Accounts Receivable audit Assignment

Get Professional Corporate Finance Homework Help Services from Experts

Finance is a really important area in our daily lives. Without this we can't manage so we have to learn about this properly. Now-a-days corporate world has become inseparable part of our daily lives, especially due to the office and work structure and culture. Corporate Finance has become an extremely important and tricky area which we need to master meticulously. Corporate finance is a subject which has special value in areas like Management, Banking, Investment, Stock exchange and so on. While learning about this course, the students mostly can be given homework, projects or assignments on this topic and sometimes those can be really tough to deal with. This is the time when one should seek online help. Urgenthomework.com is the best place to provide Corporate Finance homework help, assignment help. They are also willing enough to teach fundamentals of corporate finance and corporate finance homework help solutions.

Avail Our Reilable Corporate Finance Homework Help Service Online

As we all know Corporate Finance is that particular area which deals with the structures of the corporations or the main sources of funding and investment or the stock exchange and so on. In order to stay in business and make profit a company must manage its finance properly and the job of the corporate finance team is to manage the financial solutions or deal with those or negotiate so that the company can make profit with minimum risk. Mostly this area includes two kinds of job, accounting and financing for finance homework help online. As we all know accountants keep track of financial expenses and the bills and so on. Finance people evaluate and analyze the most effective use of the main resource of the fund. Therefore it's obvious that people will be needing analytical and mathematical skill, they must have a knack for details. Besides this, they need to have some knowledge about the economic condition and the contemporary market values and profits. Therefore in order to master these qualities one is needed to have an MBA degree. Also its better if one can do certificate courses from CPA, CFA and so on for better position in the job. People can work as internal auditor or in the sector of divisional financial services, tax department, as a treasurer or as part of corporate development and planning and so on.

Urgent Corporate Finance Assignment Help from Our Experts

The students, enrolled to these courses are of course given many homework and assignments. They need to have analytical, mathematical skills and eye for the detailing which must be problematic for the students. All the students may not have all those abilities and some of them may find it problematic to concentrate within a class full of students. There comes the online help. Urgenthomework.com is the proper place since it has tutors who are expert in that particular subject. Through their 24*7 availability, the students can be connected with them for 24 hour and ask questions whenever they want to. The student can get their plagiarism free homework help and the assignments or the projects within the particular deadlines. The work is supposed to be well written, well discussed and well researched. The tutors can also teach and guide them regarding the topics out of syllabus, in a student-friendly way. Order your corporate finance homework to avail best service from corprate finance homework help experts from urgenthomework.

Important Topics Covered in Corporate Finance Homework Help Services

- Capital Budgeting

- Corporate finance

- Finance Accounting

- Financial Ratio Analysis

- Financial Statement Analysis

- Financial Risk

- Investment management

- International Business

- Public finance

- Banking terms

- Cash Management

- Cost of Capital

- Derivatives

- Economics and finance

- Leverage

- Risk and Return

- Time Value Of Money

- Valuation

- Working Capital

Other topics in finance

Sample Corporate Finance Homework Help Solved by Experts

Raising Equity Capital Debt Financing

23-4. Suppose venture capital firm GSB partners raised $100 million of committed capital. Each year over the 10-year life of the fund, 2% of this committed capital will be used to pay GSB’s management fee. As is typical in the venture capital industry, GSB will only invest $80 million (committed capital less lifetime management fees). At the end of 10 years, the investments made by the fund are worth $400 million. GSB also charges 20% carried interest on the profits of the fund (net of management fees).

- Assuming the $80 million in invested capital is invested immediately and all proceeds were received at the end of 10 years, what is the IRR of the investments GSB partners made? That is, compute IRR ignoring all management fees.

- Of course, as an investor or limited partner, you are more interested in your own IRR—that is, the IRR including all fees paid. Assuming that investors gave GSB partners the full $100 million upfront, what is the IRR for GSB’s limited partners (that is, the IRR net of all fees paid).

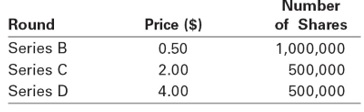

23-5. Three years ago, you founded your own company. You invested $100,000 of your money and received 5 million shares of Series A preferred stock. Since then, your company has been through three additional rounds of financing.

- What is the pre-money valuation for the Series D funding round?

- What is the post-money valuation for the Series D funding round?

- Assuming that you own only the Series A preferred stock (and that each share of all series of preferred stock is convertible into one share of common stock), what percentage of the firm do you own after the last funding round?

23-17. You have an arrangement with your broker to request 1000 shares of all available IPOs. Suppose that 10% of the time, the IPO is “very successful” and appreciates by 100% on the first day, 80% of the time it is “successful” and appreciates by 10%, and 10% of the time it “fails” and falls by 15%.

- By what amount does the average IPO appreciate the first day; that is, what is the average IPO underpricing?

- Suppose you expect to receive 50 shares when the IPO is very successful, 200 shares when it is successful, and 1000 shares when it fails. Assume the average IPO price is $15. What is your expected one-day return on your IPO investments?

24-7. On January 15, 2020, the U.S. Treasury issued a 10-year inflation-indexed note with a coupon of 6%. On the date of issue, the CPI was 400. By January 15, 2030, the CPI had decreased to 300. What principal and coupon payment was made on January 15, 2030?

However, the final payment of the maturity (i.e. the principal) is protected against deflation. So since $750 is less than the original face value of $1,000, the original amount is repaid, i.e. $1,000.

24-12. Boeing Corporation has just issued a callable (at par) three-year, 5% coupon bond with semiannual coupon payments. The bond can be called at par in two years or anytime thereafter on a coupon payment date. It has a price of $99. What is the bond’s yield to maturity and yield to call?