Analysis of the performance and financial position of Marks and Spencer Group

Solution : Q 1.

To,

The board of directors,

Marks & Spencer Plc

UK

From : Financial Consultant

Introduction

This report discusses the analysis of the performance and financial position of Marks and Spencer Group plc (commonly abbreviated as M&S or colloquially Marks and Sparks) is a major British multinational retailer with headquarters in London, England, that specialises in selling clothing, home products and food products. and their competitor The John Lewis Partnership plc (JLP) is a British company which operates John Lewis & Partners department stores, Waitrose & Partners supermarkets, its banking and financial services, and other retail-related activities.

The comparisons between the two companies for the seven years from 2013 to 2019, considering horizontal and vertical as well as 4 categories of ratio analysis (Profitability, Liquidity, Efficiency and Gearing), of the financial statements. The analysis shows the interpretation of financial health and growth prospects of the companies.

Financial Ratio Analysis

In this section, the analysis of different financial ratios i.e. profitability ratios, efficiency ratios, liquidity ratios, gearing ratios etc. has been done for both the companies – Marks and Spencer and John Lewis. These will give us the 360 degree report of Different factor affecting these ratios have also been analyzed with the help of horizontal and vertical analysis of these companies given in annexures. Also comparative studies have been done here to get the better idea about the financial performance of these companies comparatively.

1 - Profitability Ratios

Marks & Spencer

|

Ratio |

Formula |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|

ROCE % |

EBIT x 100 |

11.01% |

10.84% |

10.67% |

8.85% |

3.38% |

1.41% |

2.09% |

|

Average Capital Employed | ||||||||

|

ROA % |

PAT x 100 |

7.67% |

7.54% |

7.76% |

6.41% |

2.33% |

1.02% |

1.35% |

|

Average Total Assets | ||||||||

|

Asset Turnover ratio (x) |

Total Revenue x 100 |

1.38 |

1.37 |

1.34 |

1.37 |

1.40 |

1.51 |

1.62 |

|

Average Total Assets | ||||||||

|

Gross Profit Margin% |

Gross Profit x 100 |

37.86% |

37.54% |

38.65% |

39.11% |

38.48% |

37.83% |

36.91% |

|

Total Revenue | ||||||||

|

EBITDA Margin% |

EBITDA x 100 |

12.03% |

11.29% |

11.87% |

12.38% |

8.61% |

9.39% |

8.27% |

|

Total Revenue | ||||||||

|

Net Profit Margin % |

Net Profit x 100 |

5.63% |

5.63% |

5.82% |

4.63% |

1.66% |

0.62% |

0.82% |

|

Total Revenue |

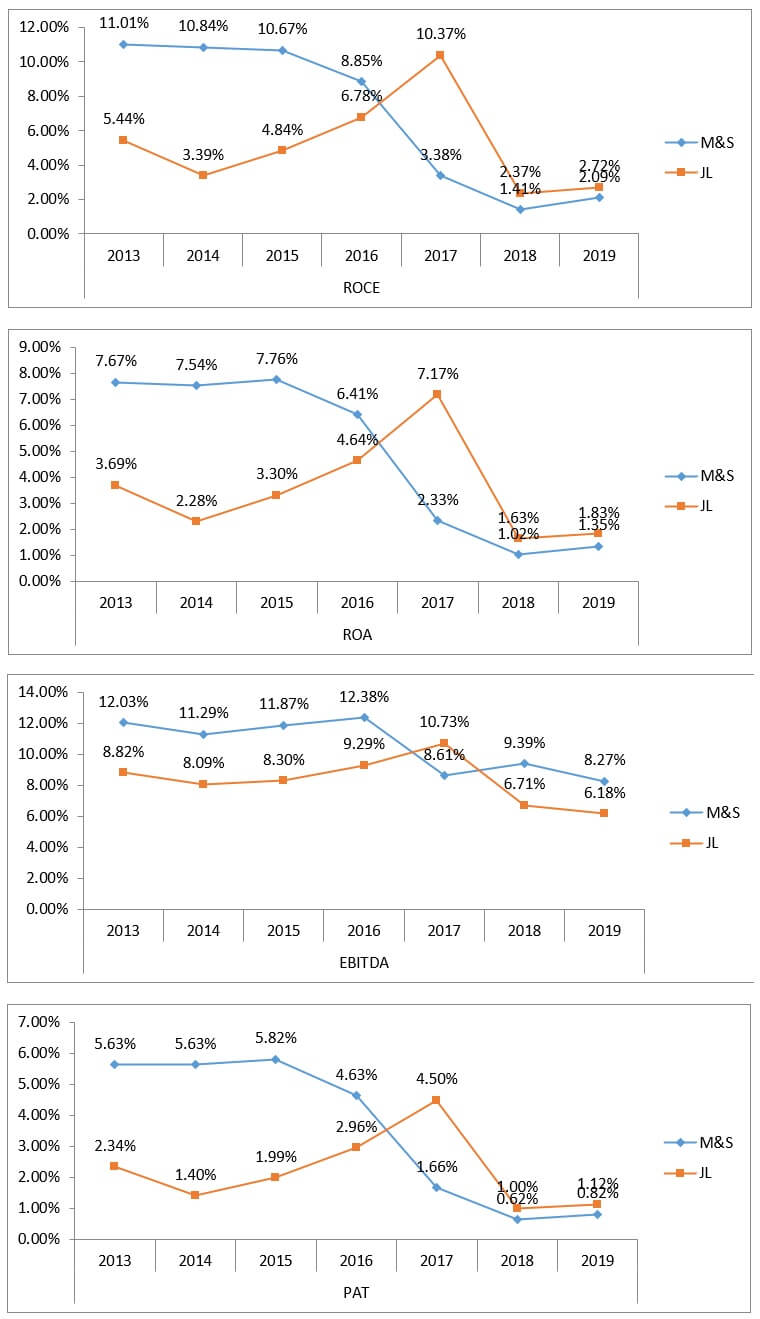

Vertical & Horizontal Analysis – Profitability Ratio – Marks and Spencer

ROCE : It has been seen from the above analysis of profitability ratio that the ROCE (%) for M&S has reduced drastically from 11.01 % to 2.09 %. There is reduction is happening due 2 factors, one is EBIT is called the operating profit as well as Average Capital Employed. When we see the Vertical Analysis of Income statement of M&S in Appendix B we found that the operating profit has reduced from 7.54% to merely 1.56%.It is happening on 3 count. There is increase in cost of sales of 1% (aporx.), than increase in administrative expenses of .5% & major increase in exceptional items of 4% ( aprox.) as well as there is a reduction in other operating income of .5%. these all put together makes it reduction of 6% (approx.). comparison is made from 2013 to 2019.

ROA & PAT : ROA % has decreased from 7.67% to 1.35%. by analyzing the income statement vertical we could see that PAT is reduced from 4.57 % to .36%, we can see that there is considerable reduction in payment of interest but the operating profit panic has impacted the PAT also.

Asset turnover ratio : After analysis of Asset turnover ratio we could see that asset turnover ratio has increased from 1.38 % to 1.62% but we need to be very happy with increase in this ration as after analysis of horizontal income statement( Appendix D) as well as horizontal balance sheet ( Appendix E) we could see that turnover has increased just by 3.5 % but due to reduction is the total assets by 15% the assets turnover ratio has increased significantly.

Gross Profit Ratio : One good thing is maintained by the company is that they are very consistent about maintaining gross profit ration almost all of the 7 previous year.

EBITDA : EBITDA ratio has also decreased but it has just decreased by 4% approx. compare to huge reduction in operating profit the company EBITDA has just decreased by 4% because of two count that depreciation has increased over the period from 2013 to 2019 as well as amortization and impairment has increased from 2013 to 2019.

Net Profit Margin: Net Profit Margin has drastically reduced because of Depreciation Increase, increase in amortization, decrease in operating profit. With the analysis of horizontal analysis of income statement (Appendix D) we could see from the 2013 to 2019 there is huge increase in exceptional items, increase in administrative expenses, very less increment is sales, increase in amortization, depreciation as well as remuneration. These all the analysis is made after analyzing last 7 years data from year 2013 to 2019 of Marks & Spencer.

John Lewis

|

Ratio |

Formula |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|

ROCE % |

EBIT x 100 |

5.44% |

3.39% |

4.84% |

6.78% |

10.37% |

2.37% |

2.72% |

|

Average Capital Employed | ||||||||

|

ROA % |

PAT x 100 |

3.69% |

2.28% |

3.30% |

4.64% |

7.17% |

1.63% |

1.83% |

|

Average Total Assets | ||||||||

|

Asset Turnover ratio (x) |

Total Revenue x 100 |

1.60 |

1.66 |

1.71 |

1.62 |

1.60 |

1.62 |

1.64 |

|

Average Total Assets | ||||||||

|

Gross Profit Margin% |

Gross Profit x 100 |

33.38% |

33.44% |

33.75% |

33.92% |

33.84% |

32.97% |

32.82% |

|

Total Revenue | ||||||||

|

EBITDA Margin% |

EBITDA x 100 |

8.82% |

8.09% |

8.30% |

9.29% |

10.73% |

6.71% |

6.18% |

|

Total Revenue | ||||||||

|

Net Profit Margin % |

Net Profit x 100 |

2.34% |

1.40% |

1.99% |

2.96% |

4.50% |

1.00% |

1.12% |

|

Total Revenue |

Vertical & Horizontal Analysis – Profitability Ratio – Jown Lewis

ROCE: After analyzing the Income statements as well as Balance sheets of Jown Lewis for last 7 years from year 2013 to 2017 our findings is as follows.

ROCE has decreased from 5.44% to 2.72 % over the period of 7 years and it has happened on 2 counts. Firstly after analyzing the Income Statements ( Annexure F) we could see there is minor increase in COS but the Administrative expenditure is increased 3% approx. over period of 7 years. Little bit increase in other operating expenditure . hence operating profit got down by 3% approx.. after analyzing horizontal statement of balance sheet ( Appendix I) we could see there is significant increase in avg. capital employed over the above period and these two factor effected the decreased the ROCE of the company.

ROA : this ratio has also decreased over a period of 7 years because the PAT decreased due to reduction of operating profit and horizontal analysis of balance sheet(Appendix I) shows there is increase in the % of total assets by 17.68% over 7 years time period. This has lower down the ROA from 3.69% to 1.83 % over the 7 years period.

Asset Turnover Ratio: Assets turnover ratio has been maintained consistently from 1.60 % to 1.64% over a period of 7 years. By analyzing the horizontal analysis statements of balance sheet ( Appendix h) we could see that he turnover has increased from 100% to 121.87 % but there is also increase in Total Assets from 100% to 117.68% over a period of 7 years from the year 2013 to 2019. Due to this reason Asset turnover ratio is consistent.

Gross Profit Ratio: There is no issue with the gross profit ration company has maintain steady rate of gross profit from 33.38% to 32.82% with minor fluctuation. With the analysis horizontal income statements there is consistent increase in turnover from 100% to 121.87% and the gross profit ratio also increase by 22.89% over a period of 7 years. Due to this reason the gross profit is maintained at consistence rate with minor fluctuation.

EBITDA margin: EBITDA % has decrease from 8.82 % to 6.18% over a period of 7 years. By analyzing the vertical statements of income statements for the company (Appendix F), we could see that effect is coming from the reduction in the operating profits but there is little improvement in the reduction of depreciation, increase in the amortization expenses impacted the changes in EBITDA % over a period of 7 years from year 2013 to 2019.

Net Profit Margin: by the above statements we are able to see that there is a reduction in net profit margin from 2.34% to 1.12 %. By analyzing the Vertical income statements ( appendix F) we could see that Net profit margin has reduced over the period of 7 years because the operating profit % has decreased and by analyzing the Horizontal analysis of statements of income (appendix H) we could see that this reduction has mainly due to increase in the operating costs by 73.19% over a period of 7 years, reduction in the total other income over this period.

Comparison

Comparison Statements between Marks & Spencer and Jown Lewis

ROCE: Comparison of above graph of ROCE depicts that Marks & Spencer ROCE is consistently reduced over a period of 7 years. The management of the M&S is not in position of improve this ration in last 7 years. Only there is minor improvement with the last year %. That showing minor correction. But it is very serious issue for the M&S because all this branded retails sales has been badly effected with the online branded product as well as online marketer. As far as JL is concern their ROCE has decreased from year 2013 to 2014 but after that they improved drastically but in again in the year 2018 and 2019 it is down. But comparatively ROCE is better for JL than M&S.

ROA: ROA graph movement is almost same like ROCE and with the change in % almost explanation is same for ROA also. Here also the performance of profit towards capital and total assets are better for JL compare to M&S.

EBITDA: EBITDA there is reduction for M&S from 12.03 % to 8.27% compare to 8.82% to 6.18% for JL . here also JL is operationally performing better than M&S in Managing well their assets and their different type of profits compare to M&S.

PAT: PAT analysis is again very bad for M&S because it reduced due to increase in depreciation, amortization as well as increase in administrative cost. But for JL there is decrease in depreciation as well as increase in amortization & administrative expenses. But still JL PAT is better because comparatively decrease is quite less than the M&S over a period of 7 years.

Conclusion : JL is better company in operating their operation, managing their cost, utilization of their assets. M&S board of directors has to see issue very seriously and do the deep analysis of financial and non financial operation to improve the result other wise in future they find major consequences from the market, customer as well as from their investors.

2 - Liquidity Ratios

These ratios show the short term liquidity position of the company whether the company has sufficient funds to finance its short term liquidity requirement i.e. working capital requirement or not. Liquidity ratio consist of mainly 3 following ratios.

Marks & Spencer

|

Ratio |

Formula |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|

Current Ratio (x) |

Current Assets |

0.57 |

0.58 |

0.69 |

0.69 |

0.73 |

0.72 |

0.67 |

|

Current Liabilities | ||||||||

|

Quick Ratio (Acid Test Ratio) (x) |

Current Assets - Inventories |

0.22 |

0.22 |

0.31 |

0.31 |

0.41 |

0.29 |

0.35 |

|

Current Liabilities | ||||||||

|

Cash Ratio (x) |

Cash + Marketable securities |

0.09 |

0.08 |

0.10 |

0.12 |

0.20 |

0.11 |

0.13 |

|

Current Liabilities |

CURRENT RATIO : Current ratio for Marks & Spencer has increased from 0.57 to 0.67 over a period of & years . Vertical Analysis Statements ( Appendix C) shows that current assets has increased from 17.22% to 23.78 % over a period of 7 years, their current liabilities is also increased from 30.41% to 35.55 % over a 7 year period. Horizontal analysis also shows that there is increase of current assets by 17.55% over a period of 7 years. Due to this reason current ratio is increased from 0.57 to 0.67. it shows some improvement. This will increase the liquidity of the company. But if we compare with the industries norms the ideal norms is 2. If you have 2:1 ratio your liquidity will be best. The present current ratio may increase its profitability but may reduce its liquidity.

Quick Ratio: this ratio is also increased from 0.22 to 0.35. Horizontal statements analysis of balance sheet(appendix E) shows that there is decrease in the value of stock from 100% to 91.28%. as well as there is increase in the bank and deposits from 100% to 147.80% over a period of 7 years. Due to this there is significant increase in the quick ratio. But as per the industrial norms it must be 1. It must be 1:1 and with this ratio our liquidity will increase and we must be in position to dispose our liability on time . I advice to the board of directors to look into this matter and improve the ratio other wise there may be serious concern in the payment of the current liability.

Cash Ratio : Cash ratio is also increased due to increase in the bank and marketable securities and increase from 0.09 to 0.13. but the overall cash ration is very less. Ideal cash ratio suggested is also 1 or at least with the payment of the very short term current liability . our accounts payable always look for a better cash ratio for better liquidity.

John Lewis

|

Ratio |

Formula |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|

Current Ratio (x) |

Current Assets |

0.72 |

0.63 |

0.63 |

0.78 |

0.84 |

0.88 |

0.93 |

|

Current Liabilities | ||||||||

|

Quick Ratio (Acid Test Ratio) (x) |

Current Assets - Inventories |

0.43 |

0.32 |

0.32 |

0.47 |

0.52 |

0.54 |

0.62 |

|

Current Liabilities | ||||||||

|

Cash Ratio (x) |

Cash + Marketable securities |

0.31 |

0.20 |

0.18 |

0.34 |

0.35 |

0.33 |

0.35 |

|

Current Liabilities |

Current Ration: Current ration of JL is improved from 0.72 to 0.93 in the last 7 years . after analyzing the horizontal analysis of balance sheet (appendix I) we could see that current assets of JL is increased from 100% to 154.62 % and the current liabilities of JL is increased from 100% to 119.89% over a period of 7 years from2013 to 2019. Due to this current ratio is increased. But as discussed above the current ration of 2:1 is best. This is an ideal ratio.

Quick Ratio: Current ratio also increased from 0.43 to 0. 62 in the last 7 years, after analyzing the horizontal analysis of balance sheet we could see that there are significant increase in bank & deposit over a period of 7 years from 100% to 134.13%. but as discussed above quick ratio of 1 is best as per the industry practices.

Cash Ratio: cash ratio also increased from 0.31 to .35 due to increase in bank deposits and marketable securities.

But the ratio is bit less than the industrial norms prescribed above.

Comparison

When we compare the above results we can say that JL is in much better position in the context of CR, QR, CR compare with the M&S. The Quick ratio and cash ratio of M&S is badly managed and it is very poor. Their liquidity might have been effected and will be effected badly in the future. If proper steps has not been taken by the Board of directors and middle management there will be lot of problem arising while paying its liability. Comparatively JP position is better managed but their ratios are also quit poor and their management has also start taking corrective measures to improve this .

3 - Efficiency Ratios

Marks & Spencer

|

Ratio |

Formula |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|

Receivable Collection Period (days) |

Average Receivables x 365 |

3.94 |

4.49 |

4.38 |

4.00 |

3.76 |

3.89 |

4.17 |

|

Annual Sales | ||||||||

|

Payable Payment Period (days) |

Avg trade payables x 365 |

35.41 |

40.50 |

34.25 |

35.34 |

33.25 |

29.78 |

32.05 |

|

Purchase | ||||||||

|

Inventory Turnover Period (days) |

Avg inventory x 365 |

44.95 |

47.93 |

46.03 |

45.43 |

42.37 |

42.86 |

39.05 |

|

COGS |

Receivable collection period : Receivable collection period is increased from 3.92 days to 4.17 days. There is insignificant increase in the receivable. It is good that M&S maintained it consistently.

Payable Payment Period : Payable payment period is decrease from 35.41 to 32.05. there is decrease of almost 2.5 days. Means company are paying little early.

Inventory turnover ratio: As far as inventory turnover period it is reduced from 44.95 days to 39.05 days. There is significant increase of improvement in stock turnover by 5 days. Means it is taking 5 less days for sales. Overall procurement to sells and their collection period has reduced from 14 days to 11 days. And here company has shown good sign of improvement.

John Lewis

|

Ratio |

Formula |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|

Receivable Collection Period (days) |

Average Receivables x 365 |

2.13 |

2.23 |

2.16 |

2.28 |

2.47 |

3.02 |

2.64 |

|

Annual Sales | ||||||||

|

Payable Payment Period (days) |

Avg trade payables x 365 |

30.10 |

31.86 |

33.53 |

34.62 |

35.01 |

33.74 |

32.50 |

|

Purchase | ||||||||

|

Inventory Turnover Period (days) |

Avg inventory x 365 |

33.26 |

33.65 |

32.98 |

35.24 |

34.55 |

35.30 |

34.63 |

|

COGS |

Receivable collection period : Receivable Collection Period is almost consistence for John Lewis company. It is increased from 2.13 days to bit 2.64 days over a period of 7 years. After analyzing the horizontal analysis statements (appendix H) we have seen that sales has increased from 100% to 121.87% as well as debtors also increased from 100% to 150.51%. due to this reason we could see the consistency in the collections.

Payable payment periods: Payable period is increased from 30.10 days to 32.50 days over the period of 7 years. And this shows some sign of relief.

Inventory turnover ratio : Inventory turnover ratio is consistent over a period of 7 years and we could see the minor increase in that. From 33.26 days to 34.63 days. Overall period from procurement to sells and collection is 5 days approx. for 2013 is almost 5 days approx. in 2019. So this ratio is almost same.

Comparison

John Lewis receivable collection period is less than the Marks & Spencer as well as inventory turnover ratio is also very less in no of days. As far as payable period is concerned it is almost same . when we talk about the overall working capital cycle from procurement to sells and their collection is only 5 days for John Lewis compare to 11 days for Marks and spencer. All these analysis has been made over a period of seven years from 2013 to 2019.

4 – Financial Risk Ratios

Marks & Spencer

|

Ratio |

Formula |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|

Gearing Ratio (x) |

Debt |

126.79 |

114.30 |

84.50 |

68.88 |

81.75 |

65.02 |

69.84 |

|

Debt + Equity | ||||||||

|

Interest Coverage Ratio (x) |

EBIT |

3.59 |

5.17 |

6.14 |

5.20 |

2.56 |

1.59 |

1.76 |

|

Interest Expense |

Gearing Ratio: Gearing ratio of Marks & Spencer is reduced drastically from 126.79 to 69.84. after analyzing the horizontal statements (appendix E) we could see that there is decrease in long term debt by 26 %. This has improved the gearing ratio for the company. Gearing ratio is also means improvement of long term solvency position of the company.

Interest Coverage Ratio: Interest Coverage ratio is decreased from 3.59 to 1.76 over a period of 7 years. This has happened due to drastic reduction in the operating profit from 7.54 % to 1.56% over a period of 7 days. But we could see from the vertical analysis of income statements ( Appendix B) as well as vertical analysis of balance sheet ( Appendix C) that due to reduction in the long term loan there is reduction of interest paid from 2.18% to 1.08%. but due to operating profit the interest coverage ratio is decreased drastically.

John Lewis

|

Ratio |

Formula |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|

Gearing Ratio (x) |

Debt |

104.69 |

119.19 |

185.98 |

124.44 |

116.96 |

91.79 |

75.53 |

|

Debt + Equity | ||||||||

|

Interest Coverage Ratio (x) |

EBIT |

3.44 |

2.32 |

2.97 |

3.90 |

5.26 |

2.23 |

2.56 |

|

Interest Expense |

Gearing Ratio : Gearing ratio of John Lewis has reduced drastically from 104.69 to 75.53 . after analyzing the horizontal analysis statements of balance sheet (appendix I) we can see that there is decrease in the long term liabilities from 100% to 93.84% as well as equity funds is increased from 100% to 137.52% over a period of 7 years. Due to the gearing ratio is decreased and solvency position of company is has increase. It is good for financial health of the company.

Interest Coverage ratio: Interest coverage ratio has been reduced from 3.44 to 2.56 over a period of 7 years. It is mainly reduction of operating profit from 5.31 % to 2.20 % ( vertical analysis of Income statements). There is improvement in the payment of interest due to reduction in the long term loan. All these impacted the company reduce their interest coverage ratio over a period of 7 years from 2013 to 2019.

Overall Conclusion

Ratio Analysis is a tool made only for the purpose for comparisons, we do 2 types of comparisons called

- Inter firm comparison ( Means comparison between the firms like M&S as well JL)

- Intra firm Comparison ( Means comparison within the firm for last several year of performance with current year of performance.

When we compare their financial as well as operational results from the angle of different ratios as well as with the above types of comparison we do 360 degree approach of analysis. Unless we do the holistic analysis we won’t be able to judge the position of our company. We won’t be able to analyze our each any every activity from board of directors level to lower level of management as well as we won’t be able to analyze from the perspective of different stack holder. We would be working like frog in the well and one fine morning we will hear that so and so company has become insolvent and with bad management practices spoiled all the interest of stake holder.

After analysis of financial reports which include the income statements as well as balance sheet from the different perspective of vertical analysis as well as horizontal analysis of all the statements as well as all the ratios for the period of 7 years from year 2013 to 2017 we have come to conclusion and our summarized reports are as follows for the perusal of the board of directors

- Profitability Ration: Most of the profitability ratio of Marks & Spencer was very good initially but due to increase in the operation cost , depreciation as well as amortization charges their ration has guan down over a period of 7 years. But gross profit ratio was maintained consistently but due to increase in several cost they could not maintain the pace.

As far as John Lewis is concerned their profitability has also been reduced but not drastically like M&S. Gross profit ratio is maintained steadily

- Liquidity ratio : Liquidity ratio of John Lewis is much better than Marks & Spencer. All the ratio you can see in the above reports that JL is having better liquidity position than M&S, but when the industrial norms comes into the picture still both the company has to work a lot from the different perspective for improvement of liquidity. Specially it is a serious concern for Marks & Spencer and their Board need to start working on these issues.

- Efficiency Ratio : Efficiency ratio is also very good for the John Lewis compare with the Marks & Spencer, we can check from their analysis made above. Again we suggest board of Marks & Spencer that they need to start the corrective measures to improve their efficiency.

- Financial Risk Ratio : Gearing ration is very good for both the company. If we see the current year ratio both the company are standing at approximately same ratio for gearing. The ratio has guan down drastically for both the company over the last 7 years period. The long term solvency of the company has increased drastically and it is good for the company. As far as interest coverage ratio has guan down over a period of 7 years due to decrease in the operating profit for both the company. And it is really a serious concern and both the company need to work hard and come with different strategy to improve the operating profit . This will increase the interest coverage ratio .

Appendix A: Ratios

1a) Marks & Spencer: Profitability Ratios

|

Ratio |

Formula |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|

ROCE % |

EBIT x 100 |

11.01% |

10.84% |

10.67% |

8.85% |

3.38% |

1.41% |

2.09% |

|

Average Capital Employed | ||||||||

|

ROA % |

PAT x 100 |

7.67% |

7.54% |

7.76% |

6.41% |

2.33% |

1.02% |

1.35% |

|

Average Total Assets | ||||||||

|

Asset Turnover ratio (x) |

Total Revenue x 100 |

1.38 |

1.37 |

1.34 |

1.37 |

1.40 |

1.51 |

1.62 |

|

Average Total Assets | ||||||||

|

Gross Profit Margin% |

Gross Profit x 100 |

37.86% |

37.54% |

38.65% |

39.11% |

38.48% |

37.83% |

36.91% |

|

Total Revenue | ||||||||

|

EBITDA Margin% |

EBITDA x 100 |

12.03% |

11.29% |

11.87% |

12.38% |

8.61% |

9.39% |

8.27% |

|

Total Revenue | ||||||||

|

Net Profit Margin % |

Net Profit x 100 |

5.63% |

5.63% |

5.82% |

4.63% |

1.66% |

0.62% |

0.82% |

|

Total Revenue |

1b) John Lewis: Profitability Ratios

|

ROCE % |

EBIT x 100 |

5.44% |

3.39% |

4.84% |

6.78% |

10.37% |

2.37% |

2.72% |

|

Average Capital Employed | ||||||||

|

ROA % |

PAT x 100 |

3.69% |

2.28% |

3.30% |

4.64% |

7.17% |

1.63% |

1.83% |

|

Average Total Assets | ||||||||

|

Asset Turnover ratio (x) |

Total Revenue x 100 |

1.60 |

1.66 |

1.71 |

1.62 |

1.60 |

1.62 |

1.64 |

|

Average Total Assets | ||||||||

|

Gross Profit Margin% |

Gross Profit x 100 |

33.38% |

33.44% |

33.75% |

33.92% |

33.84% |

32.97% |

32.82% |

|

Total Revenue | ||||||||

|

EBITDA Margin% |

EBITDA x 100 |

8.82% |

8.09% |

8.30% |

9.29% |

10.73% |

6.71% |

6.18% |

|

Total Revenue | ||||||||

|

Net Profit Margin % |

Net Profit x 100 |

2.34% |

1.40% |

1.99% |

2.96% |

4.50% |

1.00% |

1.12% |

|

Total Revenue |

2a) Marks & Spencer: Liquidity Ratios

|

Ratio |

Formula |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|

Current Ratio (x) |

Current Assets |

0.57 |

0.58 |

0.69 |

0.69 |

0.73 |

0.72 |

0.67 |

|

Current Liabilities | ||||||||

|

Quick Ratio (Acid Test Ratio) (x) |

Current Assets - Inventories |

0.22 |

0.22 |

0.31 |

0.31 |

0.41 |

0.29 |

0.35 |

|

Current Liabilities | ||||||||

|

Cash Ratio (x) |

Cash + Marketable securities |

0.09 |

0.08 |

0.10 |

0.12 |

0.20 |

0.11 |

0.13 |

|

Current Liabilities |

2b) John Lewis: Liquidity Ratios

|

Ratio |

Formula |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|

Current Ratio (x) |

Current Assets |

0.57 |

0.58 |

0.69 |

0.69 |

0.73 |

0.72 |

0.67 |

|

Current Liabilities | ||||||||

|

Quick Ratio (Acid Test Ratio) (x) |

Current Assets - Inventories |

0.22 |

0.22 |

0.31 |

0.31 |

0.41 |

0.29 |

0.35 |

|

Current Liabilities | ||||||||

|

Cash Ratio (x) |

Cash + Marketable securities |

0.09 |

0.08 |

0.10 |

0.12 |

0.20 |

0.11 |

0.13 |

|

Current Liabilities |

3a) Marks and Spencer: Efficiency Ratios

|

Ratio |

Formula |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|

Receivable Collection Period (days) |

Average Receivables x 365 |

3.94 |

4.49 |

4.38 |

4.00 |

3.76 |

3.89 |

4.17 |

|

Annual Sales | ||||||||

|

Payable Payment Period (days) |

Avg trade payables x 365 |

35.41 |

40.50 |

34.25 |

35.34 |

33.25 |

29.78 |

32.05 |

|

Purchase | ||||||||

|

Inventory Turnover Period (days) |

Avg inventory x 365 |

44.95 |

47.93 |

46.03 |

45.43 |

42.37 |

42.86 |

39.05 |

|

COGS |

3b) John Lewis: Efficiency Ratios

|

Ratio |

Formula |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|

Receivable Collection Period (days) |

Average Receivables x 365 |

2.13 |

2.23 |

2.16 |

2.28 |

2.47 |

3.02 |

2.64 |

|

Annual Sales | ||||||||

|

Payable Payment Period (days) |

Avg trade payables x 365 |

30.10 |

31.86 |

33.53 |

34.62 |

35.01 |

33.74 |

32.50 |

|

Purchase | ||||||||

|

Inventory Turnover Period (days) |

Avg inventory x 365 |

33.26 |

33.65 |

32.98 |

35.24 |

34.55 |

35.30 |

34.63 |

|

COGS |

4a) Marks & Spencer: Financial Risk Ratios

|

Ratio |

Formula |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|

Gearing Ratio (x) |

Debt |

126.79 |

114.30 |

84.50 |

68.88 |

81.75 |

65.02 |

69.84 |

|

Debt + Equity | ||||||||

|

Interest Coverage Ratio (x) |

EBIT |

3.59 |

5.17 |

6.14 |

5.20 |

2.56 |

1.59 |

1.76 |

|

Interest Expense |

4b) John Lewis: Financial Risk Ratios

|

Ratio |

Formula |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|

Gearing Ratio (x) |

Debt |

104.69 |

119.19 |

185.98 |

124.44 |

116.96 |

91.79 |

75.53 |

|

Debt + Equity | ||||||||

|

Interest Coverage Ratio (x) |

EBIT |

3.44 |

2.32 |

2.97 |

3.90 |

5.26 |

2.23 |

2.56 |

|

Interest Expense |

Appendix B - Vertical Analysis Statement of Income for Marks & Spencer 2013-2019

|

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 | |

|

Turnover |

100.00% |

100.00% |

100.00% |

100.00% |

100.00% |

100.00% |

100.00% |

|

Cost of Sales |

-62.14% |

-62.46% |

-61.35% |

-60.89% |

-61.52% |

-62.17% |

-63.09% |

|

Gross Profit |

37.86% |

37.54% |

38.65% |

39.11% |

38.48% |

37.83% |

36.91% |

|

Administration Expenses |

-30.99% |

-31.73% |

-32.05% |

-32.33% |

-32.58% |

-32.03% |

-31.52% |

|

Other Operating Income/Costs pre OP |

0.92% |

0.93% |

0.79% |

0.66% |

0.59% |

0.46% |

0.40% |

|

Exceptional Items pre OP |

-0.26% |

0.00% |

-0.59% |

-1.90% |

-4.12% |

-4.81% |

-4.23% |

|

Operating Profit |

7.54% |

6.74% |

6.80% |

5.53% |

2.38% |

1.46% |

1.56% |

|

Total Other Income & Int. Received |

0.26% |

0.24% |

0.15% |

0.20% |

0.34% |

0.23% |

0.33% |

|

Profit (Loss) before Interest paid |

7.80% |

6.98% |

6.95% |

5.73% |

2.72% |

1.69% |

1.89% |

|

Interest Received |

0.26% |

0.24% |

0.15% |

0.20% |

0.34% |

0.23% |

0.33% |

|

Interest Paid |

-2.18% |

-1.35% |

-1.13% |

-1.10% |

-1.06% |

-1.06% |

-1.08% |

|

Net Interest |

-1.91% |

-1.11% |

-0.98% |

-0.90% |

-0.72% |

-0.84% |

-0.75% |

|

Profit (Loss) before Tax |

5.63% |

5.63% |

5.82% |

4.63% |

1.66% |

0.62% |

0.82% |

|

Taxation |

-1.06% |

-0.72% |

-1.15% |

-0.80% |

-0.57% |

-0.35% |

-0.46% |

|

Profit (Loss) after Tax |

4.57% |

4.91% |

4.67% |

3.83% |

1.09% |

0.27% |

0.36% |

|

Depreciation |

3.73% |

3.68% |

3.88% |

4.49% |

4.64% |

6.24% |

4.93% |

|

Total Amortization and Impairment |

0.76% |

0.87% |

1.19% |

2.36% |

1.59% |

1.69% |

1.78% |

|

Remuneration |

13.18% |

13.69% |

13.64% |

14.08% |

14.62% |

14.76% |

14.56% |

|

EBITDA |

12.03% |

11.29% |

11.87% |

12.38% |

8.61% |

9.39% |

8.27% |

Appendix C - Vertical Analysis Statement of Balance Sheets for Marks & Spencer 2013-2019

|

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 | |

|

Tangible Assets |

68.38% |

66.73% |

65.04% |

65.93% |

63.77% |

66.78% |

64.26% |

|

Land & Buildings |

34.12% |

32.97% |

32.52% |

34.03% |

34.11% |

36.75% |

36.27% |

|

Other Fixed Assets |

34.26% |

33.76% |

32.52% |

31.90% |

29.66% |

30.03% |

27.99% |

|

Intangible Assets |

9.44% |

10.50% |

11.09% |

10.53% |

9.35% |

9.11% |

7.97% |

|

Investments |

4.96% |

5.00% |

5.06% |

4.38% |

4.17% |

4.08% |

3.99% |

|

Fixed Assets |

82.78% |

82.23% |

81.19% |

80.84% |

77.28% |

79.97% |

76.22% |

|

Stock & W.I.P. |

10.42% |

10.98% |

10.31% |

10.49% |

10.00% |

11.87% |

11.17% |

|

Trade Debtors |

1.47% |

1.65% |

1.60% |

1.52% |

1.44% |

1.73% |

1.89% |

|

Bank & Deposits |

2.62% |

2.36% |

2.66% |

3.25% |

6.18% |

3.16% |

4.55% |

|

Other Current Assets |

1.90% |

2.37% |

2.56% |

2.71% |

2.76% |

2.96% |

3.25% |

|

Investments |

0.81% |

0.41% |

1.67% |

1.20% |

2.34% |

0.32% |

2.90% |

|

Current Assets |

17.22% |

17.77% |

18.81% |

19.16% |

22.72% |

20.03% |

23.78% |

|

Trade Creditors |

-13.21% |

-14.85% |

-12.51% |

-13.40% |

-12.75% |

-13.27% |

-14.54% |

|

Short Term Loans & Overdrafts |

-7.59% |

-5.83% |

-3.61% |

-3.90% |

-6.83% |

-1.91% |

-8.19% |

|

Total Other Current Liabilities |

-9.60% |

-9.82% |

-11.18% |

-10.30% |

-11.63% |

-12.58% |

-12.83% |

|

Current Liabilities |

-30.41% |

-30.50% |

-27.30% |

-27.60% |

-31.21% |

-27.75% |

-35.55% |

|

Total Assets |

100.00% |

100.00% |

100.00% |

100.00% |

100.00% |

100.00% |

100.00% |

|

Long Term Debt |

-23.46% |

-21.49% |

-22.57% |

-23.27% |

-22.56% |

-25.39% |

-20.41% |

|

Total Other Long Term Liab. |

-11.63% |

-5.32% |

-10.09% |

-4.63% |

-8.62% |

-9.55% |

-5.19% |

|

Provisions for Other Liab. |

-3.35% |

-3.56% |

-4.49% |

-5.11% |

-5.21% |

-6.82% |

-7.47% |

|

Pension Liabilities |

2.62% |

-4.00% |

5.80% |

5.77% |

9.13% |

14.41% |

11.39% |

|

Balance sheet Minorities |

0.26% |

0.01% |

0.01% |

0.02% |

0.08% |

0.04% |

0.00% |

|

Long Term Liabilities |

-35.56% |

-34.35% |

-31.34% |

-27.22% |

-27.18% |

-27.31% |

-21.68% |

|

Net assets |

34.03% |

35.15% |

41.36% |

45.18% |

41.60% |

44.94% |

42.77% |

|

Issued Capital |

5.48% |

5.30% |

5.33% |

5.32% |

5.35% |

6.17% |

6.48% |

|

Total Reserves |

28.55% |

29.85% |

36.04% |

39.86% |

36.25% |

38.76% |

36.29% |

|

Share Premium Account |

4.28% |

4.62% |

5.07% |

5.39% |

5.49% |

6.33% |

6.65% |

|

Profit (Loss) Account |

83.10% |

82.12% |

86.23% |

90.85% |

87.23% |

99.71% |

99.50% |

|

Other Reserves |

-58.82% |

-56.88% |

-55.27% |

-56.38% |

-56.47% |

-67.27% |

-69.86% |

|

Shareholders’ Funds |

34.03% |

35.15% |

41.36% |

45.18% |

41.60% |

44.94% |

42.77% |

Appendix D - Horizontal Analysis Statement of Income for Marks & Spencer 2013-2019

|

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 | |

|

Turnover |

100.00% |

102.82% |

102.84% |

105.27% |

105.94% |

106.70% |

103.50% |

|

Cost of Sales |

100.00% |

103.35% |

101.53% |

103.16% |

104.88% |

106.75% |

105.09% |

|

Gross Profit |

100.00% |

101.95% |

104.98% |

108.74% |

107.67% |

106.61% |

100.89% |

|

Administration Expenses |

100.00% |

105.30% |

106.37% |

109.85% |

111.37% |

110.27% |

105.28% |

|

Other Operating Income/Costs pre OP |

100.00% |

103.69% |

88.82% |

75.35% |

68.62% |

53.75% |

45.60% |

|

Exceptional Items pre OP |

100.00% |

0.00% |

239.06% |

784.38% |

1708.59% |

2008.20% |

1713.28% |

|

Operating Profit |

100.00% |

91.87% |

92.76% |

77.26% |

33.49% |

20.70% |

21.48% |

|

Total Other Income & Int. Received |

100.00% |

94.34% |

58.49% |

79.62% |

136.60% |

90.94% |

127.55% |

|

Profit (Loss) before Interest paid |

100.00% |

91.95% |

91.60% |

77.34% |

36.98% |

23.08% |

25.07% |

|

Interest Received |

100.00% |

94.34% |

58.49% |

79.62% |

136.60% |

90.94% |

127.55% |

|

Interest Paid |

100.00% |

63.75% |

53.53% |

53.35% |

51.79% |

52.15% |

51.15% |

|

Net Interest |

100.00% |

59.52% |

52.84% |

49.71% |

40.06% |

46.79% |

40.58% |

|

Profit (Loss) before Tax |

100.00% |

102.85% |

106.33% |

86.62% |

31.26% |

11.84% |

14.99% |

|

Taxation |

100.00% |

69.99% |

111.29% |

79.40% |

57.10% |

35.47% |

44.50% |

|

Profit (Loss) after Tax |

100.00% |

110.48% |

105.17% |

88.30% |

25.26% |

6.35% |

8.14% |

|

Depreciation |

100.00% |

101.50% |

106.95% |

126.60% |

131.76% |

178.48% |

136.70% |

|

Total Amortization and Impairment |

100.00% |

117.28% |

160.60% |

325.65% |

220.42% |

236.52% |

241.36% |

|

Remuneration |

100.00% |

106.79% |

106.43% |

112.53% |

117.51% |

119.50% |

114.37% |

|

EBITDA |

100.00% |

96.46% |

101.46% |

108.29% |

75.80% |

83.29% |

71.13% |

Appendix E - Horizontal Analysis Statement of Balance Sheet for Marks & Spencer 2013-2019

|

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 | |

|

Tangible Assets |

100.00% |

102.11% |

99.95% |

99.87% |

96.11% |

87.29% |

80.03% |

|

Land & Buildings |

100.00% |

101.12% |

100.15% |

103.32% |

103.03% |

96.27% |

90.54% |

|

Other Fixed Assets |

100.00% |

103.10% |

99.75% |

96.44% |

89.21% |

78.35% |

69.57% |

|

Intangible Assets |

100.00% |

116.32% |

123.48% |

115.51% |

102.01% |

86.22% |

71.93% |

|

Investments |

100.00% |

105.62% |

107.15% |

91.53% |

86.68% |

73.56% |

68.47% |

|

Fixed Assets |

100.00% |

103.94% |

103.06% |

101.15% |

96.22% |

86.34% |

78.41% |

|

Stock & W.I.P. |

100.00% |

110.19% |

103.97% |

104.25% |

98.85% |

101.79% |

91.28% |

|

Trade Debtors |

100.00% |

117.08% |

114.22% |

106.93% |

100.92% |

105.17% |

109.51% |

|

Bank & Deposits |

100.00% |

94.30% |

106.63% |

128.22% |

242.67% |

107.56% |

147.80% |

|

Other Current Assets |

100.00% |

130.69% |

141.70% |

148.00% |

149.71% |

139.13% |

145.85% |

|

Investments |

100.00% |

52.86% |

218.01% |

153.54% |

298.99% |

35.02% |

306.57% |

|

Current Assets |

100.00% |

107.93% |

114.76% |

115.26% |

135.92% |

103.94% |

117.55% |

|

Trade Creditors |

100.00% |

117.61% |

99.48% |

105.06% |

99.47% |

89.74% |

93.68% |

|

Short Term Loans & Overdrafts |

100.00% |

80.31% |

50.01% |

53.25% |

92.72% |

22.48% |

91.84% |

|

Total Other Current Liabilities |

100.00% |

107.03% |

122.31% |

111.10% |

124.84% |

117.06% |

113.75% |

|

Current Liabilities |

100.00% |

104.96% |

94.34% |

94.04% |

105.79% |

81.58% |

99.56% |

|

Total Assets |

100.00% |

104.63% |

105.08% |

103.58% |

103.06% |

89.38% |

85.15% |

|

Long Term Debt |

100.00% |

95.82% |

101.08% |

102.74% |

99.10% |

96.72% |

74.08% |

|

Total Other Long Term Liab. |

100.00% |

47.83% |

91.21% |

41.27% |

76.40% |

73.38% |

38.00% |

|

Provisions for Other Liab. |

100.00% |

111.07% |

140.82% |

157.92% |

160.24% |

181.92% |

189.91% |

|

Pension Liabilities |

100.00% |

-159.48% |

232.64% |

228.13% |

358.96% |

491.30% |

369.84% |

|

Balance sheet Minorities |

100.00% |

3.16% |

4.21% |

9.47% |

31.05% |

13.16% |

0.53% |

|

Long Term Liabilities |

100.00% |

101.06% |

92.60% |

79.28% |

78.77% |

68.64% |

51.92% |

|

Net assets |

100.00% |

108.06% |

127.71% |

137.51% |

125.98% |

118.01% |

107.01% |

|

Issued Capital |

100.00% |

101.14% |

102.11% |

100.57% |

100.67% |

100.67% |

100.69% |

|

Total Reserves |

100.00% |

109.39% |

132.62% |

144.60% |

130.84% |

121.34% |

108.22% |

|

Share Premium Account |

100.00% |

112.82% |

124.53% |

130.53% |

132.15% |

132.15% |

132.31% |

|

Profit (Loss) Account |

100.00% |

103.40% |

109.04% |

113.25% |

108.18% |

107.25% |

101.96% |

|

Other Reserves |

100.00% |

101.18% |

98.73% |

99.28% |

98.93% |

102.21% |

101.13% |

|

Shareholders’ Funds |

100.00% |

108.06% |

127.71% |

137.51% |

125.98% |

118.01% |

107.01% |

Appendix F - Vertical Analysis Statement of Income for John Lewis 2013-2019

|

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 | |

|

Turnover |

100.00% |

100.00% |

100.00% |

100.00% |

100.00% |

100.00% |

100.00% |

|

Cost of Sales |

-66.62% |

-66.56% |

-66.25% |

-66.08% |

-66.16% |

-67.03% |

-67.18% |

|

Gross Profit |

33.38% |

33.44% |

33.75% |

33.92% |

33.84% |

32.97% |

32.82% |

|

Administration Expenses |

-28.82% |

-29.07% |

-30.10% |

-30.70% |

-30.02% |

-30.54% |

-31.72% |

|

Other Operating Income/Costs pre OP |

0.76% |

0.82% |

0.89% |

0.87% |

0.93% |

1.08% |

1.08% |

|

Exceptional Items pre OP |

0.00% |

-0.52% |

0.08% |

1.33% |

1.71% |

-1.09% |

0.02% |

|

Operating Profit |

5.31% |

4.67% |

4.61% |

5.42% |

6.45% |

2.43% |

2.20% |

|

Total Other Income & Int. Received |

-2.02% |

-2.21% |

-1.61% |

-1.44% |

-0.90% |

-0.60% |

-0.36% |

|

Profit (Loss) before Interest paid |

3.30% |

2.46% |

3.00% |

3.98% |

5.55% |

1.82% |

1.84% |

|

Interest Received |

0.47% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

|

Interest Paid |

-0.96% |

-1.06% |

-1.01% |

-1.02% |

-1.06% |

-0.82% |

-0.72% |

|

Net Interest |

-0.48% |

-1.06% |

-1.01% |

-1.02% |

-1.06% |

-0.82% |

-0.72% |

|

Profit (Loss) before Tax |

2.34% |

1.40% |

1.99% |

2.96% |

4.50% |

1.00% |

1.12% |

|

Taxation |

-0.55% |

-0.27% |

-0.52% |

-0.68% |

-0.98% |

-0.30% |

-0.38% |

|

Profit (Loss) after Tax |

1.79% |

1.13% |

1.48% |

2.28% |

3.52% |

0.70% |

0.74% |

|

Depreciation |

3.01% |

2.82% |

2.90% |

2.93% |

3.19% |

3.17% |

2.79% |

|

Total Amortization and Impairment |

0.49% |

0.60% |

0.78% |

0.94% |

1.09% |

1.12% |

1.19% |

|

Remuneration |

19.64% |

19.43% |

19.45% |

20.15% |

18.86% |

18.10% |

18.06% |

|

EBITDA |

8.82% |

8.09% |

8.30% |

9.29% |

10.73% |

6.71% |

6.18% |

Appendix G - Vertical Analysis Statement of Balance Sheet for John Lewis 2013-2019

|

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 | |

|

Tangible Assets |

71.24% |

72.18% |

71.05% |

67.44% |

65.42% |

63.22% |

60.36% |

|

Land & Buildings |

60.83% |

61.44% |

60.12% |

57.57% |

55.59% |

54.26% |

52.20% |

|

Other Fixed Assets |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

|

Intangible Assets |

3.98% |

4.83% |

5.73% |

6.25% |

6.88% |

7.89% |

8.11% |

|

Investments |

1.52% |

2.36% |

3.19% |

1.60% |

1.80% |

1.49% |

0.97% |

|

Fixed Assets |

76.74% |

79.37% |

79.96% |

75.30% |

74.11% |

72.60% |

69.44% |

|

Stock & W.I.P. |

9.58% |

10.03% |

9.92% |

10.01% |

9.99% |

10.53% |

10.42% |

|

Trade Debtors |

0.92% |

1.00% |

0.98% |

0.98% |

1.08% |

1.35% |

1.18% |

|

Bank & Deposits |

9.96% |

6.50% |

5.80% |

10.74% |

10.72% |

10.22% |

11.36% |

|

Other Current Assets |

2.71% |

3.10% |

3.17% |

2.62% |

2.91% |

3.30% |

3.29% |

|

Investments |

0.08% |

0.00% |

0.16% |

0.35% |

1.20% |

1.99% |

4.31% |

|

Current Assets |

23.26% |

20.63% |

20.04% |

24.70% |

25.89% |

27.40% |

30.56% |

|

Trade Creditors |

-13.02% |

-14.27% |

-15.22% |

-14.89% |

-15.30% |

-15.02% |

-14.55% |

|

Short Term Loans & Overdrafts |

-4.64% |

-3.37% |

-3.07% |

-6.06% |

-1.74% |

-1.76% |

-5.40% |

|

Total Other Current Liabilities |

-14.43% |

-15.04% |

-13.49% |

-10.55% |

-13.83% |

-14.51% |

-12.74% |

|

Current Liabilities |

-32.09% |

-32.68% |

-31.77% |

-31.50% |

-30.87% |

-31.29% |

-32.69% |

|

Total Assets |

100.00% |

100.00% |

100.00% |

100.00% |

100.00% |

100.00% |

100.00% |

|

Total Other Long Term Liab. |

-2.22% |

-4.94% |

-5.70% |

-3.37% |

-3.51% |

-3.62% |

-4.14% |

|

Provisions for Other Liab. |

-2.54% |

0.00% |

0.00% |

-2.39% |

-2.73% |

-2.61% |

-2.69% |

|

Pension Liabilities |

-15.33% |

-18.17% |

-21.34% |

-15.16% |

-16.13% |

-11.64% |

-7.42% |

|

Long Term Liabilities |

-32.46% |

-35.07% |

-43.30% |

-35.28% |

-36.47% |

-31.97% |

-25.89% |

|

Net assets |

35.45% |

32.25% |

24.93% |

33.22% |

32.67% |

36.74% |

41.42% |

|

Issued Capital |

0.12% |

0.12% |

0.11% |

0.11% |

0.11% |

0.11% |

0.11% |

|

Total Reserves |

35.32% |

32.13% |

24.81% |

33.12% |

32.56% |

36.64% |

41.31% |

|

Share Premium Account |

0.01% |

0.01% |

0.01% |

0.00% |

0.00% |

0.00% |

0.00% |

|

Profit (Loss) Account |

35.22% |

32.20% |

24.74% |

32.94% |

32.41% |

36.88% |

41.30% |

|

Other Reserves |

0.10% |

-0.08% |

0.06% |

0.17% |

0.14% |

-0.25% |

0.01% |

|

Shareholders’ Funds |

35.45% |

32.25% |

24.93% |

33.22% |

32.67% |

36.74% |

41.42% |

Appendix H - Horizontal Analysis Statement of Income for John Lewis 2013-2019

|

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 | |

|

Turnover |

100.00% |

106.64% |

114.59% |

115.16% |

118.44% |

120.54% |

121.87% |

|

Cost of Sales |

100.00% |

106.54% |

113.95% |

114.22% |

117.61% |

121.27% |

122.89% |

|

Gross Profit |

100.00% |

106.85% |

115.88% |

117.03% |

120.09% |

119.08% |

119.83% |

|

Administration Expenses |

100.00% |

107.57% |

119.70% |

122.65% |

123.38% |

127.71% |

134.11% |

|

Other Operating Income/Costs pre OP |

100.00% |

115.76% |

134.32% |

132.92% |

144.93% |

172.07% |

173.79% |

|

Exceptional Items pre OP | |||||||

|

Operating Profit |

100.00% |

93.66% |

99.56% |

117.57% |

143.85% |

55.06% |

50.50% |

|

Total Other Income & Int. Received |

100.00% |

116.87% |

91.56% |

82.48% |

52.90% |

36.15% |

21.68% |

|

Profit (Loss) before Interest paid |

100.00% |

79.46% |

104.44% |

139.03% |

199.50% |

66.63% |

68.14% |

|

Interest Received |

100.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

0.00% |

|

Interest Paid |

100.00% |

118.02% |

121.11% |

122.84% |

130.62% |

102.96% |

91.85% |

|

Net Interest |

100.00% |

233.74% |

239.85% |

243.28% |

258.68% |

203.91% |

181.91% |

|

Profit (Loss) before Tax |

100.00% |

63.69% |

97.63% |

145.66% |

227.68% |

51.77% |

58.43% |

|

Taxation |

100.00% |

52.47% |

107.96% |

141.94% |

210.54% |

65.81% |

85.38% |

|

Profit (Loss) after Tax |

100.00% |

67.13% |

94.46% |

146.80% |

232.94% |

47.46% |

50.17% |

|

Depreciation |

100.00% |

99.80% |

110.43% |

112.11% |

125.32% |

126.73% |

112.70% |

|

Total Amortization and Impairment |

100.00% |

130.07% |

181.62% |

217.66% |

259.67% |

272.32% |

293.32% |

|

Remuneration |

100.00% |

105.50% |

113.52% |

118.14% |

113.73% |

111.10% |

112.08% |

|

EBITDA |

100.00% |

97.80% |

107.87% |

121.32% |

144.02% |

91.74% |

85.38% |

Appendix I - Horizontal Analysis Statement of Balance Sheet for John Lewis 2013-2019

|

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 | |

|

Tangible Assets |

100.00% |

104.35% |

108.88% |

109.64% |

107.63% |

103.93% |

99.71% |

|

Land & Buildings |

100.00% |

104.01% |

107.89% |

109.60% |

107.09% |

104.45% |

100.99% |

|

Other Fixed Assets | |||||||

|

Intangible Assets |

100.00% |

124.89% |

157.00% |

181.75% |

202.48% |

231.96% |

239.64% |

|

Investments |

100.00% |

160.20% |

229.12% |

121.99% |

139.31% |

115.11% |

75.31% |

|

Fixed Assets |

100.00% |

106.52% |

113.75% |

113.63% |

113.18% |

110.80% |

106.49% |

|

Stock & W.I.P. |

100.00% |

107.78% |

112.98% |

120.99% |

122.14% |

128.70% |

127.94% |

|

Trade Debtors |

100.00% |

111.31% |

115.76% |

123.23% |

136.97% |

170.71% |

150.51% |

|

Bank & Deposits |

100.00% |

67.16% |

63.59% |

124.89% |

126.07% |

120.17% |

134.13% |

|

Other Current Assets |

100.00% |

117.73% |

127.77% |

111.82% |

125.70% |

142.54% |

142.89% |

|

Investments |

100.00% |

0.00% |

228.57% |

511.90% |

1792.86% |

2980.95% |

6480.95% |

|

Current Assets |

100.00% |

91.32% |

94.04% |

123.00% |

130.45% |

137.93% |

154.62% |

|

Trade Creditors |

100.00% |

112.89% |

127.66% |

132.45% |

137.75% |

135.12% |

131.60% |

|

Short Term Loans & Overdrafts |

100.00% |

74.75% |

72.10% |

151.18% |

43.88% |

44.36% |

136.77% |

|

Total Other Current Liabilities |

100.00% |

107.34% |

102.03% |

84.65% |

112.33% |

117.76% |

103.90% |

|

Current Liabilities |

100.00% |

104.87% |

108.09% |

113.66% |

112.73% |

114.18% |

119.89% |

|

Total Assets |

100.00% |

102.99% |

109.17% |

115.81% |

117.20% |

117.11% |

117.68% |

|

Total Other Long Term Liab. |

100.00% |

228.58% |

279.88% |

175.44% |

185.08% |

190.61% |

219.28% |

|

Provisions for Other Liab. |

100.00% |

0.00% |

0.00% |

108.81% |

126.14% |

120.41% |

124.74% |

|

Pension Liabilities |

100.00% |

122.05% |

151.96% |

114.54% |

123.31% |

88.96% |

56.94% |

|

Long Term Liabilities |

100.00% |

111.26% |

145.60% |

125.86% |

131.65% |

115.33% |

93.84% |

|

Net assets |

100.00% |

93.70% |

76.78% |

108.55% |

108.01% |

121.40% |

137.52% |

|

Issued Capital |

100.00% |

100.00% |

100.00% |

100.00% |

100.00% |

100.00% |

100.00% |

|

Total Reserves |

100.00% |

93.68% |

76.70% |

108.58% |

108.03% |

121.47% |

137.65% |

|

Share Premium Account |

100.00% |

100.00% |

100.00% |

100.00% |

100.00% |

100.00% |

100.00% |

|

Profit (Loss) Account |

100.00% |

94.17% |

76.71% |

108.33% |

107.86% |

122.64% |

138.00% |

|

Other Reserves |

100.00% |

-79.25% |

71.70% |

196.23% |

169.81% |

-294.34% |

16.98% |

|

Shareholders’ Funds |

100.00% |

93.70% |

76.78% |

108.55% |

108.01% |

121.40% |

137.52% |

Q2. A)

Solution 2(a)

2(a) Media wise sells a range of media products in package deals. The products sold within bundles are as follows.

|

TV |

Stand |

Speaker | |

|

Selling Price (£) |

400 |

50 |

40 |

|

Variable Cost (£) |

250 |

30 |

25 |

- Calculate the Contribution per package for Package A and Package B

|

Package A (TV & Stand) |

Package B (TV, Stand and 2 Speakers) | |

|

Selling Price (£) |

420 |

480 |

|

Variable Cost (£) |

280* |

330** |

|

Contribution per package |

140 |

150 |

- *280 = 250+30 ( 1 unit of TV + 1 unit of Stand)

- ** 330 = 250+30+50 ( 1 unit of TV + 1 unit of Stand + 2 units of speaker)

(Contribution = Sales Price – Variable Cost)

- Calculate the break-even point (in number of packages and sales revenue)

|

Package A (TV & Stand) |

Package B (TV, Stand and 2 Speakers) | |||

|

Selling Price (£) |

420 |

480 | ||

|

Variable Cost (£) |

280 |

330 | ||

|

Contribution per package |

140 |

150 | ||

|

P/V Ratio |

140/420* 100 = 33.33 % |

150/480*100 = 31.25 % | ||

|

Total Fixed Cost (£) |

82000 | |||

|

a) Break-even point If only package As are sold |

586 Packages / £246,120 in sales revenue | |||

|

b) Break-even point If only package Bs are sold |

547 Packages / £262,560 in sales revenue | |||

|

c) If both packages are sold in the current mix |

225 Package A |

337 Package B |

562 TVs, 562 Stands and 674 Speakers | |

Breakeven point means when the company sells enough products to recoup all the investment and after which start profiting. Step 1. Calculate

Contribution using

Contribution = Sales Price – Variable Cost

Working Notes

Step 2. Calculate breakeven point using

- Break-even point for single package :

- BEP for A

- = 82000/140 = 585.714 of Pacakge A or 586 (Approx.)

- Total Sales Values = 586 * 420 = £246,120

- Break Even Points for Package B

= 82,000/150 = 546.666 Packages = 547 Packages

Total Sales Values = 547 * 480 = £262,560

Break-even point for product mix :

* Calculation of Weighted Contribution = 2 Units of Packages A & 3 Units of Packages B

= 2 *140 + 3 *150 = 730 is weighted contribution

Combined Break Even Points = 82,000/ 730 = 112.32876

Units of Sales Mix of Packages A = 2 * 112.32876 = 224.657 units of Packages A

= 225 units of Packages A ( approx..)

Units of Sales Mix of Packages B = 3 * 112.32876 = 336.986 units of Packages A

= 337 units of Packages B ( approx..)

Total nos. of TV sold = 225*1 + 337*1 = 225 + 337 = 562 units of TV

Total nos. of stand sold = 225*1 + 337*1 = 225 + 337 = 562 units of stands

Total nos. of speaker sold = 337*2 = 674 units of TV

- Calculate the margin of safety (in number of bundles and as a percentage) if the current sales mix remain unchanged

- Total Nos of Packages Sold out 600 Packages

No of packages A sold out = 600*2/5 = 240 Packages

No of Packages B sold out = 600*3/5 = 360 packages

The margin of safety is the difference between the expected sales and the Break-even point. It helps us understand the amount of cushion we have in terms of absolute value and percentage

|

Bundles sold (A) |

240 |

|

Breakeven of Bundles (A) |

225 |

|

Margin of Safety for bundle (A) |

15 bundles / 6.25% |

|

Bundles Sold (B) |

360 |

|

Breakeven of Bundles (B) |

337 |

|

Margin of safety for Bundle (B) |

23 bundles / 6.38% |

|

Total Sales at current mix |

£273,600 |

|

Breakeven Sales at current mix |

£256,260 |

|

Margin of safety at current mix |

£17340 / 6.33% |

- Margin of safety in units: Total Units sold – Breakeven units

Margin of safety in £ : Total Sales – Breakeven Sales

c. Margin of safety in % :

Break even Sales at Current Mix = 225 * 420 + 337 * 480 = £256,260

- Calculate the current expected profit

|

Package A |

Package B | |

|

Total Units |

240 |

360 |

|

Sales Price per packages |

£ 420 /- |

£ 480 /- |

|

Total Sales Revenue |

240 x 420 = £100,800 |

360 x 480 =£172,800 |

|

Sales revenue in terms of package |

£100,800 |

£172,800 |

|

Total Sales Revenue |

£273,600 | |

|

Variable Cost |

240 x 280 =£67,200 |

360 x 330=£118,800 |

|

Variable Cost |

£67,200 |

£118,800 |

|

Total Variable Cost |

£186,000 | |

|

Total Contribution |

£273,600 - £186,000 = £87,600 | |

|

Fixed Cost |

£82,000 | |

|

Total Expected Profit |

£5,600 | |

Expected Profit is the total leftover revenue after deducting all the expenses. Thus

Expected Profit= Expected Sales – Variable Costs – Fixed Expenses

- Calculate number of packages to be sold to achieve a profit of £15,000

Ans)To calculate the packages sold so that the company can generate profits of 15000, we use the Target profit formula. Assuming the sales mix remains the same Media wise needs to sell 266 Packages A and 399 Packages B to get a profit of £15,000

Target sales quantity to earn target profit ( Sales Mix ):

Target Sales Quantity( Sales Mix ) =

Target sales Quantity ( sales Mix ) = 132.8767 units of mix

Pacakge A sold to get target profit = 2 * 132.8767 = 265.75 = 266 units ( approx..)

Pacakge B sold to get target profit = 3 * 132.8767 = 398.63 = 399 units ( approx..)

- Memo to management

- Which is the best package to sell and why?

Ans) It all depend upon the situation of the company, market as well as the limiting factors. In this question there are no limiting factors has been mentioned than for the purpose of taking decisions that which packages we must sell .

If we are having limitation of sales value than we will sell the product on the basis of P/V ratio, according to P/v ratio we must sell packages A as it gives us 33.33% of p/v ration as compare to Packages B p/v ratio is only 31.25 %. But if the numbers of packages are having limitation than we must sell the packages B as it gives us more contribution per unit of packages sold. It gives us a total contribution of rs. 150 as compare to package A which gives contribution of rupess 140 per packages only .

Whether this selling package is realistic and why or why not?

Ans)

|

Package A (TV & Stand) |

Package B (TV, Stand and 2 Speakers) |

TV |

Stand |

Speaker | |

|

Selling Price (£) |

420 |

480 |

400 |

50 |

40 |

|

Variable Cost (£) |

280 |

330 |

250 |

30 |

25 |

|

Contribution per package |

140 |

150 |

150 |

20 |

15 |

|

P/V Ratio |

140/420* 100 = 33.33 % |

150/480*100 = 31.25 % |

150/400*100 = 37.5% |

20/50*100 = 40 % |

15/40*100 37.5% |

As we are able to see from the above calculation that the individual contribution percentage which called p/v ratio is better than the packages A and Packages B p/v ratio.

Opinion 1 : when individual contribution and their percentage of contribution is better than the contribution and percentage of contribution on selling Packages deal hence it is not realistic to go for selling the products in package deal. This may be the contentions.

Opinion 2 : According to me in the present condition of competitive market it is very difficult to sell the individual products. because if other companies are providing some complementary offer than it is very difficult to sell the product individually, hence for the grabbing of market share it is the consumer demand that if we make bundle of product consumer are becoming incentivised and huge demand for the bundle of the product has been created and we can easily achieve the sales target and meet the break even points as well as margin of safety . Hence it is fully realistic to make bundle of product and push into the market.

- How else the profitability of the business could be improved.

Ans.) Company’s are earning some amount of profits right now and according to question there are no demands for individual products in the market. If we discontinue than all the fixed cost will turn to losses in short run and there will be loss even we shut down the operation, it is called shut down cost. What the management look forward to develop new products line with Research and development facility or make some joint venture and do some technological tie ups. Those product should have high value addition and give better contribution than the present product portfolios. We will try to sell individual products or make a bundle of the products and try to increase the contribution .

We are having 2nd option that we should go for buying these product instead of buying. According to marginal costing we will look forward for making or buying decisions. If we get the products at cheaper rates than our variable cost we will decide to buy from outside and we will increase the contribution. We will also search for some other opportunity through which we can use the spare capacity to develop some new products and add to product portfolio and increase the contributions. These are the ways through we can maximise the contribution and increase the profitability of the company .

Formulas used for working

- Contribution = Sales Price – Variable Cost

- a&b. Break-even point for single package :

Break-even point for product mix : - Margin of safety in units: Total Units sold – Breakeven units

b. Margin of safety in £ : Total Sales – Breakeven Sales

c. Margin of safety in % : - Expected Profit : Expected Sales – Variable Costs – Fixed Expenses

- Target Sales to earn Target profit( sales mix ) :

Q2. B

Solution Q2(B)

Given:

|

Cost of Capital |

12% |

|

Pay-back period |

< 3 years |

|

Investments |

£ 6,865,000 (Land + Building + Fitting & equipment) |

|

Sales Revenue |

£ 14,300,000 |

|

Cost of alpha products |

£ 3,950,000 |

|

Cost of beta products |

£ 2,830,000 |

|

Staffing cost |

£ 590,000 |

|

Light & Heat |

£ 838,000 |

|

Other Overheads |

£ ,212,000 |

|

Inflation |

£ 2% |

- Calculate Net Present Value (NPV)

Net Present Value is the difference between inflows and outflows of cash which the company will receive over a period of time in current time

NPV = + + - Initial Investment

Here R1 = Net cash inflow during first period

R2 = Net cash inflow during first period

R3 = Net cash inflow during first period

i = Cost of capital = 12%

Initial investment = £ 6,865,000

Net Present Value = Cash Inflow ( CFAT ) – CASH Outflows

|

Year 1 |

Year 2 (2% inflation) |

Year 3 (2% inflation) | |

|

Net Cash Flow |

£2,880,000 |

£2,937,600 |

£2,996,352 |

|

YEAR |

CASH FLOW (CFAT) |

DISCOUNTING FACTOR @ 12 % |

PRESENT VALUE |

|

Year 1 |

£2,880,000 |

0.893 ( round off) |

£ 2,571,840 |

|

Year 2 |

£2,937,600 |

0.797 ( round off ) |

£ 2,341,267 |

|

Year 3 |

£2,996,352 |

0.712 ( round off ) |

£ 2,133,403 |

|

Total Present Value |

£ 7,046,510 | ||

|

Total Cash Outflow |

£ 6,865,000 | ||

|

NPV |

£ 1,81,510 |

CALCULATION OF NET PRESENT VALUE UNDER INFLATION OF 5 %

|

YEAR |

CASH FLOW (CFAT) |

INFLATION DISCOUNTING @ 5 % |

Adjusted Cash flow Under inflation |

DISCOUNTING FACTOR @ 12 % |

PRESENT VALUE @ 12 % |

|

Year 1 |

£2,880,000 |

0.9524 |

£ 2,742,912 |

0.893 ( round off) |

£ 2,449,420 |

|

Year 2 |

£2,937,600 |

0.9071 |

£ 2,664,697 |

0.797 ( round off ) |

£ 2,123,764 |

|

Year 3 |

£2,996,352 |

0.8639 |

£ 2,588,549 |

0.712 ( round off ) |

£ 1,843,047 |

|

Total Present Value |

£ 6,416,231 | ||||

|

Total Cash Outflow |

£ 6,865,000 | ||||

|

NPV |

( £ 448,769) |

There is a negative NPV of ( - £ 448,769) when we consider 5 % inflation .

- A) Payback Period

Payback period is the time taken to recoup the investment or payoff any capital borrowed

Step 1. To calculate the normal payback period we will consider the net cash flow with increasing inflation over a 3 year period

|

Year 1 |

Year 2 (2% inflation) |

Year 3 (2% inflation) | |

|

Net Cash Flow |

£2,880,000 |

£2,937,600 |

£2,996,352 |

|

YEAR |

CASH FLOW (CFAT) |

CUMULATIVE CASH FLOWS |

|

Year 1 |

£ 2,880,000 |

£ 2,880,000 |

|

Year 2 |

£ 2,937,600 |

£ 5,817,600 |

|

Year 3 |

£ 2,996,352 |

We need the additional cash flow for payback period

= £ 6,865,000 - £ 5,817,600 = £ 1,047,400

Hence Pay back Period = 2 years +

= 2 + 0.34955

= 2.35 years

Hence through payback period method, it would take company 2 years and 4.2 months to recoup the entire investment

- Discounted payback period

To calculate the discounted payback period we calculate the Discounted value of the net cash flow for all the three years

|

YEAR |

CASH FLOW (CFAT) |

DISCOUNTING FACTOR @ 12 % |

PRESENT VALUE |

Cumulative discounted Cash flows |

|

Year 1 |

£2,880,000 |

0.893 |

£ 2,571,840 |

£ 2,571,840 |

|

Year 2 |

£2,937,600 |

0.797 |

£ 2,341,267 |

£ 4,913,107 |

|

Year 3 |

£2,996,352 |

0.712 |

£ 2,133,403 | |

|

Total Present Value |

£ 7,046,510 | |||

|

Total Cash Outflow |

£ 6,865,000 | |||

|

NPV |

£ 1,81,510 |

Additional amount needed in 3rd year for discounted pay back period

= £ 6,865,000 - £ 4,913,107 = £ 1,951,893

Hence Discounted Pay back Period = 2 years +

Hence Discounted Pay back Period = 2 years + 0.91492

= 2.915 years

= 2 years & .915x12 months

= 2 years & 11 months