FNSACC312 Administer subsidiary accounts and ledgers

FNS30317Certificate III in Accounts Administration FNS40217Certificate IV in Accounting& Bookkeeping

Assessment 1 Portfolio of Evidence

Question 1

(Elements: 1.1-1.4, 7.2)

The Accounts Receivable and Accounts Payable listings in the books of Marlin Machinery at the end of April were as follows:

|

Accounts Receivable as at 30 April |

Accounts Payable as at 30 April | |||

|

T Yu |

450 |

Franklin Electronics |

1,600 | |

|

M Markey |

640 |

K Parris |

350 | |

|

P Thomas |

1,400 | |||

|

M Jack |

700 | |||

|

3,190 |

1,950 | |||

The following transactions occurred in them month of May. The invoices sent and received include GST.

|

Date |

Transaction |

|

May-02 |

Invoices sent to T Yu $462 and S Smedley $330 |

|

May-04 |

Received cheque from M Markey for $640 |

|

Sent invoices to P Thomas for $220 | |

|

May-09 |

Bought tools from Quality Spare Parts for $891 |

|

May-10 |

Received cheque from M Jack for $700 |

|

May-13 |

Received cheque for $450 from T Yu |

|

May-15 |

Invoiced M Markey for $572 |

|

May-18 |

Sent invoices to S Smedley for $385 |

|

May-20 |

Paid Franklin Electronics $1,600 |

Title/s

|

May-23 |

Bought $1,320 equipment from Franklin Electronics |

|

May-24 |

Paid K Parris $200 |

|

May-27 |

Invoiced P Thomas $1,100 |

|

May-30 |

Received from P Thomas $1,400 |

Required

- Enter opening balances in the subsidiary ledger accounts and post the May transactions to the accounts. Calculate the closing balances at the end of the month.

- Prepare the Accounts Receivable Control account and the Accounts Payable Control account showing the effect of the above. Calculate the closing balances at the end of the month.

- Prepare a list of Accounts Receivable and Accounts Payable as at 31 May. Question 2

(Elements: 2.1-2.3, 3.1-3.2, 4.1-4.2, 6.1-6.3, 7.1-7.2)

As a newly qualified accounts receivable clerk, your employer has asked you to analyse the following outstanding debts and determine which debts you would consider to be bad (e.g. the client or debtor is unlikely to ever pay the account).

List of Debtors Outstanding for Lamp Pty Ltd

|

Jason Robands |

$1,000 |

Outstanding 45 days |

|

Sue Lang |

$789 |

Outstanding 29 days |

|

Maree Stammers |

$5,000 |

Outstanding 121 days |

|

Xi Zhou |

$6,890 |

Outstanding 5 days |

|

Paul Stim |

$10,120 |

Outstanding 116 days |

|

Franklin Electronics |

$572 |

Outstanding 37 days |

|

Simmons Pty Ltd |

$2,190 |

Outstanding 58 days |

|

Limp Café Subiaco |

$240 |

Outstanding 99 days |

|

B Company Limited |

$46,890 |

Outstanding 215 days |

|

Graeme Sullers |

$150 |

Outstanding 63 days |

Required:

- Complete an Aged Debtors Report based on the following format using an Excel spreadsheet and ensure that you sum each column with the total amount.

|

Debtors name |

Amount |

0-30 days |

31-60 days |

61-90 days |

> 90 days |

- In the second part of this question based on the age debtors report prepared determine which accounts you would consider to be “doubtful” debts and those which would be “bad” debts?

- For those debts now more than 90 days what actions do you think the company should take?

Title/s

Title/s

Question 3

(Elements: 1.1-1.4)

Alana Adams has provided you with a list of her debtors and creditors:

|

Accounts Receivable balance at March 1, 2016 |

$ 79,750 | |

|

Accounts Payable balance at March 1, 2016 |

11,550 | |

|

Invoices received from Subcontractors (Suppliers) |

7,645 | |

|

Invoices sent to clients for consulting services |

137,500 | |

|

Fee income received in cash |

12,200 | |

|

Expenses paid in cash |

4,400 | |

|

Contra of accounts payable to accounts receivable |

2,880 | |

|

Cash received from accounts receivable |

120,000 | |

|

Bad debt (including GST) written off |

880 | |

|

Cash payments to accounts payable |

32,000 | |

|

Purchase of Motor Vehicle on credit |

30,800 | |

|

Interest income received in cash |

8,000 |

Required:

- Prepare the Accounts Receivable Control account, as it would appear in the general ledger.

- Prepare the Accounts Payable Control account, as it would appear in the general ledger. (All amounts include GST)

Question 4

(Elements: 2.1-2-3, 3.3-3.4)

As part of your role in assisting Alana Adams in preparing the balances for the accounts payable and accounts receivable control accounts (question 3). She has now requested for you to develop a policy on debtors and creditors.

Required:

You are required to develop a policy for debtors and creditors for Alana Adams and this must include the following:

- What procedures must Alana take to ensure (1) creditors are paid by the due date, (2) creditors are paid early when a discount is offered, and (3) creditors are not paid twice

- What procedures must be taken to identify debts that are doubtful and those that a bad and must be written off

- What procedures should be in place when chasing up debts, e.g. when and how should phone calls be made, letters of demand, legal action

This can be in the form of a Memo or a letter and should be no more than 1 page and you can use dot points

Note:

In addition to using information from the textbook and sessions/topics slides, you should also undertake a Google search for “organisational policies on debts”

Title/s

Question 5

(Elements: 2.1-2.3, 3.1-3.2)

Nupina Gifts has the following balances as at 30 June 2017:

- Accounts receivable $343,630

- Balance of allowance for doubtful debts is $4,200

- Bad debts to be written off are $3,630 including GST

- Allowance for doubtful debts to be adjusted to 3% of accounts receivable

Required:

(a) General journal entries to record the bad debts and allowance adjustment (b) Post general ledger to relevant accounts

Question 6

(Elements: 1.1-1.4, 2.1-2.3, 4.1-4.2, 5.1-5.2, 6.1-6.3)

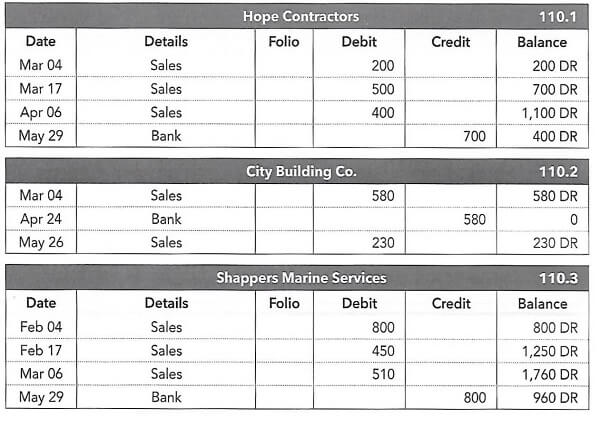

Landline Equipment Hire provides to credit to customers on a 30-day basis. Accounts receivables ledger shows the following:

Required:

- Prepare an Aged Debtors Report as at 31 May

- What actions do you recommend Landline Equipment Hire take to recovering the outstanding debts?