Urgent debates pike river mine disasterrelease report

The Technical Development of Pike River Coal Mine

PCRM was formed in 1982 and acquired by New Zealand Oil & Gas Ltd (NZOG) in 1998. Over a 13-year period PCRM explored and then acquired the necessary authorisations for the mine, including a mining permit, an access arrangement and resource consents. Initial exploration indicated a recoverable coal reserve of 19 million tonnes of high-quality hard coking coal. In 2005 the Pike board decided to proceed with development of the mine. By May 2007 Pike offered shares in the company and assigned 85 million one-dollar shares to over 5000 new investors. NZOG remained the major shareholder, but no longer held a controlling interest. Development costs were estimated at $124 million, with annual coal production of more than a million tonnes projected by 2008.

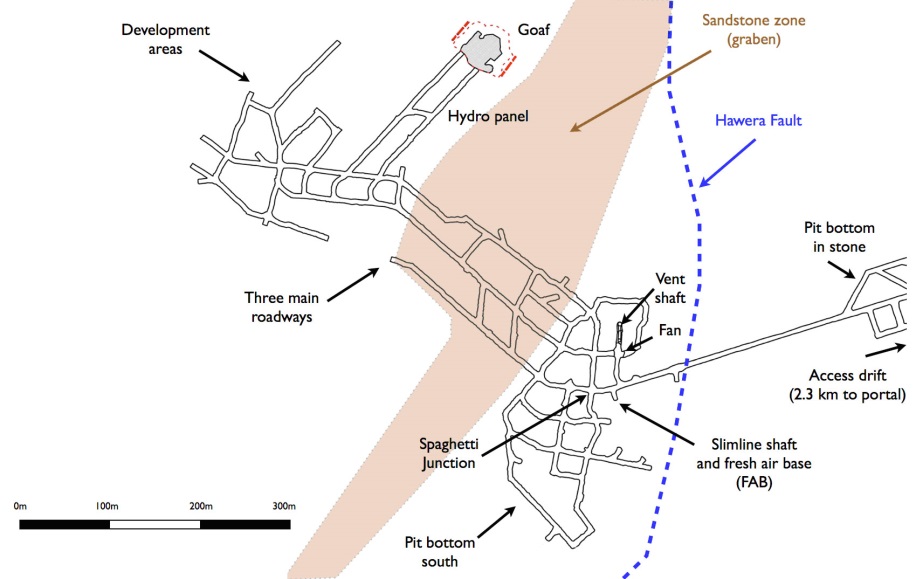

Figure 1: The mine plan as at November 2010

The investigation of incident reports was haphazard, with the result that in October 2010 a backlog of outstanding investigations was written off. Other information from underground, including methane readings from fixed and portable sensors, was not systematically analysed and the problems addressed. "In the 48 days before the explosion there had been 21 reports of methane levels reaching explosive volumes, and 27 reports of lesser, but potentially dangerous, volumes of the gas," the Royal Commission into the Pike River Coal Mine Tragedy noted. "The reports of excess methane continued up to the very morning of the tragedy. The warnings were not heeded."

The area most likely to contain a large volume of methane was a goaf formed during mining of the first coal extraction panel in the mine. It is also possible that methane which had accumulated in the working areas of the mine fuelled the explosion, or at least contributed to it. Potential ignition sources include arcing in the mine electrical system, a diesel engine overheating, contraband taken into the mine, electric motors in the non-restricted part of the mine and frictional sparking caused by work activities. The main fan was not explosion protected and failed in the explosion. A back-up fan at the top of the ventilation shaft was damaged in the explosion and did not automatically start as planned. The ventilation system shut down.

At the executive management level there was a culture of ‘production before safety’ at Pike River and as a result signs of the risk of an explosion were either not noticed or not responded to.

Shortly after the explosions at Pike River Coal Mine (PRCM), the mine was closed and the company went into receivership. As most of the independent contractors were unsecured small creditors, neither they nor their workers or their families received any money owed to them by Pike River Coal Mine Ltd (in receivership). It is estimated that unsecured creditors, including the independent contractors are owed $(NZ)31m, with another $20.5m owed to Pike's major shareholder and secured creditor, New Zealand Oil and Gas.

The case study on PRCM illustrates that there were serious communication problems, for instance between the mine management and the company Board. What were some factors that impeded communication within the company and how could these aspects have been better managed?

While this is a technical case, you are expected to apply the management theory taught in class and the textbook. You are also expected to research further using peer-reviewed journal articles and Pike River analysis. Start your research early to gain high marks- the links below are a good starting point.

Royal Commission into the Pike River Coal Mine Tragedy (2012). Commission’s report- Volume One. Found at:

http://pikeriver.royalcommission.govt.nz/Volume-One---What-Happened-at-Pike-River