The futures trade and the bid and offer move and

1.5 minutes per question for a total of 180 minutes (3 hours) for this session of the exam.

1.Bailey Watson, CFA manages 25 emerging market pension funds. He recently had the

opportunity to buy 100,000 shares in a publicly listed company whose prospects are considered “above industry norm” by most analysts. The company’s shares rarely trade because most managers take a “buy and hold” strategy because of the company’s small free float. Before placing the order with his dealer, Watson allocated the shares to be purchased according to the weighted value of each of his clients’ portfolios. When it came time to execute the trades, the dealer was only able to purchase 50,000 shares. To prevent violating Standard III (B) Fair Dealing, it would be most appropriate for Watson to reallocate the 50,000 shares purchased by:A. reducing each pension fund’s allocation proportionately.

A is correct because Standard III (B) Fair Dealing requires members and candidates to deal fairly and objectively with all clients. Certain clients cannot be favored over other clients when their investment objectives and circumstances are similar. Therefore, the most appropriate way to handle the reallocation of an illiquid share is to reduce each client’s proportion on a pro rata, or weighted basis.

2.Dilshan Kumar, CFA, is a world-renowned mining analyst based in London. Recently, he received an invitation from Cerberus Mining, a London Stock Exchange listed company with headquarters in Johannesburg, South Africa. Cerberus asked Kumar to join a group of prominent analysts from around the world on a tour of its mines in South Africa, some of which are in remote locations, not easily accessible. The invitation also includes an arranged wildlife safari to Krueger National Park for the analysts. Kumar accepts the invitation, planning to visit other mining companies he covers in Namibia and Botswana after the safari. To prevent violating any CFA Institute Standards of Professional Conduct, it is most appropriate for Kumar to only accept which type of paid travel arrangements from Cerberus?

C is correct because Standard I (B) Independence and Objectivity requires members and candidates to use reasonable care and judgment to maintain their independence and objectivity in their professional activities. Best practice dictates that Kumar only accept transportation to the remote mining sites in that it is unlikely he would be able to source commercial flights to the locations and ground transport may not be viable. Because Kumar would normally visit mining sites around the world as part of his job and because he is combining this trip with trip to other mine sites in different countries, it would be inappropriate for Cerberus to pay for the analyst’s travel expenses from London. Although Kumar could go on safari with the group of analysts, he should pay his own way so as to restrict any influence such a gift could possibly have when making his investment recommendations on Cerberus.

3.Abdul Naib, CFA, was recently asked by his employer to submit an updated document providing the history of his employment and qualifications. The existing document on file was submitted when he was hired five years ago. His employer notices the updated version shows Naib obtained his Master of Business Administration (MBA) degree two years ago, whereas the earlier version indicated he had already obtained his MBA. Because the position Naib was hired for had a minimum qualification of an MBA, Naib is asked to explain the discrepancy. He justifies his actions by stating: “I knew you wouldn’t hire me if I didn’t have an MBA degree, but I already had my CFA designation. Knowing you required an MBA, I went back to school on a part-time basis after I was hired to obtain it. I graduated at the top of my class, but this shouldn’t come as any surprise, as you have seen evidence I passed all of my CFA exams on the first attempt.” Did Naib most likely violate the CFA Institute Standards of Professional Conduct?

【梦轩考资www.mxkaozi.com】 QQ106454842 专业提供CFA FRM全程高清视频+讲义

the CFA Designation, and the CFA Program if it is factual. There is no evidence given to indicate he did not pass as claimed.

C is correct because Standard III (A) Loyalty, Prudence and Care stipulates that the client owns the brokerage. Therefore members and candidates are required to only use client brokerage to the benefit of the clients (soft commissions policy). Because the firm specializes in domestic equity, an offshore investment database service would not benefit clients.

5.Elbie Botha, CFA, an equity research analyst at an investment bank, disagrees with her research team’s buy recommendation for a particular company’s rights issue. She acknowledges the recommendation is based on a well-developed process and extensive research but feels the valuation is overpriced based on her assumptions. Despite her contrarian view, her name is included on the research report to be distributed to all of the investment bank’s clients. To avoid violating any CFA Institute standards, it would be least appropriate for Botha to undertake which of the following?

Distinguish between conduct that conforms to the Code and Standards and conduct that violates the Code and Standards.

C is correct because Standard IV (A) calls for employees to be loyal to their employer by not causing harm. If Botha released a contradictory research recommendation report to clients, it could possibly cause confusion amongst clients and embarrassment to the firm.

B is correct because Standard VI (B) Priority of Transactions dictates members and candidates give their clients and employer priority when making personal investment transactions. Even when clients allow or insist the manager invest alongside them, the manager’s transactions must never adversely affect the interests of the clients. A popular or “hot” IPO in a frontier market is likely to be oversubscribed. In such cases, Standard VI (B) dictates the manager should not participate in this event to better ensure clients will have a higher probability of getting their full subscription allotment, even though clients have allowed or dictated that she participate alongside them.

7.Christina Ng, a Level I CFA candidate, defaulted on a bank loan she obtained to pay for her Master’s degree tuition when her wedding cost more than expected. A micro finance loan company lent her money to pay off the tuition loan in full, including penalties and interest. The micro finance loan company even extended further credit to pay for her parents’ outstanding medical bills. Unfortunately, her parents’ health problems escalated to the point where Ng had to take extensive time away from work to deal with the issues. She was subsequently fired and consequently defaulted on the second loan. Because she was no longer employed, Ng decided to file for personal bankruptcy. Do the loan defaults leading up to Ng’s bankruptcy most likely violate Standard I (D) Misconduct?

“Guidance for Standards I–VII,” CFA Institute

2013 Modular Level I, Vol. 1, Reading 2, Standard I (D) Misconduct

Study Session 1–2–a

Demonstrate the application of the Code of Ethics and Standards of Professional Conduct to situations involving issues of professional integrity.A is correct because although Ng’s first loan default, which played a part in the subsequent bankruptcy, is a result of poor financial choices (i.e. paying for higher wedding costs rather than her tuition loan), neither of the loan defaults or the bankruptcy involves fraudulent or deceitful business conduct but are based on unfortunate personal circumstances. Therefore, she would most likely not be in violation of Standard I (D) Misconduct.

“Guidance for Standards I–VII,” CFA Institute

2013 Modular Level I, Vol. 1, Reading 2, Standard I (A) Knowledge of the Law, Standard I (B) Independence and Objectivity, Standard III (C) Suitability

Study Session 1–2–c

Recommend practices and procedures designed to prevent violations of the Code of Ethics and Standards of Professional Conduct.C is correct because there is no indication Mbuwanga’s recommendation is based on any compensation package based on sales targets as being part of the sales team. If he had a sales target as part of his responsibility to promote the new product, it could be conceived that his independence and objectively was in question. Mbuwanga does, however, seem to be in violation of Standard III (C) Suitability in that, although research with regard to correlation was undertaken, an analysis based on each individual client’s return and risk objectives was not

Answer = B

“Guidance for Standards I–VII,” CFA Institute

2013 Modular Level I, Vol. 1, Reading 2, Standard I (A) Knowledge of the Law

Study Session 1–2–c

Recommend practices and procedures designed to prevent violations of the Code of Ethics and Standards of Professional Conduct.B. asset management clients first.

C. newsletter recipients and asset management clients simultaneously.

11.Danielle Deschutes, CFA, is a portfolio manager who is part of a 10-person team that manages equity portfolios for institutional clients. A competing firm, South West Managers, asks Deschutes to interview for a position within its firm and to bring her performance history to the interview. Deschutes receives written permission from her current employer to bring the performance history of the stock portfolio with her. At the interview, she discloses that the performance numbers represent the work of her team and describes the role of each member. To bolster her credibility, Deschutes also provides the names of institutional clients and related assets constituting the portfolio. During her interview Deschutes most likely violated the CFA Institute Standards of Professional Conduct with regards to:

A. the stock portfolio’s performance history.

B. her contribution to the portfolio’s returns.

C. providing details of the institutional clients.

【梦轩考资www.mxkaozi.com】 QQ106454842 专业提供CFA FRM全程高清视频+讲义

service or for managing the pooled fund. Younis’ investment returns attract interest from friends and co-workers who persuade him to include their assets in his investment pool. Younis recently retired from all board responsibilities and now spends more than 80% of his time managing the investment pool for which he charges non-family members a management fee.

A is correct because golf equipment is a business independent of the financial services industry such that any board obligations would not likely be considered a conflict of interest requiring disclosure according to Standard IV (B) Additional Compensation Arrangements. Standard IV (B) requires members and candidates to obtain permission from their employer before accepting compensation or other benefits from third parties for the services that might create a conflict with their employer’s interests. Managing investments for family and non-family members could likely create a conflict of interest for Younis’ employer and should be disclosed to his employer.

13.Kim Klausner, CFA, monitors several hundred employees as head of compliance for a large investment advisory firm. Klausner has always ensured that his company’s compliance program met or exceeded those of its competitors. Klausner, who is going on a long vacation, has delegated his supervisory responsibilities to Sue Chang. Klausner informs Chang that her responsibilities include detecting and preventing violations of any capital market rules and regulations, and the CFA Institute Code and Standards. Klausner least likely violated the CFA Institute Standards of Professional Conduct by failing to instruct Chang to also consider:

【梦轩考资www.mxkaozi.com】 QQ106454842 专业提供CFA FRM全程高清视频+讲义

Study Session 1–2–b

Distinguish between conduct that conforms to the Code and Standards and conduct that violates the Code and Standards.“Guidance for Standards I–VII,” CFA Institute

2013 Modular Level I, Vol. 1, Reading 2, Standard III (B) Fair Dealing, Standard V (A) Diligence and Reasonable Basis, Standard VI (B) Priority of Transactions

Study Session 1–2–b

Distinguish between conduct that conforms to the Code and Standards and conduct that violates the Code and Standards.A is correct because the analyst violated Standard III (B) Fair Dealing by selectively distributing the recommendation only to investment banking clients despite being responsible for making investment recommendations to all group clients. Schleif should distribute the change in recommendation to all clients who received the initial recommendation, not just those within the investment banking division of the group.

C. internal control procedures.

Answer = A

Answer = C

“Guidance for Standards I–VII,” CFA Institute

2013 Modular Level I, Vol. 1, Reading 2, Standard VI (C) Referral Fees

Study Session 1–2–c

Recommend practices and procedures designed to prevent violations of the Code of Ethics and Standards of Professional Conduct.

B. broad topic areas.

C. the examination essays.

Statement 2: The CFA designation is globally recognized which is why I use it as part of my firm’s name

Statement 3: CFA charterholders must satisfy membership requirements to continue using the designation.In explaining the use of the CFA designation, Haas least likely violated the CFA Institute Standards of Professional Conduct concerning which of the following statements?

C is correct because according to Standard VII (B) Reference to CFA Institute, the CFA

Designation, and the CFA Program this is an accurate statement concerning the CFA designation.

Questions 19 through 32 relate to Quantitative Methods

“The Time Value of Money,” Richard A. DeFusco, CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFA

2013 Modular Level I, Vol. 1, Reading 5, Section 3.3

Study Session 2–5–c, dCalculate and interpret the effective annual rate, given the stated annual interest rate and the frequency of compounding. Solve time value of money problems for different frequencies of compounding:

A.platykurtotic (less peaked than a normal distribution).

B.leptokurtotic (more peaked than a normal distribution).

B is correct. Most equity return series have been found to be leptokurtotic.

21.The following 10 observations are a sample drawn from an approximately normal population:

| Observation | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| Value | –3 | –11 | 3 | –18 | 18 | 20 | –6 | 9 | 2 | –16 |

C is correct. The sample mean is:

̅ ∑ / n = (– 3 – 11 + 3 – 18 + 18 + 20 – 6 + 9 + 2 –16) / 10 = –2.00 / 10 = –0.20.The sample variance is:

s2 = ∑ - ̅)2 /( n – 1).

Sum of squared

differences 1563.6

Divided by n –1 173.7333333

Square root 13.1807941122.Event X and event Y are independent events. The probability of X is 0.2 [P(X) = 0.2] and the probability of Y is 0.5 [P(Y) = 0.5]. The joint probability of X and Y [P(X, Y] is closest to:

23.Assume that a stock’s price over the next two periods is as shown below.

|

||

|---|---|---|

|

||

|

Sud,du = 79.2 | |

Answer = B

“Common Probability Distributions,” Richard A. DeFusco, CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFA

2013 Modular Level I, Vol. 1, Reading 9, Section 2.2, Figure 2

Study Session 3–9–, g

Calculate and interpret probabilities, given the discrete uniform and the binomial distribution functions.The probability of a down move followed by an up move is 0.25 × 0.75 also = 0.1875. Both of these sequences result in an end value of $79.2.

Therefore, the probability of an end value of $79.2 is (0.1875 + 0.1875) = 37.5%.

A is correct. When the null and alternative hypotheses are of the form: H0: θ = θ0 versus Ha: θ ≠θ0, the correct approach is to use a two-tailed test.

25.A stock is declining in price and reaches a price range wherein buying activity is sufficient to stop the decline. This is best described as a:

“Technical Analysis,” Barry M. Sine, CFA and Robert A. Strong, CFA

2013 Modular Level I, Vol. 1, Reading 12, Section 3.2

Study Session 3– 12– c

Explain the uses of trend, support, resistance lines, and change in polarity.A is correct Support level is defined to be “a low price range in which buying activity is sufficient to stop the decline in price.”

A. 0.4.

B. 0.6.

C. 0.8.Answer = C

Therefore, P(1 ≤ X ≤ 4) = 1.0 – 0.2 = 0.8.

27.A sample of 240 managed portfolios has a mean annual return of 0.11 and a standard deviation of returns of 0.23. Theestimateof the standard error of the sample mean is closest to:

C is correct.

|

||

|---|---|---|

| Here, | ||

and sample size greater than 30 is .

B is correct. The reliability factor for a 95% confidence interval with unknown population variance and sample size greater than 30 is .

The confidence interval estimate is (√ ).

C. possibility that the borrower will fail to make a promised payment at the contracted time and in the contracted amount.

Answer = A

|

||||

|---|---|---|---|---|

|

9.81 | 13.99 | ||

| 10.12 | 14.47 | |||

| 10.84 |

|

14.85 | ||

|

11.33 | 15.00 | ||

| 12.25 | 17.36 | |||

| 13.39 |

|

17.98 | ||

|

13.42 |

A is correct. First, find the position of the first quintile with the following formula:

Ly = (n + 1) × (y / 100),

where

y is the percentage point at which we are dividing the distribution. In our case we have y = 20, which corresponds to the 20th percentile (first quintile);

n is the number of observations (funds) in the peer group. In our case we have n = 13;L20 corresponds to the location of the 20th percentile (first quintile). L20 = (13 + 1) × (20/100) = 2.80.

A. 9.53%.

B. 11.91%.

C. 13.69%.Answer = A

| ∑ |

|---|

| Fund A | ||

|---|---|---|

| 70 | 30 | |

|

10 | 16 |

|

7 | 13 |

| 0.80 | ||

“Probability Concepts,” Richard A. DeFusco, CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFA

2013 Modular Level I, Vol. 1, Reading 8, Section 3

Study Session 2–8–k, l

Calculate and interpret covariance and correlation.Calculate and interpret the expected value, variance, and standard deviation of a random variable and of returns on a portfolio.

WA = 70%. This is the weight of Fund A in the portfolio WB = 30%. This is the weight of Fund B in the portfolio.

|

. |

|---|

“Demand and Supply Analysis: Introduction,” Richard V. Eastin and Gary L. Arbogast, CFA 2013 Modular Level I, Vol. 2, Reading 13, Section 3.2, Example 2.

Study Session 4–13–f

Calculate and interpret individual and aggregate demand, inverse demand and supply functions and interpret individual and aggregate demand and supply curves.

|

|

A. equal to 60.

B. less than 60.

C is correct. Because the consumer is indifferent between all three baskets, they must all fall on the same indifference curve. The MRSBA at Basket 2 is 4, meaning that the slope of the

|

|---|

Which of the following statements is most accurate? If the unit selling price is:

“Demand and Supply Analysis: The Firm,” Gary L. Arbogast, CFA and Richard V. Eastin

2013 Modular Level I, Vol. 2, Reading 15, Section 3.1.3, Example 6

Study Session 4–15–d, e, h

Calculate and interpret total, average, marginal, fixed, and variable costs. Determine and describe breakeven and shutdown points of production. Distinguish between short-run and long-run profit maximization.

|

|

|

|

|

|

36.The following data pertain to the total output in units and average selling prices in an economy that produces only two products, X and Y:

If the implicit price deflator for GDP in 2011 was 100, for 2012 it is closest to:

| Nominal GDP | Real GDP | |

|---|---|---|

|

|

|

|

||

A.An increase in aggregate real personal income (less transfer payments)

B.A decrease in average weekly initial claims for unemployment insurance

C.The narrowing of the spread between the 10-year Treasury yield and the federal funds rateAnswer = B

|

|

|---|

“Demand and Supply Analysis: Introduction,” Richard V. Eastin and Gary L. Arbogast, CFA 2013 Modular Level I, Vol. 2, Reading 13, Sections 3.9, 3.10

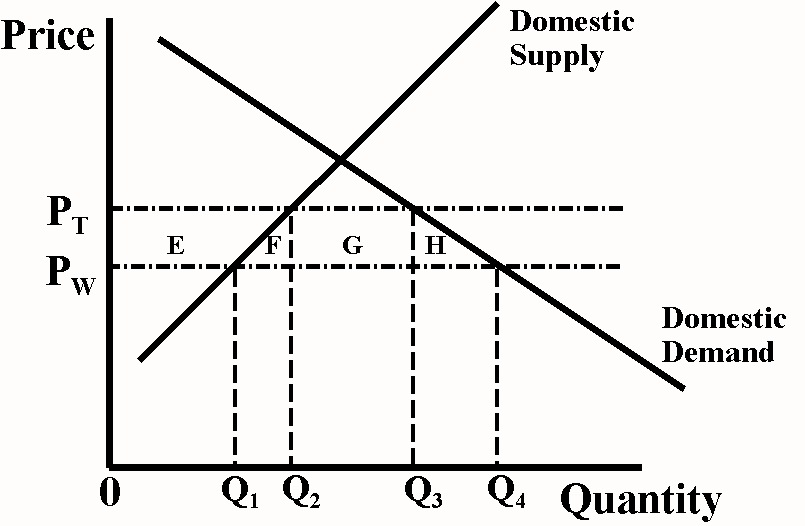

“International Trade and Capital Flows,” Usha Nair-Reichert, PhD and Daniel Robert Witschi, PhD, CFA

2013 Modular Level I, Vol. 2, Reading 20, Sections 3.1, Exhibit 12

Study Session 4–13–i, j, 6–20–e

Calculate and interpret consumer surplus, producer surplus, and total surplus.

Analyze the effects of government regulation and intervention on demand and supply.Compare types of trade and capital restrictions and their economic implications.

Answer = A

“International Trade and Capital Flows,” Usha Nair-Reichert, PhD and Daniel Robert Witschi, PhD, CFA

2013 Modular Level 1, Vol. 2, Reading 20, Section 5.2

Study Session 6–20–i

Describe functions and objectives of the international organizations that facilitate trade, including the World Bank, the International Monetary Fund, and the World Trade Organization (WTO).

If the investor shorts BRL500,000 he will achieve a risk-free arbitrage profit (in BRL) closest to:

A. –6,327.

B. 1,344.

C. 6,405.

| ) | ⁄( ) ( |

|---|

Sf/d = Spot rate: number of units of foreign currency (price currency) per one unit of domestic currency

Ff/d = Forward rate: number of units of foreign currency (price currency) per one unit of domestic currency

id = Domestic interest rate

if = Foreign interest rate

The arbitrage profit is the right side of the equation minus the left side.Left side of equation: BRL500,000 × (1 + 0.041) = BRL520,500. Right Side:

| Qd sp = 1,000 – 20Psp+ 2I; |

|---|

Qd sp = Quantity demanded in number of units

Qs sp = Quantity supplied in number of units

Psp = Price per smart phone in $

I = Household income in $ per year

W = Wage rate in $ per hourCurrently, the firm has priced the smartphone at $250 per unit. If the wage is $10 per hour and the household income is $9,500 per year, the smartphone’s equilibrium price is closest to:

1,000 – 20Psp+ 2(9,500) = –200 + 50Psp– 80(10)

– 20Psp – 50Psp = – 200 – 800 – 1,000 – 19,000

–70Psp = – 21,000; Psp = – 21,000/–70 = $300.42.A firm in a perfectly competitive environment has its total costs equal to total revenue and marginal costs greater than marginal revenue. Given this, which of the following strategies is most appropriate? The firm should:

C is correct. A firm in a perfectly competitive environment with total costs equal to total revenue and marginal costs greater than marginal revenue is operating at the upper breakeven point. Therefore, it should decrease the level of production to enter profit territory.

43.The following data are for a basket of three consumption goods used to measure the rate of inflation:

Using the consumption basket for August 2011, the Paasche index is closest to:

A. 123.7.

B. 124.6.

C. 125.4.A. monetary variables have a major impact on GDP growth.

B. persons are unemployed because their asking wages are too high. C. governments should intervene when the economy is in contraction.

45.The current ratio for an industry is 3.2. Data for a firm in the industry is presented below:

|

£ ‘000s |

|---|---|

| 200 | |

| 350 | |

| 1,250 | |

| 300 | |

|

200 |

|

600 |

Answer = B

“Understanding Balance Sheets,”Elaine Henry, CFA and Thomas R. Robinson, CFA

2013 Modular Level I, Vol. 3, Section 7.2, Exhibit 19, Example 8

“Working Capital Management,” Edgar A. Norton, Jr., CFA, Kenneth L. Parkinson, and Pamela Peterson Drake, CFA

2013 Modular Level I, Vol. 4, Reading 40, Sections 2.2.

B.decided to make greater use of long-term borrowing capacity.

C.implemented a new IT system allowing it to reduce working capital levels as a percentage of assets.

A is correct.

An increase in price is not sustainable in a fragmented and competitive industry. Fragmented industries tend to be highly price competitive because of the need to increase market share and to undercut prices in an attempt to steal share.

“Understanding Cash Flow Statements,” Elaine Henry, CFA, Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, and Michael A. Broihahn, CFA

2013 Modular Level I, Vol.3, Reading 27, Section 3.1, 3.2.5

Study Session 7–23–-e, 8–27–e

Explain the relationships among the income statement, balance sheet, statement of cash flows, and statement of owners’ equity.Describe how the cash flow statement is linked to the income statement and balance sheet.

| 7,000 | |

|

4,200 |

|

500 |

| 250 | |

| 200 |

Answer = B

“Understanding Income Statements,” Elaine Henry, CFA, and Thomas R. Robinson, CFA 2013 Modular Level I, Vol.3, Reading 25, Section 4.2.3, Example 10, 5.3, 5.5

Study Session 8–25–f

Distinguish between the operating and non-operating components of the income statement. B is correct.

A is correct. Analyzing the prospects of the industry would be done in the collect data phase of a financial analysis.

50.Which of the following reports is least likely to be filed with the SEC?

51.An analyst is forecasting gross profit of the three following companies. He uses the five-year average gross margins and forecasts sales using an internal model.

• Company 1’s products currently enjoy healthy margins because of its technological edge. New technologies typically replace old ones every two years in this industry.

C. 3.

Answer = B

| Component | Cost | Useful Life |

|---|---|---|

| A | $500,000 | 10 years |

| B | $500,000 | 5 years |

A. the same.

B. $50,000 lower.

C. $50,000 higher.

53.Dividends received are most likely classified as which type of cash flow under both IFRS and U.S.GAAP?

54.The following selected data are available for a firm:

| $ millions | |

|---|---|

|

90.0 |

| 15.2 | |

| 28.0 | |

| 34.3 | |

| 13.0 |

If the firm’s tax rate is 40%, the free cash flow to the firm (FCFF) is closest to:

A. 57.9.

B. 74.7.

C. 87.7.

| 74.7 |

|---|

55.The following financial data is available for a company:

A. 4.00%.

B. 4.40%.

C. 4.78%.Answer = B

|

|

|---|---|

|

|

A. Current

B. Debt-to-equity

C. Number of days in inventoryAnswer = B

B. notes to the financial statements.

C. management discussion and analysis.Answer = C

Total liabilities at the end of the year are closest to:

A. $472,000.

B. $482,000.

C. $487,000.B is correct.

|

||

|---|---|---|

| $ 50,000 | ||

| 225,000 | ||

|

450,000 | |

|

5,000 | |

| (402,000) | ||

| 53,000 | ||

| (10,000) | ||

| 43,000 | 43,000 | |

|

$318,000 | |

59.According to the International Accounting Standards Board’s Conceptual Framework for Financial Reporting, the two fundamental qualitative characteristics that make financial information useful are best described as:

C is correct. Relevance and faithful representation are the two fundamental qualitative characteristics that make financial information useful according to the IASB Conceptual Framework.

60.Which of the following statements about balance sheets is most accurate? Under:

Describe different types of assets and liabilities and the measurement bases of each.

A is correct. Under U.S. GAAP intangibles must be valued at historical cost, whereas under IFRS they can be valued at cost or revaluation.

On the 2012 statement of cash flows, the company’s net cash flow from investing activities (in $‘000s) is closest to:

A. -275.

B. -215.

C. 285.

| $ millions | |

|---|---|

|

4,800 |

|

2,880 |

The company’s cash conversion cycle (in days) is closest to:

A. 84.

Cash conversion cycle = Days sales outstanding + Days of inventory on hand – Days of payables

|

Accounts receivable | Inventory | |

|---|---|---|---|

| Days in Sales (DSO) | Days on hand (DHO) | ||

| Sales | Purchases | ||

| A/R | Inventory | Payables | |

| 4,800 ÷ 625 | 2,880 ÷ 710 | 2,940 ÷ 145 | |

| = 7.68 times | |||

| = 4.06 times | = 20.3 times | ||

| 365 ÷ 7.68 | |||

| 365 ÷ 4.06 | 365 ÷ 20.3 | ||

| = 48 days | = 90 days | = 18 days |

Cash conversion cycle = DSO + DOH – Days in Payables = 48 + 90 – 18 = 120 days

63. Select information from a company that uses the FIFO inventory method is provided below.

| 300 | 7.70 | ||

|---|---|---|---|

|

600 | 12.00 |

|

| 400 |

C. the same.

Answer = C

A.€6.5 million charge to net income

B.€6.5 million charge to revaluation surplus

C.€4.5 million charge to revaluation surplus and €2.0 million charge to net incomeAnswer = A

65. Which of the following statements most accurately describes a valuation allowance for deferred taxes? A valuation allowance is required under:

A. IFRS on revaluation of capital assets.

B is correct. A valuation allowance is required under U.S. GAAP if there is doubt about whether a deferred tax asset will be recovered. Under IFRS the deferred tax asset is written down directly.

66. An analyst can most accuratelyidentify a LIFO liquidation by observing a(n):

“Financial Reporting Quality: Red Flags and Accounting Warning Signs,”Thomas R. Robinson, CFA and Paul Munter

2013 Modular Level 1, Vol. 3, Reading 33, Section 3

Study Session: 10-33-d

Describe common accounting warning signs and methods for detecting each.B is correct. The most appropriate way to identify a LIFO liquidation is by reviewing the inventory footnotes for a decrease in the LIFO reserve. Although a LIFO liquidation may result in an increase in gross margin or changes in inventory out of line with changes in sales there are other factors that could explain those changes.

| 2011 December 31 |

||

|---|---|---|

| 2,200 | 2,500 | |

|

28% | 30% |

|

1,400 | 1,400 |

| 25% | 25% | |

| 55 | 60 | |

| 500 | 500 |

A. $169.

B. $202.

C. $244.Answer = C

B. a higher earnings per share in future periods. C. the same free cash flow to the firm in that period.

Answer = C

| Example | ||

|---|---|---|

|

||

|

||

|

||

|

||

Answer = B

“Capital Budgeting,” John D. Stowe, CFA, and Jacques R. Gagne, CFA 2013 Modular Level I, Vol.4, Reading 36, Sections 4.1, 4.2, 4.8.

The NPV of project A is €1,780.59

| ) | ) | ) | ) |

|---|

The NPV of Project B is €1,765.36

C.remain unchanged.

Answer = B

| [ ( ) |

|---|

If the tax rate increases, then the bracketed term (1 – tax rate) decreases making the equity beta decrease because the asset beta is unchanged.

71. Which date in the chronology of a dividend payment is most likely determined by a Securities Exchange? The:

“Dividends and Share Repurchases: Basics,” George H. Troughton, CFA and Gregory Noronha, CFA

2013 Modular Level I, Vol.4, Reading 39, Section 3.1, 3.2, 3.3.Study Session 11-39-b

Describe dividend payment chronology, including the significance of declaration, holder-of-record, ex-dividend, and payment dates.C.remain unchanged.

Answer = B

A.Obsolete inventory

B.Reduction in a line of credit

C.Increased difficulty in collecting receivablesAnswer = B

A.meet only in the presence of management.

B.have a “lead” director when the board chair is not independent. C.hire independent consultants who are pre-approved by management.

75. The unit contribution margin for a product is $12. Assuming fixed costs of $12,000, interest costs of $3,000, and a tax rate of 40%, the operating breakeven point (in units) is closest to:

A.750.

76. The effective annualized cost (%) of a banker’s acceptance that has an all-inclusive annual rate of 5.25% for a one-month loan of $2,000,000 is closest to:

A.5.27.

B.5.38.

C.5.54.

77. Which of the following is most consistent with the best practices of corporate governance?

A.All stakeholders should have the right to participate in the governance of the firm.

Describe practices related to board and committee independence, experience, compensation, external consultants, and frequency of elections, and determine whether they are supportive of shareowner protection.

C is correct. Appropriate controls and procedures exist that cover management’s activities in running the daily operations of the firm is consistent with the best practices of corporate governance.

Answer = B

“Cost of Capital,” Yves Courtois, CFA, Gene C. Lai, and Pamela Peterson Drake, CFA

2013 Modular Level I, Vol. 4, Reading 37, Section 2.2

Study Session 11-37-c

Explain alternative methods of calculating the weights used in the WACC, including the use of the company’s target capital structure;

B. help define minimum standards of practice for agents.

C. require that regulated firms maintain optimum levels of capital.

A. higher return on equity.

B. higher operating margin.

C. lower sustainable growth.Answer = A

A is correct. Selling unproductive land and using the proceeds from the sale to buy back shares reduces the total assets. Holding sales constant the decrease in assets would improve the asset turnover. Buying back shares increases the firm’s financial leverage. Both the increase in asset turnover and financial leverage will lead to a higher return on equity.

81. Which of the following is the most appropriate reason for using a free-cash-flow-to-equity (FCFE) model to value equity of a company?

A is correct. FCFE is a measure of the firm’s dividend paying capacity.

82. The following information is available about a company:

“Introduction to Industry and Company Analysis,” Patrick W. Dorsey, CFA, Anthony M. Fiore, CFA and Ian Rossa O’Reilly, CFA

2013 Modular Level I, Vol. 5, Reading 50, Section 6.1

“Equity Valuation: Concepts and Basic Tools,” John J. Nagorniak, CFA and Stephen E. Wilcox, CFA 2013 Modular Level I, Vol. 5, Reading 51, Section 4.3, Example 8

Study Session 14-50-k, 14-51-e

Describe the elements that should be covered in a thorough company analysis.Calculate and interpret the intrinsic value of an equity security based on the Gordon (constant) growth dividend discount model or a two-stage dividend discount model, as appropriate.

| V3 = | ) = $46.86 | ) + | ||

|---|---|---|---|---|

| V0 = | ) + | ) + | ||

A. $20.57.

B. $25.20.

C. $30.86.Answer = A

A. Dealers

B. Brokers

C. ExchangesA is correct.

Answer = B

“Market Organization and Structure,” Larry Harris

2013 Modular Level I, Vol. 5, Reading 46, Section 6.1, Exhibit 2 Study Session 13-46-g, h

Compare execution, validity, and clearing instructions.B. the use of resources where they are most valuable.

C. liquid markets with low commissions and order price impacts.

2013 Modular Level I, Vol. 5, Reading 47, Section 2

Study Session 13-47-b

Calculate and interpret the value, price return, and total return of an index.C is correct. The total return of an index is the price appreciation, or change in the value of the price return index, plus income (dividends and/or interest) over the period, expressed as a percentage of the beginning value of the price return index.

“Market Efficiency,” W. Sean Cleary, CFA, Howard J. Atkinson, CFA, and Pamela Peterson Drake, CFA.

2013 Modular Level I, Vol. 5, Reading 48, Section 3.2

Study Session 13-48-d

Contrast weak-form, semi-strong-form, and strong-form market efficiency.

| Company A | Company B | |

|---|---|---|

| $20 | $10 | |

| $22 | $13 | |

|

16% | 13% |

|

40% | 60% |

“Overview of Equity Securities” Ryan C. Fuhrmann, CFA, and Asjeet S. Lamba, CFA

2013 Modular Level I, Vol. 5, Reading 49, Section 7.1

“Equity Valuation: Concepts and Basic Tools” John J. Nagorniak, CFA, and Stephen E. Wilcox, CFA 2013 Modular Level I, Vol. 5, Reading 51, Section 4.2

Study Session 14-49-g, 14-51-e

Distinguish between the market value and book value of equity securities.Calculate and interpret the intrinsic value of an equity security based on the Gordon (constant) growth dividend discount model or a two-stage dividend discount model, as appropriate.

90. An investor gathers the following data about a company:

|

$1.47 |

|---|---|

| $4.00 | |

| Estimate of long-run return on equity (ROE) | 15% |

| 40% | |

| 12% |

A. 10.0.

B. 13.3.

C. 20.0.Answer = B

Alternatively:

Justified forward P/E: P0/E1 = (D1 / E1) / (r – g)

g = (1 – Dividend payout ratio) × ROE = (1- 0.40) × 15 = 9%

D1 = $1.47 x 1.09 = 1.60; E1 = $4.00 (given); r = required rate of return = 12% (given) P0/E1 = (D1 / E1) / (r – g) = (1.60 / 4.00) / (0.12 – 0.09) = 13.3x

Questions 91 through 96 relate to Derivative Investments.

“Derivative Markets and Instruments,” Don M. Chance, CFA

2013 Modular Level I, Vol. 6, Reading 60, Section 2.1

Study Session 17-60-c

Define forward contracts, futures contracts, options (calls and puts), and swaps and compare their basic characteristics.A is correct because a swap is a series of forward payments. Specifically, a swap is an agreement between two parties to exchange a series of future cash flows. The corporation receives fixed interest rate payments and makes variable interest rate payments. Given that the contract is for 1 year and the floating rate is based upon 3-month LIBOR, at least 4 payments will be made during the year.

Answer = C

“Forward Markets and Contracts,” Don M. Chance, CFA

2013 Modular Level I, Vol. 6, Reading 61, Section 3.1.1

Study Session 17-61-d

Describe the characteristics of equity forward contracts and forward contracts on zero-coupon and coupon bonds.“Futures Markets and Contracts,” Don M. Chance, CFA

2013 Modular Level I, Vol. 6, Reading 62, Section 3

Study Session 17-62-d

Describe price limits and the process of marking to market, and calculate and interpret the margin balance, given the previous day’s balance and the change in the futures price.A is correct. Because the future has a daily price limit of $5, the highest possible settlement price on Day 2 is $111. Therefore, the marked to market value would be ($111-$106) x 40 = $200.

Answer = C

“Option Markets and Contracts,” Don M. Chance, CFA

2013 Modular Level I, Vol. 6, Reading 63, Section 5.6

Study Session 17-63-n

Explain how cash flows on the underlying asset affect put-call parity and the lower bounds on option prices.“Swap Markets and Contracts,” Don M. Chance, CFA

2013 Modular Level I, Vol. 6, Reading 64, Section 3.1

Study Session 17-64-b

Describe, calculate, and interpret the payments of currency swaps, plain vanilla interest rate swaps, and equity swaps.B is correct because the bank’s payments are based upon a notional principal of EUR 50,000,000 and an interest rate of 4.5%. The payment is: EUR 50,000,000 x (.045) x (180/360) = EUR 1,125,000.

C is correct because buying a call gives the owner the right to buy the stock at the exercise price. The investor predicts that the stock will increase to $95 at the end of two months. He will likely be able to sell his calls for at least $7 and realize a profit.

Questions 97 through 108 relate to Fixed Income Investments.

Answer = C

“Features of Debt Securities”, Frank J. Fabozzi, CFA

2013 Modular Level I, Vol. 5, Reading 52, Section 6.3

Study Session 15-52-d

Explain the provisions for redemption and retirement of bonds.Answer = A

“Risks Associated with Investing in Bonds”, Frank J. Fabozzi, CFA 2013 Modular Level I, Vol. 5, Reading 53, Section 3

Study Session 15-53-g

B.Both investors will choose the tax-exempt bond.

C.Investor A will choose the tax-exempt bond and Investor B will choose the taxable bond.

A.spot rate.

B.yield spread.

C.forward rate.A.increase.

B.decrease.

102. The market value of an 18-year zero-coupon bond with a maturity value of $1,000 discounted at a 12% annual interest rate with semi-annual compounding is closest to:

A.$122.74.

B.$130.04.

C.$192.86.

Answer = B

“Yield Measures, Spot Rates, and Forward Rates”, Frank J. Fabozzi, CFA

2013 Modular Level I, Vol. 5, Reading 57, Section 4.2.1.1

Study Session 16-57-f

Explain nominal, zero-volatility spread, and option-adjusted spread, and the relations among these spreads and option cost.

| Notation | Forward Rate |

|---|---|

| 1f0 | 0.50% |

| 1f1 | 0.70% |

| 1f2 | 1.00% |

| 1f3 | 1.50% |

| 1f4 | 2.20% |

| 1f5 | 3.00% |

| 1f6 | 4.00% |

Answer = B

“Yield Measures, Spot Rates, and Forward Rates”, Frank J. Fabozzi, CFA

2013 Modular Level I, Vol. 5, Reading 57, Section 5.2

Study Session 16-57-g

Explain a forward rate and calculate spot rates from forward rates, forward rates from spot rates, and the value of a bond using forward rates.

which is then multiplied by two to convert to a bond-equivalent basis, where the forward rates are adjusted to a semi-annual basis and z1 = 1f0. Therefore, z6 = [1.0025 × 1.0035 × 1.0050 × 1.0075 × 1.0110 × 1.0150]1/6 – 1 = 0.0074 × 2 = 1.48%.

105. One advantage of the full valuation approach to measuring interest rate risk relative to the duration/convexity approach is that the full valuation approach:

“Introduction to the Measurement of Interest Rate Risk”, Frank J. Fabozzi, CFA

2013 Modular Level I, Vol. 5, Reading 58, Section 2

Study Session 16-58-a

Distinguish between the full valuation approach (the scenario analysis approach) and the duration/convexity approach for measuring interest rate risk, and explain the advantage of using the full valuation approach.A is correct because the full valuation approach allows modeling of the response to both parallel and non-parallel yield curve changes and will reflect cash flows that change when interest rates change, whereas the duration/convexity approach assumes parallel yield curve changes and fixed cash flows.

| D | = | 2 | V | − | − |

|

, |

|

||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| × | V 0 | × | ∆y | |||||||||||

| D | = | 2 | 94 . 474 | − | = |

|

||||||||

| × | 92 . 733 | × | .0 0060 | |||||||||||

107. Which of the following is least likely to be a type of embedded option in a bond issue granted to bondholders? The right to:

“Features of Debt Securities,” Frank J. Fabozzi, CFA

2013 Modular Level I, Vol. 5, Section 6.1, and Section 10.1

Study Session 15-52-e

Identify common options embedded in a bond issue, explain the importance of embedded options, and identify whether an option benefits the issuer or the bondholder.B is correct because this is a type of embedded option granted to issuers, not bondholders.

B is correct because the bond’s duration is computed using:

) )

B. venture capital fund.

C. leveraged buyout fund.Answer = A

A. price return.

B. collateral yield.

111. The most likely impact of adding commodities to a portfolio of equities and bonds is to:

A. increase risk

B. enhance return.C is correct. Over the long term, commodity prices are closely related to inflation and, therefore, including commodities in a portfolio of equities and bonds will reduce its exposure to inflation.

112. The return on a commodity index is likely to be different from returns on the underlying commodities because:

“Introduction to Alternative Investments,” Terri Duhon, George Spentzos, CFA, and Scott D.

Stewart, CFA

2013 Modular Level I, Vol. 6, Reading 66, Section 6.1

Study Session 18-66-e

Describe issues in valuing, and calculating returns on, hedge funds, private equity, real estate, and commodities.C. Commercial mortgage backed securities.

Answer = A

structures, and due diligence

A is correct. Real estate investment trusts (REITS) provide investors with indirect, equity real estate

If the incentive fee and management fee are calculated independently, the effective return for a hedge fund investor is closest to:

A. 10.89%.

B. 11.06%.

C. 12.29%.hedge funds.

A is correct. The management fee = $541,500,000 × 0.015 = $8,122,500

115. Which of the following institutional investors are most likely to have a low tolerance for investment risk and relatively high liquidity needs?

A. Insurance company

B. Charitable foundation

C. Defined benefit pension plan116. An asset management firm generated the following annual returns in their U.S. large cap equity portfolio:

"Portfolio Risk and Return: Part I" by Vijay Singal, CFA

Modular Level I, Vol. 4, Reading 43, Section 2.1.3

Study Session 12-43-a

Calculate and interpret major return measures and describe their appropriate uses.

C is correct. ̅ √ ) ) ) ) )

"Portfolio Risk and Return: Part I" by Vijay Singal, CFA

Modular Level I, Vol. 4, Reading 43, Section 2.3.3

Study Session 12-43-e, f

Calculate and interpret portfolio standard deviation

Describe the effect on a portfolio’s risk of investing in assets that are less than perfectly correlated.B is correct. The standard deviation of a two asset portfolio is given by the square root of the

| 2 + w2 2σ2 |

|---|

118. An asset has an annual return of 19.9%, standard deviation of returns of 18.5%, and correlation with the market of 0.9.

If the standard deviation of returns on the market is15.9% and the risk-free rate is 1%, the beta of this asset is closest to:

β= (ρi,mσi)/σm

β= (0.90×0.185)/0.159

β= 1.047119. Which of the following performance measures most likely relies on systematic risk as opposed to total risk when calculating risk-adjusted return?

C is correct because the Treynor ratio measures the return premium of a portfolio versus the risk free asset relative to the portfolio’s beta which is a measure of systematic risk.

120. A financial advisor gathers the following information about a new client:

• The client is a successful economics professor at a major university

• The client plans to work full time for seven years and then will work part time for 3 years before retiring

• The client owns two homes and does not have any outstanding debt

• The client has accumulated retirement savings of approximately $ 2 million through their employer’s retirement plan and will have anticipated retirement spending needs of $60,000 per year

• The client reads numerous financial publications and follows markets closely

• While concerned about the current health of the global economy, the client maintains that he is a long-term investor

Based on the above information, which of the following best describes this client?Describe the investment constraints of liquidity, time horizon, tax concerns, legal and regulatory factors, and unique circumstances and their implications for the choice of portfolio assets.

C is correct. The client is in a strong financial situation (stable job, no debt), has a reasonably long time horizon before needing any liquidity (10 years), and reasonable retirement spending needs relative to total assets. These factors indicate a high ability to take risk. In addition, the client’s knowledge of financial markets, experience, and focus on the long term also indicates a high willingness to take risk.