Remove the cost the disposed asset from the balance sheet asset account

Reporting and Analyzing Long-Term Operating

Assets

|

2 |

|---|

Two common characteristics:

Acquired for the purpose of producing and delivering

| 4 |

|---|

Tangible Assets

Have physical substance

Usually include land, buildings, machinery, fixtures and equipmentIntangible Assets

Have no physical substance

Provide the owner with specific rights and privileges Include trademarks, patents, copyrights

| Jan. 31, 2019 |

|

|---|

Property and equipment:

| $12,760 | ||

|---|---|---|

| (5,682) |

|

|

|

$7,078 |

Determine which costs to

capitalize and report as assets and which costs to expense.

©2020 Cambridge Business Publishers

Characteristics that expenditures must possess to be capitalized:

1. The asset must be owned or controlled by the company.

Constructed Assets

When assets are constructed by a company for its own use, capitalized costs should include:

| 10 |

|---|

Improvement or betterment

Consist of outlays that enhance the usefulness of the asset or extend the asset’s useful life beyond the original expectation Costs should be capitalized Routine repairs and maintenance Expensed in the period incurred

|

|---|

| 1) |

|---|

| Balance Sheet | Income Statement | |||||

|---|---|---|---|---|---|---|

|

||||||

|

| (1) |

|

|

13 |

|---|

|

|||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

14 |

|---|

Plant Assets on the Balance Sheet

|

|

|

Apply different depreciation

methods to allocate the cost of assets over time.

Residual Value

The expected realizable value of the asset at the end of its useful life

Also known as salvage value

Can represent the scrap, disposal, or resale value©2020 Cambridge Business Publishers 17

Equal expense each year

Double-declining-balance method

©2020 Cambridge Business Publishers 18

Straight-Line Depreciation—Example

Depreciation expense = Depreciation base x

Double-Declining-Balance Depreciation—Example

Tanner Enterprises purchased a delivery truck for $80,000, and

Comparing Depreciation Methods Because double-declining-balance is an

accelerated method, the

expense in the early years’ of life is larger than in its latter

| Year | at End of Year | Depreciation Expense |

|

|

| 1 | $14,400 | $65,600 | $32,000 |

|

| 2 | 14,400 | 51,200 | 19,200 | |

| 3 | 14,400 | 36,800 | 11,520 | |

| 4 | 14,400 | 22,400 | 6,912 | |

| 5 | 14,400 | 8,000 | 2,368 | 8,000 |

|

|

|||

methods.

Depreciation expense = Actual units of service x

Changes in Accounting Estimates

Estimates of useful lives and residual value are made when assets

are acquired

When necessary, companies can change estimates Changes are applied

prospectively

i.e., only to future accounting periods

Tanner Enterprises decided to extend the useful life of the truck from 5 to 7 years after completing 4 years of service. Straight-line depreciation is used. (Note that the residual value estimate does not change.)

Step 1:Determine the book value at the date of estimate change.

|

|

|---|

©2020 Cambridge Business Publishers

Gains and Losses on Asset Sales

|

|||

|

26 |

|

27 |

|---|

3. Record the proceeds as an increase in cash (i.e., debit the cash account).

4. Record the gain (credit) or a loss (debit) on the income statement.

| 3) |

|---|

| (3) | 25,000 | 29 | ||

|---|---|---|---|---|

| (3) | 57,600 | |||

|

80,000 | |||

|

2,600 | |||

| Cash (A) | ||||

| Truck (A) | ||||

| 80,000 |

|

2,600 (3) | ||

| ©2020 Cambridge Business Publishers | ||||

Asset Impairments

Impairment Analysis of Long-Term Assets

| 31 |

|---|

Recording an Asset Impairment

The impairment write-down reduces assets by the amount of the write-down and a loss is recognized on the income statement.

Analysis of asset write-downs present two potential challenges:

Insufficient Write-Down

| 33 |

|---|

IFRS Reporting Insight

A Single-step process is used.

©2020 Cambridge Business Publishers 34

Walmart’s Footnote Disclosure

| Depreciation | 35 | |

|---|---|---|

| Method | ||

|

PPE Turnover (PPET)

Measures how efficient management utilized its plant

Applying the PPE Turnover ratio to Procter & Gamble:

|

|---|

Comparison of PPE Turnover PPE Turnover at P&G and a Competitor:

|

37 |

|---|

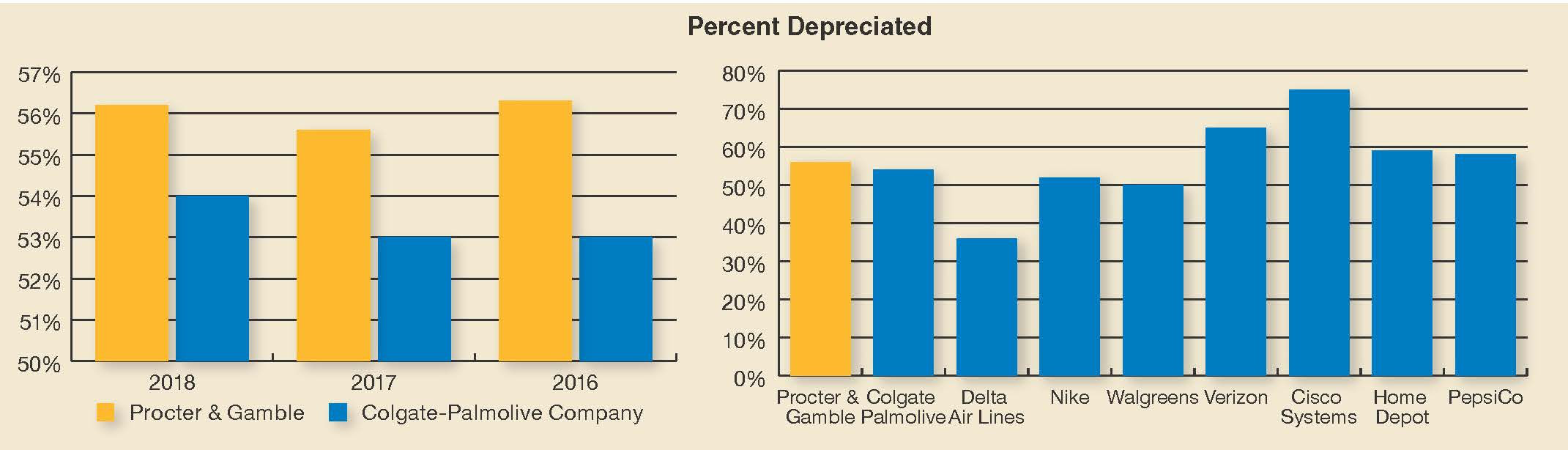

Percent Depreciated

Measures the percent of a company’s operating

assets that have been depreciated.

| Percent | ||

|---|---|---|

|

||

| Cost of depreciable Applying the Percent Depreciated ratio to P&G: asset* | ||

2016: $20,481 / $36,391 = 56.3%

Percent Depreciated

Percent Depreciated for Procter & Gamble and a

|

|||||

|---|---|---|---|---|---|

©2020 Cambridge Business Publishers 40

Percent Depreciated

Percent Depreciated for companies in different

Cash Flow Effects

Acquisition of plant or equipment

Reported as a use of cash in the investment section of the statement of cash flows

Cash received from asset sales

Reported as a source of cash in the investment section of the statement of cash flows

| Jan. 31, 2019 | |

|---|---|

|

|

©2020 Cambridge Business Publishers

Intangible Assets

|

|

|---|

©2020 Cambridge Business Publishers 44

Accounting for Intangible Assets

Benefits provided by intangibles are uncertain and difficult to quantify

Useful life often impossible to estimate with confidence

Accounting for costs of patents

If purchased from another company

Capitalized and amortized

If developed internally

Only legal costs and registration fees are capitalized and amortized

Can be acquired

Cost is capitalized and amortized over the expected remaining economic life

| 47 |

|---|

slogan that is associated with a product

Accounting for costs of trademarks

The NIKE Trademark

®

What is a franchise right?

A contractual agreement that gives the right to operate a

*Source: http://www.thefranchisemall.com/franchises/details/11138-0-moes_southwest_grill.htm

Straight-line method used most often

Amortization expense reported on the income statement as part of operating income

| 1) |

|---|

the year to purchase a patent. The patent has a remaining

legal life of 10 years, but the management at Moe’s believe

|

||||||

|---|---|---|---|---|---|---|

| 2) |

|---|

the year to purchase a patent. The patent has a remaining

legal life of 10 years, but the management at Moe’s believe

| (2) | 16,000 | 53 | |

|---|---|---|---|

| (2) | 16,000 | ||

|

|||

|

16,000(2) | ||

| ©2020 Cambridge Business Publishers | |||

Considered to be impaired if the book value of the asset exceeds its fair value

Write-down equal to:

Management determined the trademark’s fair value was $40,000 and its book value was $62,000.

$80,000 ÷ 5 years = $16,000

|

|||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Goodwill

|

Purchase of | |

|---|---|---|

|

||

| Company A |

Subject to impairment of value

©2020 Cambridge Business Publishers 56

| Learning Objective | 6 |

|---|

Analysis Implications

Hidden assets

Makes comparison of companies difficult for users

Publishers

www.cambridgepub.com