CAPM Extra Practice Questions

Test 2 Practice Questions

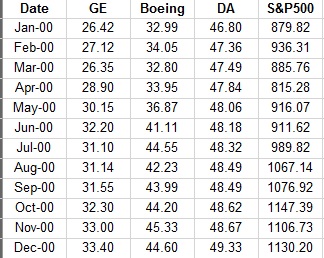

Answer all the questions using the data provided. You have been supplied with MONTHLY stock prices for 3 stocks as well as the index.

1. Calculate the expected return, standard deviation, and variance for each stock and the index.

2. Using the market model alpha to determine if any of the stocks had abnormal returns (when compared to the index) For this part do not run the regression…find the market model alpha using some other function.

- Now run a regression for each company against the index. According to the regression results are these abnormal return figures reliable/statistically significant at a 5% level of precision?

3. Find the beta for each stock (Using the index as your proxy for the market portfolio). Do not use the regression method, try another function.

- Now revert to your regression results from the previous question. Are your betas? Statistically significant at the 5% level?

4. Find the R^2 for each stock (Using the index as your proxy for the market portfolio). Do not use the regression method, try another function.

- What do the R^2 values tell us?

- Use the value to calculate each company systematic and unsystematic risk

5. Calculate abnormal returns using Jensen’s Alpha. Which stocks are over/underpriced?

- If you thought that next month GE would sell for $33.41 and you had access to a 5% risk free rate:

- What returns does this price change promise?

- Is the stock overpriced or underpriced according to this method?

6. What should the new corrected price be?

- Construct a portfolio with equal weights for the assets. Calculate all of the measure that you previously calculated on the stocks.

- Did you manage to beat the market?

7. Find the Max ER, Min ER, and Min SD portfolios.

8. Plot out some of the main points on the minimum variance frontier. Use returns of 2%, 1.5%, 1%, .5%, .49% and .48%.

9. Plot out some of the main points on the efficient frontier. Use sd’s of 4%, 3.25%, and 1%. Remember that all points on the minimum variance frontier that are beyond the minimum variance portfolio can also be included in the efficient frontier.

10. Using a 5% risk free rate, find your optimal risky portfolio.

11. Using a 15% lending and borrowing rate find your second optimal risky portfolio.

12. Find portfolios with the following returns or standard deviations given the following borrowing/lending constraints. In a test I will ask you for a specific weight or another portfolio measure.

a. You can borrow and lend at 5%

- Return = 1%

- SD = 2.5%

b. You can borrow and lend at 15%

- Return = 3%

- SD = 1%

c. You can only lend at 5%

- Return = 1.5%

- SD = 1.5%

- SD = 0.5%

d. You can lend at 5% and borrow at 15%

- Return = 2%

- Return = 5%

- SD = 2%

- SD = .5%