Reduce the tax payable the income and capital gains earned assets

PERSONAL FINANCIAL PLANNING (FIN533)

TABLE OF CONTENTS

First of all, I would like to express my deepest appreciation to all those who provided me the possibility to complete this individual assignment. A special gratitude I give to Madam Siti Aminah Hj Mainal, my lecturer of Personal Financial Planning (FIN533), for giving me a good guideline for advice, guidance, encouragement for this assignment.

Furthermore, I would also like to acknowledge with much appreciation to En Ahnaf and family, who gave the permission to use all required information related to the financial planning to complete the task of my individual assignment “Family Financial Planning” as the completion of this assignment gave me much pleasure.

BIODATA OF THE FAMILY

and children, except for their third daughter Nur Athirah which is she stay at her college and just be at home during weekend only. They stay at that house for almost 15 years after En Ahnaf’s bought it for his family.

|

|---|

|

|---|

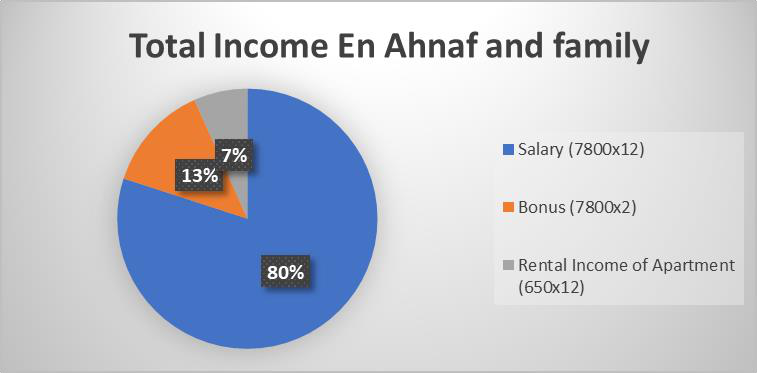

FINANCIAL INFORMATION

7

|

|

|

|

|

|

|

|

|

|

8

MONTHLY EXPENSES

BALANCE SHEET STATEMENT

10

Total

Assets

RM 783,900

11

|

|---|

| 350,000 | 76,100 | |

|---|---|---|

| 70,000 | 11,415 | |

|

280,000 | 64,685 |

|

4.25% | 3% |

| 35 years/ 420 months | 9 years/ 108 months | |

| 696,500 | 17.465 | |

| 19,900 | 9,128 | |

| 20 years | 5 years | |

|

398,000 | 45,639 |

12

13

|

|

|---|

| Level of Debt | ||

|---|---|---|

| i. | Debt ratio | |

Insurance planning is one of the parts and parcel of today’s life. As En Ahnaf build his wealth, it is important to protect his assets against any unforeseen events while not as direct a way of saving as investing. Insurance planning can save significant amounts of money over the long-term. Currently, the insurance planning has been carried by En Ahnaf and family are medical insurance for spouse and children

18

process of estimating and other needs and determining how these needs can be met if En Ahnaf no longer working. It is beneficial to those who are working that rely on pensions, gratuity, and any other employer-sponsored retirement plans during retirement. En Ahnaf who is working on the public sector in which fully depending on Employees Provident Fund (EPF) contributed 11% every month from his gross salary for future retirement. Regarding the outflows, he contributed RM10,296 annually for EPF. It is actually not enough for En Ahnaf to cover the debt and other expenditures after his retirement due to his commitments. In the future, En Ahnaf wants to retire early, but he is not sure when he can do so. He wants it at the age of 55 but can take it up to the age of 60 to adjust with his financials. Moreover, En Ahnaf should invest in Private Retirement Scheme (PRS) and it can declare tax relief not exceed RM3,000. Due to recently, the EPF revised its target minimum savings (the recommended amount to have in your EPF at the age of 55 to see you through 20 years of retirement) from RM196, 800 to RM228, 000 (Group, 2020). En Ahnaf’s as an active contribution to EPF alone may not be sufficient for achieving his retirement goal. In the PRS, each provider must choose out of three core funds as a default option. The most suitable for En Ahnaf is moderate funds because of the focus on growing the portfolio whilst seeking income. Even more, the range of age from 45 until 54 years old (PRS, 2020).