ACC703 Accounting Information

{`

King’s Own Institute

ACC703 Accounting Information

Trimester 2, 2018

Individual Assignment (30% in total)

`}

A major component of the ACC703 course is the MYOB assignment that is an individual assignment. Your individual assignment will be assessed on three aspects of the assignment:

- MYOB Assignment: 18%;

- MYOB Work Activity Report: 800 words plus or minus 20% (5%);

- Prepare Job Claim Statement and Resume (5%); and

- Individual presentation based on MYOB assignment: (2%).

Students should report the progress of their MYOB assignment to tutors by showing the completed chapters or parts of the MYOB assignment to the tutor each week. Final MYOB Assignment is due by week 10.

MYOB Assignment

- MYOB assignment text book is “Wendy Pabst & Brian Perrin (2015), Accounting With MYOB 19, 1st Edition, Cengage Learning, Australia”

- Please read the downloading and installing MYOB Software

- Each chapter has Revision Exercise. Please Do not do Revision Exercise.

- When you finish each chapter, please print the reports specified in the book , compare the results of the your printed reports and the results of reports of the book and sign at the bottom of each printed report as an evidence of completing the comparison of two reports before starting the next chapter. If two results of the reports are different, you should mark the different results on your printed reports, analyse the difference and write down the possible reasons of the difference.

- The assignment should include one title page and 9 chapter cover pages (chapter 2 to 10) in front of the printed reports of each chapter, and be tied tightly by binding or using plastic folders. Please do not forget to write your student number, name and course on the title page.

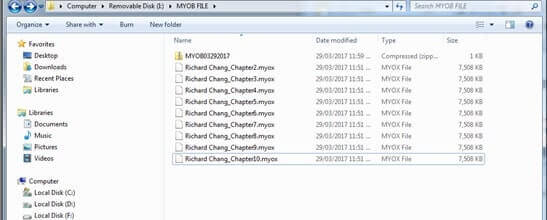

- MYOB assignment is due by Week 10. Students submit both the paper-printed version and the USB stick to contain 9 MYOB assignment files (*.myox) at the start of the lecture in week 10. If student does not submit the USB to contain 9 MYOB (*myox)files, the printed version will not be accepted or 20% penalty of total available mark will apply to the assignment.

- When students submit the paper-printed version to the lecturer, the lecturer will ask validation questions to the student to check whether the submitted MYOB assignment is the student own work or not.

- In the past, we found that some students had copied other student’s work, changed name and format, printed and submitted the printed version , or copied word outputs, changed name and converted to PDF file. We remind you again that If we find the students who submits other students’ work with changed name and format , we will take action against the students.

Common Mistake

One of the most common errors is to enter the date in correctly. Though the student does not have any intension to enter the date in correctly it can happen. MYOB by default enters the today’s date. However the accounting MYOB assignment has transaction dates which relates to future dates. So this is a trap for the student and it is very likely that a wrong date is entered. Thus student should double check the date before entering it in to the system.

Go to the DATE SETTING on your computer to see the format of the date. Ensure that this is in the format DATE-MONTH-YEAR. If it is not in this format, then you should change the setting to this format, or else remember that it is not in this format, before entering any information. A common problem for students is assuming that the date setting on their computer will be DAY–MONTH–YEAR. However, it may be set as MONTH–DAY-YEAR and finding that transactions attempting to be entered on 13/7/2009 will not be accepted, is the first students know that their computer is set to the date setting MONTH–DAY-YEAR. At that stage there is no alternative but to start over again, losing all transactions entered. To set your computer so that DATE-MONTH-YEAR date format are used for your transactions, go to Control Panel and then to Regional and Language Options and change to DATE-MONTH-YEAR date format

To set your computer so that dollars are used for your transactions, go to Control Panel and then to Regional and Language Options and change to DOLLAR (Australian) format.

Enter opening balances as positive numbers. Don’t, for example, enter your liability account balances as negative numbers. Enter negative amounts only if accounts truly have negative balances. As a rule, these will be asset accounts that record accumulated depreciation. For example you have to enter the opening balance of the trial balance (page 28). The trial balance has two columns (debit and edit) The scree of MYOB balance has one column. Please enter -275, -4,410, -3,830, -11,940 in asset category and also enter -3,790 -21,500 in liability category.

When you creating Purchase or Sales invoices in MYOB, there is a tick box asking you whether the invoice is Inc. or Exc. GST, also when loading in price for products. It is another common mistake for students to forget to tick or untick the in the tick box, based on the information of the book.

You have entered an invoice twice in MYOB and closed both of them. You need to find out how to delete one of them, You are finding it difficult because it's already closed. Have to delete the payment that closed the invoice first. If you are looking at the invoice click on history then delete the line entry that has the payment that closed the invoice. Once you delete the payment, you will be able to delete the invoice.

The textbook was published in 2015, and the payroll year is 2018. If tax withheld amount is different to the textbook, you may manually change the tax withheld amount. It won’t happen in the real world, as we subscribe the MYOB, the latest tax table will be uploaded automatically. If you get the error message when loading tax tables in Chapter 9 Payroll, you can download the attached file, 'pay2myob.bin' in moodle. Click OK on the error message window and select the file from your 'Downloads' folder.

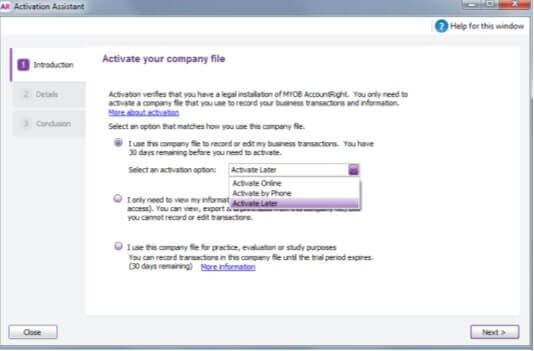

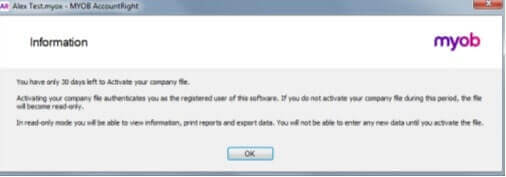

Your tutors will activate your company file in week 5 once you complete chapter 4. Before you copy the chapter 4 file to start chapter 5, ask tutors for the serial number. Then the ‘chapter 4’ will be activated, and the copied files (chapter 5 - chapter10) will be automatically activated. Your chapter 2&3 files are not activated. After 30 days, you are not able to change, but you can still open the file as ‘read only’. Do not activate your chapter 2&3 files as we will waste serial numbers.

MYOB Rubric

Criteria: How to perform | Unsatisfactory | Satisfactory | Effective | Excellent | Exceptional | % |

Fail | Pass | Credit | Distinction | High Distinction | ||

|

Company setup, including changing company information and the chart of accounts: Create a new company file Set up and link accounts Enter account opening balances Reports using other option | Student work does not demonstrates a basic developed understanding of how to perform (more than 10 errors) | Student work demonstrates a basic developed understanding of how to perform (6-10 errors) | Student work demonstrates an effective developed understanding of how to perform (3-5 errors) | Student work demonstrates a proficient developed understanding of how to perform (1-2 errors) | Student work demonstrates an advanced developed understanding of how to perform (no errors) | 2 |

General Ledger Set-up and General Journal Entries Initial bank reconciliation General journal transaction Understanding GST Reports using menu bar | Student work does not demonstrates a basic developed understanding of how to perform (more than 10 errors) | Student work demonstrates a basic developed understanding of how to perform (6-10 errors) | Student work demonstrates an effective developed understanding of how to perform (3-5 errors) | Student work demonstrates a proficient developed understanding of how to perform (1-2 errors) | Student work demonstrates an advanced developed understanding of how to perform (no errors) | 2 |

|

Purchase (Accounts Payable) Setup supplier and enter opening balance Set-up inventory items Purchase transaction Bill with discount Adjustment note Pay supplier Cash purchase Purchase register | Student work does not demonstrates a basic developed understanding of how to perform (more than 10 errors) | Student work demonstrates a basic developed understanding of how to perform (6-10 errors) |

Student work demonstrates an effective developed understanding of how to perform (3-5 errors) | Student work demonstrates a proficient developed understanding of how to perform (1-2 errors) | Student work demonstrates an advanced developed understanding of how to perform (no errors) | 2 |

|

Sales (Accounts Receivable) Set up customer and opening balance Sales transaction Received payment Cash sales Adjustment note Part payment received | Student work does not demonstrates a basic developed understanding of how to perform (more than 10 errors)) | Student work demonstrates a basic developed understanding of how to perform (6-10 errors) | Student work demonstrates an effective developed understanding of how to perform (3-5 errors) | Student work demonstrates a proficient developed understanding of how to perform (1-2 errors) | Student work demonstrates an advanced developed understanding of how to perform (no errors) | 2 |

|

Banking Spend, receive and transfer money Pay BAS liability Petty cash and credit card Bank register Bank reconciliation | Student work does not demonstrates a basic developed understanding of how to perform (more than 10 errors) | Student work demonstrates a basic developed understanding of how to perform (6-10 errors) | Student work demonstrates an effective developed understanding of how to perform (3-5errors) | Student work demonstrates a proficient developed understanding of how to perform (1-2 errors) | Student work demonstrates an advanced developed understanding of how to perform (no errors) | 2 |

|

Inventory Set up inventory items Enter inventory opening balance Inventory transaction Auto build inventory items End of period stock taking | Student work does not demonstrates a basic developed understanding of how to perform (more than 10 errors) | Student work demonstrates a basic developed understanding of how to perform (6-10 errors) | Student work demonstrates an effective developed understanding of how to perform (3-5 errors) | Student work demonstrates a proficient developed understanding of how to perform (1-2 errors) | Student work demonstrates an advanced developed understanding of how to perform (no errors) | 2 |

|

Integration Monthly sales budgets: transactions Addition information: Bank reconciliation Prepare Business Activity Statement Business insights | Student work does not demonstrates a basic developed understanding of how to perform (more than 10 errors) | Student work demonstrates a basic developed understanding of how to perform (6-10 errors) | Student work demonstrates an effective developed understanding of how to perform (3-5 errors) | Student work demonstrates a proficient developed understanding of how to perform (1-2 errors) | Student work demonstrates an advanced developed understanding of how to perform (no errors) | 2 |

Payroll Set up payroll Assign linked accounts for payroll transactions Payroll transactions Build employee list | Student work does not demonstrates a basic developed understanding of how to perform (more than 10 errors) | Student work demonstrates a basic developed understanding of how to perform (6-10 errors) | Student work demonstrates an effective developed understanding of how to perform (3-5 errors) | Student work demonstrates a proficient developed understanding of how to perform (1-2 errors) | Student work demonstrates an advanced developed understanding of how to perform (no errors) | 2 |

Time Billing and Job Costing Set up customer and Supplier cards Set up employee cards and enter billing rate Time billing activities Setting time billing and job Time billing and job costing Activity slips and log Record supplier bills Time billing invoices Pay employees | Student work does not demonstrates a basic developed understanding of how to perform (more than 10 errors) | Student work demonstrates a basic developed understanding of how to perform (6-10 errors) | Student work demonstrates an effective developed understanding of how to perform (3-5 errors) | Student work demonstrates a proficient developed understanding of how to perform (1-2 errors) | Student work demonstrates an advanced developed understanding of how to perform (no errors) | 2 |

MYOB Work Activity Report (5%)

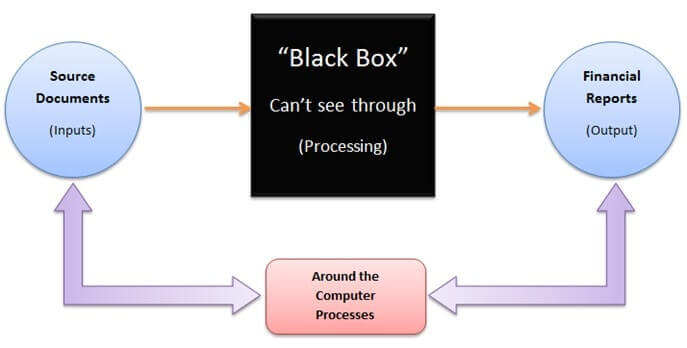

You have to provide an individual work report on how you have worked to produce your MYOB assignment. Major part of your individual report is to practice “Audit Around the Computer Approach” and to prepare report. “Audit Around the Computer approach” is more often known as black box audit approach as shown below:

In your MYOB assignment, you enter input data in to the MYOB software based on the source documents (input) of the book, print the outputs (the reports) generated by MYOB software and then compare the printed outputs with the outputs of the book. If two results of the two reports are different, you should reconcile the different results

Periodic information such as starting, ending and printing dates of each chapter entries must be inserted into the correct section in chronological order, including causes and solutions of the problems. Particularly when you finish each chapter, please print the reports specified in the book and compare the results of the your printed reports and the results of reports of the book . If two results of the two reports are different, you should reconcile the different results on your printed reports and write down the possible reasons in your report.

The final report should use an appropriate business report format and should include a detailed description on (Times new Roman 12 point):

- progress based on time spent on each chapter;

- any issues or problems that have occurred or been managed in each chapter, including details of what the issues or problems (if there are difference between two results of the report produced by you and the report of the book, analyse the difference and write down the possible reasons of the differenc), how have been dealt with them and what have been done to fix the issue or the problems (how to reconcile the difference).

- your achievement in your MYOB assignment

- what work is planned for the next 3 months in getting MYOB related accounting job.

MYOB Work Activity Report (5% in Total)

|

Criteria | Unsatisfactory | Satisfactory | Effective | Excellent | Exceptional | % |

Fail | Pass | Credit | Distinction | High Distinction | ||

Amount of issues/problem | One or two important issues/problems are identified | A few important issues/problems are identified | Some important issues/problems are identified | Majority of important issues/problems are identified | All important issues/problems are identified | 1 |

Explanation of issues/problem | Issue/problem is stated arbitrarily | Issue/problem is stated without clarification or description. | Issue is stated and clarified with some ambiguities, and/or backgrounds unknown. | Issue/problem is stated, described, and clarified so that understanding is not seriously impeded. | Issue/problem is stated clearly and described comprehensively | 1 |

Analysis | Analysis is arbitrary | Analysis is vague and not evident. | Analysis is accurate but not evident | Analysis is through and evident | Analysis is in depth and evident | 1 |

Solution | Solutions is arbitrary | Solutions not based on analysis and not based on evidence/sound methods | Solutions based on analysis but not based on evidence/sound methods | Solutions based on analysis and evidence/sound methods but can not fix the problems | Solutions based on analysis and evidence/sound methods and fix the problems. | 1 |

Achievement and Future Plan | Student does not addresses either what achieved or how learned, and what’s next regarding mastering MYOB | Student addresses either what achieved or how learned, but does not address what is next with regard to mastering MYOB | Student addresses what achieved and how achieved, but does not address what is next with regard to mastering MYOB | Student addresses what achieved, how achieved , and what is next with regard to mastering MYOB clearly | Student addresses what achieved, how achieved , and what is next with regard to mastering MYOB clearly | 1 |

JOB Claim Statement (5%)

The following document are required and attached :

- Printed job advertisement you applied for;

- Job claim statement (Job Claim Statement is different from Job Application Cover Letter.)

- Resume

- Confirmation email from your applied JOB advertiser

Find the job advertisement related to MYOB from www.seek.com.au, www.careerone.com.au or gumtree.com.au. The advertisement will provide an overview of the position, information on how to apply and a closing date for applications. You may contact the employer and get the position description to contain a more in depth description of the position and to include details of the selection criteria required to successfully undertake the position.

After analyzing the job advertisement, prepare the job claim statements of no more than three pages outlining your motivation and suitability for the role, addressing the selection criteria individually. Addressing the selection criteria provides you with an opportunity to demonstrate your key strengths by providing examples from past experiences to show how you meet the requirements of the position.

Make sure you individually address each criterion, carefully reading each one and breaking it down into parts ensuring you address each aspect thoroughly. The most important aspect of addressing selection criteria is to provide evidence through relevant examples. Support your claims with actual, specific examples of what you have done and how well you did it. One way to do this is to use the STAR model:

- Situation: Outline a specific circumstance where you developed the particular experience or used the required skills or qualities. Set the context of the situation.

- Task: What was your role? What did you have to do?

- Action: What did you do and how did you do it?

- Result: What did you achieve? What were the results of what you did?

Tips

- use clear language with specific and relevant examples from your current or past employment (paid or unpaid), study, extra-curricular activities or other experience.

- quantify your experience or skills if you can, e.g. ‘three years experience in creating monthly budgets using Microsoft Excel.’

- if an example applies to a number of selection criteria, include it under each separate criterion.

- remember you are limited to a maximum of 500 words for each selection criterion

Example

Here is an example to address selection criteria.

Demonstrated capacity to communicate effectively

‘My ability to communicate effectively with a range of people was demonstrated in my position as receptionist with the organisation. I dealt with members of the general public, officers from the local council and government departments, and representatives from private businesses on a daily basis.

I communicated with these people face to face, over the phone and through use of email. As I was the first point of contact for the organisation it was very important that I was professional, courteous and helpful in my interactions. In recognition of my positive interpersonal skills my temporary position was extended for nine months beyond my initial contract.’

Preparing your resume / curriculum vitae: your resume (also known as curriculum vitae or CV) is a snapshot summarising your qualifications, experience, skills, qualities and key accomplishments / achievements. A resume needs to be clear, concise and neatly organised with content relevant to the role you are applying for.

JOB Claim Statement (5% in Total)

Criteria | Unsatisfactory | Satisfactory | Effective | Excellent | Exceptional | % |

Fail | Pass | Credit | Distinction | High Distinction | ||

Documentation |

Job claim statement is less than one page |

Job claim statement | Job claim statement Resume | Job claim statement Resume Confirmation email |

Job advertisement Job claim statement Resume Confirmation email | 1 |

Resume | Only one or two aspects of the resume apply to the advertised Job | A few aspects of the resume apply to the advertised Job | Half of the resume applies to the job | Most of the resume applies directly to the job. | All aspects of the resume applies directly to the job | 1 |

Job Claim Statement | Outline motivation and suitability for the role and address one or two selection criteria individually | Outline motivation and suitability for the role and address a few selection criteria individually | Outline motivation and suitability for the role and address some selection criteria individually | Outline motivation and suitability for the role and address most selection criteria individually | Outline motivation and suitability for the role and address all selection criteria individually | 2 |

Professional Format | Job claim statement and resume are viewed as not acceptable. | Job claim statement and resume are viewed as adequate | Job claim statement and resume are viewed as effective | Job claim statement and resume are viewed as professional | Job claim statement and resume are viewed as extremely professional | 1 |

Individual Presentation (2%)

Presentation marks will be based on individual student performance at the presentation of your MYOB assignment based on the MYOB Work Activity in weeks 11 and 12 tutorials. If any student does not attend their presentation, the student will not get presentation marks unless a medical certificate has been provided.

Presentation Rubric (2% in Total)

Criteria | Unsatisfactory | Satisfactory | Effective | Excellent | Exceptional | % |

Fail | Pass | Credit | Distinction | High Distinction | ||

Organisation | Not Applicable | Presentation is not smooth and audience attention lost because there is little sequence of information. |

Audience has difficulty following presentation because some of the information is not in logical sequence. | Student presents information in logical sequence which audience can follow. | Student shows enthusiasm and presents information in logical, interesting sequence which engages the audience. | 0.5 |

Content | Not Applicable | Some information is not accurate, not sufficient information | Accurate information, not sufficient information | Accurate information, sufficient information | Accurate and in depth information, sufficient amount of information | 0.5 |

Audience Interaction | Not Applicable | Student just reads presentation with no eye contact or no use of appropriate gestures | Student primarily reads presentation, occasionally uses eye contact and uses appropriate gestures. |

Student maintains eye contact and uses appropriate gestures while often referring to notes. |

Student maintains eye contact and uses appropriate gestures while seldom returning to notes. |

0.5 |

|

Communication & Time Management | Not Applicable | Student mumbles, and speaks too quietly for students in the back of class to hear and/or the presentation was too brief or too long. |

Student's voice is low. Audience members have difficulty hearing presentation and/or the presentation was somewhat short or somewhat long. |

Student's voice is clear. Most audience members can hear presentation. The presentation was of the proper duration. |

Student uses a clear voice and correct, precise terms so that all audience members can hear presentation. The presentation was of the proper duration. |

0.5 |

Downloading and installing MYOB Software

The URL and serial numbers provided in the MYOB textbook (Accounting with MYOB 2015) are not valid.

- The student edition of the MYOB software is Windows based and is available as a free download from the following URL:

https://drive.google.com/a/koi.edu.au/file/d/1ej7rN8NX5J8Z5cBOmupdw4Ejp1ltV1P0/view?usp=drive_web

- Download the MYOB 2017.2.zip file, then save the file in your computer

- Once downloaded, open 2017.2 folder, and run MYOB_AccountRight application

- Accept the T&C, and Install the program.

- Once installed, you can see the icon on your desktop.

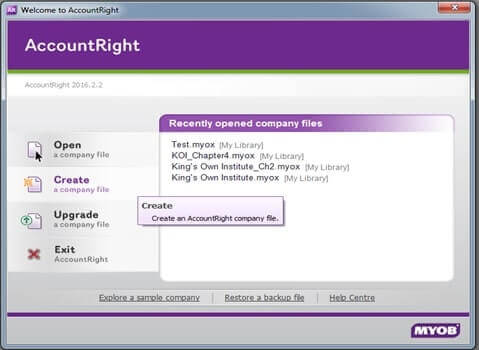

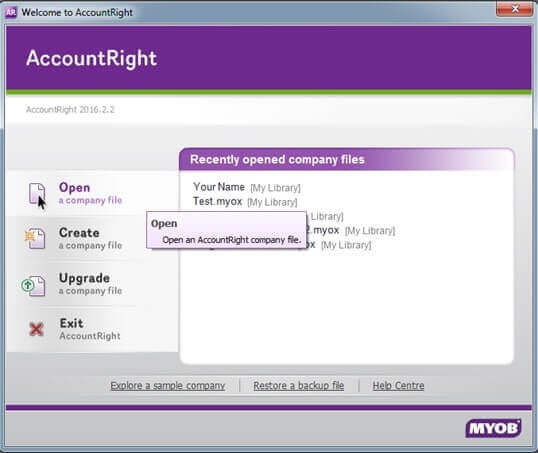

Open MYOB and click [Create a Company File] – the screenshot is based on version 2016.2.2.

We will be using version 2017.2

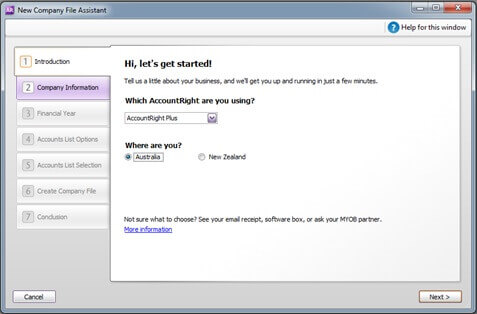

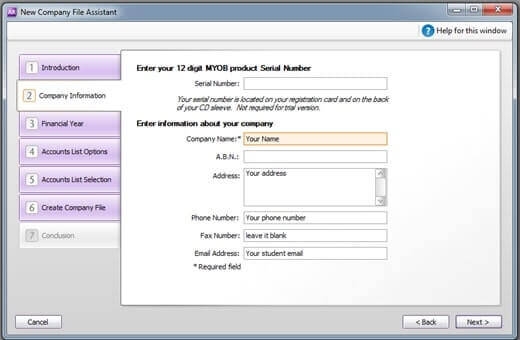

Company information

- Serial Number: to be given by tutor in week 5 (Do not activate your file until you finish chapter 4)

- Company Name: Your Name (on your student ID)

- B.N (11 digits): 218 + Your Student Number

- Address: Your Address or 1/31 Market St Sydney NSW 2000

- Phone Number: Your mobile phone number

- Fax Number: Leave it blank

- Email Address: Your student email

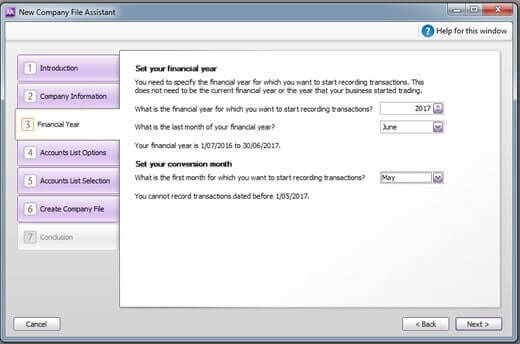

Company Information

- Current Financial Year: 2017

- Last month of Financial Year: June

- Conversion Month: May

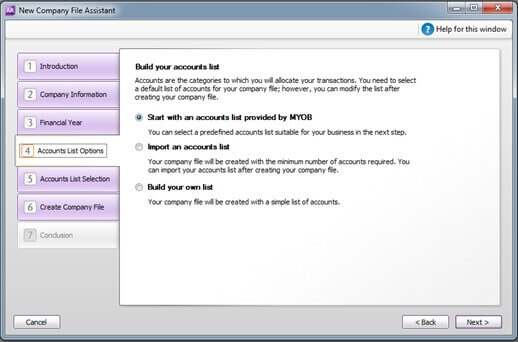

Accounts List Options

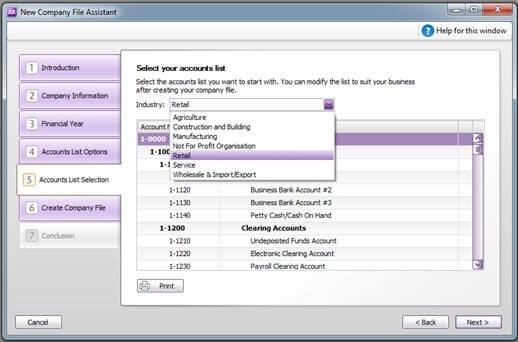

Accounts List Selection

Select 'Retail' from the drop down box

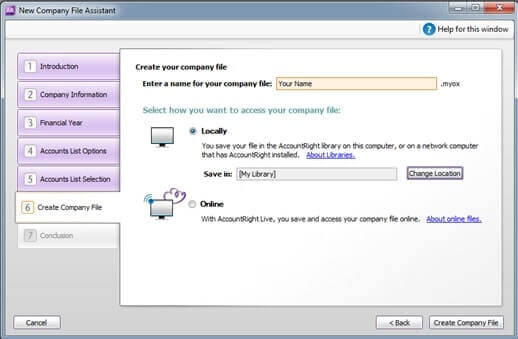

Create your company file

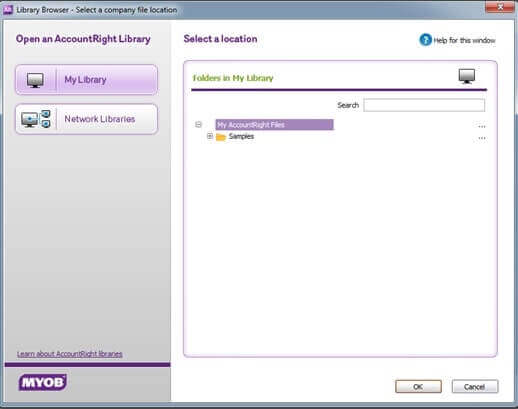

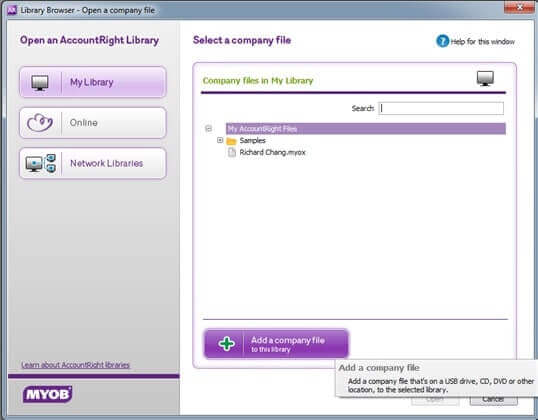

The default saves it to [My Library] on C drive

You need to keep your my file on your USB. (to be explained)

But It is complicated to change default location on your computer.

Save in [My Library] first.

Then click [Create Company File]

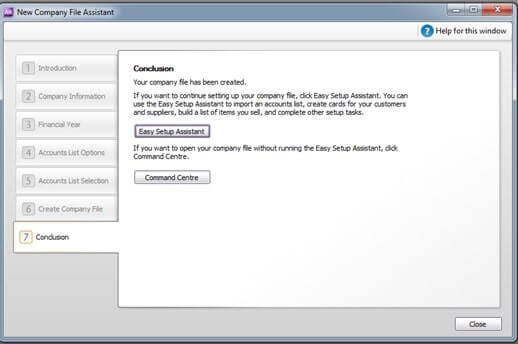

Conclusion

Activate your company file

Select ‘Activate Later’. Tutors will activate your company file in week 5

Conclusion

Congratulations! You successfully installed MYOB software.

From now on Follow the instruction on the textbook. (from page 19)

Backup File

When you finish each chapter (or you close software in the middle), you need to back up your file in your USB, as your file is currently in [MY LIBRARY]. Please remember when you open your MYOB file, it is added to [My Library], and all new transactions are recorded in the added file in [My Library]. Backup procedure is a bit complicated as you will be doing assignments both at home and in tutorial classes. All documents in [My Library] of KOI computer labs are deleted weekly. Do not ask IT teams to find your files.

Close MYOB software When you close MYOB software, Back up screen will be showing.

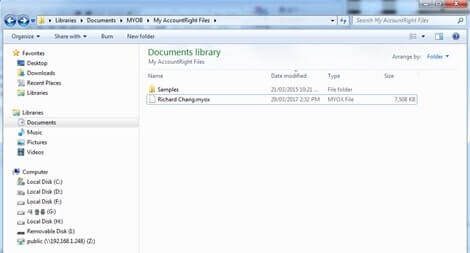

Click [No], and Go to Liabraries>Documents> MYOB>My AccountRight Files

- Your MYOB File is currently saved in [My Library].

Go to Liabraries>Documents> MYOB>My AccountRight Files

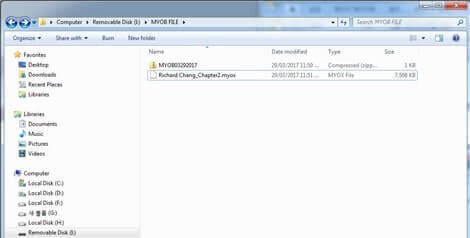

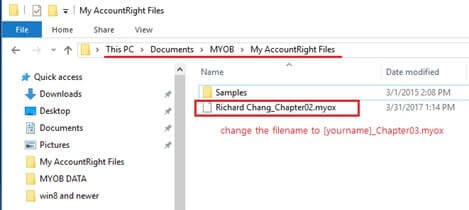

- Copy the file from My Library, and paste in your USB Drive

- Rename your MYOB file to Your Name_Chapter 2.myox

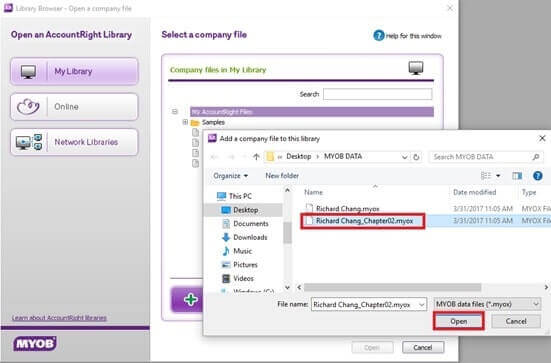

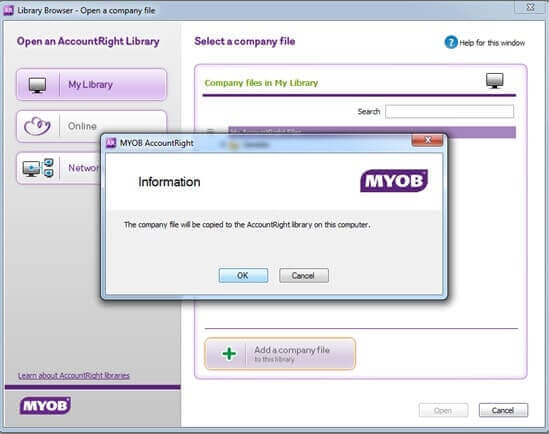

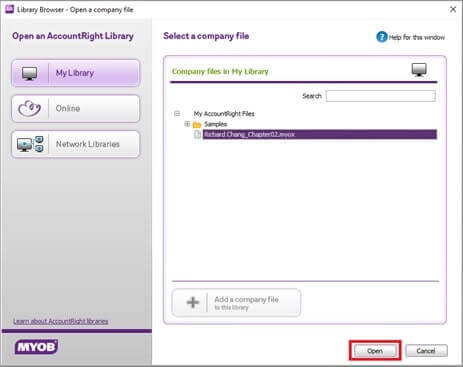

Starting a new chapter

ADD the previous company file. For example, when you start Chapter 3, open the file 'Yourname_Chapter2.myox'.

Once you finish a chapter, change the company file name in [My Library] folder and move it to your USB.

You are required to keep separate backup files for each chapter. After you finish your assignment, you should have 9 files. If you lose a MYOB backup file in the real world, you will lose your job.

NO EXCUSE!!! KEEP YOUR FILES

Make sure you are required to submit the reports for each chapter with chapter cover page.

Also, you need to submit your 'WORK ACTIVITY REPORT' with backup files. Backup files will be returned to you.

If you have further question, please ask tutors for help in tutorial classes.

Diploma Courses in Australia

- ACC203 Management Accounting

- ACC703 Accounting Information

- BSB61015 Advanced Diploma of Leadership

- BSB60515 Advanced Diploma of Marketing

- BSBADM502 Manage Meetings

- BSBADM502 Manage Meetings Answers

- BSBADM506 Manage business document design

- BSBCOM603 Plan and establish compliance management

- BSBFIM601 Manage Finances Prepare budgets

- BSBFIM601 Manage Finances Monitor and review budget

- BSBHRM509 - MANAGE REHABILITATION OR RETURN

- BSBHRM512 develop and manage performance

- BSBINM601 Manage knowledge and information

- BSBINN601 Lead and manage organisational change Task 1

- BSBINN601 Lead and manage organisational change Task 2

- BSBINN601 Lead and Manage Organisational Change Task 2

- BSBINN601 Lead and manage organisational change Task 3

- BSBMGT403 Assessment Answers

- BSBMGT502 Assessment 1

- BSBMGT502 Assessment 2

- BSBMGT502 Assessment 3

- BSBMGT502 Assessment 4

- BSBMGT517 Assessment 2 - Operational Plan

- BSBMGT517 Manage Operational Plan Assignment Answers

- BSBMGT605 Provide leadership across the Organisation T1

- BSBMGT605 Provide leadership across the Organisation T2

- BSBMGT605 Provide leadership across the Organisation T3

- BSBMGT605 Provide leadership across the Organisation T4

- BSBMGT608 Manage innovation and continuous

- BSBMGT616 Develop and implement strategic plans

- BSBMGT617 Develop and Implement A Business Plan

- BSBMGT624 Develop and implement corporate social

- BSBMKG502 Establish and adjust the marketing mix

- BSBMKG609 Develop a marketing plan

- BSBPMG505A Manage Project Risk

- BSBPMG505A Manage Project Quality

- BSBRSK501 Manage Risk Answers

- BSBSUS501 Develop workplace policy

- BSBSUS501 Develop workplace policy and procedures

- BSBSUS501 Develop workplace policy and procedures

- BSBSUS501 Develop workplace policy and procedures

- BSBWHS605 Develop, implement and maintain WHS

- BSBSUS501 Develop workplace policy and procedures

- BSBWRK510 Business Services Training Package

- BSBWRK510 Manage employee relations

- BUS707 – Applied Business Research

- BMA583: Managing People and the Employment

- CHCAGE001 Facilitate the empowerment of older people

- CHCAGE002 Implement falls prevention strategies

- CHCAGE005 Provide support to people living with dementia

- CHCCCS011 Meet personal support needs

- CHCCCS015 Provide individualised support

- CHCCCS015 Provide individualised support Assessment

- CHCCCS023 Support independence and well being

- CHCCOM005 Communicate and work in health

- CHCDIV001 Work with diverse people Assessment

- CHCLEG001 Work legally and ethically Assessment

- CHCPAL001 Deliver care services using a palliative approach

- CHCPOL003 Research and apply evidence to practice

- CHCDIS002 Follow established person-centred behaviour

- CHCDIS003 Support community participation and social

- CHCDIS007 Facilitate the empowerment of people with

- CHCDIV001 Work with diverse people

- CHCLEG001 Work legally and ethically

- CHCLEG001 Work legally and ethically Learner Guide

- CHCLEG001 Work legally and ethically Learner Workbook

- CHCWHS312A Follow WHS safety procedures for direct care

- CPCCBC5011A Develop and Implement an Environmental

- CPCCBC5011A Manage Environmental Management Practices And Processes In Building And Construction

- CPCCBC5003A Construction Project Planning

- CPCCBC5018A Apply structural Principles Medium rise

- HLTAAP001 Recognise healthy body systems Assessment

- HLTAAP001 Recognise healthy body systems

- HLTAAP001 Recognise healthy body systems Case Study

- HLTAAP001 Recognise healthy body systems Learner Guide

- HLTAAP001 Recognise healthy body systems Learner

- HLTWHS002 Follow safe work practices for direct client care

- HLTWHS002 Follow safe work practices for direct client care

- HLTWHS002 Follow safe work practices for direct client care

- HLTWHS002 Follow safe work practices for direct client care

- Manage project risk

- MITS5002 Software Engineering Methodology

- MKT01907 Tourism And Hospitality Management

- SHBXWHS001 Apply safe hygiene, health and work practices

- SITHKOP002 Plan and cost basic menus Learner Guide

- SITHKOP002 Plan and cost basic menus Learner Workbook

- SITHKOP006 Plan Catering for events or Functions

- SITXCCS007 enhance customer service experiences

- SITXCCS007

- SITXHRM003 Lead and manage people

- SITXINV004 Control stock

- SITXFIN003 - MANAGE FINANCES WITHIN A BUDGET