Activity based Costing Homework Help

The costing field of accountancy deals with the recording of costs of all the materials and services and overheads incurred on them so as to assist management in the proper reduction in the costs.

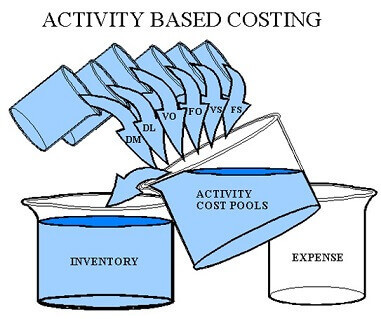

Activity Based Costing or famously known as ABC Analysis method deals with allocating the overheads to the activities or functions in the way they are actually used. The ABC Analysis is used in the process of overhead costs reduction. It works the best in the circumstances of complex business models with many types of machinery, products and tools. Thus the resources are categorized into A-B-C Groups and the overhead allocation is taken forward.

How does it work?

In contrast to Traditional Method of costing the ABC

Analysis method accumulates all the overheads and then

apportions it to the activities, products and services. The

most important function in the analysis is the

categorization of the activities for the apportionment of

the costs.

In contrast to Traditional Method of costing the ABC

Analysis method accumulates all the overheads and then

apportions it to the activities, products and services. The

most important function in the analysis is the

categorization of the activities for the apportionment of

the costs.

The Activity Based Costing Analysis could be done in the following manner:

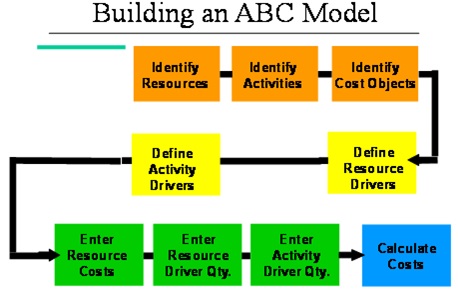

1. Identifying activities: The base for ABC Analysis is the identification of the activities to which the costs can be assigned. An in-depth analysis must be carried out to identify the activities of all the responsibility centers. The activities must be in such a manner that they assist or result in the production of services or products in the business.

2. Assign resource costs to activities:{" "} This process involves the identification of the relevant costs and assigning them to the activities in proportion. There are different types of cost depending upon the way they can be apportioned. These are:

(i) Direct Costs: The direct costs refer to those costs which can be assigned to different activities easily. They can be traced or allocated to any one output appropriately. For example: cost of labor used to produce one unit of product.

(ii) Indirect Costs: Indirect costs refer to the costs which cannot be assigned to any one output. These are generally the costs which are incurred on more than one activity. They are not easy to be assigned and thus different estimates are used to allocate them. For example: Maintenance costs, repairs etc.

(iii) Administration Costs: The administration costs refer to those costs which cannot be associated or allocated to any of the activities. They are used by all of them. For example: Stationary, Fee of clerk etc.

3. Identify Outputs: This phase deals with identifying the outputs produced by different activities. Every activity was associated with some output which could be in the form of products or services.

4. Assigning activity costs to outputs:{" "} This process means recovering the activity costs from the outputs produced. The activity costs are allocated to the different outputs produced.

Applications of Activity Based Costing System:

The ABC System is highly in prevalence. It is a highly reliable concept. It can be used in the following ways:

- ABC System helps to identify inefficient products and activities.

- It helps in mitigating the costs which are ineffective and unnecessary.

- ABC helps in allocating the costs to the activities with more profits.

- It helps in the control of the costs per product per level.

- ABC helps in fixing the prices of the products and services so as to recover the costs.

-

The stocks can be maintained easily using ABC System.

Limitations of Activity Based Costing System:

Where the ABC System has so many advantages; it has some limitations as well.

1. Problem of tracing costs: The basic problem followed in the ABC System is that of tracing the costs. The Costs are hard to be traced. Identifying that which costs relates to which activity. The allocation of indirect costs and administration costs is not reliable because it is done on an estimation basis.

2. Installation time: ABC System is a lengthy method and it takes a long time to set up its functionality. The identification of different activities, costs, allocation and apportionment of costs to outputs takes a long time for implementation.

3. Costly method: Activity Based Costing system requires a huge set up. The huge set up requires different experts for proper analysis of the results. Thus it involves huge costs for the set up.

4. Multi-department data sources: ABC Analysis requires data from different departments for its implementation. The higher the frequency of data required the more will be the chances of the failure of the data’s reliability.

The Activity Based Costing System’s implementation in practical life can be of great use. For this more information is required. You can visit urgenthomework.com to know more about the ABC System.

We understand how much good marks value to you. This is why we brought this facility for you where you can get your homework done online from the professionals. In case you have any query or need any assistant with any subject you can communicate with the teachers and experience the online classes. All the teachers are best in their respective fields. You can also get your homework, assignment done. All you need to do is just submit your assignment along with the deadline. What makes us different from other companies is the hard work we put in and the good and timely order we deliver.

So experience the best service sitting at your home. Just visit urgenthomework.com now.

Accounting Topics

- Accounting ratios

- Activity based Costing

- Accounts Problem And Solutions

- Amortization

- Bank Reconciliation Statement

- Bookkeeping

- Break even Point

- Cost Accounting

- Cash Flow Statement

- Financial Accounting

- Intangible assets

- Inventory

- Managerial Accounting

- Non-profit Accounting

- Payroll Accounting

- Standard Costing and Variance Analysis

- Taxation