Committee and Research For Blog

PART 1: Committee Report

There has been a recent repeal of interest rates caps which has resulted in macroeconomic instability due to market volatility and uncertainties. As a result, the Central Bank of Kenya lowered the interest rates to 8.5%. In the period between 1991 and 2019, the country’s interest rates have averaged 13.69%. As a result of lowering the interest rates, the government has managed to maintain the level of inflation at the desired level. The short term economic impact is the food prices have been relatively stable. At the same time, the cost of energy has also been low. Another effect of lowering the interest rates is that credit in the private sector also increased. The level of investment in the country also increased. The government’s decision to lower the interest rates was due to numerous factors. One of the factors is that the weather conditions have improved, the tourism industry has also improved. The long term effect of lowering the interest is that the government is expecting the level of investment in the country to increase thereby leading to macroeconomic stability (Kenya Interest Rate, 2019).

Aggregate Demand and Aggregate supply

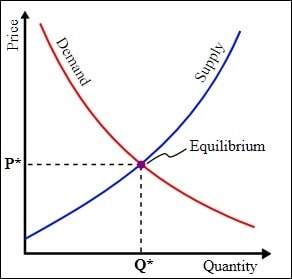

In an economy, there is the concept of equilibrium which refers to a state whereby the forces of demand and supply are in a balance. If there are no changes in the market as a result of external forces, then the quantity and price remain balanced or in equilibrium. This concept is illustrated in figure 1. In a market where competition exists, the price per unit of a commodity continues changing until the point where the quantity supplied is equal to the quantity demanded (Ball & Tseng, 2017). In a situation where there is an increase in the quantity demanded while the quantity supplied remains constant, then there is a shortage and therefore the prices tend to increase.

Figure 1

Aggregate supply-Aggregate demand

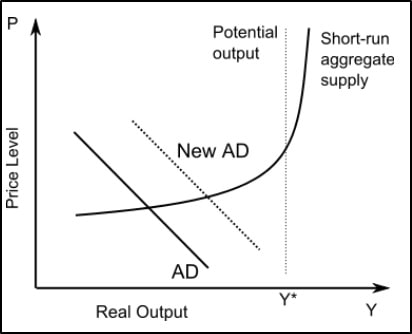

The macroeconomic equilibrium is represented by the AS-AD curve/graph. The price of goods and services, in the long run, will increase if the aggregate demand increases. The increase in aggregate demand leads to a shift in the aggregate demand curve. The shift takes place to the right. In the long-run, the aggregate supply is influenced by technological changes, population increase as well as an increase in physical capital stock (Brady, 2018). The aggregate supply is responsible for determining the level of increase in the aggregate demand as reflected by the increase in output. Also, it determines the prices of goods and services.

Figure 2

The effect on interest rates on the AS-AD model

A decrease in the interest rate as in the case of Kenya in 2019 discussed in this paper leads to the expansion of the economy. It implies that the money supply has increased and as a result, the net exports and the level of investment have increased. Consequently, the AD curve will shift to the right or outwards (Hartwig, 2011). A decrease in the rates of interest is accompanied by an increase in government spending. Also, there is an increase in consumer confidence as well as business confidence. Besides, the economy experiences an increase in the level of investment.

PART 2: Research for blog

Raising of the short-term interest rate in 1995

In the financial year ending 1994, the federal government perceives that there was a probability that the rate of inflation was going to be higher than normal. For this reason, the federal government raised the short-term interest rate by 3%. This move was meant to slow down economic activity. Some of the reasons as to why the rate of inflation was increasing are that the level of spending, employment rate, and output had increased. By mid-1995, the level of retail sales had decreased as a result of a declined activity in the manufacturing industry (Klein, 2019). The rate of sales decreased from 9% to 3%. As a corrective mechanism, the federal government lowered the policy rate in 1996. Another impact of raising the short-term interest rate is that the number of jobs created reduced significantly from 300,000 to 100,000. After the interest rates were lowered, the United States’ economic activity regained as the country’s level of output increased. Also, the level of employment increased as more jobs were created. The economy recovered considerably with respect to the recession that took place in 1991.

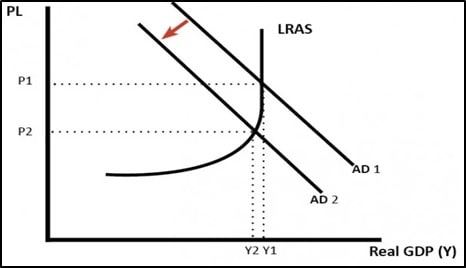

Whenever the government perceives that the inflation rate is expected to rise, the central bank takes the initiative of increasing the interest rates. When the interest rates are high, the country’s economic growth becomes moderated. Consumer spending becomes reduced, the cost of borrowing increases and the disposable incomes becomes reduced. The overall effect is that the aggregate demand reduces and the AS-AD curve shifts inward as illustrated in figure 3.

Figure 3

References

Ball, R., & Tseng, A. (2017). Aggregate Supply and Demand Shocks and Asset Prices. SSRN Electronic Journal. Doi: 10.2139/ssrn.2930996

Brady, M. (2018). Keynes’s IS-LM(LP) Model Was Complementary with Keynes’s Aggregate Demand(D)-Aggregate Supply(Z) Model: They Were Never Rival Models. SSRN Electronic Journal. Doi: 10.2139/ssrn.3261010

Hartwig, J. (2011). Aggregate Demand and Aggregate Supply: Will the Real Keynes Please Stand Up? Review of Political Economy, 23(4), 613-618. Doi: 10.1080/09538259.2011.611626

Kenya Interest Rate. (2019). Kenya Interest Rate | 2019 | Data | Chart | Calendar | Forecast | News. Retrieved 14 December 2019, from https://tradingeconomics.com/kenya/interest-rate

Klein, M. (2019). How to Avoid a Recession? Cut Interest Rates Like It’s 1995. Retrieved 14 December 2019, from https://www.barrons.com/articles/how-to-avoid-recession-cut-rates-like-its-1995-51565993023

Resources

- 24 x 7 Availability.

- Trained and Certified Experts.

- Deadline Guaranteed.

- Plagiarism Free.

- Privacy Guaranteed.

- Free download.

- Online help for all project.

- Homework Help Services

Testimonials

Urgenthomework helped me with finance homework problems and taught math portion of my course as well. Initially, I used a tutor that taught me math course I felt that as if I was not getting the help I needed. With the help of Urgenthomework, I got precisely where I was weak: Sheryl. Read More