MOD004051 Financial report for CLS holdings

Including: Acquisition of Oxley Wharf Property 1 Limited

1 Introduction

1.1 Rationale for Report

CLS Holdings has achieved significant financial success over the last five years and is now seeking to invest and acquire a company to maintain a nd achieve higher long term growth. This repot therefore summarises CLS Holdings current financial position, analyses a further investment of £30m, and evaluates the acquisition of Langham Hospitality Investments.

1.2 Company background

CLS Holdings is a British-based company investing mainly in UK commercial property, particularly London. CLS London portfolio of 72 properties are valued at £934m (31 December 2017) and account for 52% of all interests. The French portfolio was valued at £290m and German portfolio at £578m (31 December 2017), (CLS Holdings, 2018). It was founded in 1987 by Sten Mortstedt, who built up the company until by 2016 had revenue of £128 million, and is listed on the London Stock Exchange. It aims to achieve stable cash flows by investing in, refurbishing and developing mainly office buildings let on long leases. CLS Holdings is probably most well-known for investing and divesting in the Shard, which resulted in a drop in profits and share price in 2007-8. CLS Holding's property portfolio was valued at £1.6 billion in 2016.

1.3 Main findings

This report has found that CLS Holdings is in robust health and has achieved steady growth over the last 5 years. Due to its low gearing and conservative investment strategy in the past, it could afford to both make further investment in itself and acquire another financial company while still maintaining reasonable gearing and exposure to risk.

1.4 Structure of report

Section 2 will analyse current financial performance of CLS Holdings.

Section 3 will evaluate NPV and IRR techniques with relation to investment in current company.

Section 4 will describe and evaluate potential acquisition of Oxley Wharf Property 1 limited.

Section 5 will conclude this report.

2 Evaluation of current financial performance (2013- 17)

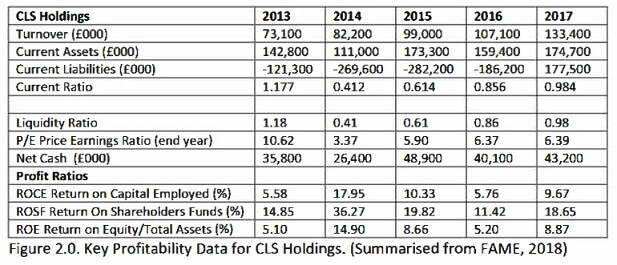

From Figure 2.0 (FAME,2018) we can see that there was a steady increase in all variables 2013-17 as the company expanded and prior investments paid off. However, 2014 seems to be an outlier year.

2.1 Profitability

Profitability ratio is arguably the most important of all financial ratios as without profit, there is no company.

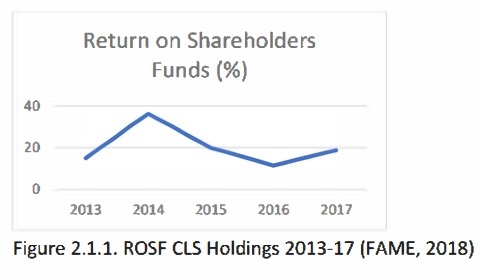

Figure 2.1.1. ROSF CLS Holdings 2013-17 (FAME, 2018) Looking at figure 2.1.1, regarding return on shareholder funds, in 2013 it stood at 14.8%. There was then a dramatic increase to 36.2% in 2014, before dropping back to a reasonable 19.8% in 2015 and 11.4% in 2016, before rising again to 18.6% in 2017. We might surmise this is because assets were sold off. We can see from Figure 2.0 current assets reduced from 6

£142.8m in 2013 to £111m in 2014, a £31.8m or 22% sell-off of assets, before resuming the increase to ££173.3m in 2015. Current liabilities likewise increased from -£121.3m to -£269m, a £147.7m or 122% increase in liabilities. Return on shareholder fun ds jumped from 14.8% in 2013 to 36.2% in 2014, before returning to a more modest 19% in 2015. It seems that this sell off in assets was returned to shareholders in the form of a large dividend. The price/ earnings ratio dropped sharply from 10.6 in 2013 to 3.3 in 2014, before climbing to 5.9 in 2015. This would suggest that the high increase in earnings was not matched by a corresponding high increase in share price. This may be because, although CLS Holdings shares are publically traded on the FTSE 250, CLS Holdings has a small number of large investors who effectively control the market and can, to a certain extent, manipulate the CLS share price to their own advantage. Overall, CLS compares well to peer return on shareholder funds, see Figure 2.1.2, where it is mid-placed at fifth, of 11 competitors.

Figure 2.1.2. Peer comparison ROSF (%) (CLS Holdings is #5)(Osiris, 2018)

Figure 2.1.3. ROCE for CLS Holdings, 2013-17 (FAME, 2018)

Turning to figure 2.1.3, the return on capital employed followed a similar pattern to ROSF,starting at 5.5% in 2013. 2014 saw a sharp peak at 17.9%, before falling to 10.3% in 2015 and 5.7% in 2016. Finally, there was a second acceleration to 9.6% in 2017. This increase on ROCE in 2014 lends further evidence to assets being sold off and profits returned to shareholders only in 2014. The low of 2016 for ROCE can largely be attributed to paying off liabilities, as liabilities dropped from -£282m to -£186m from 2015 to 2016 respectively. For a real estate investment company, this means paying down bank loans and debt, as there is negligible supplies as is the case in a manufacturing company.

2.2 Liquidity

Liquidity ratio is important for investment companies as this is a measure of how much money they have to pay their bills.

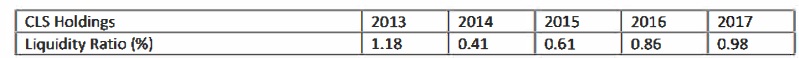

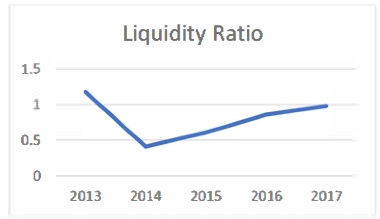

Figure 2.2.1. Key Liquidity Data for CLS Holdings.

Figure 2.2.1. Liquidity Ratio for CLS Holdings, 2013-17 (FAME, 2018)

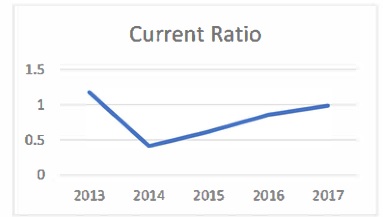

Figure 2.2.2. Current Ratio(%) for CLS Holdings 2013-17 (FAME, 2018)

Considering figure 2.2.2, Liquidity Ratio stood at 1.18 in 2013, after that it fell seriously to 0.41 in 2014. By 2015 the liquidity ratio had recovered to 0.61, followed by a further increase in 2016 to 0.86. 2017 saw a flattening to 0.98. Moving on to current ratio shown on figure 4, 2013 saw a five-year high of 1.17, before plunging to 0.41 in 2014, then recovering to 0.61 in 2015 and maintaining a steady increase to 0.85 in 2016 and 0.98 in 2017. Normally, a current ratio of less than one, such as in 2014 in CLS case, would be cause for concern. However, there is a specific reason for CLS. Similar to the peak in ROCE and return on shareholder funds for 2014, shown in Figures 2.1.1 and 2.1.2, the drop in both liquidity ratio and current ratio can be attributed to the selloff of assets and dividend distributed to shareholders, which means there is less real estate and less rental to service the debt, so both LR and CR decreased in 2014. In any case, a low LR and CR in a real estate investment company is less cause for concern than in, say a manufacturing company, as CLS can always sell some real estate, or defer liability payment to banks with only a slight increase in lending costs. With a manufacturing company, if they do not pay suppliers, they may stop supplying, or even go out o f business.

2.3 Evaluation of ratio analysis

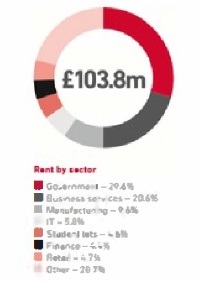

Looking at 2014, we can see that this year is very unusual in that turnover increased, while assets decreased, and ROSF and ROCE increased considerably. It is apparent that CLS Holdings sold some of their assets and distributed the funds as profit to shareholders. This appears to be a one-off, as 2015 and 2016 returned to the normal trend of steadily increasing turnover and reasonably steady profits. Overall, this is a very healthy investment company. One contributory factor is their low vacancy rates of only 3% in 2014 (Millis, 2014), 2.9% in 2016 and 4.6% in 2017 (CLS Holdings 2018b). This c ompared well with the London average of 6.1% 9 in 2014, 5.3% in 2016 and 4.6% in 2017 (Statista, 2018). Another contributing factor is the buoyant London property market over the last several years. Between 2009 and 2015 therewas an approximately doubling of London Commercial real estate prices (McBride and Garret/Galland Research, 2017). This means that property bought or leased by CLS Holdings and kept for some years will appreciate in price and achieve capital gains growth. This is in addition to any rental fees that they can achieve. In addition, from figure 7, we can see that 29% of all CLS Holdings contracts are governmental (CLS Holdings, 2017b), which means they are relatively secure, impervious to economic downturns and likely to be renewed for many years.

2.4 Analysis of problems and limitations of financial ratios

Atrill and Mclaney (2017, p.2) describe accounting as giving financial information to improve the quality of decisions. Thus, accounting is not just merely something that businesses do in order to satisfy government regulators and pay tax, but another tool at the businessperson's disposal to use as and when the occasion demands, much like consumer demand information, product information, production information, in order to make more informed decisions about the company. Watson and Head (2016, p.2) stress the importance of factoring in time and risk in any calculation of finance, since money earned, owed or invested, is over a fixed time period, not money floating about indefinitely. The risk of doing or not doing something, also has to be factored in, since a higher risk would normally suggest a higher return required. Thus, financial ratios, although useful, are just one of the factors in assessing a company, and should be used alongside other measures, such as 'gut feeling' about a company.

3 Future investment appraisal

Bamber and Parry (2014, p.330) suggest the three most common and useful techniques usedin evaluating capital investment decisions are payback period (PP), accounting rate of return (ARR), and discounted cash flow DCF). DCF can further be divided into internal rate of return(IRR) and net present value (NPV).

3.1 Evaluation of NPV techniques

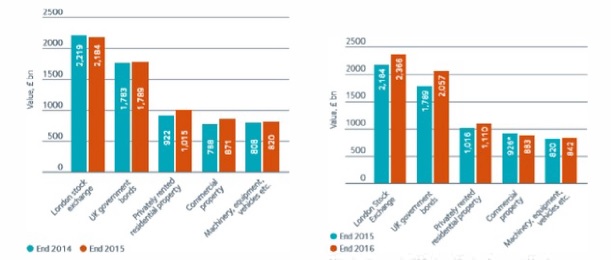

The NPV technique is considered more so phisticated than the payback period or IRR (Bamber and Parry, 2014, p.343) because NPV takes into account the timings of earnings of an investment. The further into the future of the project, the more the income is discounted. Another problem with only considering the payback period is that only the investment payback period is considered (Watson and Head, 2016, p.173), whereas NPV takes into account the full investment period. However, NPV does not take into account any income after this period, nor the value of the asset at the end of the investment period. In manufacturing investment, this is reasonable as if, for example a company invests in machinery for manufacturing, the machinery is likely nearly obsolete after this period, has little income potential, nor resale value. However, in commercial real estate, this is clearly not the case. Especially in the London real estate market, we would expect the value of the asset to have appreciated considerably and the income generated from rent to have risen. Moreover, both will likely rise considerably for some decades after the initial investment has risen, and NPV takes no account of this. As can be seen from Figure 3.1, the value of UK commercial real estate increased more than the London stock exchange, government bonds, privately rented residential property, and machinery and equipment, vehicles etc., from £788b to £871b (10.5%) 2014-5. 2015-16 showed a slight decline, but this is likely to be a short-term anomaly.

Figure 3.1 Value UK investments 2014-5, 2015-6 (Property Industry Alliance, 2017)

3.2 Evaluation of IRR techniques

All other things being equal, a company would normally strive for as high an IRR as possible. However, although IRR is commonly used to assess a project's profitability, it can be misleading when used alone as a project may have a low IRR but a high NPV as the project may be slow, but add overall value to the company. Likewise, if a project has a short duration and so has a high IRR, it may also have a low NPV. Conversely, a long project may have a low IRR, bringing in income slowly and steadily, but add value over time. Another problem with IRR is that a project may have varying IRR values over the lifetime of the project. Lastly, continuous profits during the project may or may not be reinvested. This will affect the value of the IRR. Finally, although a project may have low IRR and low NPV, the company may still continue with it for other reasons, such as diversification of risk from the core business, it may be the pet project of the owner or CEO, it may be a stepping stone to a more lucrative deal at a later date, or it may be a complementary product or service to the core business and so will be perceived as adding value by the customer.

3.3 Invest ment appraisal results

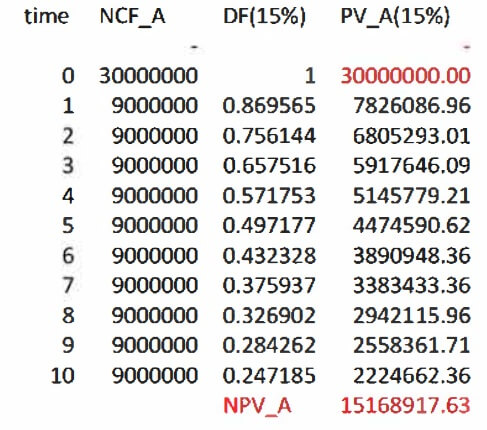

This section will consider making a further investment in the current product of £30m with an expected life of 10 years. Discount rate is 15% and inflation and tax are ignored. Assume a cash flow of 30% for London commercial real estate for 10 years. Using the calculation:

NPV= ∑Tt = 1 ct/(1+r)t - Co

Where: Ct=net cash inflow during time t Co= total initial investment costs r=discount rate T=number of time periods Sample calculation for the first year, t=l:

Net Cash flow (NCF)=30% of £30m. £30mX30%=£9m/year. NCF=£9/year. DF at 15% is taken from standard discount tables, such as available from UNEP (2018), shown in Figure 7.1 in appendix. PVt=1 =NCF X DF =£9 X 0.869 = £7.8m or £7,826.086. Summing the ten years of PV we get £45.lm or £45,168,917.63. Deducting original £30m investment, profit is £15.lm. That is, we make £15.lm profit, and in addition get back our original £30m investment after 10 years. NPV is calculated each year and presented in Figure 3.0.1.

Figure 3.2.1. Calculation of NPV for £30m investment

Payback period (PP) remains the most widely used means of investment appraisal, being used by about 80% of businesses. (Bamber and Parry, 2014, p.335). From Figure 3.0.1 it can be seen that the payback period for this investment occurs in year 5. That is, we get back our investment money in full after 5 years.

Using the calcul ation:

IRR = A% + NPVa /(NPVa-NPVb) X B%

IRR = 15% + NPVa (NPVa - NPVb)X20%

NCF is same as in NPV i.e. £9/year

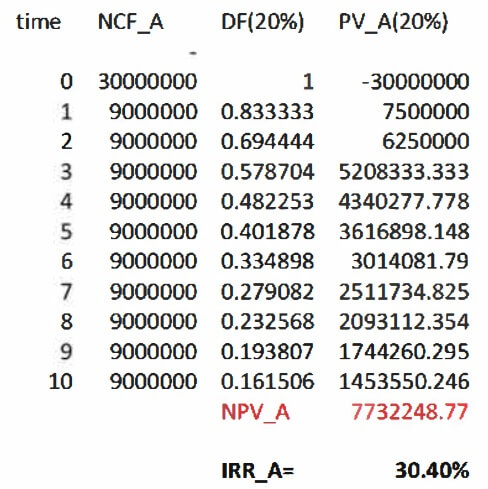

DF is now 20%, using standard DF tables such as in Figure 7.1 in appendix (UNEP, 2018) we get DF for each year as shown in Figure 3.0.2.

Sample calculation for the first year, t=l:

PVt= NCFt=1 X DFt=1 £9m X 0.8333 = £7.Sm, or £7,500,000

Summing PVt =1 to PVt =10 we get £107.7m, or £10,773,248

IRR= PV minus original investment= £7.Sm/£30m = 0.304 or 30.4%.

That is this investment has a 30.4% return rate.

Figure 3.2.2. Calculation of IRR for £30m investment

3.4 Potential implications of i nvestment

According to these calculations, this investment should definitely proceed as a pa yback period of only 5 years, NPV of £15.lm and IRR of 30.4% after 10 years is an excellent investment. In addition, unlike other types of investment, we will still have this asset after 10 years for either potential sale, or continued rental fee, which due to inflation, will increase over the long-term. From Figure 3.0 we can see that Net Cash from Operating Profit was £43.2m in 2017. This is sufficient to finance the £30m investment, and so should be used for this purpose. This will leave only £13.2m for contingencies, a small amount for this size of company, but the company is in otherwise robust health and would likely be able to cover any shortfall by either delaying payment of bills, or bank borrowing at low interest rates (4.3% in December 2017), (indexmundi, 2018). Using Mortgage Calculator (2018) based on 4.3% interest rate and 10 year payback, monthly repayments would be £0.312m, yearly £3.7m. This should be easily achievable by CLS. The building in Royal Wharf can always be sold to pay off any loans or liabilities, or used as collateral to secure new loans.

4 Potential acquisition of Oxley Wharf Property 1

Limited Oxley Wharf Property 1 Limited is a private limited company registered in Colchester that develops building projects. It owns freehold and leasehold property at Royal Wharf, Woolwich, London. It is minutes from the financial centre Canary Wharf. Its two people withsignificant control of the company are directors Ching Chiat Kwong and Low See Ching, registered as living in Singapore. Note this covers only the potential acquisition of Oxley WharfProperty 1 Limited, not Oxley Wharf Property Wharf 2 Limited, nor other Oxley Wharf companies.

4.1 Rationale for choosing target company

Oxley Wharf Property 1 Limited is small, and so can be acquired relatively cheaply, partly from CLS's high profit and cash reserves, and partly by borrowing at historically low bank borrowing rates. Oxley Wharf Property 1 Limited is a small residential development company with a foreign owner. Their main investment is one building at Royal Wharf, London. The owner is likely investing in London real estate as an investment, seeking to make as much profit as possible. They are therefore likely to be amenable to a sale of their company if the price is right. There is no point in making an offer for a company if it is the baby of the owner who is running the company as part of their dream and is unlikely to sell. A friendly acquisition, rather than a hostile takeover is considered because the two owners, Ching Chiat Kwong and Low See Ching have controlling shares and so without their agreement, nothing will likely happen. Oxley Wharf is invested in Royal Wharf, an up-and-coming area currently not reaching its full potential.

Di versification from CLS's focus on commercial leased real estate. As can be seen from Figure 4.1.1, CLS Holding's investments are concentrated in only two sectors, government and 16 business services. As CLS grows, it is desirable to diversify and expand in another area, to use the windfall profits from the short-term boom in one area and invest in a more long-term growth strategy in another. Housing is one such area, related to commercial real estate, but less volatile as people have to live somewhere.

Figure 4.1.1. CLS Holdings rent by Sector (CLS Holdings, 2018b)

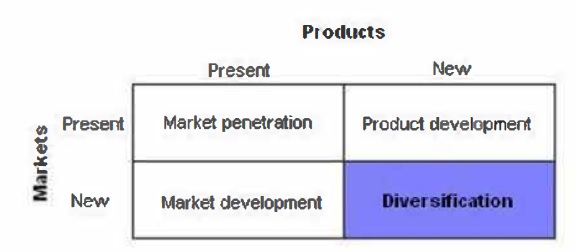

Johnson et al (2014, p.227) suggest Ansoff's Matrix can be adapted for diversification strategies. If we consider Figure 4.1.2, we can see buying Oxley Wharf represents a new product (residential real estate) and a new market (residential renters) for CLS.

Figure 4.1.2. Corporate strategy directions (Johnson et al, 2014, p.227)

The company is did not make a profit for its first three years of existence but in 2017 achieved a modest £27m profit before tax, see figure 7.2 (FAME, 2018). CLS can therefore use its current high profits and cash reserves to invest in projects that can be bought relatively cheaply now, but achieve long term returns. There will likely be a steady and sustained rise in both land value and rental income in both the long term and short term growth in both the greater London area, and in the Royal Wharf 17

development. From Figure 4.2.2 we can observe an increase in prices from an index of 100 in 2007 to 126 in 2016 .

Figure 4.1.2. Commercial Property Price Index 1997-15 (Statista, 2018)

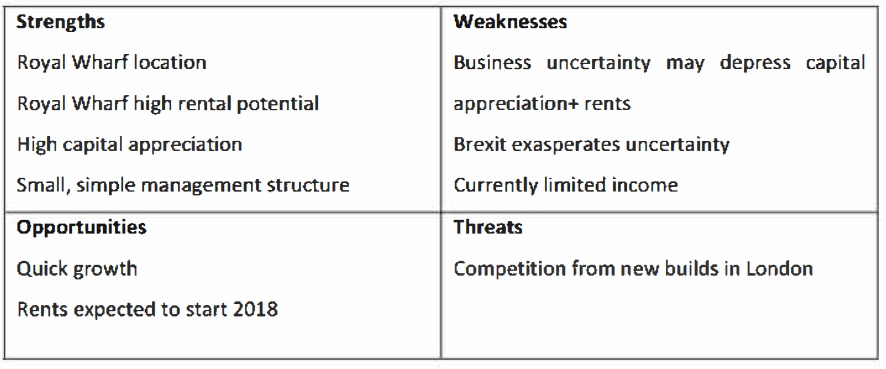

Describing the Royal Wharf project, Ballymore, the joint developer of Royal Wharf, together with Oxley Wharf Property 1 Limited, describes the site as "one of the last opportunities to build a new town within London" (ballymoregroup, 2018). SWOT analysis for Oxley Wharf Property 1 Limited is summarised in figure 4.1.3. As can be seen, there are four main strengths. Royal Wharf is located close to Canary Wharf, London's financial centre which means both high expected capital gains and rental. Oxley Wharf is a private company and only has two owners, this means the management structure is simple and any decision for sale is likely to be acted on quickly. In a big company there wuld likely be numerous meeting and proposals before a decision could be made. Weaknesses, however, are a major consideration as in 2018 there is great economic uncertainty in the UK, made worse by Brexit. According to Kahl (2017), there were 20 new high rise residential towers under construction in 2017 as a direct result of London's financial district exodus. Therefore, there is likely a depression of capital gains and rental income in the short-term. A bright point, however, is the opportunity created by the expected completion of Royal Wharf in 2018 which will bring in rental income. Threats, of course, are from other construction companies building similar residential accommodation. However, this is mitigated by the fact that within Royal Wharf, all available land has already been allocated, so nothing yet under construction will be allowed. There is also a substantial number of new residential construction in the 18

capital, with JLL (2015) reporting a total of 120 residential towers over 20 stories high currently under construction. This will certainly have a knock-on effect on both capital and rental growth.

Figure 4.1.3. Summary of SWOT analysis for Oxley Wharf

4.2 Synergistic gain of acquisition PV(c + o) > PVc + PVo Where PV=present value c=CLS Holdings o=Oxley Wharf Property 1 Limited

We might expect some synergy in Oxley Wharf acquisition where the total value of the two companies combined is greater than the individual values when added together. Rothaermel (2017, p.273) suggests related diversification has two main benefits: economies of scale and scope. Grant and Jordan (2012, p. 316) consider organizational capabilities are also subject to economies of scope and thus, CLS organizational capability can be replicated in the new company at a fraction of the cost. The existing commercial real estate leasing and refurbishment program can proceed and be managed alongside the acquired new residential rental program with minimal disruption. There may be some cross-selling as some of the customers may even be the same as the workers using the commercial office space need somewhere to live and may well be interested in renting nearby accommodation. Cleaning contracts used in both can likely be combined and just one company used, resulting in savings. 19

4.3 Explanati on and evaluation of financing of acquisition Although only trading for three years and so limited financial information is available, from table 4.3 .1 we can see that turnover was £117m in 2017. Prof it rose steadily from a loss of £1.8m in 2014 to a profit of £27m in 2017. Liquidity ratio remained steady, falling slightly from 0.38 in 2015 to 0.30 in 2017. From table 4.3.2 we can see that Oxley Wharf's profit before tax is comparable to other peers at £30m, in contrast to CLS Holdings which has profit of £190m. However, looking at turnover, the two companies are comparable, with Oxley achieving a turnover of £120m compared to CLS turnover of £130m (table 4.3.3). Clearly, CLS is performing above its peers in terms of profit.

Figure 4.3.1. Peer comparison of Oxley Wharf for turnover.

Figure 4.3.2. Peer comparison of Oxley Wharf for profit before tax.

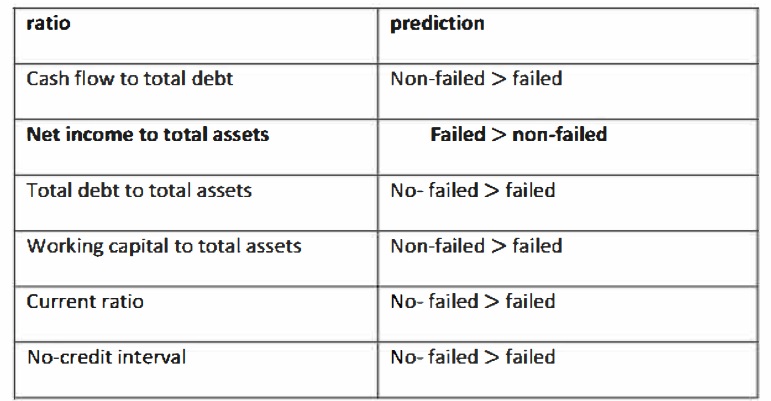

4.4 Analysis of risks and uncertainties Beaver (1966) suggests although financial information and ratios can be useful, they do not tell the whole story, and they should be used in conjunction with simple common sense and understanding of the firm. Looking at Beaver's (1966, p.81) analysis of failed firms in Figure 4.4.1, we can see that the key ratio to predict failure is net income to total assets. In CLS 20

acquisition of Oxley Wharf, therefore, we should look at future total net income compared to future total net assets.

Figure 4.4.1. Prediction of failed and non-failed firms (Beaver, 1966, p.81)

There is also the potential risk of a general downturn in the London real estate market due to economic uncertainty partly due to Brexit, and partly due to the upswing in the EU economy, which means some EU workers may return home and therefore demand less housing. This could be particularly felt in the financial sector with potential changing visa regulations for non-UK citizens. In acquisition strategies, a market premium, typically in the 20-30% range is often paid by the purchaser over and above the market value of the company (Laamanen, (2007, p.1359). Although Laamanen's study (2007, p.1367) was not specifically focused on acquisition of real estate firms, it does show the general trend that there is typically up to a four-year delay in realizing full shareholder's returns from acquisition date. 4.5 Discussion of potential implications on firm performance Because of the low profit from the Oxley Wharf acquisition in the first two or three years, CLS should therefore ensure it has sufficient funds to cover debt repayment over this period. It should also warn investors there is likely to be little dividend, if any, during this period, but 21

that acquisition is necessary to build the company and achieve long term growth with diversification of assets. In 2017 CLS Holdings had £43.2m cash (Figure 2.0 (FAME2018)). If £30m is used for further organic growth as suggested in section 3, the remaining £13.2m is insufficient to acquire Oxley Wharf Property 1 Limited. Two options are to either issue new shares, or to borrow from a bank. Because this company is high growth, high income, high risk, t he shareholders are likely of a similar disposition. Conservative investors usually seek conservative investments and vice versa. Therefore, are likely to prefer bank borrowing as although this will increase the company's risk exposure there will be less erosion of value and dividend compared to a share offering. Companies House (2018) financial information for Oxley Wharf Property 1 Limited (June 2017): Revenue £117m, Gross Profit £36m, Net Profit £22.3m, Total assets £505m, Amount Due to creditors within one year £84.9m, amount due after one year £401m. Estimated value of company if insolvent tomorrow: £505- (84.9+401)m = £19m We believe an offer in the region of £60m will be acceptable to the shareholders of Oxley Wharf as his represents three years profit and effectively reduces their exposure to risk to zero. Based on the same conditions as section 3.4 organic growth strategy, 4.3% bank rate (indexmundi, 2018) and using Mortgage Calculator (2018) at 10 year payback, £60m bank loan repayments are £0.62m/month or 7.4m/year. This is easily financed from current profit of £19m/year for Oxley Wharf with generous ratio of 2.5 bank loan coverage.

5 Conclusion This report has shown in section one and two that CLS Holdings is a high-risk, high-profit commercial real estate investment company currently invested primarily in the London market for buying, refurbishing and leasing out office space. Section two has shown that CLS should use some of its profits and borrow further from banks at historically low interest rates to invest £30m in current projects over a ten year period. Section four has shown CLS should take steps to acquire Oxley Wharf Property 1 Limited for £60m using bank loans repaid over a ten-year period for long term investment in both rental and capital gain growth. The same owners of Oxley Wharf Property 1 Limited, Kwong Ching Chiat and Ching Low See also own Oxley Wharf Property 2 Limited. This could also be considered for acquisition at a later date. 23

6 References

Atrill, P., 2017. Accounting and finance for non-specialists. 10th ed. Harlow: Pearson.

Bamber, M. and Parry, S. 2014. Accounting and Finance for Managers. [e-book) London:Kogan Page. Available through: Anglia Ruskin University Library <http://libweb.anglia.ac.uk> [Acces sect 26 April 2018].

Beaver, W., 1966. Financial Ratios as Predictors of Failure. Journal of Accounting Research, [e-j ournal] 4, pp.71-111. doi:10.2307/2490171.

Ballymoregroup, 2018. Ballymore. [Online] Available at: <www.ballymoregroup.com/project /detail/royal-wharf> [Accessed 24 April 2018].

CLS Holdings, 2018a. CLS Holdings pie. History. [Online] Available at: <www.clsholdings.com> [Accessed 26 March 2018].

CLS Holdings, 2018b. 2017 Annual Report and Accounts. [Online] Available at:< htt p://ww7. i nvestorrelations .co. u k/ cls/u p loads/ reports/els-a r-2017-ann ua I-re portsi ngles.pdf> [Accessed 5 April 2018].

Companies House, 2018. Oxley Wharf Property 1 Limited. Report and Financial Statements. [Online] Available through: Anglia Ruskin University Library <http://libweb.anglia.ac.uk [Accessed 26 March 2018].

FAME, 2018. Report (standard report) CLS Holdings PLC. [Online] Available through: Anglia Ruskin University Library <http://libweb.anglia.ac.uk> [Accessed 26 March 2018].

FAME, 2018b. Report (standard report) Oxley Wharf Property 1 Limited.[Online] Available th rough: Anglia Ruskin University Library <http://libweb.anglia.ac.uk> [Accessed 24 April 2018 ].

Grant, R. and Jordan, J. 2012. Foundations of Strategy. Chichester: John Wiley & Sons. lndexmundi, 2018.United Kingdom Commercial bonk prime lending rate .. [Online] Availabl e at: <https ://www.indexmundi.com/united_ kingdom/commercial_ bank _prime_ lending_ rat e.html> [Accessed 26 April 2018].

Johnson, G. et al. 2014. Exploring Strategy. 10th Ed. Harlow: Pearson. JLL, 2015. 120 residential towers under construction in London. [Online] Available at: <http:/ /www.jll.co.uk/united-kingdom/en-gb/news/2092/120-residential-towers-under-constructi on-in-london> [Accessed 26 April 2018].

Kahl, S., 2017. 20 New Residential Towers Are Being Built in Frankfurt Because of Brexit Demand. Bloomberg. [Online] Available at: < https://www.bloomberg.com/news/articles/2017-11-29/frankfurt-to-get-20-newresidential-towers-brexit-spurs-demand>> [Accessed 26 April 2018].

Laamanen, T. 2007. On the Role of Acquisition Premium in Acquisition research. Strategic M anagement Journal, 28(13), pp.1359-1369. [Online] Available at: <http://www.jstor.org/stab le/20141994> [Accessed 24 April 2018].

McBride, 5., Garret/Galland Research, 2017. 3 charts that show why commercial real estate could be the next 'big short'. Business Insider.[Online] Available at: <http://uk.businessinsid er .com/3-c harts-show-why-com me rcia l-re al-estate-could-be-the-next-big-short-2017-3> [ A ccessed 6 April 2018]. Millis, 2014. CLS vacancy rates buoyed by markets. City AM. [Online] Available at: <http://www.city am .com/1416446461/cls-vaca ncy-rates-bu eyed-markets> [Accessed 5 April 2018]>

Mortgage Calculator, 2018. App, Apple Store. [Accessed 26 April 2018].

Osiris, 2018. Report. CLS Holdings. [Online] Available through: Anglia Ruskin University Library <http://libweb.anglia.ac.uk> [Accessed 6 April 2018].

Property Industry Alliance, 2017. Property Data Report 2017: Facts and Figures about the U K commercial property industry to year-end 2016. Available at:< https://www.bpf.org.uk/si t es/default/files/resources/PIA-Property-Data-Report-2017.PDF> [Accessed 24 April 2018].

Rothaermel, F. 2017. Strategic Management. 3rd Ed. New York: McGraw Hill. Statista, 2018. Office properties vacancy rate in London (UK) from 2006 to 2019*. Statista. [Online] Available at: <h ttps://www.statista.com/statistics/430697 /vacant-office-space-Ion don-united-kingdom/> [Accessed 5 April 2018].

UNEP, 2018. Financing Cleaner Production. [Online] Available at: <http://www.financingcp.org/docs/CP3_NPVTab1e.pdf> [Accessed 6 April 2018].

Watson D. and Head, A., 2016. Corporate finance: Principles and practice. 7th Ed. Harlow: Pearson Education.

Homework Help UK

- HND Assignment Help

- Do my assignment UK

- IMarEST Ceng report for the UK council

- Business Plan Writing for the new UK Innovator VISA

Sample Assignments UK

- Individual Project Development

- CORC373 Advanced Object Oriented Programming

- CSY3024: Databases 3

- CBB042 Organic Chemistry

- ENG490 - Introduction to Petroleum Engineering

- COMP1664 Network Technology

- IB9EN0 Financial Markets

- IMC Campaign Planning Project

- BM019 Operational Supply Chain Management

- IB98W0 Management Accounting And Control

- BTEC Pearson Higher Nationals in Computing Unit 01

- BTEC Pearson Higher National Diploma in Computing Unit 11

- BTEC HND in Computing Unit 6 Managing a Successful Computing Project

- Business Plan on Cafe in UK

- Summarise monzo current business model

- A global challenge that is experienced by a company

- MOD004051 Finance for Decision Making

- UK BTEC HND in Computing ECE2072 ASSIGNMENT

- UK BTEC HND in Computing Unit 15: Transport Network Design

- UK BTEC HND in Computing Unit 16 Cloud Computing

- UK BTEC HND in Computing Unit 30 Application Development

UK Universities

- Abertay University

- Aberystwyth University

- Bangor University

- Birmingham City University

- Coventry University

- Huddersfield University

- Lancaster University

- Leeds University

- Leicester essay writing help

- Loughborough University

- Kingston University

- Manchester Essay Writing Help

- Manchester Metropolitan University

- Middlesex University

- Newcastle University

- Northumbria University

- Nottingham Trent university

- Oxford Brookes University

- Regents University

- Robert Gordon University

- Royal Holloway

- University of Arts London

- University of Bedfordshire

- University of Birmingham

- University of Bradford

- University of Bristol

- University of Dundee

- University of East Anglia

- University of East London

- University of Glasgow

- University of Greenwich

- University of Hertfordshire

- University of Kent

- University of Law

- University of Lincoln

- University of Manchester

- University of Nottingham

- University of Porstmouth

- University of Reading

- University of Sheffield

- University of Southampton

- University of St. Andrews

- University of Stirling

- University of Strathclyde

- University of Surrey

- University of Ulster

- University of Warwick

- University of Westminster

- University of Winchester

Testimonials

The assignment I got was complicated enough and it was hard for someone else to do it. Our professor had explained a proper technique and format to do it, I was worried if urgenthomework could do it or not? I had a talk with their customer care and they gave me the contact details of the expert who would do my work. I told them the procedure and I was surprised by the product delivery. It was an excellent work framed in the style and Format I wanted it.

I had a critical task accommodation due date. One of my companions recommended that I should hire the services of urgenthomework.com. When I put in the task request, they quickly acknowledged it and comprehended the earnestness and urgency of time. they conveyed my task until before a day of submission date. Services are as good as your writing is. And quite affordable as well. Wish you good luck for the future. Keep growing.

I have been using this website since last many years. It helps me in my college project and homework. Excellent study materials are provided which is easy to understand and learn. Read More