balance sheet size of the banking sector. We complemented these credit series with narrow (M0 or M1) and broad (typically M2 or M3) monetary aggregates as well as data on nominal and real output, inflation, and investment. To investigate the potential inter-relationship between crises, credit, and asset prices, we have also collected long-run stock market indices from a number of (partly new) sources as discussed in a later section below.

Table 1—Annual Summary Statistics by Period

| Pre-World War II | Post-World War II | ||||||

|---|---|---|---|---|---|---|---|

| N | Mean | N | Mean | SD | |||

| 665 | 0.4217 | 831 | 0.5470 | 0.4239 | |||

| 617 | 0.7132 |

|

828 | 1.0135 | 0.6688 | ||

| 742 | 0.5343 |

|

834 | 0.6458 | 0.2405 | ||

| 642 | 0.7581 | 833 | 0.8380 | 0.4942 | |||

| 586 | 1.2790 | 831 | 1.5758 | 0.7525 | |||

| 868 | 854 | 0.0270 | 0.0253 | ||||

| 826 |

|

852 | 0.0452 | 0.0396 | |||

| 787 |

|

825 | 0.0780 | 0.0717 | |||

| 741 | 0.0365 | 833 | 0.0857 | 0.0552 | |||

| 652 | 0.0416 | 833 | 0.1094 | 0.0749 | |||

| 607 | 0.0433 | 825 | 0.1048 | 0.0678 | |||

| 626 | 0.0017 | 825 | 0.0222 | 0.0643 | |||

| 573 | 0.0043 |

|

820 | 0.0182 | 0.0595 | ||

|

|||||||

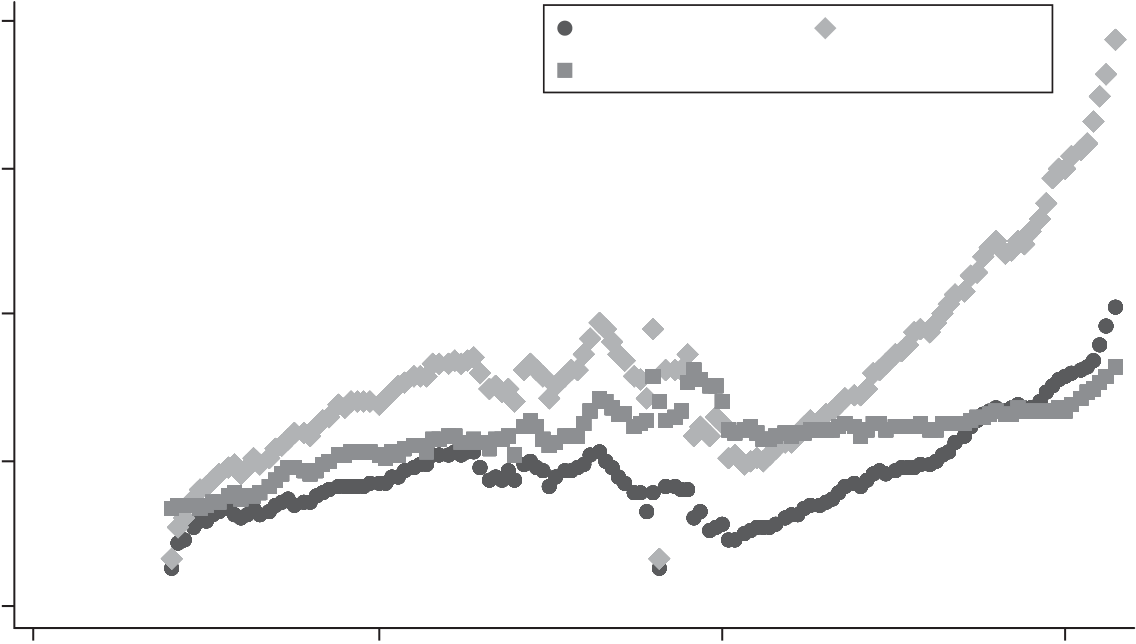

From these figures we see that the first financial era lasted from 1870 to WW2. In this era, money and credit were volatile but over the long run they maintained a roughly stable relationship to each other and relative to the size of the economy as measured by GDP. Money and credit grew just a little faster than GDP in the first few decades of the classical gold standard era from 1870 to about 1890, but then remained more or less stable relative to GDP until the credit boom of the 1920s and the Great Depression. In the 1930s, both money and credit aggregates collapsed. Figure 2 shows that the relationship between the loan or asset measures and broad money remained almost perfectly stable throughout the first era up to WW2, save

1

0.5

| 1850 | 1900 | Year | 2000 |

|---|

0.5

| 1850 | 1900 | Year |

|

2000 |

|---|

Figure 2. Aggregates Relative to Broad Money (year Effects)

To sum up, the ratio of credit to money remained broadly stable between 1870 and 1930. The Great Depression then saw a marked deleveraging of the banking system. In the postwar period, banks first grew their loan books relative to avail-able deposits, before sustaining high credit growth through increasing reliance on nonmonetary liabilities. The dynamics are basically comparable between the European countries in the sample and the United States, but the pace of the bal-ance sheet growth has been even higher in Europe than in the United States, as, in the latter, nonbank financial intermediaries like broker dealers have played a large role and exhibited even stronger balance sheet expansion than the commercial banks (Adrian and Shin 2008). What does this structural change mean for the questions about money, credit, and output raised before? First, in the latest phase, in which banks fund loan growth through nonmonetary liabilities, the traditional monetarist view could potentially become more problematic. While central banks might still be able to steer aggregate credit through the monetary aggregates, it is also possible that the link between money and credit becomes looser than in a situation where banks’ liabilities are predomi-nantly or even exclusively monetary. This is exactly what many of the world’s central banks found out in the 1980s, as Friedman and Kuttner (1992) have documented. Second, if we look at the ratio of bank credit to nonmonetary liabilities on banks’ balance sheets, it is easy to see how funding structures have changed in a historically

7 It is even likely that our numbers underestimate the process of credit creation in the past decades as a growing portion of lending, at least in some countries, was securitized and is no longer carried on banks’ balance sheets.

−1−2−3 ITA

|

1037 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CAN | CHE | DEU | |||||||||||

| ESP | FRA | GBR | |||||||||||

| JPN | NLD | NOR | |||||||||||

| 1850 | 1900 | 1950 |

|

1900 | 1950 | 2000 | |||||||

|

|||||||||||||

| 1900 | 1950 | log(Loans/broad money) |

|

||||||||||

| 2000 1850 |

|

1950 | |||||||||||

IV. Money, Credit, and Output after Financial Crises: An Event Analysis

| VOl. 102 NO. 2 | sCHulARICk ANd TAylOR: CREdIT BOOMs gONE BusT | 1039 | |

|---|---|---|---|

|

D log(Bank loans) | ||

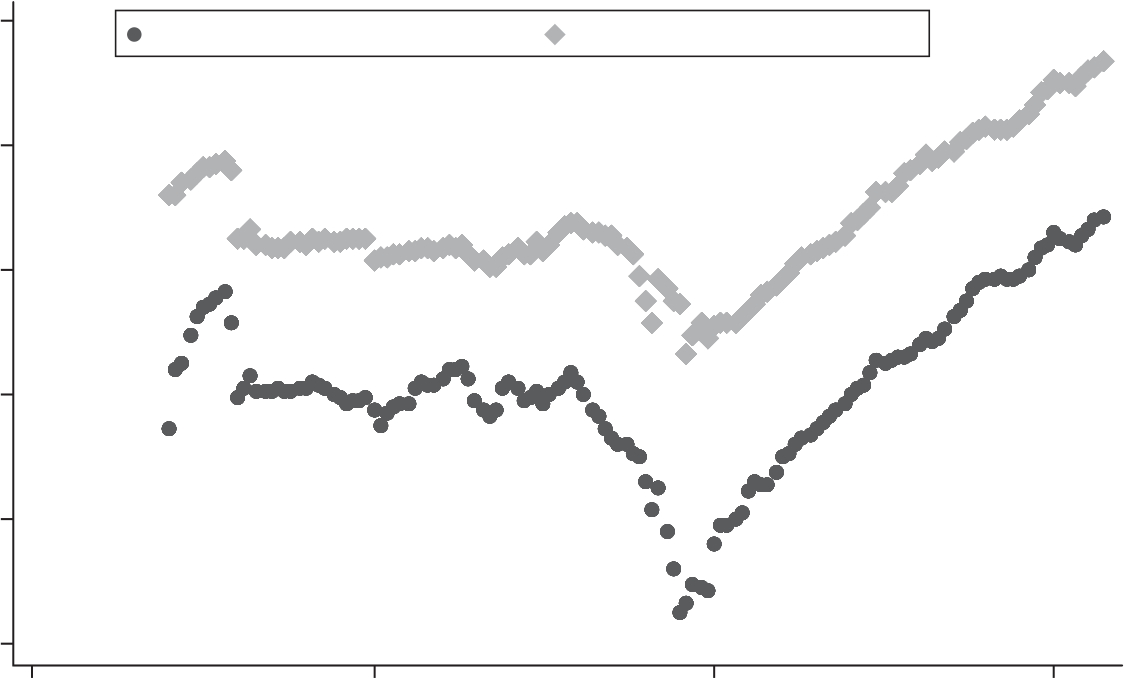

Figure 4. Aggregates (postcrisis periods Relative to Normal)

growth of the monetary base, prevented collapse of broad money, and thus kept bank lending at comparatively high levels. Only total bank assets now behave in a mean-ingfully different way after financial crises, as we will discuss in further detail below. Turning to real economic effects, shown in Figure 5, it becomes clear that the impact of financial crises was more muted in the postwar era in absolute numbers, but of comparable magnitude relative to trend. As mentioned before, this result holds up even when the Great Depression is excluded from the prewar event analysis. Measured by output declines, financial crises remain severe in the post-1945 period. The maximum decline in real investment activity was somewhat more pronounced before WW2, albeit with a sharp bounce back after four to five years.

| 1040 | ApRIl 2012 |

|---|

0.1

D log(Real GDP) D log(Real investment)

Figure 5. Real Variables (postcrisis periods Relative to Normal)

| 0.15 |

|---|

0

−0.05

loans 25 percent below trend. In the postwar period, however, narrow money growth did not slow down relative to trend, and the declines were a mere 8 percent (not sta-tistically significant) for broad money and 14 percent for bank loans.

|

1041 |

|---|

Note: Standard errors in parentheses.

*** Significant at the 1 percent level.

** Significant at the 5 percent level.

* Significant at the 10 percent level.Of course, a key institutional difference between the pre- and postwar environ-ments is the introduction of deposit insurance in many countries in response to the banking panics during the Great Depression. The effects are visible in our long-run data, which show the greater stability of narrow and broad monetary aggre-gates in financial crises in the postwar era. By contrast, total bank assets, which rely on uninsured sources of funding to a greater extent, have actually become more volatile in the postwar era. Turning next to the effect on the securities side of banks’ balance sheets, the signs of a changing response to crises are even stronger, with bank assets falling 26 percent below trend in the postwar period, versus 16 percent prewar. This confirms the modern findings by Adrian and Shin (2008), who show that the behavior of nonloan items on the balance sheets of financial institutions is particularly procyclical.

| 1042 | ApRIl 2012 |

|---|

V. Credit Booms and Financial Crises

In the previous sections we have documented the rise of credit and

discussed how activist monetary policy responses to crises could have

been a factor behind the uninterrupted growth of leverage in the postwar

financial system. We now look at the sources of recurrent financial

instability in modern economies. More specifi-cally, we want to know

whether the financial system itself creates economic instabil-ity

through endogenous lending booms. In other words, are financial crises

“credit booms gone wrong?”

By looking at the role of the credit system as a potential source of

financial insta-bility—and not merely as an amplifier of shocks, as the

financial accelerator theory has it—we implicitly also ask a different

question about the importance of credit in the conduct of monetary

policy. The precrisis New Keynesian consensus held that money and credit

have essentially no constructive role to play in monetary policy. Hence,

central bankers were to set interest rates in response to inflation and

the out-put gap, with no meaningful additional information coming from

credit or monetary aggregates. Yet even before the crisis of 2008–2009,

this view did not go unchal-lenged. A number of dissenters argued that

money and credit aggregates provided valuable information for

policymakers aiming for financial and economic stability.11

Our contribution to this literature is twofold. First, our sample consist of long-run data for 14 developed economies, in contrast to the focus of much of the recent literature on the experience of developing countries, where financial crises are often linked to currency instability or sovereign debt problems. A pure developed-country sample is also arguably less affected by the institutional weaknesses and credibility questions that emerging markets tend to face. Second, our focus is clearly on the long run. Our cross-country dataset spans 140 years of economic history. Moving beyond explorations of selected events and the experience of the past 30 or 40 years, our interest is in whether there is systematic evidence for credit growth–induced financial instability in history. If we can find such a link, then the argument for the credit boom-and-bust story will be strengthened. In this respect, our work follows in the footsteps of recent long-run comparative work by Reinhart and Rogoff (2009) and others. A key innovation here, however, is that our new dataset enables us to work with detailed financial and other macroeco-nomic data on an annual basis, including data (e.g., bank loans and assets) that have never been collected or explored in previous research. As a consequence, we can study the determinants and temporal dynamics of financial crises in consider-ably greater detail than before. In this respect, our work is more closely related to the analyses of lending booms focusing on recent decades (e.g., Gourinchas, Valdes, and Landerretche 2001). To test for this link, we propose to use a basic forecasting framework to ask a sim-ple question: does a country’s recent history of credit growth help predict a financial crisis, and is this robust to different specifications, samples, and control variables? Formally, we use our long-run annual data for 12 countries, and estimate a probabi-listic model of a financial crisis event in country i, in year t, as a function of a lagged information at year t, in one of two forms,

might dampen suboptimal business-cycle volatility (Christiano, Motto, and Rostagno 2007).

| 1044 | ApRIl 2012 |

|---|

We first present some simple variants of these models in Table 3. These results take the form of an estimate of the above equations with no additional controls, so that the term X is omitted. In this long and narrow panel there are 1,272 observations over 14 countries, with an average of about 91 observations per country. The depen-dent variable is a dummy equal to one when there is a financial crisis according to our definitions, and otherwise zero. Our crisis definitions are the same as detailed above.

To keep the lag structure reasonable, we consider up to five annual lags of any regressor.13 Model specification 1 presents an OLS Linear Probability model with simple pooled data. Model specification 2 adds country fixed effects to the OLS model, but these are not statistically significant (p = 0.75). Keeping country effects, model specification 3 then adds year effects to OLS, and these are highly statistically significant. What does this say? It implies that there is a common global time component driving financial crises—and, if you happen to know this effect ex ante, you can use it to dramatically enhance your ability to predict crises. This is not too surprising given the consensus view that financial crises have tended to happen in waves and often afflict multiple countries, but is also not of very much practical import for out-of-sample forecasting, since such time effects are not known ex ante. Thus, from now on, given our focus on prediction, we study only models without time effects.

| OLS | OLS | Logit | Country | ||

|---|---|---|---|---|---|

|

|

||||

|

|||||

|

|||||

|

14 | 14 | 14 | 14 | 14 |

|

0.425*** | 0.417*** | 0.443*** | 10.10*** | 9.697*** |

| 0.123 | 0.126 | 0.136 | 2.590 | 2.920 | |

| 4.061*** | 3.871*** | 4.328*** | 24.95*** | ||

| 0.00116 | 0.00174 | 0.000661 | 0.000143 | 0.00408 | |

| — | 0.71 | 0.84 | — | 7.67 | |

| — | 0.754 | 0.617 | — | 0.864 | |

| — | — | 4.15*** | — | — | |

| — | — | 0.0001 | — | — | |

|

0.016 | 0.023 | 0.290 |

|

|

| — | — | — | |||

| 4.061*** | 1.638* | 4.184*** | |||

| 0.0012 | 0.0445 | 0.00001 | 0.000143 | 0.00663 | |

|

0.673*** | 0.720*** | 0.952*** | 0.673*** | 0.717*** |

|

0.0357 | 0.0341 | 0.00865 | 0.0360 | 0.0349 |

| Notes: †Reported statistic is F for OLS, χ parentheses. Logit standard errors are robust. 2 for logit. ††Reported statistic is Pseudo R 2 for logit. Standard errors in | |||||

large and positive, confirming that when the second derivative of credit changes sign we can see that trouble is likely to follow (Biggs, Mayer, and Pick 2009). The sum of the lag coefficients is about ten, and also statistically significant. To interpret this we need to convert to marginal effects, where in column 5, at the means of all variables, the sum of the marginal effects over all lags is 0.301, similar to, albeit a little smaller than, the 0.40 estimate given by the OLS Linear Probability model noted above.

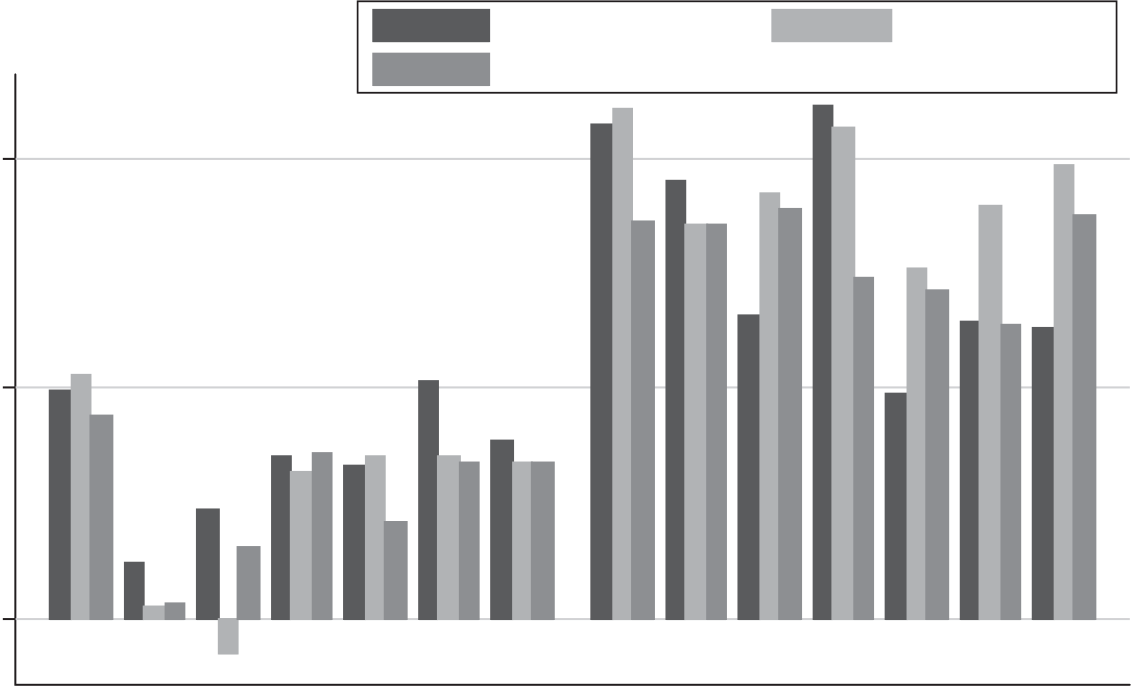

Finally, we note that in all its forms the model has predictive power, as judged by a standard tool used to evaluate binary classification ability, the Receiver Operating Characteristic (ROC) curve. This is shown in Figure 7 for our preferred baseline model. The curve plots the true positive rate Tp(c) against the false posi-tive rate Fp(c), for all thresholds c on the real line, where the binary classifier is I( p − c > 0), I(.) is the indicator function, and p is the linear prediction of the model which forms a continuous signal. When the threshold c gets large and nega-tive, the classifier is very aggressive in making crisis calls, almost all signals are above the threshold, and Tp and Fp converge to one; conversely, when c gets large and positive, the classifier is very conservative in making crisis calls, almost all signals are below the threshold, and Tp and Fp converge to zero. In between, an informative classifier should deliver Tp > Fp so the ROC curve should be above the 45-degree line of the null, uninformative (or “coin toss”) classifier. At this point, we would prefer not to take a stand on where the policymaker would place the cutoff value of the threshold. The utility computation depends on costs of different outcomes and the frequency of crises. For example, the cutoff should be more aggressive if the cost of an undiagnosed crisis is high, but less so if the cost of a false alarm is higher. If crises are rare, the threshold bar should also be raised to deflect too-frequent false alarms (see Pepe 2003). Fortunately, a test of predictive ability exists that is independent of the policymaker’s cutoff. This is the area under the ROC curve (AUROC). It is essentially a test of whether the distribution of the model’s signals are significantly different under crisis and non-crisis states, thus allowing them to use a basis for meaningfully classifying these outcomes. The AUROC provides a simple test against the null value of 0.5 with an asymptotic normal distribution, and for our baseline model AUROC = 0.717 with a standard error of just 0.0349. The model can therefore be judged to have predictive power versus a coin toss, although it is far from a perfect classifier, which would have AUROC = 1.14 All the above forecasts suffer from in-sample look-ahead bias, even though they use lagged data. To put our model to a sterner test, we limited the forecast sample to the post-1983 period only (350 country-year observations) and compared in-sam-ple and out-of-sample forecasts (the former based on full sample predictions, with look-ahead bias; the latter based on rolling regressions, using lagged data only). The in-sample forecast produced an even higher AUROC = 0.763 (s.e. = 0.0635), but the out-of-sample also proved informative, with an AUROC = 0.646 (s.e. = 0.0695), with the latter having statistical significance at better than the 5 percent level. We think any predictive power is impressive at this stage given the general

False positive rate

Specification 7 replaces real loans with real broad money, still deflated by CPI. The fit is still statistically significant, although slightly weaker judging from lower

|

ApRIl 2012 |

|---|

|

|

1049 |

|---|

*** Significant at the 1 percent level.

** Significant at the 5 percent level.

* Significant at the 10 percent level.

| 1050 | True positive rate | THE AMERICAN ECONOMIC REVIEW | ApRIl 2012 | ||||

|---|---|---|---|---|---|---|---|

|

|||||||

|

|||||||

| 0.25 | 0.50 | 1.00 | |||||

False positive rate

one model or the other was to be preferred in each period for its binary classifica-tion ability. Before WW2 (for N = 486 common observations), a test of equality in AUROCs between the credit and money models passed easily ( p = 0.37); the ROC curves are very close to each other and almost overlapping; and both models attain a maximum height above the diagonal that is significantly different from zero. After WW2 (for N = 700 common observations), the money model ROC curve is below the credit model ROC curve at almost all points, except at a few points close policymaker; the two AUROCs are different, with a p-value of 0.237. We also find that to the (0, 0) and (1, 1) points, where operation is unlikely to be optimal for the of the four ROCs in Figure 8, only the post-WW2 money model fails the Kolmogorov-Smirnov test, so its maximal height above the diagonal (Tp minus Fp) is not statisti-cally different from zero at conventional levels, which is also highly discouraging.

How do we interpret these results? The findings mesh well with our overall under-standing of the dramatic changes in money and credit dynamics after the Great Depression. In the summary data for the pre-WW2 sample, we saw how broad money and credit moved hand in hand, so that a Friedman “money view” of the financial system, focusing on the liability side of banks’ balance sheets, was an adequate simplification. After WW2 this was no longer the case, and credit was delinked from broad money aggregates, which would beg the question as to which was the more important aggregate in driving macroeconomic outcomes. At least with respect to crises, the results of our analysis are clear: credit matters, not money.

|

|

ApRIl 2012 |

|---|

| VOl. 102 NO. 2 | 1053 |

|---|

the two variables also had virtually no impact on the fit or the predictive power of the model.17 In brief, when it comes to investment finance versus consumption finance, we could not find any conclusive evidence that the nature of the credit boom made any difference. If this is the case, then the suspicion arises that when banks originate lending, they may be almost equally incapable of assessing repayment capacity in all cases, with investment loans having no special virtues.

Summing up the results from Table 6, we conjecture that, although some of the auxiliary control variables may matter in some contexts—perhaps in other samples that include emerging markets—for the developed economies these other factors are not the main signal of financial instability problems. Rather, the key indicator of a problem is an excessive credit boom. Indeed, the sum of the lag loan coefficients (or their marginal effects) is even higher in Table 6 columns 15–19 than in the baseline specification (6), so credit effects are amplified here, rather than being diminished by the added controls; and the pseudo- R2 values range between 0.0765 and 0.123, compared to the 0.0659 value in the baseline case, showing that the greater fraction of the model’s fit is always due to the credit terms.

prices into our regression yields strong predictive signals, this

would be evidence that stock price booms per se pose financial stability

risks. Later on, we will also use interaction terms to test whether the

financial risks emanating from stock price booms depend on credit levels

or the pace of credit creation. To create the database of long-run stock

prices in the 14 countries in our sample we started with standard

sources (e.g., Global Financial Data), and then, thanks to the help of a

number of colleagues, we were able to extend our dataset and include

extended time series of historical equity-market indices for France,

Italy, the Netherlands, and Sweden that have become available in recent

years.18

The results are shown in Table 7. In specification 20 we add 5 lags of

changes in nominal stock prices to our baseline, and in regression 21 we

add changes in real (CPI-deflated) stock prices. The overall results of

these additive models are mixed. The lags of nominal stock prices are

insignificant, but reach significance at the five percent level in the

case of real prices. The predictive ability of the model as measured by

the AUROC rises slightly from 0.717 to 0.731. The pseudo- R2

remains in 0.09 range, demonstrating that the greatest fraction of the

fit of the model still comes from the credit terms which remain highly

significant in all specifications. While asset prices contain some

additional information about the likelihood of future crises, their

overall contribution is relatively small. From a policy perspec-tive,

the key variable to watch is credit.

|

1055 |

|---|

Table 7—Credit, Asset Prices, and Financial Development

|

ApRIl 2012 |

|---|

Table 8—Credit, Asset Prices, and Financial Development—Interactions

| VOl. 102 NO. 2 |

|

1057 |

|---|

others that it is the unwinding of leverage-driven asset bubbles that puts financial stability most at risk, posing a serious challenge for central banks.

asset price booms and busts, our empirical analysis demonstrated that stock mar-ket booms become more problematic with larger financial sectors. At early stages of financial development, run-ups in equity markets are much less dangerous. Second, in light of 140 years of financial crises, the evidence suggests that larger financial sectors are more crisis-prone. While the underlying causes remain in the dark—possibly fragility effects of growing complexity, increased moral hazard in more financialized economies, or lax regulation as a result of both a larger finan-cial system and frequent financial crises—this empirical finding deserves further dedicated research.

In terms of lessons for policymakers and researchers, history demonstrates that they ignore credit at their peril. Credit aggregates contain valuable information about

|

1059 |

|---|

“From Great Depression to Great Credit Crisis: Similarities, Differences and Lessons.” Economic policy 62: 219–52, 259–65.

Adrian, Tobias, and Hyun Song Shin. 2008. “Liquidity and Financial Cycles.” Bank for International Settlements Working Paper 256.

Bernanke, Ben S., and Mark

Gertler. 1995. “Inside the Black Box: The Credit Channel of

Monetary Transmission.” American Economic Review 82(4):

901–21.

Bernanke, Ben S., and Mark

Gertler. 1995. “Inside the Black Box: The Credit Channel of

Monetary Transmission.” American Economic Review 82(4):

901–21.

Bernanke, Ben S., and Mark

Gertler. 2001. “Should Central Banks Respond to Movements in

Asset Policy Transmission.” Journal of Economic perspectives

9(4): 27–48.

Bernanke, Ben S., and Mark

Gertler. 2001. “Should Central Banks Respond to Movements in

Asset Policy Transmission.” Journal of Economic perspectives

9(4): 27–48.

“Is the Crisis Problem Growing More Severe?” Economic policy: A European Forum 32: 51–75. Borio, Claudio. 2008. “The Financial Turmoil of 2007–?: A Preliminary Assessment and Some Policy Considerations.” Bank for International Settlements Working Paper 251.

Borio, Claudio, and Philip Lowe. 2002. “Asset Prices, Financial and Monetary Stability: Exploring the Nexus.” Bank for International Settlements Working Paper 114.

Cecchetti, Stephen G., Marion Kohler, and Christian Upper. 2009. “Financial Crises and Economic Activity.” National Bureau of Economic Research Working Paper 15379.

Chari, V. V., Lawrence J. Christiano, and Patrick J. Kehoe. 2008. “Facts and Myths about the Financial Crisis of 2008.” Federal Reserve Bank of Minneapolis Working Paper 666.

Eckstein, Otto, and Allen Sinai. 1986. “The Mechanisms of the Business Cycle in the Postwar Era.” In oping and Developed Countries.”International Monetary Fund staff papers 45(1): 81–109.

The American Business Cycle: Continuity and Change, edited by Robert J. Gordon, 39–105. Chi-cago: University of Chicago Press.

Fisher, Irving. 1933.

“The Debt-Deflation Theory of Great Depressions.” Econometrica

1(4): 337–57. Freixas, Xavier, and Jean-Charles Rochet.

1997. Microeconomics of Banking. Cambridge, MA: MIT Press.

Fisher, Irving. 1933.

“The Debt-Deflation Theory of Great Depressions.” Econometrica

1(4): 337–57. Freixas, Xavier, and Jean-Charles Rochet.

1997. Microeconomics of Banking. Cambridge, MA: MIT Press.

Friedman, Benjamin M., and Kenneth N. Kuttner. 1992. “Money, Income, Prices, and Interest Rates.”

Goldsmith, Raymond W. 1969. Financial structure and development. New Haven, CT: Yale Univer-of Money, Credit, and Banking 20(3): 559–88.

sity Press.

Hume, Michael, and Andrew Sentance. 2009. “The Global Credit Boom: Challenges for Macroeco- nomics and Policy.” Bank of England External MPC Unit Discussion Paper 27.

Jermann, Urban, and Vincenzo Quadrini. 2009. “Macroeconomic Effects of Financial Shocks.” National Bureau of Economic Research Working Paper 15338.

Kaufman, Henry. 1986. “Debt: The Threat to Economic and Financial Stability.” In debt, Finan-cial stability, and public policy, edited by Stephen H. Axilrod et al., 15–26. Kansas City: Federal Reserve Bank of Kansas City.

Kindleberger, Charles P. 1978. Manias, panics, and Crashes: A History of Financial Crises. New York: Basic Books.

Laeven, Luc, and Fabian Valencia. 2008. “Systemic Banking Crises: A New Database.” International

McKinnon, Ronald I. 1973. Money and Capital in Economic development. Washington, DC: Brook-Monetary Fund Working Paper 08/224.

Mishkin, Frederic S.

1978. “The Household Balance Sheet and the Great Depression.”

Journal of Eco-Alternative to ‘Standard’ Theory.” Nebraska

Journal of Economics and Business 16(1): 5–16.

Mishkin, Frederic S.

1978. “The Household Balance Sheet and the Great Depression.”

Journal of Eco-Alternative to ‘Standard’ Theory.” Nebraska

Journal of Economics and Business 16(1): 5–16.

Mishkin, Frederic S. 2008. “How Should We Respond to Asset Price Bubbles?” Financial stability nomic History 38(4): 918–37.

Oxford: Oxford University Press.

Rajan, Raghuram G. 2005. “Has Financial Development Made the World Riskier?” proceedings of the Federal Reserve Bank of kansas City 2005: 313–69.

Schularick, Moritz, and Alan

M. Taylor. 2012. “Credit Booms Gone Bust: Monetary P30(4):

657–78.

Schularick, Moritz, and Alan

M. Taylor. 2012. “Credit Booms Gone Bust: Monetary P30(4):

657–78.

rises, 1870–2008: Dataset.” American Economic Review. .

This article has been cited by:

1. Anjan Thakor. 2015. Lending Booms, Smart Bankers, and Financial Crises. American Economic Review105:5, 305-309. [] [] []

6. Serena Ng, Jonathan H. Wright. 2013. Facts and Challenges from the Great Recession for Forecasting and Macroeconomic Modeling. Journal of Economic Literature51:4, 1120-1154. [] [] []

7. Kevin H. O'Rourke,, Alan M. Taylor. 2013. Cross of Euros. Journal of Economic Perspectives27:3, 167-192. [] [] []