The Impact of Microfinancing Sample Assignment

The Impact of Microfinancing on borrower’s income and performance of Microfinancing Institutions (MFIs)

Abstract

Micro-finance is incentivizing the lower segments of the society by offering economically feasible and affordable loan products. The minimized charges of lending services have provided the opportunities of uplift for the low-income people who are seeking viable solutions to address their financial problems. However, the risks associated with the provision of micro-finance loans have limited the ability of micro-finance institutions to serve the millions of low-income aspiring to avail the micro-loans. This paper investigates the impact of micro-finance on the economic conditions of the society. This study takes into different dimensions including education, food conditions, entrepreneurial enhancement, employment, women empowerment and policies of micro-finance institutions. A survey was conducted with a pre-developed questionnaire investigating the age, gender, employment status, purpose of the loan, and income level of over 200 participants before and after availing the micro-finance. The findings show that a large segment of the population is experiencing the positive impacts of micro-finance on their economic conditions. Because this type of loan increases the income of a country. Many low-income employees need such type of loan for many purposes like for house building loan, small business loan, pension loan, pledge and also for educational purposes, etc. And in return, the money will circulate in the country.

1.1 Introduction

Microfinance is the small finance on easy installments and a meager interest rate. This finance is available to the poor Pakistanis; this should be distinguished from charity or giving grants to the low-income families who are unable to generate income or unable to repay a loan. Microfinance is not just restricted to microcredit only. It may include a wide range of products such as savings loan, insurance money transfer, and working capital loans. However, it is restricted just to the microcredit unfortunately in Pakistan.

The smaller businesses about the environment of Pakistan are reluctant to support themselves with heavy financial aids. Haroon Jamal narrates the applications and workability of the micro-financing for the firms in the Pakistani market. According to the assessment made, evidence of smoothness in the practicability of the company operations has been proven to improve with the help of micro-financing[1]. The borrowers can improve their economic lifestyle as well as support the business growth, which helps retain competency as well as payback of the financial help that has been borrowed from the financing entity (Jamal, 2008).

The process of micro-financing allows the borrower to resume its financial activities as well as invest in other financial propositions that can help elevate its current situation (Wright & Dondo, 2001). Studies indicate by allows important idea regarding the usefulness of micro-financing that enables the users to utilize the finance to improve their financial status. This includes the managing of the current situation, paying off debts, educational facilities, etc.

Studies also indicated that the microfinancing could help reduce poverty. However, according to the study of, it is never that the financial institutions that are providing the aid are reluctant of charging interest rates over the financial assistance. In such cases, people with low income are unable to use financing due to high interest rates that apply to the process. Over the years, $110 million has been provided to the people, and 99.9% have been recovered as well (Zaidi, 2017).

State Bank of Pakistan plays an important role in the development of the micro-finance sector. For well-developed legal, strategic and regulatory framework microfinance sector of Pakistan is globally recognized. The State bank of Pakistan organized the formulation of national microfinance strategy for the purpose to stimulate the growth of the sector on a sustainable basis. The policy of the state bank of Pakistan has the aim to promote the market based financial services as these meet the diverse needs of the poor as well as low-income segments. Some of the important segment on which the new policy focuses;

- The improvement of the quality of growth by promoting the inclusive financial services along with the credit operations.

- Improvement in sector discipline by the consumer protection policies and financial literacy programs.

- Promote innovations for the purpose to achieve rapid scale as well as reduce operating costs.

- Promote the organization development with the help of effective governance and professional management at the operational, strategic and middle level.

1.2 Purpose of Microfinancing

Microfinance is meant to improve the livelihood of the poor people. In simple words, the main purpose of the micro-financing is to increase the income of poor and low-income people. In this way, the economic status of the people also improved. Today micro-finance is considered as the effective tool for reducing poverty. Furthermore, micro-finance plays a vital role in bridging the gap between formal financial institutes and rural poor. The developmental issues can be resolved by fighting against the poverty. The microcredit program is seen to be highly successful if there is high repayment rate on time, and the target group is having awareness about how it can be used most effectively for the beneficial development of the borrower.

The microfinance program extends loans and financial aids to the people and business that are unable to gather sources of income and financial support to run their business and household works. As larger banking organizations require larger amounts of collateral for ensuring the safety of their loans, the entrepreneurs often reside on microfinancing institutions for financial help (Imtiaz, Mehmood, Akram, & Irfan, 2014).

The women empowerment is also supported through microfinancing. The financial aid from such institutions allows the women to establish themselves by investing in smaller home-based businesses that can generate revenues for them.

1.3 Objectives of Microfinancing

In many developing nations like Pakistan, this anti-poverty instrument can be used to target the poor, especially women to learn some skills and start their small new ventures. The main objectives disclosed by micro-financing institutions was to increase income, reduce expenditures, and promote child education and women empowerment (Sani, Khan, Raja, Ahmed, & Aziz, 2017).

Also, the microfinancing allows the poor as well as the average class’s access to the capital. The microfinancing banks manage the processes using lesser strict constraints that are applied by the traditional financial operating institutions (RAUF & MAHMOOD, 2009). The access to the capital increases the possibility of self-employment and entrepreneurship in the economy.

The financial aids provided to the lower classes in the economy allows the elevation in the standards of living. Also, the financial assistance from the microfinance institutions provides protection from sudden financial pressures including debts, educational investments, living standards, etc. The financial aid can be used for payment of medical bills, affording medical treatments as well as the covering of emergencies (Asad, Noor, Sharif, Mohammed, & Alekam, 2016).

One of the pertaining goals as well as the advantages of microfinancing is the increase in the economic development of women, particularly in the lower classes. The financial backup supported by the microfinancing allows the women to support themselves for running their families. In addition, it provides them opportunities to begin a business and increase their income sources. Microfinance programs target the women of lower classes in order to aid them in stabilizing their families financially, leading to a decline in the poverty levels in the economy (Shirazi & Ullah, 2009).

The overall impact of microfinancing allows the economy to flourish. Moreover, the new businesses can increase the investment in the economy by providing employment chances and increasing income sources for the community members. This helps decrease the overall inflation rate with the increase in the per capita income, allowing an overall increase in the GDP of the country (Kaleem & Ahmad, 2016).

Access to capital is another objective of micro-finance. People cannot tap into the typical financial system in order to gain the capital to start a business. This can force them to turn an informal source such as relatives, friends, loan sharks, etc. these sources are unreliable as well as expensive as they charge potentially reunion interest rates. The higher interest rate strangles the business before it can get the start. The micro-finance institutes provide access to capital by providing lending to those people.

Micro-finance is an effective source of entrepreneurship and self-sufficiency. Deprived people have profitable ideas, but they have no potential to put them into action due to lack of sufficient capital for startup costs. By providing micro-credit, those people get their ideas off the ground in this way they can begin turning a profit. They can then pay off their microloans as well as gain income.

The micro-finance ultimately has the aim to give impoverished people financial stability in order to move from simply surviving to accrue savings. This provides a sufficient amount of protection to those people. Savings allows them to improve nutrition, better living conditions, invest in education and reduce illness. Another segment of the micro-finance institute is the micro-insurance that provides the ability in people to pay for health care when they need. Therefore, they can receive the treatment for health conditions.

A large proportion of micro-finance beneficiaries is made by the women. Women in underdeveloped countries have no ability to effectively participate in economic activity, for this purpose micro-finance institutes provide finance to those women to start a business venture. Moreover, in this way women effectively participate in the economy of the country. The primary aim of the micro-finance is to improve their status as well as make them more active in decision making. By providing finance to women, micro-finance institutes encourage gender equality. It is observed that the micro-finance declines the violence against women.

Microfinance is improved not only the living standard of their clients but also improve health conditions of communities of clients. New business ventures provide the employment opportunity in this way the income among community increases.

1.4 Key Principles

The key principles of microfinance were to provide financial services to the poor people, not just the loans. The microfinance was a tool to fight poverty, by building a financial system that will serve the poor. However, it was found that microcredits are not best suitable for everyone and for every situation. The interest rate ceilings were making harder for the poor to get credit. All the objectives of the microfinance can be met when these institutions will disclose and measure its performance. The key principle of micro-financing includes;

Poor people need not only loan but also need a financial service

Poor people also need convenient and flexible financial services. Moreover, poor people not only need credit but also need savings, insurance, and cash transfer but it depends on their circumstances.

Microfinance is a powerful instrument against poverty

A sustainable financial service allows the poor to increase their income, build assets as well as reduce their vulnerability to external shocks. In most of the developing countries, there is a majority of poor people. An overwhelming of poor lead them to lack of access to basic financial services. In some of the countries, micro-finance has become a marginal sector and development concern for socially responsible investors, donors, and governments. Furthermore, the micro-finance has become an integral part of the financial sector for the purpose to achieve the full potential to reach a large number of poor.

Microcredit is not always the answer

For every situation and for everyone microcredit is not suitable. The people who have no income and those have no means of repayment; those people need another source of support before they can make use of loans. In many cases, the most effective and appropriate tools for poverty alleviation are the small grants, training programs, infrastructure improvement, and other non-financial services.

1.5 Strategy for Social Development

Pakistan has found the micro-financing as one of the social development strategies and the figures reported by the Microfinance Report 2016 shows that this sector is growing on its way to being an industry. Previously there was no institution other than banks to provide micro-credits,and banks too were reluctant to provide finance where the risk of non-payment is high, and loans are no asset-backed.The proactive factor can increase the likelihood of well-being and success of poor people, and this can be possible only with the availability of micro-financing. The social development strategies provide an effective way to increase the proactive factors for the poor in the community. For government and micro-finance institutions, social development is the daily interaction with poor people as it helps to keep them on track for healthy development. In Pakistan, the social development strategy has five components. These are as follows;

Opportunities: This component provides the developmentally appropriate opportunities to young, poor people for actively participating in the economy of the country.

Skills: by providing the microfinance with the skills of the young, poor people can be used.

Recognition: provide consistent specific recognition for effort in order to improve and achieve.

Bonding: it is important for the microfinance institution to acknowledge the efforts of young, poor people as well as promote positive bonding.

Clear standards: it is the responsibility of microfinance institutions to describe the standards about the loans and credit clearly.

1.6 Economic and social impact

The purpose of this research is to investigate the economic impact on the microfinance institutions on providing short finances to the household borrowers and especially to investigate the impact of small loans in the high inflationary economy like Pakistan. The further specification was the creation of a dual regulatory environment by the SECP. Microfinance creates a positive social impact on three levels. These are as follows;

Household level

With the help of micro-financing empowerment of women lead to their higher social status, more independence and better education. Moreover, micro-finance develops the ability among the poor to cope with their economic shocks through micro-insurance products, savings, and credit. High income leads the people to better access to education, sanitary infrastructure, healthcare, sanitary, etc.

Local community level

Microfinance is an effective way to create jobs. The quality of employment opportunity helps the people to stable their income for the community. The entrepreneurial activities improve the economic base as well as the resilience of the community.

Regional level

Microfinance has also created a job at the regional level. Microfinance strengthens the microenterprise sector as it is the backbone of the developing countries. Micro-finance is the source for the growth of the financial sector.

1.7 Problem Statement

The poor classes in the economy face the most problems in terms of financially supporting themselves. The beginning of new business as well searching of new means of livelihood makes it difficult for such classes to utilize their available resources for financially managing themselves. Furthermore, the micro-financing banks provide loans to the borrowers on similar but less strict conditions, which can include increased tenures for the loan and decreased interest rates. However, such classes face difficulty in repayment of the loans as well due to pertaining circumstance including the failure of the business, capital mismanagement, confiscation of money by participating entities, debts, etc. (Saleem, Kaleem, Malik, & Raza, 2011). So for the micro-financing institution, it is the major risk factor for them that either the customer will always pay back the loan amount on the due date or not. As they mostly give loan packages for the middle class so their risk of payback of loan amount and interest rate fluctuation.

The research tends to address the potential benefits and drawbacks of micro-financing over the poverty levels of the lower class, elevating the information with insights regarding women empowerment, profit margins, government efforts, market situations, etc. The research aims to discover whether microfinancing is able to decrease the poverty levels in the society or not.

1.8 The scope of the research

The area of the investigation regarding the financial processes that occur in micro-financing has not been addressed in depth with context to the economy of Pakistan, particularly in the local economy. The research aims to provide information regarding such processes in depth. Moreover, the research is expected to be useful regarding information source of policies and the administration of the operations in micro-financing as well as provide useful data regarding their affectivity in the economy as well as production.

1.9 Variables in the research

Using the following variables, the researcher will collect the information as well as perform useful analysis that will suffice for addressing the research questions and reaching the research objectives:

- Dependent Variable = Household Income (Y)

- Independent Variables = Age, Household members (HH), Education level (Edu), Loan amount of micro finance (MFL)

Equation: Y= α + Age + HH + Edu + MFL + μ

Where μ = error term.

1.10 Research objectives

For the pertaining research, the following objectives are under consideration:

- Testing whether microfinance institutions approach customers

- Evaluating the effect of micro-financing on women empowerment

- Illuminating the different policies and regulations in micro-financing as well as their effects on the creditors.

- Evaluating the impact of MF on improvement in the economic conditions including expenditures, household management, education, etc.

- Illustrating the effects of micro-financing on entrepreneurship

- Illustrating the changes in the performance of the firms operating with micro-financing.

- Determining the effects of microfinance on customer perception including satisfaction and impact on business performance, in the context of MFIs in Multan district.

1.11 Research Questions

With the pertaining research, the researcher aims to address the following questions:

- Does micro-financing influence the growth of the businesses it approaches?

- Can micro-financing affect the poverty levels in the community?

- How can MF influence women empowerment and educational facilities of people?

1.12 Research Hypothesis

The researcher intends to research by formulating the following hypothesis:

- H1: Microfinancing helps in depreciation of poverty levels

- H2: Microfinancing aids in the improvement of economic levels of the borrowers

- H3: MF allows elevation in the business processes through financial help

2. Literature Review

In Pakistan, there are several issues for those people who are suffering from poverty. People also lack basic necessities to carry out their living. Moreover, they lack financial services[2] to get finance from commercial banks to expand their business. For various healthcare and educational purposes. It has been seen that the results of microlending finance are not that good that was expected. The reason is that people may don’t know where to invest and how much to invest. So, training is required (Cozarenco, 2018). The study is on business training, loan re-payment theory and evidence from microcredit state. The non-financial services[3] may be in different forms such as information about the human and health rights of the poor people. The training of money management and business training are required to make use of microfinance effectively to generate income.

For instance, Renaud et al. (2015) underline how the business training given under the program of Women’s Initiative for Self-Employment can help the poor women to create a source of earning. The study mixes the results of having co-relation between the completed training and the successful outcomes of the entrepreneurship, especially in the United States (Attanasio O. A., 2015). The research shows that there is a significant impact of business training on the objectives of improving client knowledge, for retention of the poor client and micro-finance on increasing revenues and their quality of living. To assess the impact of socio-economic[4] factors on the lives of the borrowers of the microfinance several factors should be considered.

Rivulet al. (2017) examined that level of food intake by the poor wholly depends on income levels, savings, and access to proper healthcare, sanitation, children’s education, land ownership, and asset accumulation. The focus of the study was on household income, expenditure and savings and it was proved by evidence from Bangladesh. The study showed that economic development had created paths for the social development. The World Bank data discovered that both male and female participants of the BRAC NGOhad achieved the increased level of consumption by 11% and 18%. Some NGOs[5] have also given training to borrowers how to make use of small loans to resolve their healthcare issues, built sanitary latrines, to receive primary education, and other socio-economic factors to improve their lifestyles (Haque, 2017).

The research was being done on rural Mongolia to evaluate the micro-credit joint-liability program which is targeted at the women. The positive results were being found; these results show that loans given to the female are wholly for the entrepreneurship, to use the income for the household food consumption. The individual-liability created under the micro-credit program does not have a large impact on the poverty. The joint-liability created may prevent the consumers to use micro-credit for non-investment purposes (Attanasio O. A., 2015). The micro-financing institutions found in various countries are fighting with clients over the re-payment problems and indebtedness for a long. The expectation attached under is that ability of the microcredit is improve the quality of life for poor. By providing loan for educational, healthcare, social work, and for investment purposes in their entrepreneur businesses.

The micro-financing also works for the welfare of the general public. Many people in Pakistan cannot get low due to the concept of interest which is Haram in Islam, and other cannot get a loan due to the high-interest charged by the banks. Their policies and regulations are strict that mostly the middle-class worker is afraid to get a loan from them. In this situation, micro-financing gives a pathway to the general public for the prosperity of their future life. They mainly work to secure their future by providing different schemes like life insurance, car insurance, small business loan, property insurance, house building loan and education based loan, etc. Their interest rate is lower than the other financial institution, so mostly the general public preferred their loan products.

The move has been seen that most micro-financing institutions[6] are now moving to the group or joint-liability lending to reduce the risk of non-repayment. The research was being done by Orazio et al. (2015) on the 1,148 poor Mongolian women across 40 villages to make possible for them to have access to the individual or group loans, to measure and compare the results of both types of lending in reducing poverty Where does microfinance flourish? Microfinance institution performance in macroeconomic context (Ahlin, Lin, & Maio, 2011). Under the joint-liability program[7], if one person will default his liability will be paid by the other group members, and if the group as a whole default then they may not be having future access to the micro-credits. But there are some shortcomings; the joint liability micro-finance may call the group members frequently for meetings and exert pressure for repayment. That’s why individual micro-finance is among the most famous category. It was found that good governance by the micro-financing institutes can lead to the achievement of the MFIs objectives. The growth of the micro-financing industry had caused increased interest of private investors in providing finance to these institutions. The study was on the relation between the corporate social responsibility of the MFIs and good corporate governance. They examine the broad member characteristics and how these characteristics can help the attainment of the social mission of the micro-financing institutions (Mori, 2015). The research was being carried out by Abhijit et al. (2017) on how much the borrower value the microfinance and this was proved by the evidence from an experiment based on the concept of bundling microcredit and insurance. The high fee by the micro-finance lending institutions has resulted into 22 percent decline in the loan renewal compared to the villages where the policy of high fee was not introduced. The demand for microinsurance services in the Kenya industry is increasing; the results were obtained by survey. The study by Ndurukiaet al. (2017) showed that awareness, education, flexible and easy payment options had given access to credit. The regulators are placing a framework for micro-insurance and government is helping by incentives and subsidies (Ndurukia, 2017).

It was found that micro-finance was not having a high positive impact on the household consumption, social outcomes, income levels, women empowerment, health, and education. The results show that finance given to the regular client is making positive results than the client availing the micro-credit for the first time (Banerjee A. D., 2017). But the limitation is that once the micro-finance lending is openly available to all regular or new clients, it cannot be denied to anyone asking for. If the experience clients are better using the finance, then it seems that new clients may take some time to learn money management skills and use this finance effectively to generate a positive outcome. The most negative results were found at the district level, the reason is that micro-finance is having a larger impact on the existing clients and due to preferred approaches of interpretation used by the existing borrowers, this has led to partial equilibrium effects on the borrowers of the micro-finance that are experienced in making effective use of it. The results of the survey showed that borrowers using the micro-finance to invest in their on-going business are earning more with positive results than the borrowers using micro-finance to start a new business venture. Several micro-financing institutions in India has motivated all there new or existing clients who are using the loan to invest in the business to further purchase a health insurance policy to reduce the risk of damages by any catastrophic incidents, maternal care, and hospitalization.

The research showed that 101 villages in the rural areas of SKS, were taking treatment under the health insurance, which they purchase along with the micro-finance and 100 control villages of SKS, with no health insurance[8] due to having no access to the micro-finance opportunities. The randomized evaluation of the group-micro-finance lending was taken in Hyderabad, India (Banerjee A. D., 2015). The micro-finance had created the redistribution of income, and it had created means for short-term income generation.

The study by Khandker (2005) discusses the reduction of poverty at both the participant level and at the aggregate level by using the panel data from Bangladesh. The special focus was on female participants, and the overall focus was on the village level. The micro-finance has helped not only the poor but also the local economy to grow (Khandker, 2005).The villagers investing in the agriculture are availing the micro-finance in certain specific seasons, they may be suffering from the loss of their investment, due to no incorporation of innovation in the agricultural processes and fertilizers used, so effective cash management skills are required to get better results and to avoid the risk of non-repayment of the loan. It has been seen that decline in the scale of the business will ultimately result in the decline of business outcomes such as assets, sales, employment, and profit. The 80% of the business owners in the villages of SKS have improved their businesses by lending micro-finance and enjoyed benefits of growth and expansion. But those will very small investment, have faced a high risk of losing investment and get no better results but an obligation to repay the outstanding loan. The primary data was collected from the research study through questionnaires. For the purpose of analysis, certain techniques such as linear regression and the paired t-test were performed.

The positive results were seen in the education of the children and the financial performance of the enterprises. The mixed results were on the household income, expenditure and assets. And no significant impact was found on the housing and raising the income levels for the enterprise. The independent variable found was the number of the salaried person who is an important variable for the benefit of microfinance clients (Chughtai, 2015). The authors Chugthaiet al. (2015) has discussed the aspects of microfinance for the alleviation of poverty. More than 58.7 million population of Pakistan out of the 180 million is below the poverty line. This is about 35% of the Sindh, 33% of the Khyber Pakhtunkhwa, 18% in Punjab and more than half of the population in Baluchistan. The major reason for poverty in rural areas of Pakistan is the irregular distribution of assets and income.

The Islamic microfinance was introduced to introduce to make better arrangements of nutrition for the people, to raise income level for poor, to maintain greater high school attendance, and will lead to women empowerment (Mhammed, 2008). The microfinance will not only provide financial services to the poor, but it will also lead to economic empowerment[9]. Most poor population don’t have knowledge about the term micro-finance. So, they lack financial services to improve their lives. The study was being done to find the effects of micro-financing on the income of beneficiaries and to give suitable suggestions for the growth and development of the microfinance banks. The research shows that reducing poverty is an evil which is reducing the overall growth in Bangladesh.

The introduction of the interest-free loan[10] was the initiative to reduce poverty. For this purpose,the government has given the funds to banks to give credit to needy people and to enhance their livelihood status (Durrani, 2011). Different micro-financing institutes and NGOs are providing not only the individual but group loans. And provide them instructions on how to best use it to achieve better socio-economic[11] conditions. It has been noticed that if government relax certain regulatory requirements for the micro-finance, then they can better serve the community. The scale was developed to see the consistency[12] coefficient that will lie between the food and security of scale 0.54, and for children education, the scale of 0.97 was found (Okibo, 2014). The microfinance has a positive impact on the variables such as food and the education of the children.

The government is contributing to increase the department of the microfinance department and provide effective training to the new or existing staff to make poor aware of benefits of microfinance to raise their income levels and self-esteem. The research on the poverty form 2004 to 2006 shows that poverty is reduced to 4.09 % by providing microfinance to the poor, needy people and borrower has now turned to the higher income level than before. To assess the impact of microfinance on these institutions the credit risk management practices on the performance of loans was carried out, and the factors used for assessment was credit terms, appraisal of clients, collection policies and all the practices of credit risk control as the important tool for credit risk management. The data used for assessment comes out from the microfinance banking sector managerial level of the department credit risk management (Ahmed, 2015). The research shows that client and relaxed credit terms such as no interest and easy installments has increased the performance of the loan. And the independent variables are collection policy and credit risk management. For banks, the micro-finance area is not a core business area due to the high risk of loan repayment. This department is just a mean of fulfilling the corporate social responsibility. The poverty rate is very high in Islamic countries from Senegal to the Philippines. The reason as discussed is high-income inequality and lower production levels. The interest-based financial services are prohibited in Islam.

The establishment of Islamic microfinance organizations is to raise the financial performance of Akhuwat for the period 2002-2006, and it is of the objective to give recommendations for improvement in this sector. The target of Islamic micro financing is to eliminate the endangered poor from the economic, political and physical downturns (Akhter, 2009).

The death, sickness or accidents have forced poor to dispose of their property or other assets and any natural disaster such as theft, fire, and flood, have made them more exposed to the frequency of losses. The conventional products of micro-financing are not successful to meet the needs of the poor Islamic countries, rather an Islamic micro financing with a little help has changed the living status of many poor living families. This is done by the availability of affordable loan products and insurance products; this was used as a powerful tool to fight against all abuses of poverty. The main principles of Islamic micro-finance are based on the concept of risk sharing, collateral-free loans. The projects that are being rejected by the commercial banks due to the presence of insufficient collateral may be acceptable under the concept of profit-sharing to the Islamic banks.

Under Islamic micro-financing, there may be two models Mudarbha model on the concept of profit sharing and Murabaha model on the concept of cost-plus markup (bin Mislan Cokro Hadisumarto, 2010). The preferred model is Murabaha which is cost-effective, has a low margin for any error and provide collateral in a form that a microfinance institute will own the asset until the last installment is being paid. The micro-financing is meant to mitigate the regional disparities and microcredit can be used as a sustainable tool for the development of the territory. The remittance services provided by the microfinance institutions can maximize the benefit for the society’s development. This may result in the optimization of multiple-objectives.

The research was being performed to test the impact of microcredits on the Italian female entrepreneurship[13]. The study was based on achieving the stable approaches for programming in the imbalance territory (Arbolino, 2018). The research has used various programming models that are comprising of various objectives. This may solve various decision problems, to reach the impact on the objective and to reach a solution. Due to the high socio-economic cost worldwide, the governments are now of the motive to promote innovative entrepreneur business. The economic crisis can be mitigated by credit the weak projects and to create the impact of sustainability on the lives of the territorial people. In several developing countries micro-credits are meeting these objectives. The sustainable development can be achieved by economic, social, governance and environmental welfare and the tool used to meet the target is micro-financing. The micro-credits may give poor the opportunity to earn money and raise social dignity.

This will result in the increased level of liquidity and will create more human resource available for the market. The regional disparities may be resolved by including transparency and active participation and accountability in the governance system of the financial services providing institutions (Kastratovic, 2008). The developed countries have now introduced two services such as social microcredits and remittance services. The social micro-credits in European countries usually have a low-interest rate; they may serve individuals with economic difficulties, to better facilitate the social and economic integration. The objective is to sustain small enterprises, and these are mostly minorities. The joint contribution of institutions and borrowers will result in the maximizing the benefit for the society. The strategic importance is attached to the microfinancing to plan for socio-economic development (Nader, 2008). The strategy may be used to incorporate innovation, and the aim is to maintain natural resources and reduce the consumption. The micro-finance can be effectively used if it will meet the objectives like economies of agglomeration, polarizing of all the variables such as investment attraction, capitals, and the skilled workforce, and propagation effect may include the purchase of raw material, intermediate goods and finished goods and all the negative impacts of the unemployment. The excessive use of microcredits can achieve the coordination of program goals, by creating standardization on the national territory, and will result in the simplification of all procedures.

The proper resource allocation strategy is required to achieve income equality. The policymakers should consider the best possible solution to all the social abuses. The motive of raising women entrepreneurship in the Mediterranean countries can be achieved by fostering new business start-up by micro-finance, the investment can be used productively to generate income and employment. This will stimulate the local economic development[14]. The local progress can lead to national and international progress (Corsi, 2006).

The group based financial services by micro-financing institutes may be collateral free and may include group guarantee and peer monitoring. This kind of services is used to support marginalized people having no access to conventional financing services. These services are becoming the momentum for development of various under-developing countries. In developing countries, the micro-financing has transformed the poverty into economic development. And it is allowing access to the credit and filling the gaps in the financial systems (Hartungi, 2007).The expansion of microfinance industry research has been conducted on the Monetary Financial Institutions (MFIs) in developing countries. The scholars have mainly discussed the aspects of individual lending and group lending. The small and medium-sized enterprises are playing a major role in the national development. So, support then certain micro-financing services are available, and the level of benefit gained by the Small-sized enterprises[15]is more than the cost of obtaining finance.

The research has given advice to microfinance banks to enhance their capacity to support the business to the small companies, and by recapitalization and by managing the knowledge of the microfinance bank management, the use of collateral is a necessary condition in granting credit on relaxed credit terms to the small businesses (Taiwo, 2016). The small enterprises may include new venture capitalist and angels. They are very innovative and of the motive to achieve growth by incorporating innovation is their products, services, and operations. The sustainable growth can only be achieved by bringing something new every year for the business.

In the article new financial alternatives in seeding entrepreneurship: microfinance, crowding, and peer-to-peer innovations by the authors Bruton et al. (2015). The finance for an entrepreneur is rapidly evolving. For new business start-ups, the finance may be wholly debt, equity or the combination of the debt and equity. The investment may come from friends, family, venture capitalist, business angels, and occasionally banks, the other sources may be micro-finance, crowdfunding, peer-to-peer funding and from financial innovations (Bruton, 2015). All these sources of finance have one thing in common, that is an innovation which can easily be diffused across the world. The micro-finance has emerged out to be the solution to the lack of capital for a poor living, especially in the under-developed and developing countries. This source of finance has also provided an opportunity for the entrepreneurs to start or expand their existing businesses. The crowd-funding[16] has also emerged as the source of getting finance from the individual investor in order to bring together the small amount of finance together from in order to reach the total finance needed for the expansion of the ventures.

The peer-to-peer networks may make use of both debt and equity and may use advantage from social networks to bring together both the investors and the entrepreneurs for aggregation and transferring of funds to meet the objectives of effectiveness and efficiency. In India, innovation has emerged through social entrepreneurship which is financed by micro-venture capital or other micro-credits from the micro-finance institute. The new financial services being offered to the entrepreneurs are innovative financial services that are very difficult to be obtained otherwise. The research was being done to prove that innovations in the entrepreneurial finance can arise due to several reasons but among the most prominent is the imbalances between the supply and demand for capital, which may arise due to advancements in the technology (Sonne, 2012). Any innovation in the financial services may result in the change in ownership structure, governance style, and considerations of the outcome which is highly dependent on the type of institution and in which context they operate (Allison, 2015). It has been seen that recent changes in the regulatory and technological environment have led to the lower barrier for adoption of innovation in the sources of finance like micro-finance. This has led to various financial services the conventional financing is eliminating from the globe.

The Allison et al.(2015) examined microloans made to over 36,000 entrepreneurs in 51 countries. This was done through the platform of online crowd-funding. The study shows that lenders give a more positive response to the venture already in practice as a mean of helping others, and pay MFIs to pay less attention to the narratives highlighting as a business opportunity.

The success of the micro-finance institutions depends on the features that are affecting on the country level, particularly macroeconomic factors and macro-institutional factors. By understanding the linkage between these factors, the more accurate evaluation of the micro-finance institution can be done. The impact of microfinance institutions on the economic development can also be assessed. The Ahlin et al. (2011) has gathered data about 373 micro-finance institutions to assess the economic impact merged this data with institutional and country-level-economic data (Ahlin C. L., 2011). The well-established institutes can have greater economies of scale, low operating cost and will pass this benefit to the poor people in the form of lower or no interest rate for the micro-finance.

The performance measuring variables in the Muslim countries used for micro-financing are different from the variables used in non-Muslim countries. The Ashraf et.at (2014) are of the view that all cultural norms and religious attachment are driving forces for the implication of Islamic micro-finance principles over the conventional micro-finance (Ashraf, 2014). The results were extracted by research on 2,138 firm-years data on 754 MFIs which is across 83 countries, 33 OIC member Muslim countries and 50 non-Muslims countries. The analysis was done while considering country-specific and firm-level factors and variables. The performance of MFIs was assessed by variables such as loan re-payment, profitability, loan availability and other financial performance variables. In South Asia, women were excluded from trading outside the project area. The interview data showed that micro-finance has not yet addressed the respondent’s access to the markets in an inadequate manner. The access to the wider market for finance and trade was not clear to the members especially women. The female members have linked outside to the district or local market through the traders mostly men from urban areas they were not of view to project mechanisms to trade with urban female traders. The rural employment was generated by having access to the capital, there was limited technology in these areas, and the females were not previously integrated with the formal arrangements to get significant capital-generation linkages with the outside market. The authors Henley et al. (2010) was of the view that the credit revolution in Southeast Asia was due to the availability of micro-finance to the borrowers from a money lender (Henley, 2010).

The global data collected from the third-party rating agencies shows the relation between the corporate governance and firm performance of the micro-financing institutes. The authors Marylander al. (2009) measure the performance of MFIs by the customer and firm relationships, the effect of competition and regulation on the financial performance[17] of the MFIs (Mersland R. &., 2009). The study showed the performance depends on the local directors, not international directors, as they have more knowledge about local conditions. The clients were increased with chairman duality. The group lending performance is lower due to lower demand. There seems to be no difference between the objectives of non-profit organizations and financial performance firms with the same industry approach to the microfinance institutions governance.

The authors Elahi et al. (2006) are of the view that term micro-credit and micro-finance are often used interchangeably, but there is a lot of difference in their way of policymaking, and deciding the discourse for development. The micro-credit is offered basically too poor rural people, for supporting the income generation activities, known as self-employment[18]. These do not include collateral, and the pre-condition is that borrower should make regular savings. This type of credits is often for women empowerment.

The financial services may include the provision of credit, insurance services, savings, and the social intermediation may involve rising aspiration for the poor, develop a policy for them, and raise training and self-confidence programs for poor (Qudrat-I Elahi, 2006).The Reeves et al. highlights the necessary features of micro-finance mobile banking and the analysis was done through the use of agents.

The partnership was done between the mobile network operator and micro-finance institute. The social implications were that to serve the two billion mobile users to advertise the finance availability especially for the poor (Reeves, 2013). The study incorporates the usage of agent and technology to get access to the poor through the platforms of mobile banking.

The mobile banking has generated various social benefits to the communities of the consumer, by increasing the information on domestic capital, saves the time and cost of the MFIs, and can be used to incorporate credit facilities into the banking system. This has enabled cheaper access to the wider customer base which was difficult to be reached before. Access to the credit facilities has caused the creation of new businesses, entrepreneurship, and employment. Microfinance is the mean of elevating poverty. The interest rate charged on loan was much lesser than the commercial loans, and this caused a very little effect on the financial performance of the micro-finance providing institutions. The reason is that 93% of the start-up businesses used their savings instead of micro-finance, but later they make use of financing again expansion. So this act as the tool for providing finance for the growth and development of the running ventures (MAGHANGA-MTUWETA, 2007). The respondents may not come to take finance because the majority do not consider them in the poor category as they have high expectations for their existing businesses.

Previously, the NGOs or non-governmental organizations were only doing the social work. But now the commercial banks are providing the micro-financing facilities, but the mission of the two departments is very different, the micro-finance department has to focus not on profit-making but on social welfare (Pagura, 2006). This may contrast with the primary objectives of the commercial banks which is none other than profit making. They require profits for their on-going businesses and for meeting the fiduciary duties.

The research has shown that in doing so, the fundamental mission of the banks will be severely affected by this activity. This mission drift was seen. The strategic linkages and alliances between the financial institutions have resolved the issue of availability of micro-finance to the poorest of the poor. The study showed that 12 case studies in 11 countries are of the results that financial linkages used by both private and public formal financial institutions have targeted poor rural market. There are multiple development programs to promote the community by providing them with social capital.

The economic benefits are attached to the various social interactions by means of micro-financing. There seem to be various repeat meetings between the micro-finance institutes’ staff and poor who are coming to get a loan for the first time (Feigenberg, 2010). These mandatory meetings may lead to changes in the social ties. The Steigenberger al. (2010) investigated that increased social interaction [19]with the clients has led to an increase in the risk-sharing in an informal way and caused a reduction in the number of defaults. The study showed that more regular interactions had increased economic cooperation with the clients. The success of the group lending has helped micro-finance institutions to achieve lower default rates with no collaterals. The reason is that this mode of finance has to harness new social capital among the participants.

Khavul.S (2010) said that micro-finance as having direct engagement with the poor is a new way to get financial capital from the MFIs. This may stimulate economic growth in the developing countries (Khavul, 2010). The economic growth may result when the poor class makes effective use of the loan to invest in their existing ventures or set up a new business venture to meet their basic needs of health, education, money circulation, and improving their living styles. The ultimate goal of the micro-finance was not clearly understood, but now it has come out as the open opportunity to have access to the capital for people who were not able to get benefits from financial services.

Abhijit Banerjee et al. (2015) have presented the evidence of miracle of micro-finance with the help of randomized evaluation. The authors have conducted this study on a group of a microcredit program in Hyderabad, India. The author has collected the data from 52 neighborhoods. For this study, the simple random sampling technique is used as well as data is collected on a random basis. Furthermore, the author has found that the small investments and profit of the preexisting businesses increases while the consumption has no significant increase. On the second hand, the expenditure on the durable goods increased but the temptation goods expenditure reduced. The author has found that there are no significant changes in the health, education and women’s empowerment. In this study, the author has not described how health, education and women’s empowerment has not changed (Abhijit, Duflo, Glennerster, & Kinnan, 2015).

Julie Battling and Silvia Dorado (2017) have observed the case of commercial micro-finance organizations. The author has explored the new types of hybrid organizations. A hybrid organization is that type of organization that combines the institution'slogic in unprecedented ways. These organizations develop as well as maintain the hybrid nature in the situation when the ready to wear model is absent. The ready to wear model handles the tension between the logic that is combined by these organizations. For this study, the author has used the second approach. The author has suggested that the crucial early levels for the development of identity among the members of the organization are hiring as well as socializing policies. In this study, the author has not evaluated the major principles of micro-finance (Battilana & Dorado, 2010).

Dean Karla and Martin Valdivia (2011) have demonstrated the impact of the business training on the micro-finance clients and institutions. Most of the academic and development policies depend on the micro0fnance. It is the fact that the micro-finance plays an important role in the enhancement of education investment. Therefore, there are policies that every client must follow. With the help of these policies, people also manage their business. The author has found a number of the organization has grown micro-finance in order to improve the living standards of their clients. Furthermore, the author has found that nevertheless the business knowledge is improved and increased client retention rates for the microfinance institution. For this study, the author has used the categorical design analysis along with the treatment and control groups. In this study, the author has not studied the socio-economic effect of micro-finance (Karlan & Valdivia, 2011).

Niles Hermes et al. (2011) have elaborated the outreach and efficiency of the micro-finance institutions. The main aim of this study is to examine the tradeoff between the poor community and the efficiency of the micro-finance institutions. The author has used the stochastic frontier analysis. Moreover, the author has found that the outreach is negatively related to the efficiency of micro-finance institutes. Author has also found that the micro-finance institutes that have a low average loan are less efficient. The evidence from this study shows that the micro-finance that have the more women borrowers are less efficient. After adding the number of controls, the results remain significant. In this study, the author has not described the role of micro-finance institutes (Hermes, Lensink, & Meesters, 2011).

Roy Marshland and R. Osteen Strom (2010) has elaborated the micro-finance drift. The main aim of this study is to examine the experiences of the micro-finance institutes. The organizations which are providing micro-finance increasing the cater to customers who are better from their original customers. The author has used the average loan size as the main proxy in order to investigate the mission drift of MFIs. Furthermore, the author has used the micro-finance methodology, gender bias and the main market for the mission drift measures. That author has used the data of multi-country MFIs spanning of 11 years. The author has applied the regression analysis. Results have shown that an increase in an average profit and cost that tends to increase average loan. In this study, the author has not elaborated that how MFIs uses techniques in order to increase the number of loans (Mersland & Strøm, 2010).

Katsushi S. Imai et al. (2010) has shown the relationship between the micro-finance and poverty. The main objective of this research paper to show that how the micro-finance reduces poverty. The author has used the national household data from India. The author has used the regression analysis in order to meet the objective of the study. Moreover, the author has also applied the coefficient test in order to assess the association between the variables. The author has found that the micro-finance create a positive impact on the reduction of poverty as with the help of micro-finance people improved their living styles as well as gain more opportunities to spend their lives in a better way. The author has used the primary research approach. In this study, the author has not used all the other variables related to the micro-finance such as education, women empowerment, employment, etc. (Imai, Arun, & Annim, 2010).

Jonathan Murdoch et al. (2010) have analyzed the effects of microfinance on poverty reduction. It is proven that micro-finance is considered as one of the effective and powerful tools for the reduction of poverty. In this study, the author used the primary approach. Micro-finance has insufficiently penetrated the poorer strata of the society. Once the poverty reduced, the people can gain the basic education and primary health care. The author has examined the date over the past 10 to 15 years. In this study, the author has effectively analyzed the social and economic impact of micro-finance. The author has found an ample of evidence that supports the positivity of micro-finance and its huge positive impact on the poverty. In this study, the author has not analyzed the role of micro-finance institutes (Morduch & Haley, 2010).

Kanji (2006) has established the facts about the reduction of poverty. The main focus of the author is on the micro-finance. The author has indicated that the World Bank and the IMF group are focusing on the poverty’s reduction. The author has used the secondary research method. The author has examined the micro-finance programs in order to meet the desired results. The author has concluded that the micro-finance is the effective strategy for the reduction of poverty. In this paper, the author has not discussed the other indicators on which the micro-finance creates a positive impact (Akanji, 2006).

Roy Marshland and Osteen Storm (2009) has discussed the performance as well as governance of micro-finance institutes. The main aim of this study is to explore the relationship between the firm performance and corporate governance in microfinance institutions. The author has collected the data from the corporate personalities. Furthermore, the primary research method is used for this study. The role of institutes and organization is important for the implication of micro-finance policies as the number of the credit depends on their performance. Therefore, a large number of organizations are working for the enhancement of a number of loans. On the second side, the author has found that there is no difference between the non-profit organizations and shareholder firms in the financial performance. The author has also found that the institutions have played an important role in enhancing the loans for the people as well as improving the living standard of people. The key principles of micro-finance have not discussed in this study (Mersland R. a., 2009).

Valentina Hiratsuka and Denis Nadolnyak (2011) has assessed the effective operations of micro-finance institutions. In most of the developing countries, the pressure on the micro-finance institutions is increasing. The major aim of the author is to examine the performance of micro-finance institutions. The author has used the primary research approach by getting the data from 114 micro-finance institutes of 62 countries. The author has used the empirical model in order to examine the data. The result has shown that the borrowers have indirect benefits from the regulations in a situation is regulation is the only way for micro-finance institutes to access savings. In this study, the poverty factor has not discussed (Valentina & Nadolnyak, 2007).

BegonaGultierrezNiedto et al. (2007) have assessed the micro-finance institutions and its efficiency. The main aim is to examine the efficiency of institutions. The author has used the secondary research approach. The author has measured the performance of micro-finance institution by the financial ratios as the author has used the financial ratio analysis. With the help of financial ratio analysis, the author has examined the performance and efficiency of the micro-finance institutions. The author has found the positive impact of micro-finance institutions. Moreover, with the improvement of the performance of the micro-finance institutions, the number of loans or credit is also increasing. With the help of different models and specification, the author has categorized the efficiencies. In this study, the author has not discussed the social impact of micro-finance (Begona, Cinca, & Molinero, 2007).

This Minh Phuong Ngo and ZakiWahhaj (2012) has studied the relationship between the microfinance and gender empowerment. In this study, the author used the theoretical model of household production and credit for the purpose to analyze that how micro-finance is impacted the intra-household decision making. Moreover, the author has also identified the conditions under which female are most likely to benefits. The author has found that there is a positive relationship between the micro-finance and gender empowerment, but it depends on the initial conditions. Access to loans and microcredit programs have an impact on the variety of intra-household decision making and welfare depending on initial conditions. In this article, the author has not discussed the women empowerment (Phuong & Wahhaj, 2012).

HI rut Berkeley Haile et al. (20) have elaborated the relationship between micro-finance and female empowerment. The main objective of this research paper is to target the poor women in developing countries. Besides the poverty reduction having access to the microcredit advances and their empowerment is the basic objective of the microfinance. This study has explored the variations in the socio-cultural and economic. The author has demonstrated the variations in the formal as well as informal rules. The author has used the primary research method as well as collecting the data from the household women. The author has found that the micro-finance has increased the female empowerment along with their income. The study has also found that institution matters for the female empowerment. In this study, the author has not discussed the other factors of micro-finance and the role of micro-finance (Haile & Bettina Bock, 2012).

Philippe Louis et al. (2013) has described the social impact of micro-finance. Micro-finance has become the powerful force in terms of improving the living conditions of farmers, enterprises and vulnerable groups. The main aim is to investigate the association between the social efficiency and financial performance. The author has conducted the study by primary research method. The author has used the comprehensive data set and collected the data from 650 micro-finance institutions. The results cannot support the hypothesis. Therefore, there is a significant and positive relationship between the social efficiency and financial performance. In this study, the author has not examined the economic impact of micro-finance (Louis, Seret, & Baesens, 2013).

Maren Duvendack et al. (2011) has found the evidence of the impact of microfinance on the well-being of poor people. A key feature of micro-financing is targeting the women as according to the author they perform well as a client of micro-finance institutions as well as they effectively participate and has more desirable development outcomes. Micro-finance creates a positive impact on the income of the poor people. Micro-finance develops the ability among poor people to invest in education, on their health, and in their living. The author has used primary research method. Furthermore, the author has found that the micro-finance create a positive impact on the health of the poor people. In this study, the author has not discussed the other positive effect of micro-finance as they only discussed the well-being of people (Maren, 2011).

Philippe Louis and Bart Basins (2013) has assessed the generalizing estimation of the social impact of microfinance. The main aim is to examine whether the profit microfinance institutions achieve better financial efficiency and social impact. Primary research method has used for this research. The author has used the longitudinal data setting and collected the data from 456 microfinance institutions spanning 15 periods. Furthermore, the author has used the generalized estimating equations for the purpose to correct the correlation between the variables. The author has found that the social impact is associated with the profit microfinance institutions. On the second side, the author has found that the women are closely associated with the profit microfinance institutions. In this study, the author has not discussed the other social and economic impacts of microfinance (Philippe & Baesens, 2013).

3. Methodology

3.1 Research methodology

The research methodology will comprise of the information regarding the processes and the techniques that will be used in order to collect the information as well as using effective analysis to reach optimal conclusions. The descriptive methods used in the research methodology allow the researcher to monitor the time and the resources during the research processes (Mackey & Gass, 2015). In addition, the methodology illuminates the data collecting processes as well as provide an effective basis for drawing conclusions in accordance with the data collecting processes and research objectives.

3.2 Research Approach

For the pertaining research, the researcher has utilized a mixed research approach, which has ensured the collection of the qualitative as well as quantitative data in accordance with the research objectives. The reason behind the use of a mixed approach is that the data that was to be collected required assessment of the behaviors of the borrowers that was assessed using interviews. In addition, the researcher used questionnaires in order to gather information regarding the workability of the micro-financing [20]institutions. Thus, the collection of both numeric and non-numeric data could only be possible if the mixed research approach was used.

3.3 Research philosophy

The researcher has used pragmatism research philosophy in order to assist himself in the research processes. The pragmatism research philosophy is concerned with the collection of the information that can be interpreted subjectively and objectively. The researcher collected via numeric and non-numeric methods, he was able to present the information in multiple manners. The objective assessment allowed the analysis of non-numeric information that was collected via interviews from the borrowers of the microfinance (Hughes & Sharrock, 2016.). In addition, the subjective assessment allowed the researcher to contemplate the numeric information that was collected from the microfinancing banks through questionnaires, which helped to assess the definite requirements of the research objectives.

The terms of the philosophy are based on the idea of how the research is to be conducted in order to integrate the processes efficiently. This can help result in the better data collection, effective analysis and the better insight regarding the collected information, which can help ease the processes as well as provide the researcher with effective results that are able to address the selected hypothesis for testing.

3.4 Sources of data collection

The sources of the data collection are necessary to be assessed in order to minimize the errors that can arise in the data collection processes. Moreover, the sources have to be chosen effectively for collecting the data that is the most relevant to the research. In the context of the pertaining research, the researcher has utilized both primary resources in order to collect the information. The researcher utilized these resources for achieving in-depth details regarding the working of microfinancing[21] institutions in the city of Multan as well as assess their feasibility with regards to the pertaining poverty rates and customer facilitation. Moreover, this allowed the researcher to gather data regarding the pertaining opportunities and challenges for the microfinancing banks as well as facilities that are provided to the customers.

3.4.1 Primary research

The researcher included several sources for collecting the information. This included the selection of microfinance banking institutions as well as their clients and customers that were involved in the banking processes. These sources fulfilled the requirement of primary research for the researcher. The questions in the questionnaire can be designed with the integration of research objectives. In addition, the questionnaires can be designed in order to address the qualitative data in numeric form, which can be used by the researcher to illustrate the qualitative data numerically.

For gathering the numeric information in order to obtain a definite amount of data, the researcher used the quantitative data collection method. The researcher conducted the data gathering using a pre-formed questionnaire. This was conducted with five operating microfinance banks in the city of Multan, including FINCA Microfinance Bank Ltd, Wasilla Microfinance Bank Ltd, Tamer Microfinance Bank Ltd, Khushali Microfinance Bank Ltd, and Mobilink Microfinance Bank Ltd. The questionnaire allowed the researcher to gather numeric information regarding the statistics of the workability of the microfinance banks. In addition, it also allowed the researchers to gain insight regarding the ratios of the people that are acquiring loans as well as ratios of the usage of the loans. The researcher also used closed-ended questions in order to minimize the error that can arise due to a misunderstanding of the questions in open-ended questions.

3.5 Quantitative data collection

For collecting the quantitative information, the researcher used surveys from the clients and customers of the selected banks. This assisted the researcher in assessing the effects of microfinancing and its processes on the borrowers. It also allowed the researcher to gather information regarding the reasons behind the choosing of microfinancing by the clients. Furthermore, the survey also allowed gathering information regarding the economic conditions that were prevailing in the community opting for microfinancing. The subjective analysis allowed the researcher to manipulate the information collected in order to integrate it with the research objectives.

The reason behind opting for qualitative and quantitative analysis is that it provided a naturalistic response of the participants, which allows the research to gain significant information for understating the issues as well as gain insight to the issue, which can be used for effective analysis that can help in deducing optimal results (Neergaard & Ulhoi, 2007).

3.6 The population of the study

For the pertaining research, the researcher selected the micro-financing institutions operating in the city of Multan.

3.7 A sample of the study

The sample represents the entire population, and the results derived from the assessment of the sample are applied to the entire population. For the pertaining research, the researcher selected five operating microfinance banks in Multan. In addition, the researcher randomly selected about 200 clients and customers of those banks according to the requirements of the research.

3.8 Sampling technique

There are various types of sampling techniques that are used in research such as simple random sampling, systematic sampling, stratified sampling, cluster sampling, and convenience sampling. All the techniques have its own pros and cons, but all are useful in research. The usefulness of the techniques depends on the field, scope, and nature of the study. Basically, sampling techniques are used to select the statistical sample from a large population. For the selection of sampling technique, it is important for the researcher to select those who represent all the elements of the population.

For the current sampling in the research, the researcher used the convenience-sampling technique to select a random sample from the selected population. The convenience sampling technique is a non-probability sampling method that allows the researcher to gather sample based on the convenience of the participant. The customers and the banks that were conveniently available for the research were selected in order to carry out the research (Eriksson & Kovalainen, 2015).

3.9 Pilot test

In order to minimize the errors in the questionnaires and the interview questions, the researcher used the pilot test to eradicate flaws as well as revise the questions to be used in the data collecting process. The pilot test was conducted with a small sample, which provided significant details regarding the changes to be made in the questions.

3.10 Validation and reliability

Validity and reliability is an important part of research as both teams play an important role. The unbiased, accuracy and effectiveness of the research depends on the reliability of the data. In simple words, reliability is the degree of measurement through which a research or assessment tool produces stable as well as consistent results. On the second side, validity is the main indication of the results as it shows that the findings truly represent the phenomenon that the research claims to measure.

As the researcher is using both primary research collection methods, the researcher managed the effectiveness of the research processes. The interviews conducted were able to address the requirements of the research objectives. In addition, the questionnaires also included the most relevant questions that could help address the research questions.

The primary data needs to be assessed in order to ensure that the data collection process fulfills the requirements of the research. The efficiency of the information to be collected for the research was ensured with the connection of the researches made in context with the pertaining variables and the environment (Noble & Smith, 2015). Moreover, the changes that occurred in the era of previous researches such as technology, financial management processes, etc. were considered as well in order to integrate the researchers used with the pertaining hypothesis that needed to be addressed.

The monitoring of the information that was collected in the questionnaires, as well as interviews, were observed as well as kept confidential to minimize the threat of reputational issues for the participating financial institutions. In addition, the researcher ensured that no ethical boundaries were crossed during the conduction of the interviews and no such questions were asked that could contradict the ethical terms. Moreover, the researcher ensured that the participating entities were comfortable with the processes and that there was no pressure upon them while gathering the information.

3.11 Data Analysis

The researcher used both qualitative and quantitative data for conducting the research therefor for data analysis different statistical methods has been used. The research had already used Pilot Test for removing the errors from the questionnaire prior to data collection. While for the analysis of data which was collected with the help of questionnaire the researcher has used excel for the graphical representation. The tools of excel were selected for the data analysis of this research because it has the ability to analyze the complex data with simple instructions. This tool also gave the advantage to the researcher to generate charts, trends, and plots (Joseph, Wolfinbarger, Money, Samouel, & Page, 2015).

3.12 Ethical Consideration

Ethical consideration is an important aspect for every researcher as it is a critical part of the research.In research, the ethics are the norms and the standards for conduct that distinguish between the right and wrong. In simple words, ethics helps the researcher to determine the difference between acceptable and unacceptable behaviors. On the second side, it is the responsibility of the research to secure the confidential and personal information of participant or respondent.

During the conduction of this research the researcher very careful about the research ethics. Such as, the researcher has not asked any questions in the interview with which the participants were not comfortable. The researcher has not invaded the personal space of the respondents. The interview in the strict formal environment. The interview was recorded after the proper consent of interviewees. The researcher has not used the information and data of any other author without proper citation. The personal information of the participants will be protected.

4. Data Analysis

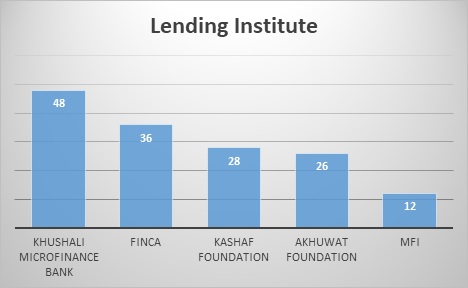

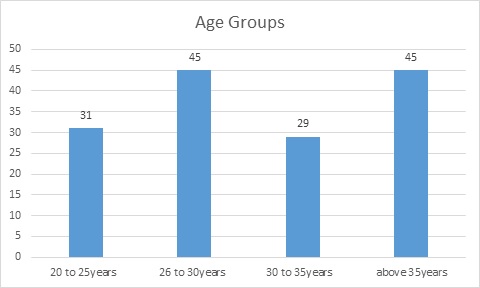

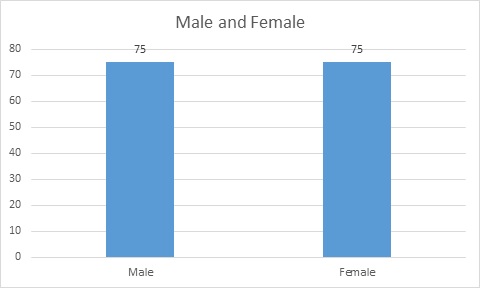

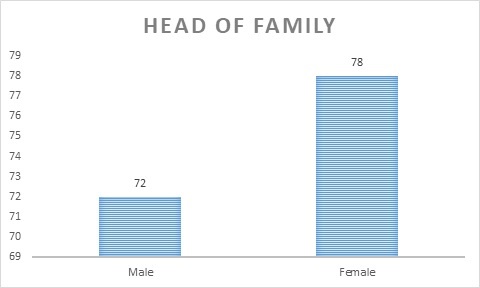

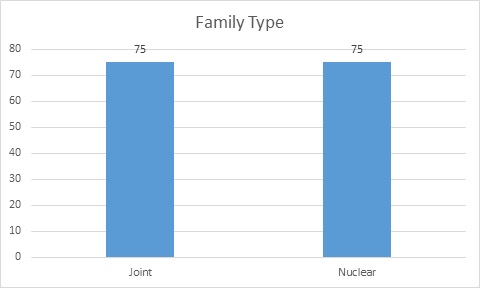

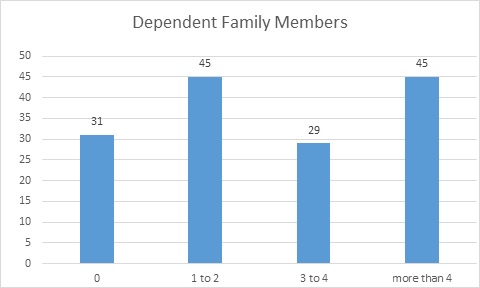

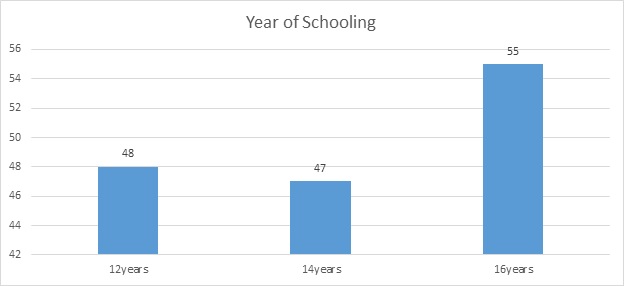

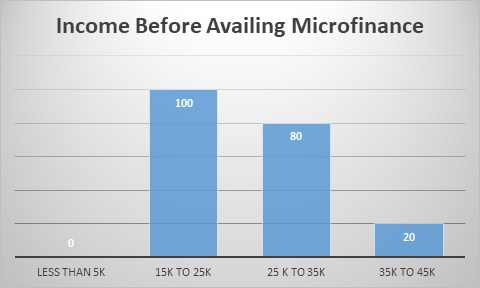

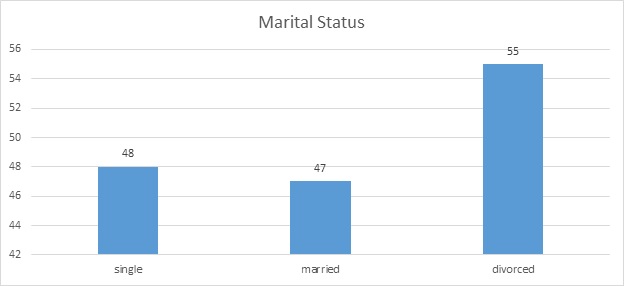

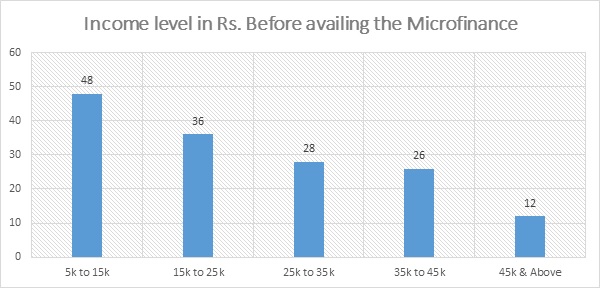

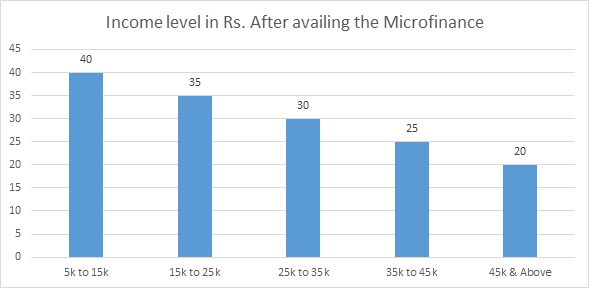

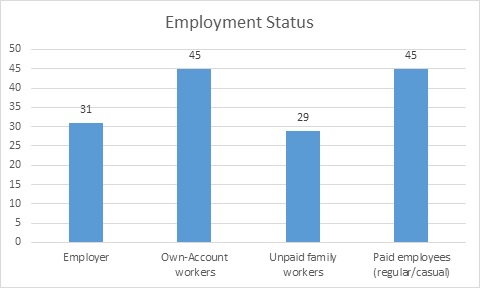

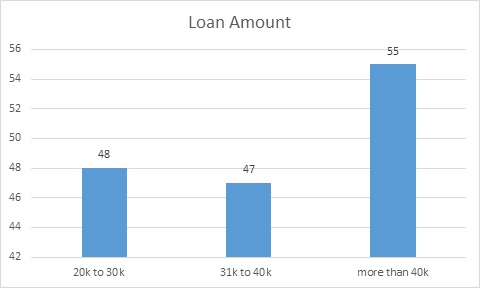

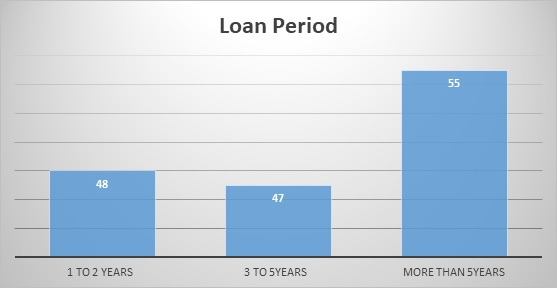

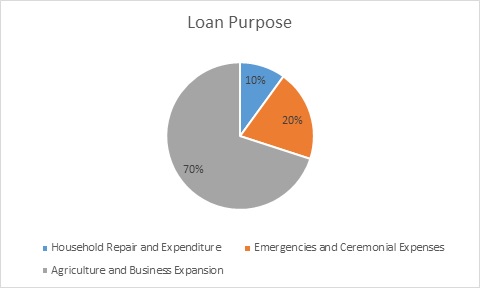

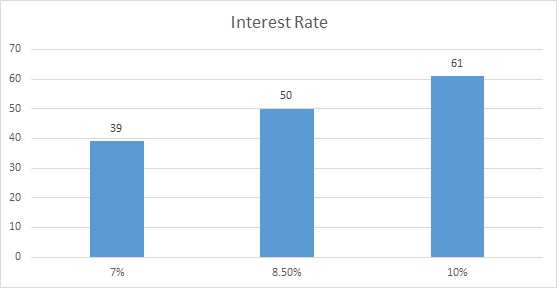

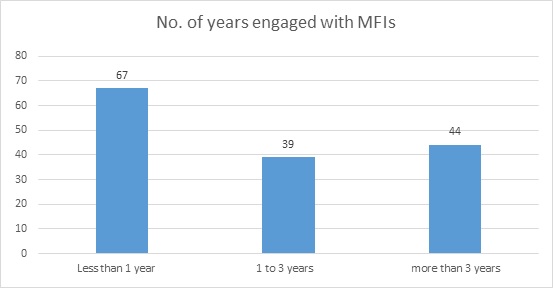

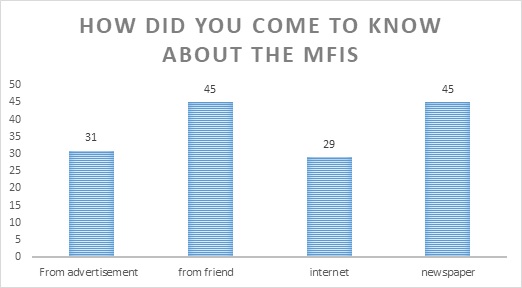

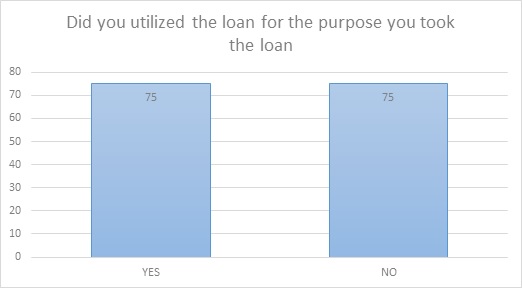

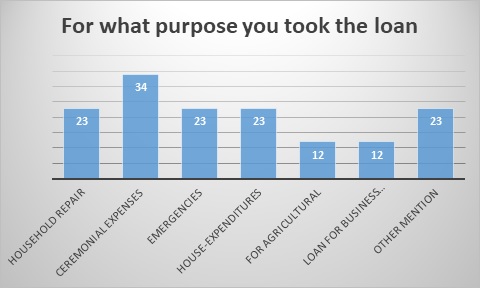

The questionnaire focused on the income level of the respondents and to which extent the microfinance improved their financial status. It accounted for some others factors such as age, gender, marital status, type of family and the position of the person in the family. The name of the lending institution provided the insight into mainstream microfinance[22] institutions which are offering feasible lending options to people with different income levels and different types of employment. Approximately 200 people participated in the survey.

Figure 1