Inflation Process in Singapore

One of the most important of all economic concepts is inflation. It forms the basic pillar of all economics concepts. The most basic definition of inflation is that it's a rise in prices. Over the period of time, when the cost of goods and services increase, the value of a dollar will go down because your dollar won't let you purchase as much you could have last month or last year. It may seem like the cost of goods are always going up in every month or two to an extent, even when inflation is thought to be in check. But it's useful to note that some degree of inflation is considered normal rather desirable when seen in the context of unemployment. During these years the annual rate of inflation is around 5.3% inflation. Deflation can be defined as a situation when prices actually decrease over a period of time. But deflation is not the same as disinflation, which happens when the rate of inflation will decrease but stays positive like, a change from a 6% rate to a 4% rate)

Inflation is commonly interpreted as a situation of substantial general increase in the price level and resultant fall in the value of money over a period of time when inflation happens. Inflation means persistent and continuous rise in the general level of prices. Inflation has a basic characteristic of long term process of operation. Inflation is known to be a monetary phenomenon and is marked by an oversupply of money and credit. The basic cause of inflation is the beyond control expansion of money supply which the normal absorption capacity of the economy cannot handle. The measurement of general prices is done through price indices. The upward and downward movement of price indices reveals the course of inflation or deflation in the economy.

The Monetary Authority of Singapore (which is known as MAS) made an announcement on Wednesday that revised the consumer inflation forecast for the year 2012 for Economy of Singapore to 4 per cent to 4.5 percent from 3.5 per cent to 4.5 per cent in the previous years. The reason is that the central bank of Singapore is expecting that the rents for houses and COE premiums will increase more over the period of time and remain at high levels.

But the Monetary Authority of Singapore has not changed its core inflation forecast much. It is usually ranging and hovering between 2.5 per cent - 3.0 per cent for the current year. As per the analysis of the MAS measure of core inflation, which does not include any costs for accommodation and private road transport is ranging and hovering between 2.7 per cent in the quarters of April-to-June.

This typical core inflation is going to reduce further much and can hover around 2 per cent by the end of the year. This percentage is not very less from the on going per year historical average of 1.7 per cent. This was confirmed by MAS managing director Ravi Menon at a news conference.

As per the MAS source the local inflation for food should remain relatively settled as compared to other type of food inflation for the rest of the year. But there is a suspicion that there could be a possibility that food prices can go up for the rest of the year. Economists are predicting some upward trend in the food inflation. As per them there is some potential threat of disruptions in supply of various food items. This is because of disruptions from US imports due to bad drought conditions and increased prices for wheat and corn. As per the regional economist of CIMB the official inflation rate as per the Singapore’s Consumer Price Index has increased to around 5.3 percent in June as compared to 5.0 percent in the last month. This is a problematic scenario as inflation is increasing quickly. Also as per the MAS information the CPI has increased by around 5.1% in first six months of the year and reduced by 5.5 percent in the next six months of 2011.

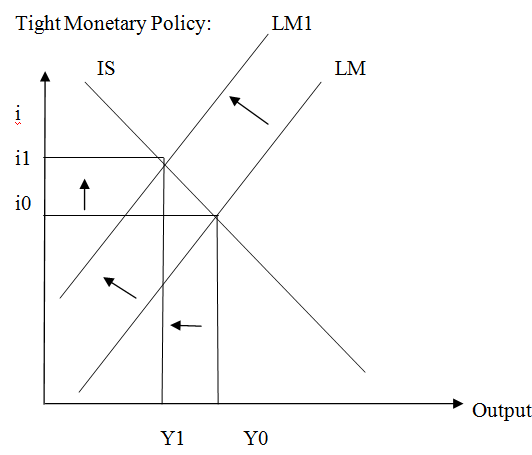

As per Mr Menon the reduction of inflation rate is the major priority of the country’s central bank. To keep a check on inflation, monetary authority is trying its best to tighten the monetary policy. This will lead to an appreciation in Singapore Dollar. This is because tightening of monetary policy will increase the interest rates in economy. This will attract foreign investment in Singapore and the demand for currency will increase. This will lead to appreciation of currency. As per the monetary authorities if the required appreciation does not take place the rising inflation will become a fatal problem. This is because in such a case CPI-All Items inflation in this particular year would be around 6.5 to 7 Percent and not 4 to 4.5 percent as the monetary authorities have projected. As per the Monetary Authority of Singapore the current monetary step taken by the authority is the most appropriate decision. The next monetary decision will be coming in this October.

If we focus our attention to consumption prices, then we use the concept of a cost-of-living index (COLI), which measures the expenditure required for a utility maximizing consumer to maintain a specified level of utility as prices change. The concept of the COLI framework comes from its association with the theory of consumer behaviour, which can provide indication as to how to deal with the changes in expenditure patterns or the introduction of new goods. Also because the COLI concept is only related to consumption, it provides very less or no guidance about the concepts of broader measures of inflation that is associated with prices for other components of output .The COLI framework therefore provides a direction guide for the construction of a consumer price index (CPI), which measures the prices of goods and services which households consume. It cannot however provide information about the construction of a price index for overall GDP, which includes the prices of all domestically produced final output consumed by all like consumers, businesses, governments, or the rest of the world.

As per all the senior economists they are not as such against any inflationary process, but they are still not able to get the logic of how monetary authority tinker the monetary policy in the direction of loose monetary policy. Tightening cannot be done as easily as it is thought to be. This is because the growth front is not doing very well in the year 2012. As per the growth predictions in Singapore economy MAS is predicting the growth rates between 1 % and 3% this year. But as per the senior economists panel there is a chance that economic growth rate in Singapore could go down by 1 percent for the rest of the year 2012 if there are some bad economic events on the cards for the country. These scenarios include a recession in the US, significant escalation of the Eurozone crisis and a "hard landing" for China's economy. But still there is a chance that growth momentum will slow down and the MAS can expect the average growth in the second half to be lower than the first six months of the year. The GDP which is known as gross domestic product will grow at an average of 4.2% in the first half of year 2012. But the problem of recession and a credit squeeze will also affect the trade relations for the country and will lead to a financial problem for the country. But as per the economists the country has the power to sustain the difficult condition. Mr Menon would be announcing a date to launch the central bank's annual report for the year ended March 31, 2012.

MAS has created a net profit of around S$2.77 billion in the previous fiscal year 2011/12, going away from the loss of S$10.94 billion in the previous financial year when the local dollar had hampered the value of reserves held in other currencies. As per the current reviews the MAS has made good foreign gains of around $12.1 billion. But still the overall net profit has come down to around $2.77 billion due to the new increased exchange rate.

References :

Michael C. Lovell, (2010). Social Security’s Five OASI Inflation Indexing Problems Prices rising for better or worse : By Scott Kilman, Ian Berry and Julie Jargon

Correlation Ricardo Reis and Mark W. Watson,(2009). Relative Goods Prices, Pure Inflation and the Phillips.

By Debbie Stampfli ,(2003). Rising and falling inflation and the global economy

David E. Lebow and Jeremy B. Rudd, (2004). Why you can’t trust the inflation numbers : By Brett Arends.