Analyzing The Financial Decision Making

Introduction

This report is about analyzing the financial decision making of organizations in New Zealand by analyzing and interpreting their financial statements and also analyzing the operating environment of Maori/Iwi organizations.. For this report we have chosen two organizations, one is Maori organization named as Moana New Zealand Ltd which was formerly known as Aotearoa fisheries limited and other is Stanford Ltd. Both companies are two of the biggest companies in New Zealand in seafood and fishing industry. Though both companies are involved in seafood production, major difference lies in the value system on which business operates. While Sanford is more economically driven and wants to be world’s best seafood company, Moana New Zealand vision is to maximise Maori fisheries assets value. This difference arises due the difference in principles as Moana follows maori principles which are discussed in the report.

For analysis purpose, ratio analysis and valuation methods have been used and the results have been compared to industry averages. Both companies’ working capital decisions, capital budgeting decisions have been analyzed and at last difference in both companies’ financial framework has been discussed to analyze Maori organizations’ operating environment.

Financial Statement Analysis

Financial statements are usually prepared to help creditors and investors assess and evaluate the financial framework of a company and use that information in decision making (Mautz, 2006). Some of the techniques that we will be using in this report for our case studies are Ratio Analysis, DuPont analysis and then will be applying some valuation models.

Ratio Analysis

Ratio analysis is that financial statement analysis tool which helps in assessing company’s financial health by focussing on some major aspects such as liquidity, solvency, efficiency and profitability (Nissim, 2001).

We have calculated some ratios for both the companies i.e. Stanford Ltd. and Moana New Zealand for the years 2013 to 2017 and then compare their performance with industry averages.

|

Table 1: Ratio Analysis for Moana New Zealand | |||||

|

Ratios |

2013 |

2014 |

2015 |

2016 |

2017 |

|

1. Activity Ratio | |||||

|

Inventory turnover ratio(Cost of Sales/ Average Inventory) |

14.20 |

15.16 |

14.88 |

16.46 |

16.69 |

|

Account Receivables Turnover Ratio (Net Sales/ Average receivables) |

10.34 |

9.66 |

8.97 |

9.00 |

9.24 |

|

2. Liquidity Ratio | |||||

|

Quick Ratio ((Cash+Receivables+Marketable securities )/Current Liabilities) |

0.56 |

0.49 |

0.51 |

0.50 |

0.35 |

|

3.Solvency Ratio | |||||

|

Debt to Equity Ratio ( Total Liabilities/Total Equity) |

0.24 |

0.29 |

0.28 | 0.28 |

0.24 |

|

4.Profitability Ratio | |||||

|

Gross Profit Margin (Gross Profit/Net Sales) |

26.06% |

23.27% |

22.94% |

19.93% |

20.52% |

|

Return on Equity (Net Income/Total Equity) |

-1.49% |

5.32% |

3.91% |

4.61% |

4.41% |

Note: Ratios have been calculated by using data from financial reports of last 5 years.

From the above table, we can make following interpretations:

- Inventory turnover ratio has increased from 14.20 to 16.69 from 2013 to 2017 which indicates improvement in inventory management system as it means inventory is getting sold at an increasing rate.

- Accounts receivable ratio experienced slight decrease from 10.34 to 9.24 which implies delayed process of collecting cash from debtors and leads to longer operating cycle.

- Quick ratio has also declined from 0.56 to 0.35 which is not a good sign for company’s liquidity as it implies Moana might need to borrow funds to pay off its short-term debts as quick assets are lesser that current liabilities.

- Debt to Equity ratio has remained fairly stable during these five years implying stability in capital structure as company is wholly owned by Maori/Iwi people and control shares are owned by Te Ohu Kaimoana (SBC, 2018).

- Gross profit margin ratio has decreased from 26,06% to 20.52% but this is because of reclassification of some expenses from administrative to cost of sales whereas Return on equity has increased from -1.49% to 4.41% implying better utilization of shareholders’ funds.

|

Table 2: Ratio Analysis for Sanford New Zealand | |||||

|

Ratios |

2013 |

2014 |

2015 |

2016 |

2017 |

|

1. Activity Ratio | |||||

|

Inventory turnover ratio(Cost of Sales/ Average Inventory) |

11.63 |

9.89 |

9.26 |

9.94 |

9.41 |

|

Account Receivables Turnover Ratio (Net Sales/ Average receivables) |

9.24 |

8.02 |

7.88 |

8.02 |

7.99 |

|

2. Liquidity Ratio | |||||

|

Quick Ratio ((Cash+Receivables+Marketable securities )/Current Liabilities) |

1.48 |

1.20 |

0.50 |

0.87 |

0.59 |

|

3.Solvency Ratio | |||||

|

Debt to Equity Ratio ( Total Liabilities/Total Equity) |

0.42 |

0.41 |

0.45 |

0.43 |

0.42 |

|

4.Profitability Ratio | |||||

|

Gross Profit Margin (Gross Profit/Net Sales) |

15.81% |

23.35% |

24.72% |

24.32% |

23.49% |

|

Return on Equity |

3.68% |

4.10% |

2.69% |

6.22% |

6.51% |

From the above table, it can be concluded that:

- Stanford’s working capital management system needs improvement as its efficiency ratios such as Inventory turnover and Accounts receivable turnover declined from 11.63 and 9.24 to 9.41 and 7.99 respectively from 2013 to 2017.

- Quick ratio has also declined gradually from 1.48 to 0.59 which is not a good signal for company’s liquidity as general acceptable level of quick ratio is 1:1.

- Debt to equity ratio has remained stable over years implying no change in financial leverage.

- Gross Margin and Return on equity both have increased from 15.81% and 3.68% to 23.49% and 6.51% respectively from 2013 to 2017 implying growth in profitability.

Comparison with industry averages

Following table shows comparison with industry average for both the companies for 2017:

|

Table 3: Ratio Comparison for year 2017 | |||

|

Moana |

Sanford |

Industry (Sanford Ltd (SAN.NZ) financials, 2018) | |

|

Inventory Turnover Ratio |

16.69 |

9.41 |

6.75 |

|

Accounts Receivable Ratio |

9.24 |

7.99 |

31.34 |

|

Quick Ratio |

0.35 |

0.59 |

1.75 |

|

Debt to Equity Ratio |

0.24 |

0.42 |

0.40 |

|

Gross Profit Margin |

20.52% |

23.49% |

27.77% |

|

Return on Equity |

4.41% |

6.51% |

5.20% |

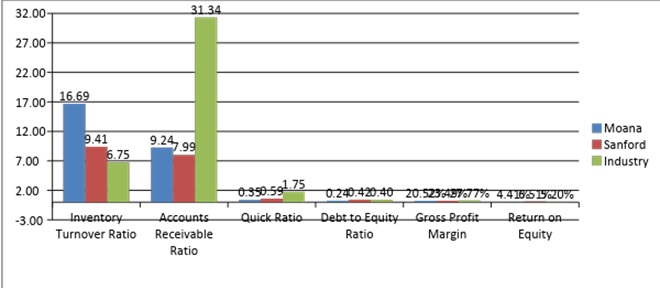

Ratio Analysis for Year 2017

By looking at the table and graph, following conclusions can be drawn:

- Both Moana and Stanford have higher inventory management ratio that industry with Moana having much higher ratio which implies that both companies are having more efficient inventory management process.

- Since receivable ratio for both companies is much lower than industry, it shows both companies need to improve their receivable management system as it impacts their liquidity and efficiency adversely.

- Quick ratio is also lower for both companies as compared to industry which reflects poor working capital management as both companies lack liquidity.

- Both companies have stable debt to equity ratio which is in line with industry average which means both companies are less risky and can utilize this in future to strengthen their capital structure.

- There is not much and significance difference in profitability ratios which shows Moana needs to increase their profitability where Stanford are providing better returns to their shareholders.

Dividend Ratio

Dividend ratio indicates that portion of net income which is paid to shareholders as dividends

|

For the year 2017 | ||

|

Moana |

Sanford | |

|

Dividend paid ($000) |

9659 |

21503 |

|

Net income ($000) |

19260 |

37478 |

|

Dividend Ratio (Dividends/Net Income) |

50.15% |

57.37% |

A indicated by above table Moana paid around 50% of net income as dividends while Sanford paid 57.37% of net income as dividends.

Valuation

Valuation is a process of determining an asset’s or a company’s intrinsic value. There are various methods to calculate a company’s share’s fundamental value such as Dividend model, DCF model, relative valuation etc. (Nissim, 2001).

For this report, we will be using comparable valuation approach where two variables will be considered; one is Price to Earnings (P/E) Ratio and second is Price to Cash Flow (P/Cash Flow) Ratio.

In comparable valuation approach, company’s valuation ratios such as P/E, EV/EBITDA, P/Sales etc. are compared with industry averages and then their share value is calculated using industry averages (Nissim, 2001).

|

Table 4: For the Year ended 2017 | |||

|

Moana |

Sanford | ||

|

A. |

Cash Flow ($000) |

19363 |

50280 |

|

B. |

Earnings ($000) |

19260 |

37478 |

|

C. |

No. Of shares (000) |

250 |

93626.735 |

|

D. |

CF/share ( A/C) |

77.452 |

0.537026096 |

|

E. |

EPS ( B/C) |

77.04 |

0.40 |

|

Industry P/Cash Flow |

13.43 |

|

Industry P/E |

15.09 |

|

Table 5: Valuation Using Comparable Approach | ||

|

Using P/Cash flow Approach |

Using P/E approach | |

|

Moana Calculated Share price |

1040.18 |

1162.53 |

|

Sanford Calculated Share price |

7.21 |

6.04 |

As we can see in Table 5, Moana’s share value should lie between 1040.18 NZD and 1162.53 NZD as per relative valuation approach whereas Sanford share value is between 6.04 NZD and $7.21 NZD

Current Market price of Sanford share is 7.76 NZD which is greater than its intrinsic value.

As per P/Cash flow variable 7.21< 7.76

As per P/E variable 6.04 < 7.76

It implies that Sanford is overvalued in the market and investors can short sell shares to earn profit.

Financial Decision Analysis

Analysis of financial decisions of both companies will be done by evaluating their inventory, receivable and payable methods.

Inventory Method

There are various methods to value a company’s inventory including FIFO, LIFO and Weighted average costing method. Choice of method has significant impact on company’s liquidity and profitability as various methods result into different ending inventory and Cost of Goods Sold (Herath, 2018).

By analyzing both companies’ financial statements, it was found that both companies use weighted average costing method and state their inventory at net realisable value or cost whichever is lower (Sanford, 2017) (Zealand, 2017).

Weighted average cost method results in higher COGS and Lower ending inventory which results in higher inventory turnover ratio and lower profitability ratios which is evident from ratio analysis performed for both companies.

Receivable Management

As inferred from Ration analysis performed in previous section, both companies have a very low receivable turnover ratio as compared to industry which implies inefficiency in receivable management system.

Moana records its receivables at fair value and establish provision for bad debts periodically when there is evidence of such occurrence whereas Sanford determine allowance of doubtful debts by evaluating line by line items..

Both companies need to increase their collection period to improve their receivable management. They can use factoring and early settlement discount schemes for the same

Payables Management

Payables management include management of trade payables which includes amount company owes to its vendors. It is also an important component for working capital management as companies needs to analyze their terms of credit to forecast their needs for short term funds.

Both Moana and Stanford recognized trade payables at fair value and then measure them at amortized cost.

Maori/Iwi organizations Environment Analysis

Maori organizations driven by Treaty of Waitangi have shown accelerated growth in past few decades. Many Maori organizations fulfil various other purposes than just making profit. As mostly maori organizations are owned by maori people i.e. majority of their shares are owned by maori people, they give more importance to cultural and social aspirations of their owners (Cultural and values/ Maori Business, 2013).

Their core value is to protect and uplift their community’s interest. Maori organizations work on Te Kaupapa pakihi fundamentals which include:

- Putake: It means the origin or reason for being. Though maori organizations come into existence for the same reason as other organizations i.e. profit making, they emphasize on ‘multiple bottom line’ where cultural, social, spiritual and economic goals are stated in annual reports and mission statements alongwith profit making objectives.

- Turanga: It means positioning. Maori organizations formed by collectively owned resources may be subject to specific laws for example, in setting up an organization, if land is core asset, that land will not be sold for either tikanga or legal reasons.

- Tikanga: It signifies value system of maori people including priorities, rules and ways of doing business. These values set them apart from other organizations. These values include:

- Maori diversity

- Maori unity

- Self determination, control and ownership

- An ethic of belonging, kinship

- Guardianship of natural resources

- Spirituality

- Generosity, hospitality, care and giving

- Cross-sectoral alignment

- The best possible return is sought on integrated goals

- Multiple responsibilities and acoountability.

Legal Environment: Maori organizations are subject to same legal framework as other organizations of New Zealand which includes Companies Act 1993, Consumer Guarantees Act 1993, Income tax act 2007 etc. Apart from this, these organizations are also governed by special governing bodies which are set up for maori organizations. For example Moana New Zealand is governed by Te Ohu Kaimoana, a body set up by the government to protect Maori interest in the marine environment (2608 Identify legal structures, taxation, and income distribution for Māori organisations, 2017).

Taxation system for maori organizations is also similar to other organizations which includes Income tax, GST, Fringe benefit tax etc.

Accounting standards and Reporting system: Maori organizations compliance requirements are same as of other organizations of New Zealand. Their financial statements are prepared with generally accepted accounting practice (GAAP) and comply with NZ IFRS i.e. New Zealand equivalent to International Financial Reporting Standards.

Therefore it can be concluded that financial considerations for Iwi/ Maori organizations are almost similar except the fact that their decisions are primarily driven by their culture and value system instead of economic considerations as they give more value to sustainability and environmental factors.

References

2608 Identify legal structures, taxation, and income distribution for Māori organisations. (2017). Retrieved September 17, 2018, from NZQA: https://www.nzqa.govt.nz/nqfdocs/units/pdf/2608.pdf

Cultural and values/ Maori Business. (2013, August 9). Retrieved September 17, 2018, from SeniorSecondary: http://seniorsecondary.tki.org.nz/Social-sciences/Business-studies/Maori-business/Culture-and-values

Herath, H. S. (2018). Inference of economic truth from financial statements for detecting earnings management: Inventory costing methods from an information economics perspective. Managerial and Decision Economics, 39(4), 389-402. Retrieved September 17, 2018

Mautz, R. D. (2006). Understanding the basics of financial statement analysis. Commercial Lending Review, 21(5), 27-34.

Nissim, D. &. (2001, March). Ratio analysis and equity valuation: From research to practice. Review of Accounting Studies, 6(1), 109. Retrieved September 15, 2018

Sanford. (2017). Sanford Annual Report 2017. Sanford Limited. Retrieved Setember 17, 2018, from file:///E:/Research%20Pixie/Sanford-2017-Annual-Report.pdf

Sanford Ltd (SAN.NZ) financials. (2018, September 17). Retrieved September 17, 2018, from Reuters: https://www.reuters.com/finance/stocks/financial-highlights/SAN.NZ

SBC. (2018, September 15). Moana New Zealand- SBC. Retrieved September 15, 2018, from Sbc: http://www.sbc.org.nz/our-members/sbc-members/moana

Zealand, M. N. (2017). Moana Annual Report 2017. Moana New Zealand Limited. Retrieved September 17, 2018, from https://moana.co.nz/wp-content/uploads/2018/03/Moana-Annual-Report-2017_web.pdf

Resources

- 24 x 7 Availability.

- Trained and Certified Experts.

- Deadline Guaranteed.

- Plagiarism Free.

- Privacy Guaranteed.

- Free download.

- Online help for all project.

- Homework Help Services

Testimonials

Urgenthomework helped me with finance homework problems and taught math portion of my course as well. Initially, I used a tutor that taught me math course I felt that as if I was not getting the help I needed. With the help of Urgenthomework, I got precisely where I was weak: Sheryl. Read More