Financial Analysis Question Sample Assignment

FINANCIAL ANALYSIS

Question 1

National Gas Company SAOG is an Oman based company that is involved in marketing, production, and distribution of liquefied gas (LPG).

Vertical analysis of the Income statement

Each line item in the income statement is stated as a percentage of the gross sales/Revenue. The top line number of sales as 100% and every other account will indicate as a percentage of the number of total sales.

|

Period Ending: |

2018 |

2017 |

2016 |

2018 |

2017 |

2016 |

|

OMR (M) |

OMR (M) |

OMR (M) | ||||

|

Total Revenue |

77.7 |

60.66 |

68.11 |

100.00% |

100.00% |

100.00% |

|

0.00% |

0.00% |

0.00% | ||||

|

Cost of Revenue, Total |

68.06 |

49.58 |

58.91 |

87.59% |

81.73% |

86.49% |

|

Gross Profit |

9.64 |

11.08 |

9.2 |

12.41% |

18.27% |

13.51% |

|

Total Operating Expenses |

73.5 |

55.06 |

63.94 |

94.59% |

90.77% |

93.88% |

|

Operating Income |

4.2 |

5.6 |

4.18 |

5.41% |

9.23% |

6.14% |

|

Interest Income (Expense), Net Non-Operating |

-0.86 |

-1.06 |

-2.17 |

-1.11% |

-1.75% |

-3.19% |

|

Gain (Loss) on Sale of Assets |

0.01 |

0.52 |

0.07 |

0.01% |

0.86% |

0.10% |

|

Other, Net |

0.42 |

0.15 |

0.49 |

0.54% |

0.25% |

0.72% |

|

Net Income Before Taxes |

3.78 |

5.21 |

2.57 |

4.86% |

8.59% |

3.77% |

|

Provision for Income Taxes |

1.1 |

1.16 |

0.73 |

1.42% |

1.91% |

1.07% |

|

Net Income After Taxes |

2.68 |

4.05 |

1.84 |

3.45% |

6.68% |

2.70% |

|

Minority Interest |

-1.01 |

-1.25 |

-0.31 |

-1.30% |

-2.06% |

-0.46% |

|

Net Income Before Extraordinary Items |

1.67 |

2.8 |

1.53 |

2.15% |

4.62% |

2.25% |

|

Net Income |

1.67 |

2.8 |

1.53 |

2.15% |

4.62% |

2.25% |

Vertical analysis of balance sheet

Each line item in the balance sheet are stated as a percentage of total assets. The top line number of total assets and total liabilities/equities of 100% and every other account will indicate as a percentage of the number of total assets or total liabilities and equity.

|

Let us convert the same into percentage terms and derive some conclusions. | ||||||

|

Period Ending: |

2018 |

2017 |

2016 |

2018 |

2017 |

2016 |

|

OMR (M) |

OMR (M) |

OMR (M) | ||||

|

Total Current Assets |

38.61% |

35.03% |

31.37% |

20.56 |

16.52 |

14.36 |

|

0.00% |

0.00% |

0.00% | ||||

|

Total Assets |

100.00% |

100.00% |

100.00% |

53.25 |

47.16 |

45.78 |

|

0.00% |

0.00% |

0.00% | ||||

|

Total Current Liabilities |

40.66% |

37.13% |

34.73% |

21.65 |

17.51 |

15.9 |

|

0.00% |

0.00% |

0.00% | ||||

|

Total Liabilities |

64.51% |

63.87% |

66.73% |

34.35 |

30.12 |

30.55 |

|

0.00% |

0.00% |

0.00% | ||||

|

Total Equity |

35.49% |

36.13% |

33.27% |

18.9 |

17.04 |

15.23 |

|

0.00% |

0.00% |

0.00% | ||||

|

Total Liabilities & Shareholders' Equity |

100.00% |

100.00% |

100.00% |

53.25 |

47.16 |

45.78 |

Horizontal analysis of the income statement

Also known as trend analysis indicates numbers in succeeding period as a percentage of the amount in the baseline year expressed which the amount is expressed and listed as 100%

Horizontal Analysis formula = [(Amount in comparison year – Amount in base year)/ Amount in base year] x 100

|

Horizontal analysis of the income statement | |||||||

|

OMR (M) |

OMR (M) | ||||||

|

Period Ending: |

2017 |

2016 |

%YOY Increase |

%YOY Increase |

2018 |

2017 |

2016 |

|

31/12 |

31/12 |

2016 |

2017 |

2018 |

2017 |

2016 | |

|

Total Revenue |

77.7 |

60.66 |

-10.94% |

28.09% |

OMR (M) |

OMR (M) |

OMR (M) |

|

77.7 |

60.66 |

68.11 | |||||

|

Cost of Revenue, Total |

68.06 |

49.58 |

-15.84% |

37.27% | |||

|

Gross Profit |

9.64 |

11.08 |

20.43% |

-13.00% |

68.06 |

49.58 |

58.91 |

|

Total Operating Expenses |

73.5 |

55.06 |

-13.89% |

33.49% |

9.64 |

11.08 |

9.2 |

|

73.5 |

55.06 |

63.94 | |||||

|

Operating Income |

4.2 |

5.6 |

33.97% |

-25.00% | |||

|

Interest Income (Expense), Net Non-Operating |

-0.86 |

-1.06 |

-51.15% |

-18.87% |

4.2 |

5.6 |

4.18 |

|

Gain (Loss) on Sale of Assets |

0.01 |

0.52 |

642.86% |

-98.08% |

-0.86 |

-1.06 |

-2.17 |

|

Other, Net |

0.42 |

0.15 |

-69.39% |

180.00% |

0.01 |

0.52 |

0.07 |

|

Net Income Before Taxes |

3.78 |

5.21 |

102.72% |

-27.45% |

0.42 |

0.15 |

0.49 |

|

Provision for Income Taxes |

1.1 |

1.16 |

58.90% |

-5.17% |

3.78 |

5.21 |

2.57 |

|

Net Income After Taxes |

2.68 |

4.05 |

120.11% |

-33.83% |

1.1 |

1.16 |

0.73 |

|

Minority Interest |

-1.01 |

-1.25 |

303.23% |

-19.20% |

2.68 |

4.05 |

1.84 |

|

Net Income Before Extraordinary Items |

1.67 |

2.8 |

83.01% |

-40.36% |

-1.01 |

-1.25 |

-0.31 |

|

Net Income |

1.67 |

2.8 |

83.01% |

-40.36% |

1.67 |

2.8 |

1.53 |

Horizontal analysis of balance sheet

Also known as trend analysis indicates numbers in succeeding period as a percentage of the amount in the baseline year expressed which the amount is expressed and listed as 100%

Horizontal Analysis formula = [(Amount in comparison year – Amount in base year)/ Amount in base year] x 100

|

Horizontal analysis | ||||||||

|

OMR (M) |

OMR (M) |

OMR (M) |

% YOY increase |

% YOY increase | ||||

|

Period Ending: |

2017 |

2016 |

2015 |

2017 |

2016 |

2018 |

2017 |

2016 |

|

OMR (M) |

OMR (M) |

OMR (M) | ||||||

|

Total Current Assets |

20.56 |

16.52 |

14.36 |

24.46% |

15.04% |

20.56 |

16.52 |

14.36 |

|

Total Assets |

53.25 |

47.16 |

45.78 |

12.91% |

3.01% |

53.25 |

47.16 |

45.78 |

|

Total Current Liabilities |

21.65 |

17.51 |

15.9 |

23.64% |

10.13% |

21.65 |

17.51 |

15.9 |

|

Total Liabilities |

34.35 |

30.12 |

30.55 |

14.04% |

-1.41% |

34.35 |

30.12 |

30.55 |

|

Total Equity |

18.9 |

17.04 |

15.23 |

10.92% |

11.88% |

18.9 |

17.04 |

15.23 |

|

Total Liabilities & Shareholders' Equity |

53.25 |

47.16 |

45.78 |

12.91% |

3.01% |

53.25 |

47.16 |

45.78 |

Recommendations

The vertical analysis of the income statement reveals the decline in the net income of the company as a result of the increased cost of goods sold. The marketing expenses for the company has increased in the percentage of sales indicating that the amount of money invested in marketing and salaries were not efficient in increasing sales growth when compared to previous years. We cannot accurately pinpoint the problems with the common size statement, but it is apparent that gross profits and cost of goods sold for the company has a big issue to the income statement.

The gross profit for National gas has declined from an increase of 83.25% in 2017 to a decline of 40.6% in 2018 while the research and development as an expense have increased from 1.2/5 to 1.3% implying that the company might be having a very competitive competitor.

The company should work towards reducing the operating cost and cost of revenue that have reduced the net income. The total operating expenses for the company have been more than 92% of the total revenue. The company should find alternative means of reducing the operating costs that have grossly contributed to shrinking net income.

Question 2

1. Evaluating IRR of the two projects using excel

|

CALCULATING IRR IN EXCEL | ||||

|

PERIOD |

SOHAR |

NIZWA |

Estimated IRR |

12% |

|

YEAR 0 |

-500000 |

-500000 |

IRR for Sohar |

21% |

|

YEAR 1 |

150,000 |

200,000 |

IRR For Nizwa |

23% |

|

YEAR 2 |

160,000 |

185,000 | ||

|

YEAR 3 |

190,000 |

160,000 | ||

|

YEAR 4 |

175,000 |

175,000 | ||

|

YEAR 5 |

200,000 |

150,000 | ||

The IRR for Nizwa is higher compared to Sohar and hence should be selected.

b)

Based on the data provided, Sohar has a higher population growth of 12% and higher consumer trend growth of 10% compared to Nizwa that had a population growth rate of five percent and consumer trend being stagnant. However, the level of competition was higher at Sohar project compared to Nizwa project. Furthermore, the IRR of Nizwa is higher than that of Sohar, and hence Nizwa looks more profitable despite being located in a place with low population growth and stagnant consumer’s growth.

Yes, the growing population of Sohar means increased demand and increased supply because of the strong level of competition. The project that will be implemented at Sohar will not care so much about the relative scarcity of competitors, and hence it will not matter if the overall population for the place is growing. The relative number of competitors and the rest of the population is what that will matter. The population, in this case, implies customers and the trend in consumer growth.

Higher population and increased consumer number mean there is a growing market where the competitors will be competing for the new customers. The Nizwa project has stagnated and shrinking consumer and population growth rate is only five percent implying the incumbent will have to compete for the existing customers. The Sohar will have a steady flow of new customers due to the population increase, and it will take it many years before closing.

Applying economic theory, competing for the customers that already exist in the market is harder due to high switching costs and the existing business have great information about their customers.

However, I would select NIzwa project because of its higher IRR and low competition which outweighs the higher growth rate and consumer growth in Sohar.

- Non-financial factors

Yes, the growing population of Sohar means increased demand and increased supply because of the strong level of competition. The project that will be implemented at Sohar will not care so much about the relative scarcity of competitors, and hence it will not matter as long as the overall population for the place is growing. The relative number of competitors and the rest of the population is what that will matter. The population, in this case, implies customers and the trend in consumer growth.

Recommendation

The Sohar will have a steady flow of new customers due to the population increase, and it will take it many years before closing. The company should select the option for Sohar. The growing population of Sohar means increased demand and increased supply because of the strong level of competition. The population, in this case, implies customers and the trend in consumer growth. Because of the stiff competition, Sohar will have to fight for customers including talking short term losses by lowering prices of its products and services.

Question 3

|

Particulars |

Product A per unit |

Product B |

|

Sales price |

20 |

15 |

|

Material |

10 |

9 |

|

Direct wages |

3 |

2 |

|

Variable expenses |

100% of direct wages |

100% of direct wages |

|

Fixed expenses |

800 |

- Contribution per unit

Product A

Contribution per unit = (Sale Price – Total Variable Costs) ÷ Total units

Contribution per unit = (20-10-3-3)/1= RO 4

Product B

Contribution per unit = (Sale Price – Total Variable Costs) ÷ Total units

Contribution per unit = (15-9-2-2)/1= RO 2

- Total contribution = contribution per unit X Number of units

Scenario 1: 100 x 4 + 200 x 2 = RO800

Scenario 2: 150 x 4 + 150 x 2 = RO900

Scenario 3: 200 x 4 +100 x 2 = RO1000

Total profit = contribution - fixed costs

Scenario 1: 800-800 = RO0

Scenario 2: 900 -800 = RO100

Scenario 3: 1000-800 = RO200

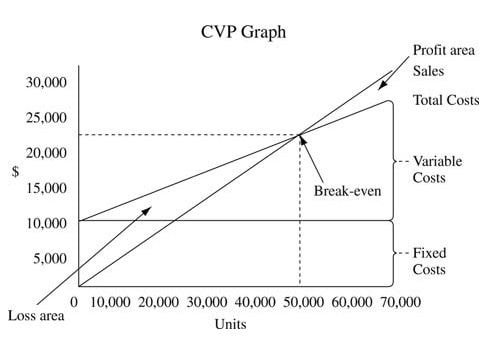

- Cost volume profit analysis

Is used to determine how changes in volume and costs affect the net income and operating income of a company (Munawwar & Ghedira, 2014). Several assumptions have been made concerning the above including all company’s profit being classified as either fixed or variable costs. When calculating the CVP analysis, necessary calculations that can be done include contribution margin ratio and contribution margin. As discussed above, the contribution margin refers to the amount of profit or income that the company has made after fixed costs have been deducted. Or it’s the amount of sales revenue available to take care of the fixed costs. The company, after ensuring its fixed cost are covered will now focus on having income. The sales revenue less variable costs are the contribution margin (Baral, 2016). The contribution margin is divided by the revenue amount or sales to find the contribution margin ratio.

The other concept of CVP involves breakeven point which represents the sales level where the net income is equated to zero. It’s the point where total costs (variable and fixed) is equal to sales revenue, and the fixed costs are equal to the contribution margin.

The analysis of the CVP involves a company trying to determine the sales level in which a specific level of income is to be attained also known as targeted income. The target income can be calculated by adding the fixed income to the targeted income, and the total figure is divided by the contribution margin ratio and hence the required level of sales in units will be known (Liu & Younis, 2012).

Recommendation

Scenario 3 should be selected by the company because of its higher value of RO200 compared to the other scenarios. The higher contribution in scenario means higher financial value after implementing the project suing the scenario.

References

Liu, L. L., Forgione, D. A., & Younis, M. Z. (2012). A comparative analysis of the CVP structure of nonprofit teaching and for-profit non-teaching hospitals. Journal of health care finance, 39(1), 12.

Baral, G. (2016). Cost–Value–Profit Analysis and Target Costing with Fuzzy Logic Theory. Mediterranean Journal of Social Sciences, 7(2), 21.

Munawwar, S., & Ghedira, H. (2014). A review of renewable energy and solar industry growth in the GCC region. Energy Procedia, 57, 3191-3202.

Bastos, J. A., & Caiado, J. (2011). Recurrence quantification analysis of global stock markets. Physica A: Statistical Mechanics and its Applications, 390(7), 1315-1325.

https://www.investing.com/equities/national-gas-co-balance-sheet

https://www.marketscreener.com/NATIONAL-GAS-20701449/company/

Resources

- 24 x 7 Availability.

- Trained and Certified Experts.

- Deadline Guaranteed.

- Plagiarism Free.

- Privacy Guaranteed.

- Free download.

- Online help for all project.

- Homework Help Services

Testimonials

Urgenthomework helped me with finance homework problems and taught math portion of my course as well. Initially, I used a tutor that taught me math course I felt that as if I was not getting the help I needed. With the help of Urgenthomework, I got precisely where I was weak: Sheryl. Read More