Logistics challenges in the United Arab Emirates

Introduction

In an ultra-competitive business environment, where competition is increased and growth in business is accomplished globally, companies look beyond their organisational boundaries to develop their logistics capabilities. In the past, logistics and Supply Chain Management (SCM) were usually confused, and their function often overlapped (Lummus, Krumwiede, & Vokurka, 2001). Today, logistics is no longer defined as SCM. Logistics management is part of SCM that, and to plan, implement, and control the effectiveness and efficiency of the warehouse, transportation between the origin location and another location in both forward and reverse flow is designed to meet customers’ needs and expectations (Sadler, 2007). Because these two terms have been developed, more companies can recognise and distinguish the difference between them (Christopher & Holweg, 2011). Globalisation has affected logistics, strategic sourcing, and supply chain management. A variety of factors have driven globalisation in logistics, including containerisation, technological change, economies of scale, and growth strategies of multinational companies. The key achievement of the supply chain is directly related to the logistics of the organisation. Therefore, it is vital for companies to recognise the logistic challenges in order to maximise overall organisation performance and customer satisfaction (Prajogo, Chowdhury, Yeung, & Cheng, 2012). The company that fails to embrace change and recognise the challenges accordingly will fail, regardless of their prior success. This paper discusses the overall view of logistics in the United Arab Emirates (UAE) and critically analyses four logistics challenges in UAE. These macro issues are road freight transportation challenges, difficulty in sustainable logistics, fuel price fluctuations, and warehousing challenges.

Logistics in UAE

The UAE has a long trading history in the Arabian Peninsula, which located on the southeast of the Arabian Gulf. According to Mayenkar (2018), UAE retained its third position in on the Logistics Performance Index after China and India in 2018. Three main factors that make UAE an international logistic hub are strategic geographical location, innovative infrastructure and processes, and free market economy policy.

Strategic geographical location

Geography is a vital aspect of any logistics and supply chain operation. The UAE is located between Asia and Europe, linking the Pacific, Atlantic, and Indian Oceans, which connect Eastern and Western counties’ trade and commercial activities. This strategic destination provides advantages to the UAE compared with other Middle Eastern counties. This helps the UAE to be one of the largest integrated facilities in the world.

Innovative infrastructure

In addition to the geographical location, the innovative and quality infrastructure of the UAE establishes significant support that enables logistical development. Jebel Ali Port in Dubai is ranked as the ninth largest container port in the world and the largest marine terminal in the Middle East (World Shipping Council, 2018). Except for infrastructure, information systems and technology also a significant component of the UAE logistics sector’s success. Technology, with its numerous features, allows companies to enhance their communication, operation speed, document processing, and transparency in the logistics operation.

Free market economy policy

The UAE economy has been kept open and free to attract international business and investors. The government has minimum involvement in and control over the regulation of the private sector. Few free-market policies have been implemented to attract expatriate investors, and these policies, including customs duties, are low at 4%, and include many exemptions. Corporate tax and personal income are also exempt (except for oil companies) (Government of Dubai, 2018). The Free Trade Zones were set up to streamline trade and logistics activities. The UAE government has established 45 free zones across the country to encourage foreign investment with simple start-up processes, labour, and immigration procedures (Cherian, 2017).

In 2016, UAE was the sixteenth largest export economy and seventeenth largest import economy in the world, and the UAE exported $298B and imported $270B (Global Edge, 2018). The top three export and import destinations of the UAE are shown in Table 1. It excludes general traded goods. oil & mineral fuels were the top exported goods, at $45.6B, and precious stones and metals were the top imported goods, at $52.8B (Global EDGE, 2018). The primarily export for the UAE is oil and gas, as well as raw materials and finished products. Imports consist of intermediary and consumer goods, and significant re-export trade to other counties, mainly India, East Africa and the Gulf region, occurs.

Table 1.

Top Three Export and Import Destinations of UAE (Global Edge, 2018).

|

Country |

Export USD$ |

Country |

Import USD$ | |

|

India |

$11,255,496,258 |

China |

$22,424,486,71 | |

|

Iran |

$8,810,492,670 |

United States |

$20,587,014,437 | |

|

Switzerland |

$7,424,957,019 |

India |

$18,669,358,619 |

Critical Aanalysis of UAE logistics challenges

Transportation – Road freight transport

Transport is regarded as a non-value-adding activity; however, it plays a crucial role in logistics, and it usually represents the single most substantial logistics cost of a company.

Effective transport improves an organisations’ supply chain by reducing total operating costs and time. Well-organised transport allows the company to work more efficiently and effectively.

Transportation is vital in the UAE economy; the logistics industry constitutes more than

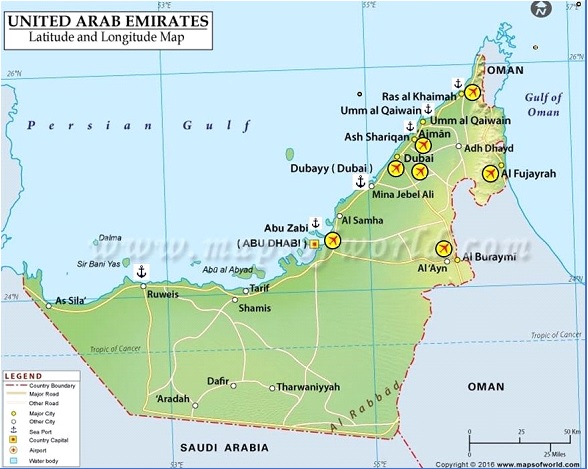

14 % of Dubai’s GDP in 2016 (Global EDGE, 2018). The UAE uses a variety of transport to support logistics activities, including road, sea, air, and pipelines for crude oil and natural gas. The UAE has an extensive and well-developed road network, and seaports and airports; however, it has a limited commercial rail network. Etihad Rail is the only rail network for national freight, which was officially operated in 2017. Although the UAE has an efficient and well-established infrastructure for its seaports and airports, the primary transportation within the country is still road transport. UAE comprehensive transportation facilities, including roads, airports, and seaports, are shown in Figure 1.The UAE faces challenges in road transportation. These changes affect UAE logistics in two areas: traffic congestion and truck driver challenges. Road transportation will be evaluated in term of cost, efficiency, and security:

Traffic congestion

The UAE has the highest population growth rate in the Gulf region because of the continued influx of expatriates, who benefit from expanding business opportunities. The growing population make traffic congestion worse in the UAE. The government predicts that the total volume of traffic on UAE’s roads will double by 2020. Traffic congestion affects logistics efficiency and direct operational costs, and also the opportunity cost of congestion-related delays (McKinnon, Edwards, Piecyk, & Palmer, 2009). Drivers’ time is wasted, more fuel is needed per kilometre travelled, and the vehicles are underutilised. The opportunity costs of congestion of traffic are mainly associated with unreliable delivery and low customer satisfaction, and these also weaken operating efficiency and sales performance.

Truck driver challenges

The UAE’s status as a logistics hub is dependent on the effective transportation of products throughout the region, However, with a crisis in the supply of drivers in terms of qualified experience and salary, it has the potential to cause service disruptions and increases in operational costs, ultimately reducing the competitiveness of the country.

Most of the truck drivers in the UAE are from India, Pakistan, and Bangladesh, and these drivers have no UAE drivers’ licences or and experience of the UAE road network. By employing drivers without the relevant UAE driving licence, overall employment procedures can be a significantly lengthy investment in terms of time and cost. This inexperienced workforce in the road network often causes delayed deliveries, thus, reducing logistics efficiency.

A basic monthly salary for a truck driver is approximately AED1,500 to AED 2,000 (AUD

554 to AUD 736), the drivers are paid around AED100 (AUD 36) for every trip (Masudi, 2016). Most of the drivers speed on the road because they are under pressure to make as many cargo trips as possible to earn extra income. Although a company is not responsible for speeding fines, it has the potential in be involved in operational costs and the supply chain increase the risk if an accident occurs. Thus, decrease the logistics security in supply chain. A well-designed supply chain should ensure that a company is protected from disruption because of external threats (Melnyk, Davis, Spekman, & Sandor, 2010).

Figure 1. The United Arab Emirates, latitude and longitude map (2016).

2. Sustainable logistics

Increasing numbers of global warming issues, and regulatory pressure, challenge companies to focus on sustainability in their logistics operations. Lifestyle changes also lead to new consumer preference, and consumers now care about how a product is sourced, manufactured, and packaged, and the companies’ stakeholders have the same environmental concerns.

Organisations have increased their interest in operating supply chains through sustainable and green logistics (Pazirandeh & Jafari, 2013; Ubeda, Arcelus, & Faulin, 2011). Sustainable supply chains produce products through a supply chain that ensures control and minimises impacts on resources in the long term (Melnyk et al., 2010) The logistics outcome used to concentrate on cost, but with the high consumers request that the companies should take more environmental responsibility.

Because of the greenhouse effect from transportation, the UAE faces challenges in implementing sustainable logistics activities. Although logistics activities have some impact on the environmental issue, transportation is the primary division that contributes the most negative impact to the environment, because transport is a significant user of energy and petroleum which create air pollution (Dekker, Bloemhof, & Mallidis, 2012). Research has shown that the UAE has one of the largest carbon footprints in the world, and 22% of the UAE’s carbon footprint was contributed by transportation (Debusmann, 2015). Many companies in the UAE are willing to transport their goods via air freight to increase their supply chain responsiveness and meet customers’ expectation. Air freight, however, provides shorter delivery time at the cost of increased emissions of gas in the air (Arikan, Fichtinger, & Ries, 2014). With the expectations of rising cargo freight volume in the next few decades, the UAE’s carbon footprint could be dramatically increased.

3. Fuel price fluctuations

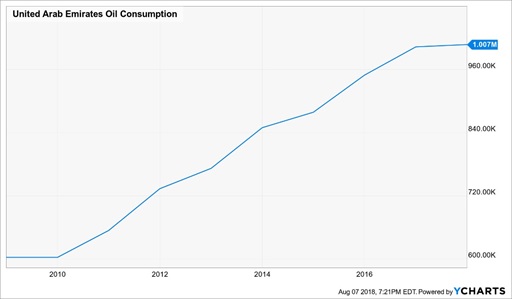

The customers’ time sensitivity and high demand leads to the small batches of shipment delivery worldwide within a few days. Consequently, fuel consumption grows as the transportation volume increases. As shown in Figure 2, UAE oil consumption has dramatically increased from 2010 (United Arab Emirates oil consumption, 2107). Because fuel is an essential commodity for logistics operations, a price rise in fuel directly affects operation costs. The price fluctuations in the crude oil market is influenced by several factors related to technological development, political stability, the growth rate of economies, exploration of new oil sources, use of regenerative energies, war, and natural disasters.

The UAE is the seventh largest crude oil producer in the world (The Statistics, 2017). Therefore, the fuel price in the UAE is generally low compared to global average prices. The crude oil price fluctuation results in positive and negative impacts on the UAE’s supply chain. The challenges of volatile oil prices are analysed in cost and responsiveness:

Decrease in fuel price

Plunging oil prices benefit most of the industry supply chain in terms of logistic costs, but it affects some industries in the UAE. Fuel cost is one of the significant costs because it affects the overall operation cost for an organisation. Transportation costs reduce because of low oil prices; this may facilitate just in time delivery and frequent shipments when needed, thus achieving cost-effectiveness in operating costs by reducing inventory on hand and warehouse costs. The Lean principle eliminates waste and removes all nonvalue-adding elements, or “Muda” in the supply chain (Carmignani & Zammori, 2015).

However, dropping oil prices have affected the UAE petroleum industry because crude petroleum contributes 21% of total exports in the UAE.

Increase in fuel prices

Compare to ocean freight; air freight enables the companies to respond to market demand and clients rapidly. With the rise in petroleum price has enlarged the operation cost between air and ship cargo, and this make air cargo more expensive; therefore, reduce the responsiveness in the companies supply chain. The operational responsiveness provides companies with the flexibility to quickly react to unpredictable demand. A sufficient supply chain should meet six outcomes: cost, responsiveness, security, sustainability, resilience, and innovation to increase the competitive advantage (Melnyk et al., 2010).

Figure 2. United Arab Emirates oil consumption.

4. Warehousing challenges

In 2009, the UAE government heavily invested in and developed warehousing infrastructure. Expansion of Jebel Ali Free Zone and the construction of Dubai Logistics City to attract global investors occurred. However, warehousing demand showed a slowdown in 2016 as a result of the economic effects, such as low oil price, a strong US dollar, and global instability (Gulf News, 2017). It is projected that growth in retail trade, e-commerce, and manufacture in 2018 could increase warehousing demand and achieve better supply chain viability. Two challenges and issues encountered in most of the UAE warehouses: lack of warehouse automation and inaccurate inventory. These problems affect UAE’s organisation supply chain in three aspects—cost, efficiency, and innovation.

Warehouse Automation

As an extension to the rapid growth of e-commerce globally, warehouses are being revolutionised by AI and robotics to support high volumes of small multi-line orders. Warehouse automation has been responsible for warehouse labour reduction. However, most of the warehousing industry in the UAE has little interest in automation because of the low labour cost, which is approximately USD 500 per month per worker. The initial investment is high for an automation warehouse. Further, routine maintenance and occasional repairs to machinery are needed, and these would undoubtedly lead to increased operating costs. A sufficient supply chain should not mainly focus on the cost factor, but the balance between all six outcomes: responsiveness, cost, sustainability, security, innovation, and resilience (Melnyk et al., 2010). Nevertheless, implementing an automated storage and retrieval system would benefit a company by reducing labour costs and human mistakes. This would increase productivity and efficiency of warehousing in the long term. Moreover, with the rapid growth of e-commerce in UAE, manual warehouse is not an innovative outcome that would gain competitive advantages for a company.

Inaccurate Inventory

Most of UAE warehouses are manual warehouses. Manual warehouses can be defined as workers moving to a picking location, picking the products, and then proceeding to a delivery dock. These procedures are not necessarily completely manual; they may include transports and forklifts in the distribution centre. Conversely, an automated warehouse works with a wide range of carriers, retrieval systems, electronic storage, sortation equipment, and other computerised material handling arrangements that move the items to the workers. In short, the manual warehouse is synonymous with “person-to-goods”, unlike an automated warehouse operation of “goods-to- person”.

The manual warehouse is less efficient because most of the picking activities are done manually. Inaccurate picking exacerbates the problem of improper stock levels and the build-up of obsolete inventory. Picking problems also increase when workers rely on inaccurate information, leading to the inefficient process. Lack of technology innovation increases information errors and mistakes in inventory management. Information technology improves supply chain performance and minimises errors (Fawcett, Wallin, Allred, Fawcett, & Magnan, 2011).

Conclusion

In conclusion, uncertainty in the external environment increases the UAE’s logistics complexity and challenges in four aspects: road freight challenges, difficulty in achieving sustainable logistics, fuel price fluctuations, and warehousing challenges. Traffic congestion in the UAE weakens the logistics efficiency, increases the operational costs, and results in higher opportunity cost. Besides these, employing drivers without the relevant UAE driving licences can be a massive investment in terms of time and cost, and reduce the logistics security when an accident occurs.

Next, transportation is one main divisions of logistics that directly affects the environment. The UAE has unsustainable logistics because of high transportation activities. Many companies in UAE are willing to transport their goods via air freight in small batches to increase their supply chain responsiveness and meet customers’ expectations.

Furthermore, crude oil price fluctuation presents both positive and negative impacts on cost and responsiveness in the UAE logistics. A decrease in fuel price will benefit most of the company logistics costs, but it affects the petroleum industry. In contrast, with the rise in petroleum price has enlarge the operation cost between air and ship cargo, and this make air cargo more expensive; therefore, reduce the responsiveness in the companies supply chain.

Last, manual warehouses in the UAE are less efficient, with low levels of innovation compared to the automation warehousing in other counties. Due to low labour costs and high initial investment in automation warehouses, most of the UAE companies still use a manual warehouse method. Manual picking increases human error and inaccurate inventories.

References

Arikan, E., Fichtinger, J., & Ries, J. M. (2014). Impact of transportation lead-time variability on the economic and environmental performance of inventory systems. International

Journal of Production Economics, 157(1), 279–288. doi:10.1016/j.ijpe.2013.06.005

Carmignani, G., & Zammori, F. (2015). Lean thinking in the luxury-fashion market. International Journal of Retail & Distribution Management, 43(10/11), 988–1012. doi:10.1108/IJRDM-07-2014-0093

Cherian, D. (2017, August 15). 45 free zones in the UAE: Find the right one for your new business. Gulf News. Retrieved from https://gulfnews.com/

Christopher, M. & Holweg, M., (2011). Supply Chain 2.0: Managing supply chains in the era of turbulence. International Journal of Physical Distribution & Logistics Management, 41(1), 63–82. doi: 0.1108/09600031111101439

Debusmann, B., (2015, April 14). Dubai to reduce carbon footprint. Khaleej Times. Retrieved from https://www.khaleejtimes.com/

Dekker, R., Bloemhof, J., & Mallidis, I. (2012). Operations research for green logistics – An overview of aspects, issues, contributions and challenges. European Journal of Operational Research, 219(3), 671–679.

Fawcett, S. E., Wallin, C., Allred, C., Fawcett, A. M., & Magnan, G. M. (2011). Information

technology as an enabler of supply chain collaboration: A dynamic‐capabilities perspective. Journal of Supply Chain Management, 47(1), 38–59. doi:10.1111/j.1745493X.2010.03213.x

Global EDGE. (2018). United Arab Emirates: Trade statistics, Retrieved from

https://globaledge.msu.edu/countries/united-arab-emirates/tradestats

Government of Dubai. (2018). Dubai economy. Retrieved from http://www.dubai.ae/en/aboutdubai/Pages/DubaiEconomy.aspx

Lummus, R. R., Krumwiede, D. W., & Vokurka, R. J. (2001). The relationship of logistics to supply chain management: developing a common industry definition. Industrial

Management & Data Systems, 101(8), 426–432. doi:10.1108/02635570110406730

Masudi, F. (2016, March 13). UAE trucker: “We're under pressure to keep driving”. Gulf News. Retrieved from https://gulfnews.com/

Mayenkar, S.S. (2018, January 22). UAE retains ranking on logistics index; sector outlook upbeat. Gulf News. Retrieved from https://gulfnews.com/

McKinnon, A., Edwards, J., Piecyk, M., & Palmer, A. (2009). Traffic congestion, reliability and

logistical performance: A multi-sectoral assessment. International Journal of Logistics Research and Applications, 12(5), 331–345. doi:10.1080/13675560903181519

Melnyk, S. A., Davis, E. W., Spekman, R. E., & Sandor, J. (2010). Outcome-driven supply chains. MIT Sloan Management Review, 51(2), 33–38. Retrieved from

http://search.proquest.com.libraryproxy.griffith.edu.au/docview/224965126?accountid= 14543

Nair, M. (2017, January 31). Dubai’s industrial realty demand hits speed bump. Gulf News. Retrieved from https://gulfnews.com/

Pazirandeh, A., & Jafari, H. (2013). Making sense of green logistics. International Journal of

Productivity and Performance Management, 62(8), 889–904. doi:10.1108/IJPPM-032013-0059

Prajogo, D., Chowdhury, M., Yeung, A. C. L., & Cheng, T. C. E. (2012). The relationship between supplier management and firm’s operational performance: A multi-

dimensional perspective. International Journal of Production Economics, 136(1), 123– 130. doi:10.1016/j.ijpe.2011.09.022

Sadler, I. (2007). Logistics and supply chain integration. Los Angeles, CA: SAGE.

The Statistics. (2017). OPEC-Statistics & Facts. Retrieved from https://www.statista.com/topics/1830/opec/

Ubeda S., Arcelus, F. J., & Faulin, J. (2011). Green logistics at Eroski: A case study.

International Journal of Production Economics, 131(1), 44–51. doi:10.1016/j.ijpe.2010.04.041

United Arab Emirates Latitude and Longitude Map [Image]. (2016). Retrieved August 08, 2018 from https://www.mapsofworld.com/lat_long/united-arab-emirates-lat-long.html

United Arab Emirates oil consumption [Image]. (2107). Retrieved from https://ycharts.com/indicators/united_arab_emirates_oil_consumption

World Shipping Council. (2018). Top 50 world container ports. Retrieved from http://www.worldshipping.org/about-the-industry/global-trade/top-50-worldcontainer-ports

Resources

- 24 x 7 Availability.

- Trained and Certified Experts.

- Deadline Guaranteed.

- Plagiarism Free.

- Privacy Guaranteed.

- Free download.

- Online help for all project.

- Homework Help Services