ECON214 Monetary policy

Introduction

The paper provides an analysis of the financial crisis in developed countries compared to the financial crisis in developing countries. The main focus is on the financial crisis concerning to US and China. Depression or recession is the prolonged and severe state of the downturn in the commercial activities of an economy. The last recession that lasts for more than two years is referred to as depression (Bianchi, 2019). The paper shows various instances of the recession in the country of the US as well as China.

The financial crisis in Developed and developing countries

United States of America

The economic crisis in the US is a sudden and severe upset in all parts or any part of the economy. The crisis could be a crash in the stock market, inflations spike and series of failures in banks or unemployment. These factors have a severe effect on the economy even if they don't necessarily go ahead for a recession (Roos & Zaun, 2016). In every ten years, it has been observed that the US has an economic crisis. Since the causes for the crisis are different every time, therefore, they are trying to get rid of.

Six major crises happened in the US economy, they are –

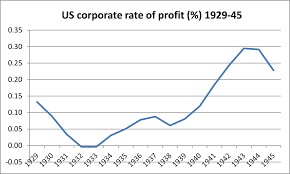

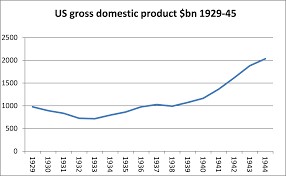

The great depression of 1929 – In October 1929 the crashing of the stock market kicked off a major recession in the country and several parts of the world. The crash disintegrated millions of people's life savings. The crash in the stock market caused depression.

One of the major causes was the use of compressed economic policy set by the Federal Reserve to protect the dollar's value, which was at the time based on the standard of gold (Benmelech, Frydman & Papanikolaou, 2019). The policies of the Federal Reserve created a deflation. According to the Bureau of Labor Statistics, the Consumer Price Index or CPI fell up to 27 per cent from November 1929 to March 1933.

The effects devastated the economic condition of America for ten years. Price of housing fell 31 per cent and the GDP fell 29 per cent. Many firms became bankrupt, and the rate of unemployment pointed at 24.9 per cent in 1933.

The spending of the government on the New Deal as well as World War II ended the depression, but it already forced the debt to GDP ratio of the country to a massive 126 per cent.

Figure: corporate profit percentage of US during 1942-45

Figure: GDP of US during 1942-45

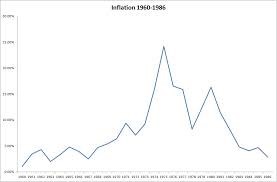

The stagflation of 1970's – the 1973 OPEC oil embargo where the OPEC countries stopped exporting oil to the US set the crisis in motion. The government's reaction to the blockade led to massive inflation and eventually to a recession. According to the Bureau of Economic Analysis, the economy had been constricted by 4.8 per cent during the first quarter of 1974.

Figure: inflation during the stagflation of 1970

The rate of unemployment was at a peak with 9 per cent in 1975. After President Nixon separated the dollar from the gold standard the price of every commodity became too high (Khademian & Azizi, 2017). He froze the prices and wages to curb inflation. This move made companies dismiss workers as they couldn't increase the rates or lower the salaries.

To end the crisis the then chairman of the Federal Reserve, Paul Volcker used constricted economic policy. He raised the rates of interest to suppress inflation.

The recession of 1981 – the high-interest rates set by the Federal Reserve to curb the inflation created an even worst recession since 1929. For the six of the twelve quarters during the recession, the economy shrank to its lowest. The second quarter of 1980 saw it shrink down to 8 per cent. The rate of unemployment was above ten per cent for ten months (Foster, Grim & Haltiwanger, 2016). During November and December 1982, the rate of unemployment further rose to 10.8 per cent. It was the highest rate seen in the world during any recession in that period.

President Ronald Reagan increased the spending and cut significant taxes to end the recession finally. The national debt during his tenure of eight years got doubled.

Savings and Loan scandal of 1989 – this crisis was created by Charles Keating who was an American banker and his counterparts. The capital was raised by them using federally insured deposits for risky investments in the real estates. Five senators were involved in accepting the contributions for destroying the bank regulator so that their criminal investigations go unnoticed (Oglesby & Steinreich, 2016). No warnings beforehand were provided to the public since the banks hid their business transactions. The crisis led to the closure of more than 1000 banks in the country.

In July 1990 the crisis led to a depression. The economy shrank down by 3.6 per cent by the fourth quarter of the year. The rate of unemployment was at a peak of 7.8 per cent in June 1992. The bailout of the economy added a national debt of 126 billion USD. The savings and loan crisis is considered as one of the worst bubbles to burst since the year 1980.

9/11 attacks – the attack at the world trade centre on 11th September 2001 stopped the air traffic and closed the New York Stock Exchange until 17th September. When the NYSE reopened, it was found that the Dow had dropped 617.70 points and at the time no warning was given to the population.

The crisis threw the country into the states of recession which lasted until 2003 (Aslam & Kang, 2015). The economy had shrunk down to 1.7 per cent by the third quarter of 2002. The rate of unemployment was at a peak of 6.3 per cent in 2003. Additionally, the uncertainty of the United States going for war and its subsequent ‘War on Terror' added debt of 2 trillion USD on the economy.

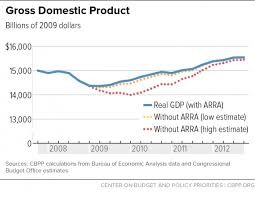

The recession of 2008 – the economic crisis was the worst the country had seen since the great depression of 1929. The housing prices started falling, and the defaults in the payments of mortgages began rising in 2006. The Federal Reserve, as well as most analysts, ignored these warnings.

The banks had allowed several people to borrow subprime mortgages and in 2007. It led to the crisis of subprime mortgage (Walker, 2019). When too many people defaulted in their mortgage payments, the banks called in the insurance companies to credit their default payments. This move forced insurance companies such as the AIG (American International Group) and Bear Sterns among others to bankruptcy.

Figure: GDP of the US during the recession of 2008-12

This caused a global banking panic, and the banks stopped lending by the mid-summer. Terrified corporations withdrew 140 million USD from their money market securities. In the first quarter, the economy of the country shrank by 2.3 per cent to 8.4 per cent in the fourth quarter. US Congress approved a bailout package of 700 million dollars to end the depression in July 2009.

Most developing economies stumble at some point or the other to face some depression or crisis. But China has not seen any financial crisis in the last 25 years. There has been a spectacular rise in the Chinese economy since 1979. China’s average Gross Domestic Product rate grew at ten per cent every year. China in the last 30 years has lifted more than 800 million people from the grip of poverty (McInnis & Myers, 2015). The rapid economic growth of China has led to significant international ties in regards to trade and manufacturing with the United States. According to the United States' trade data, the total trade between the two countries sustained major growth from 5 billion dollars in 1980 to 634 billion dollars in 2017. It is currently the US's most significant trade merchandising partner and third largest exporter as well as the most significant import source.

China

There was no recent massive crisis pertaining to the country of China because the state spends considerably in supplementing the economy of it. China also directs the banks to lend more money to the population and the organizations in the nation in addition to spending more on the economy. According to the data of the World Bank, China's stimulus is substantially represented by the increased crediting by the banks which is about 40 per cent (Fontaine, Didier & Razafindravaosolonirina, 2017). Much of this lending is done by the four major banks in the country which are state-owned. The money that the banks lend mostly goes on to infrastructure, every type of corporate projects and real estate. Many of the processes are carried out by state-owned enterprises. Since a recession could threaten the country's economic and political stability; therefore, the money is helpful to increase the growth and productivity of the country.

However, during the great depression of 1929 china ensured a higher demand for precious metals such as silver in significant quantities into the economy. This move increased the supply of money into the Chinese market and sustained mild inflation in the prices of the commodities (Wen & Wu, 2019). The banks negotiated contracts of the loan with the cotton and silk manufacturing companies on the supposition that the value of the collateral would increase over time or remain steady.

The Great Leap Forward of 1958 to 1962, China primarily focused on mobilizing the underemployed labour on projects designed to raise agricultural production (Wemheuer, 2015). The country coupled with the unwarranted withdrawal of the agricultural excess with the required agricultural products. The state combination of bureaucratic leadership the peasants with these factors led to the dissatisfaction of the peasants, and the output crashed disastrously leading to mild economic depression.

During the period of modernization under Deng Xiaoping and Liu Shaoqi in the year 1962 to 1966, the agrarian labour within huge centralized communities was abandoned. Peasants were allowed to dispose of a limited part of their agricultural surplus in the free market (Nathan, 2017). At the same time, the policy based on autocracy leadership suppressed the trading with western markets and increased the impacts of the undue recession.

After the death of the Chinese premier Mao in 1976, Deng Xiaoping committed to the spreading of the industrialization process and speeded the integration of the Chinese market into the global market. The country also speeded up its efforts for the search of credits for capitalism, dismantling the communes of the people and encouraged full rehabilitation of the material incentives (Xiaotong & Keith, 2017). This sudden turn of events threw the economy of the country in an off-balance in 1979.

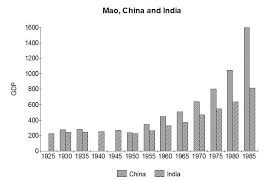

Figure: economic growth of China during the premiership of Mao

In the years of the US economic crisis, China has time and time again turns towards the policies regarding the credit to stabilize the economy. Whenever there is a risk of recession, the country encourages its banks to lend more and crack down the confidence when the bubbles concerning real estate threaten to extend out of control. In order to limit a possibility in housing bubbles, the government tightened the lending of the banks in 2011, 2013 and again in 2017. In 2014 the country eased the loan of the banks in order to encourage the economy. China cut the banks' reserve requirements to support the expansion of credit in 2016. Recently in the heat of trade war with the US, the country reduced the criteria to reserve and stimulated bank lending incorporated with various monetary policy tweaks.

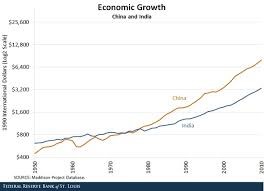

Figure: economic growth of China compared to another developing country (India)

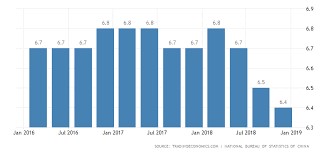

Various economic analysts are predicting that recession in China is inevitable following its trade war with the US in recent years. International Monetary Fund’s risk assessment of a country, suggests that China's economy is heading for a slowdown and it will affect every major economy of the world (Kim, 2019). The rising interest rates in the country are dampening the investments into the economy and heavily influence the profit generation of the country in the near future.

Figure: current economic growth of China

Conclusion

The paper concludes that America has seen six major recessions in the past eight decades. The first major recession was called ‘The great depression of 1929’. The second was the stagflation of 1970 which was due to the OPEC countries stopped exporting oil to the country. The third major recession happened in 1981 due to an increase in the interest rates by the Federal Reserve. The fourth major depression occurred due to the savings and loan scandal in 1989. The fifth recession happened due to the attacks of 9/11. The latest recession happened in 2008 due to the increase in mortgage lending by banks. The paper also shows that there is no major depression caused by the developing economy of China in recent years. However, the country faced some mild to a severe recession in the years 1958 to Mao's death in 1976.

References

Aslam, F., & Kang, H. G. (2015). How different terrorist attacks affect stock markets. Defence and Peace Economics, 26(6), 634-648.

Benmelech, E., Frydman, C., & Papanikolaou, D. (2019). Financial frictions and employment during the great depression. Journal of Financial Economics.

Bianchi, F. (2019). The Great Depression and the Great Recession: A View from Financial Markets. Journal of Monetary Economics.

Fontaine, I., Didier, L., & Razafindravaosolonirina, J. (2017). Foreign policy uncertainty shocks and US macroeconomic activity: Evidence from China. Economics Letters, 155, 121-125.

Foster, L., Grim, C., & Haltiwanger, J. (2016). Reallocation in the Great Recession: cleansing or not?. Journal of Labor Economics, 34(S1), S293-S331.

Khademian, Z., & Azizi, K. (2017). The effect of participatory investment, marketing, and management on increasing productivity based on solving stagflation crisis in iran. Revista QUID, 1(1), 1727-1747.

Kim, M. H. (2019). A real driver of US–China trade conflict: The Sino–US competition for global hegemony and its implications for the future. International Trade, Politics and Development, 3(1), 30-40.

McInnis, T., & Myers, E. (2015). DISRUPTIVE POWER: A COMPARISON OF POLITICAL VOICE FOR NON-ELITES AFTER THE GREAT DEPRESSION & THE RECESSION OF 2008. Undergraduate Research Journal.

Nathan, A. J. (2017). China’s changing of the guard: Authoritarian resilience. In Critical Readings on Communist Party of China (pp. 86-99). BRILL.

Oglesby, R. A., & Steinreich, D. (2016). The Savings and Loan Debacle Twenty-Five Years Later: A Critical Appraisal, Interest-Group Theory Re-Examination, and Final Closing of the Book. Journal of Accounting and Finance, 16(3).

Roos, C., & Zaun, N. (2016). The global economic crisis as a critical juncture? The crisis’s impact on migration movements and policies in Europe and the US.

Walker, S. M. (2019). Futures Thinking: Strategy Used by Trust Bank to Survive Global Economic Collapse During the Great Recession of 2008. In Futures Thinking and Organizational Policy (pp. 269-284). Palgrave Macmillan, Cham.

Wemheuer, F. (2015). Database of Chinese Great Leap Forward and Great Famine 1958-1962. The China Journal, (73), 278.

Wen, Y., & Wu, J. (2019). Withstanding the Great Recession Like China. The Manchester School, 87(2), 138-182.

Xiaotong, Z., & Keith, J. (2017). From wealth to power: China's new economic statecraft. The Washington Quarterly, 40(1), 185-203.

Resources

- 24 x 7 Availability.

- Trained and Certified Experts.

- Deadline Guaranteed.

- Plagiarism Free.

- Privacy Guaranteed.

- Free download.

- Online help for all project.

- Homework Help Services

Testimonials

Urgenthomework helped me with finance homework problems and taught math portion of my course as well. Initially, I used a tutor that taught me math course I felt that as if I was not getting the help I needed. With the help of Urgenthomework, I got precisely where I was weak: Sheryl. Read More