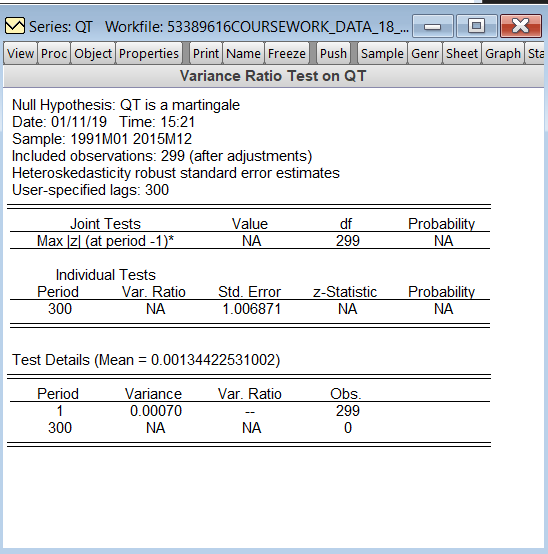

Test the hypothesis purchasing power parity ahs given estimate the equation

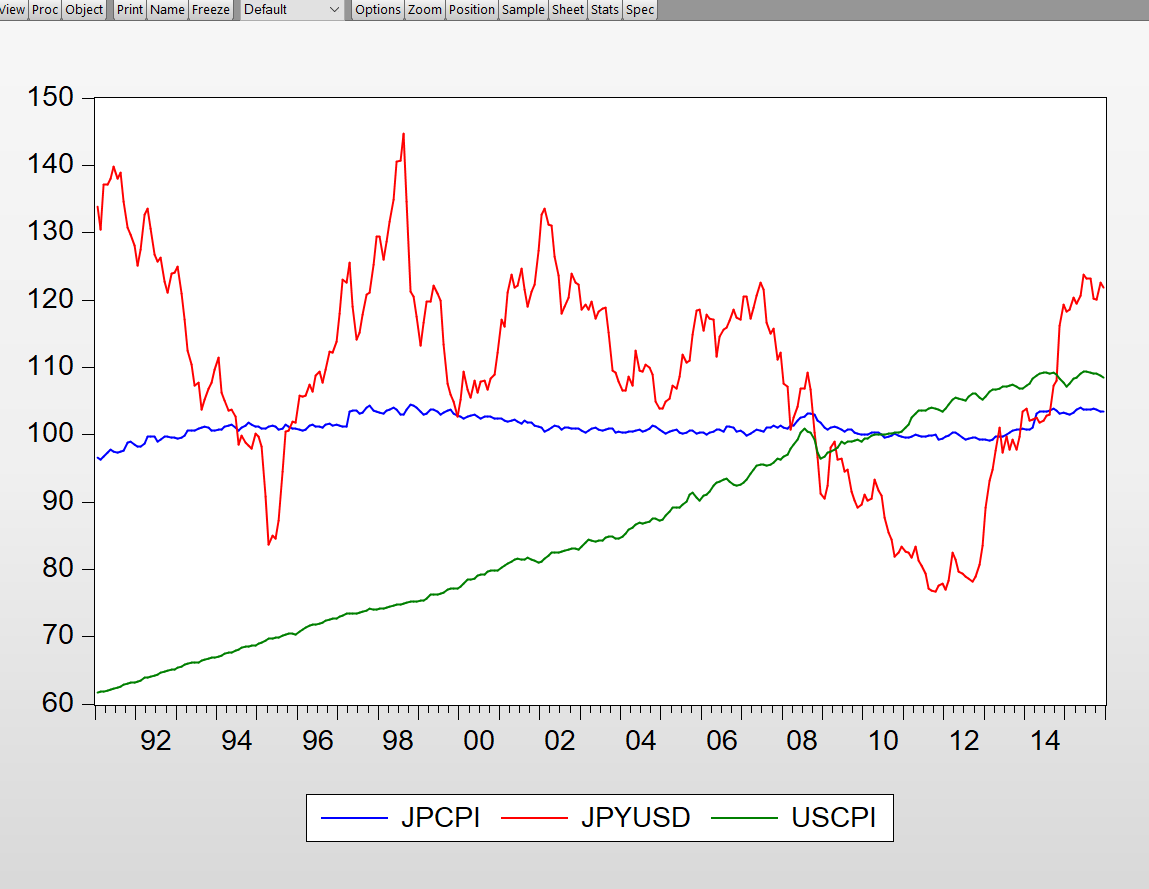

From the above graph it is clear JPCPI is stable but USCPI is progressive.

ptstar = log(uscpi)

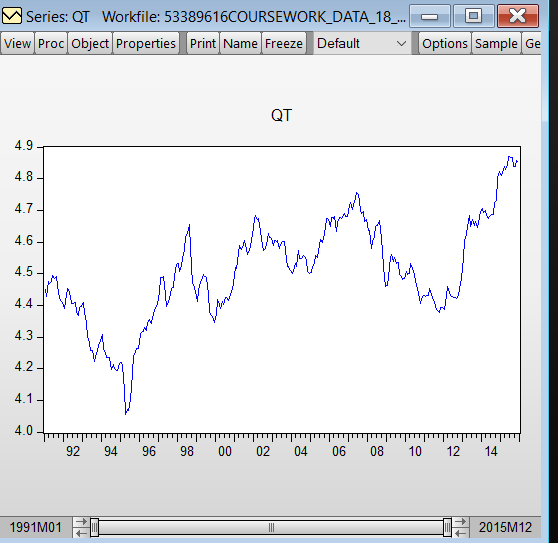

qt = st + ptstar – pt

qt has increasing nature.

d) The purchasing power parity exchange rate is the rate between the two currencies as it is given in our case between the US currencies and japan currencies. In this case it would equate the two relevant national price levels if expressed in the common currency at that rate. Due to this the purchasing power of a unit of one currency would be the same in both economies. If the nominal exchange rate is defined simply as the price of one currency in terms of another, then the real exchange rate is the nominal exchange rate adjusted for relative national level differences. The central critique of the PPP hypothesis stems from this observation that the nominal exchange rate does not move in line with movements in the aggregate price ratios between countries. one source of this failure might be at the micro-level, due to persistent deviations from the law of one price from its different averages. The order of integration of the real exchange rate and its different averages.

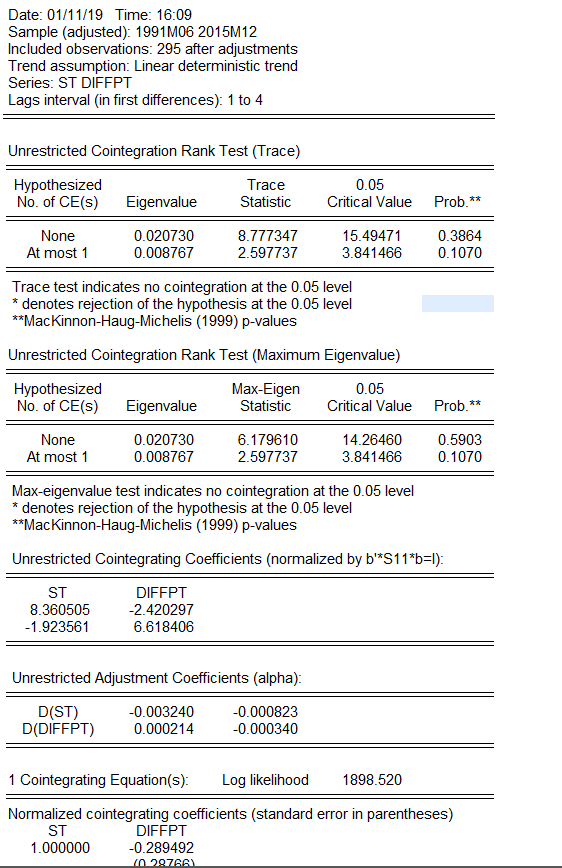

g) A vector error correction (VEC) model is a restricted VAR designed for use with nonstationary series that are known to be cointegrated. You may test for cointegration using an estimated VAR object, Equation object estimated using nonstationary regression methods, or using a Group object.