Financial Statement Analysis Definition

Financial Statement Analysis incorporates the obvious evidence of the accompanying ideas for an association's financial statements over a progression of reporting times.

Patterns for Financial Statement: Make design lines for fundamental things in the financial statements over various times, to see how the association is performing. Typical example lines are for resources, the gross margin, net advantages, cash, records of offers, and commitment.

Extent review: An assortment of financial statement ratios are open for watching the relationship between the sizes of various records in the financial statements. The user can figure an association's expedient ratio to estimate its ability to pay its active liabilities, or its commitment to esteem ratio to check whether it has handled an inordinate measure of commitment. These examines as regularly as could be expected under the circumstances between the livelihoods and costs recorded on the compensation statement and the advantages, liabilities and esteem accounts recorded on the fiscal record (Green, 2015).

Standards for Comparison in Financial Statement Analysis

Comparison to the earlier time: Financial Ratio research is a two-stage process. The initial step is to compute the relevant financial anlysis ratio, and the second step is to break down the outcomes. Obligations are liabilities or commitments a business owes.

Comparison to the contender: Competitor's money related ratios will be accessible on their site if they are traded on an unrestricted market or you might discover their data on a portion of the more well-known Internet searchers in the budgetary segment.

Comparison to average of the company: It is the comparison to the business normal gives data about their relative position inside of the business (Fridson and Alvarez, 2002).

Examples of Financial Statement Analysis

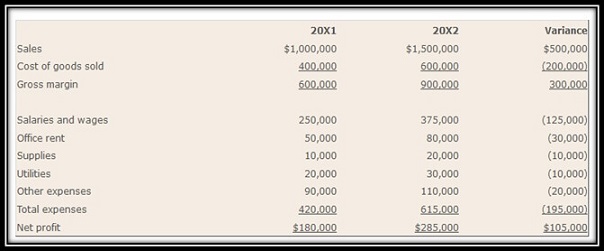

Applying Horizontal Analysis Methods for Financial Statement Analysis

The Horizontal analysis methods is the research of registered financial data over a movement of reporting times, or of the ratios got from this financial data. The point is to check whether any values are inquisitively high or low in connection with the data for separating times, which may then trigger a broad research of the reason for the refinement. The research is for the most part a clear assembling of data that is sorted by time, yet the values in each successful time can in like manner be conveyed as a rate of the aggregate in the standard year (Suthan, 2015).

Figure 1: Example of Financial Statement Analysis with Horizontal Analysis

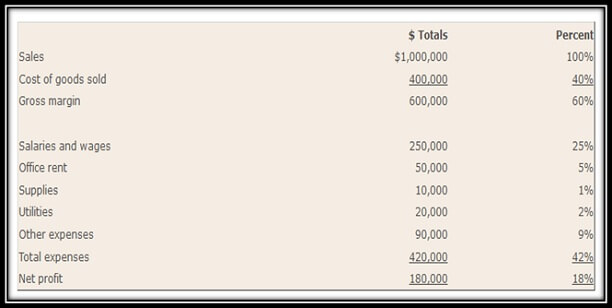

Applying Vertical Analysis Methods for Financial Statement Analysis

The vertical analysis methods are the relative studies of a financial statement, where each financial statement is recorded at a rate of some other reports. Routinely, it concludes every detail of importance on a compensation statement is conveyed at a rate of gross plans while each reserved component on a business report is imparted at a rate of aggregate resources (Robinson, 2009).

Figure 2: Example of Financial Statement Analysis with Vertical Analysis

Defining and Applying Financial Statement Analysis Ratios

Financial Ration Analysis is a champion among the most perceived tools of authoritative rational choice making. A ratio is a relationship of one value to another value, a fundamental division issue. It incorporates the connection of various figures from the financial statements remembering the finished objective to get data around an association's execution. It is the statement, rather than the figuring, that makes it a profitable mechanical assembly for company administrators. Financial Ratios can assist as pointers, bits of data, or notices on crucial associations between variables used to measure the company's execution to the extent profitability, asset use, liquidity, impact or promote valuation (Temte, 2004).

Another utilization of financial ratios is to make relative execution explores. So, standing out an affiliation's advantage from that of an essential contender or observing how the firm stacks up and how the company midpoints engages the client to case judgments concerning fundamental areas, for instance, productivity or company sufficiency. Clients of it fuse social events both inside and outsider to the firm. Outsider clients fuse security analysts, present and potential partners, creditors, contenders, and other company onlookers. Inside, executives use ratio exploration to screen execution and pinpoint qualities and defects from which particular intentions, targets, and course of action exercises may be surrounded.

Commonly Used Financial Statement Analysis Ratios

There are a few general classifications of financial statement analysis ratios, each intended to inspect an alternate part of a company's execution (Wild, Bernstein and Subramanyam, 2001). The types of financial ratios are:

Liquidity ratios

- Liquidity index

- Current ratio

- Cash coverage ratio

- Quick ratio

Activity ratios

- Inventory turnover ratio

- Working capital turnover ratio

- Accounts receivable turnover ratio

- Accounts payable turnover ratio

- Fixed asset turnover ratio

- Sales to working capital ratio

Leverage ratios

- Debt to equity ratio

- Fixed charge coverage

- Debt service coverage ratio

Profitability ratios

- Contribution margin ratio

- Breakeven point

- Margin of safety

- Gross profit ratio

- Return on operating assets

- Net profit ratio

- Return on net assets

- Return on equity

Efficiency Ratios: Types & Formula

Types of efficiency ratios are:

- Inventory ratio

- Asset turnover

- Day’s sales in inventory

Formulas for efficiency ratios are:

Total asset turnover = net sales/ average total asset Fixed-asset turnover = net sales/average net fixed assets Equity turnover = net sales/average total equity

Leverage Ratios: Types & Formula

Types of Leverage ratios are:

- Times interest earned

- Fixed charge coverage

- Net debt ratio

- Debt ratio for long-term

- Debt to equity ratio

Formulas of various leverage ratios are:

Leverage Ratio = Total debt / Total Equity

Return on Equity = Net Profit Margin x Asset Turnover x Financial Leverage Ratio

Long-term Debt to Capitalization Ratio = Long-term Debt / (Long-Term Debt + minority interest + equity)

Total Debt to Capitalization Ratio = (current liabilities + Long-Term Debt) / (current liabilities + Long-Term Debt + minority interest + equity)

Issues with Financial Statement Analysis

The company's financial statements might have changed the records in which it stores financial data, with the goal that outcomes might contrast from time to time. For instance, a cost might show up at the expense of products sold in one time, and in managerial costs in another time (Wild, Bernstein and Subramanyam, 2001).

An investigator as often as possible thinks about the financial ratios of various companies with a specific end goal to perceive how they coordinate up against one another. Be that as it may, every company might total financial data in an unexpected way so that the aftereffects of their ratios are not by any means practically identical. It can lead an investigator to make off base inferences about the consequences of a company in correlation to its rivals.

The financial investigation just surveys a company's financial data, not its operational data, so you can't see an assortment of fundamental pointers of future execution, for example, the measure of the requested surplus, or changes in guarantee claims. Hence, financial investigation just displays part of the aggregate image.

Financial Statement Analysis in Accounting

While figuring financial ratios, there is a need to do other financial statement inquire about constantly recollect that the financial statements reflect the financial norms. It suggests assets are not reported on their present quality. It is also likely that various brand names and exceptional item offerings won't be consolidated among the advantages gave a record of the benefits report, in spite of the way that they may be the most critical of the impressive value of things controlled by an association (Suthan, 2015).

These examples are signs that financial ratios and financial statement research have confinements. It is furthermore basic to comprehend that an astounding financial ratio in one company might be seen as not precisely foremost in a substitute company.

References and Financial Statement Analysis book for further studies.

Fridson, M. and Alvarez, F. (2002). Financial statement analysis. New York: John Wiley & Sons.

Green, J. (2015). Financial Statement Analysis and Equity Valuation. SSRN Electronic Journal.

Robinson, T. (2009). International financial statement analysis. Hoboken, N.J.: John Wiley & Sons.

Suthan, A. (2015). Fundamental of Financial Statement Analysis. SSRN Electronic Journal.

Temte, A. (2004). Financial statement analysis. La Cross, WI: Schweser Study Program.

Wild, J., Bernstein, L. and Subramanyam, K. (2001). Financial statement analysis. Boston, Mass.: McGraw-Hill.

Important topics in finance

- Capital Budgeting

- Corporate finance

- Finance Accounting

- Financial Ratio Analysis

- Financial Statement Analysis

- Financial Risk

- Investment management

- International Business

- Public finance

- Banking terms

- Cash Management

- Cost of Capital

- Derivatives

- Economics and finance

- Leverage

- Risk and Return

- Time Value Of Money

- Valuation

- Working Capital